Abhi Loan App in Pakistan: Access Your Salary Now!

Introduction to Abhi Loan App

In recent years, the Abhi Loan App has created a buzz in Pakistan by offering a solution to a common problem: accessing your salary whenever you need it. But what exactly is this app, and why is it gaining so much popularity among salaried individuals?

What is the Abhi Loan App?

The Abhi Loan App is a digital platform that allows salaried employees to access a portion of their upcoming salary before payday. Designed with the modern employee in mind, the app makes it simple for individuals to manage unexpected expenses or emergencies without waiting for the end of the month.

Why is it Gaining Popularity in Pakistan?

With a large portion of the workforce living paycheck to paycheck, the Abhi Loan App has become a lifesaver. In a country where emergencies can come unannounced, Abhi provides a quick and easy way to secure funds without turning to high-interest loans.

How the Abhi Loan App Works

Steps to Access Your Salary with Abhi Loan

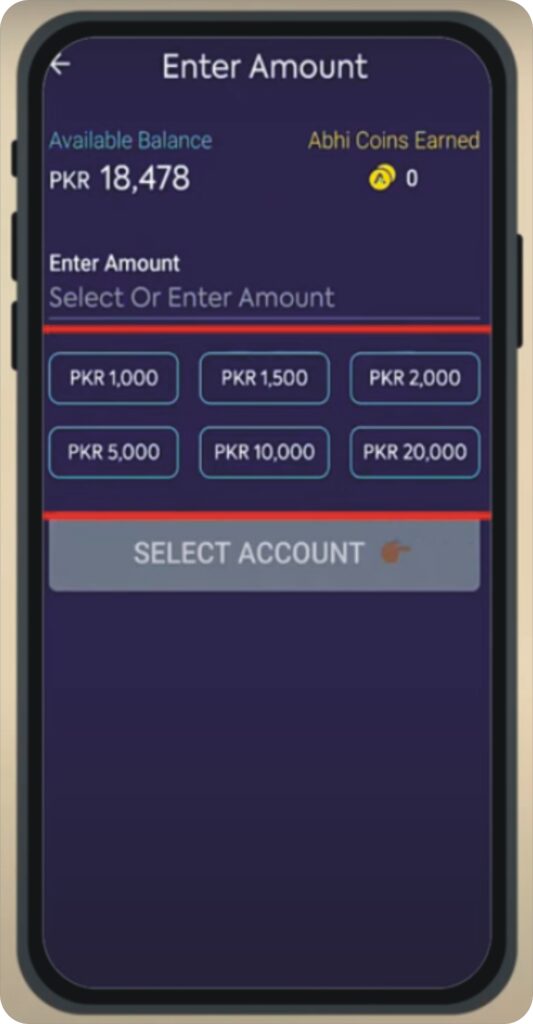

Using the Abhi Loan App is straightforward. Once you have registered and your employment details are verified, you can apply for an advance. Simply:

- Download and register on the app.

- Enter your employment details for verification.

- Request a salary advance.

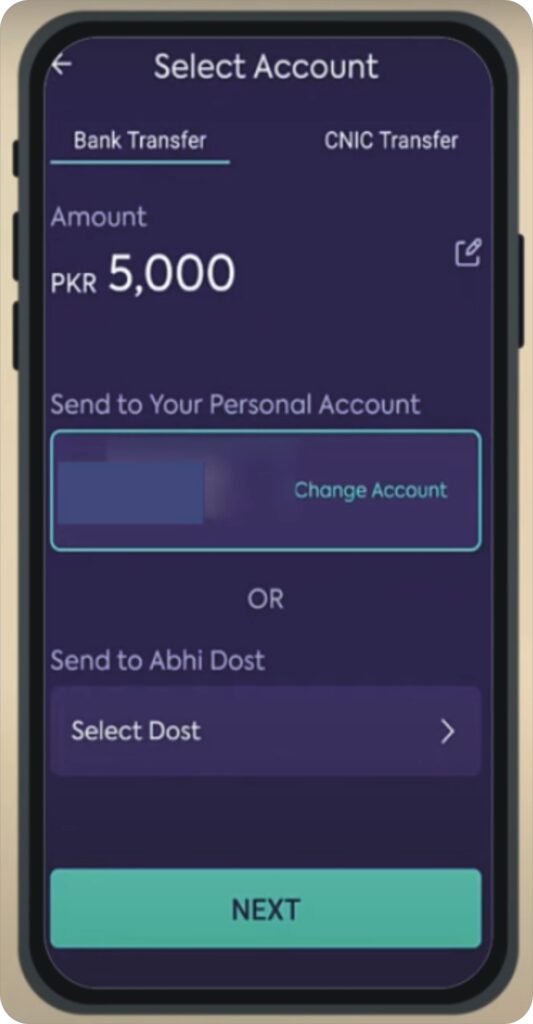

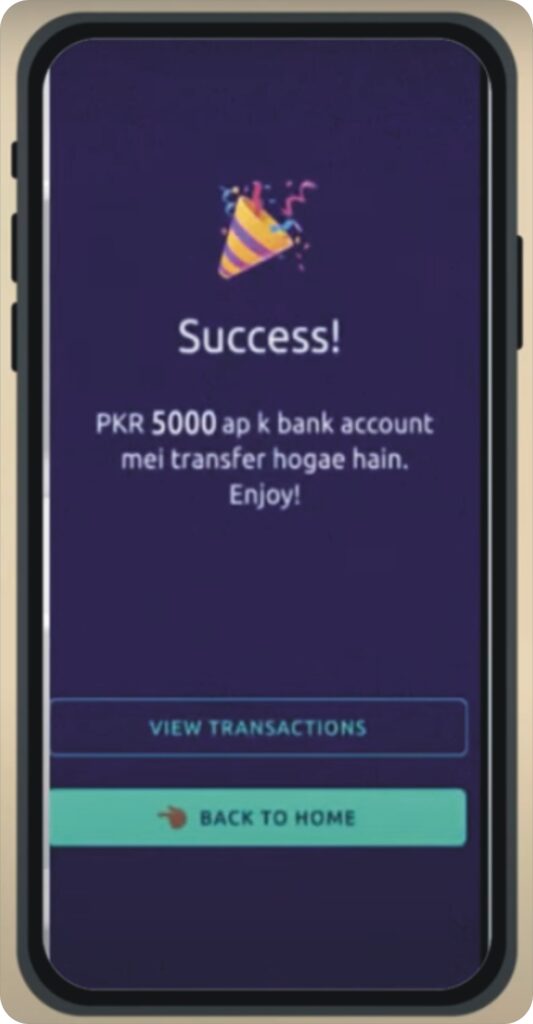

- Receive the funds directly into your account within minutes.

Eligibility Criteria for Abhi Loan App

To use the Abhi Loan App, you need to:

- Be a salaried employee at a company partnered with Abhi.

- Have a stable employment history.

- Meet the age and income requirements set by the app.

Fauricash Loan App in Pakistan

Key Features of the Abhi Loan App

Instant Salary Access

One of the apps standout features is the ability to get instant access to a portion of your salary, eliminating the need for stressful waits.

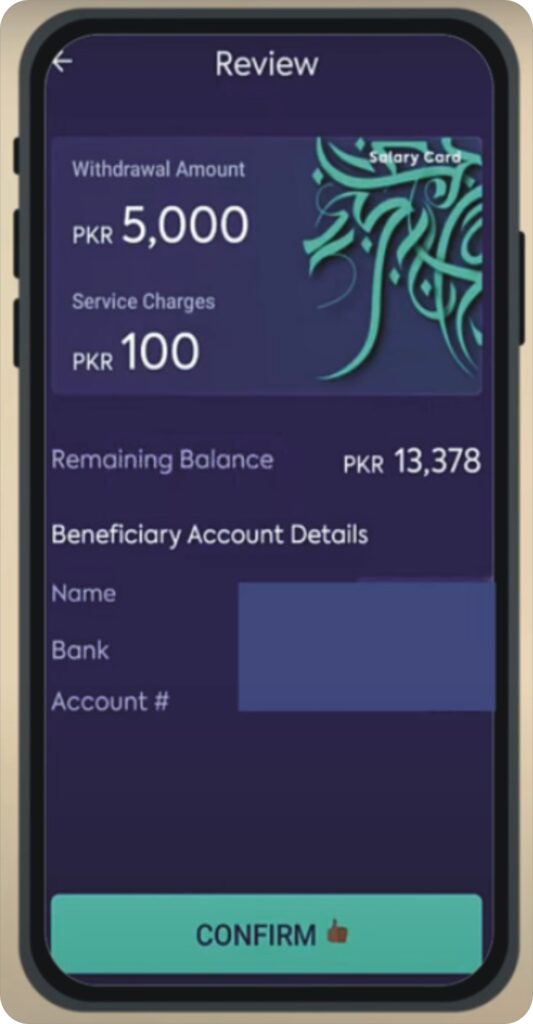

Low Interest Rates and Transparent Policies

Abhi stands out with its commitment to transparent policies and low interest rates, which makes it a more affordable alternative to traditional payday loans.

Flexible Repayment Options

Users can repay the advance in easy installments, either by the next payday or through a customized plan that fits their financial situation.

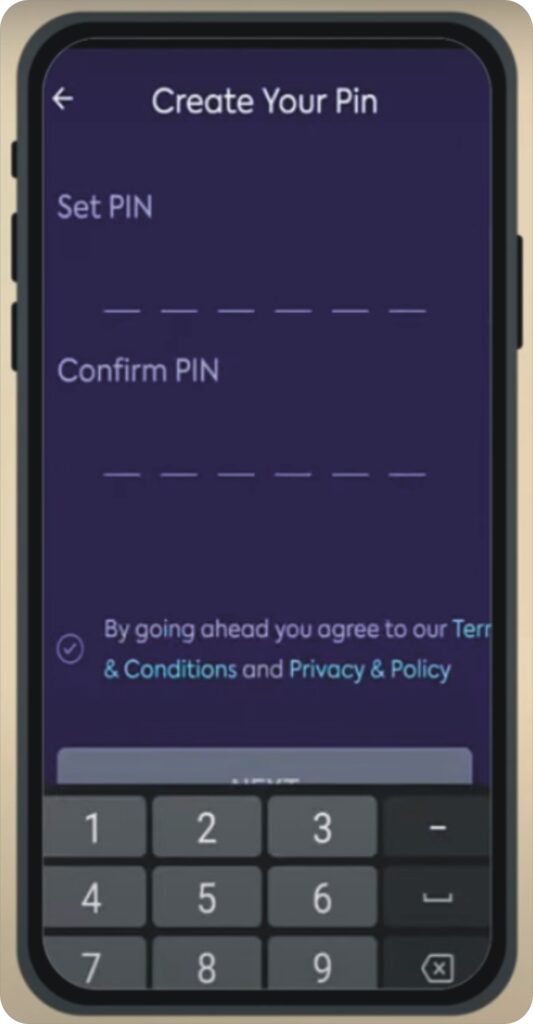

Enhanced Security for User Data

Abhi prioritizes data security, ensuring that all transactions are encrypted and personal information is safeguarded.

Benefits of Using the Abhi Loan App

Financial Flexibility for Salaried Employees

Abhi Loan offers employees the financial flexibility to handle unplanned expenses without going through the hassle of a traditional loan application.

Improved Financial Management

The app enables better financial planning by offering an advance only on earned salary, allowing users to avoid accumulating unnecessary debt.

Access to Funds in Emergencies

Whether it is a medical emergency or an urgent repair, Abhi gives employees a safety net, helping them avoid the need for high-interest payday loans.

Hakeem Loan App (Easy Finance)

Abhi – Your Salary Now!

ABHI is Pakistan first financial wellness platform. Abhi is licensed and registered as a Non-Banking Financial Company (NBFC) under Securities and Exchange Commission of Pakistan (SECP) and a whitelisted Digital Lending app from SECP & adheres to the effective regulatory compliance for Earned Wage Access (EWA). We empower salaried individuals by providing them access to their earned salaries anytime, anywhere through the ABHI App. Employees having their employers registered with Abhi can access Abhis services, which saves operational hassle of managing salary advances for HR and Finance teams, and gives financial empowerment to employees.

How it works?

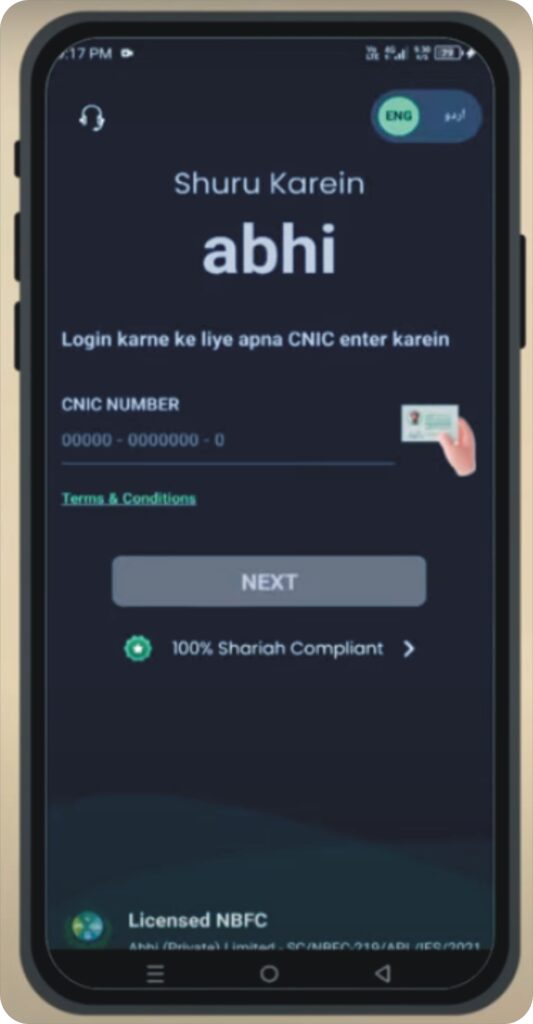

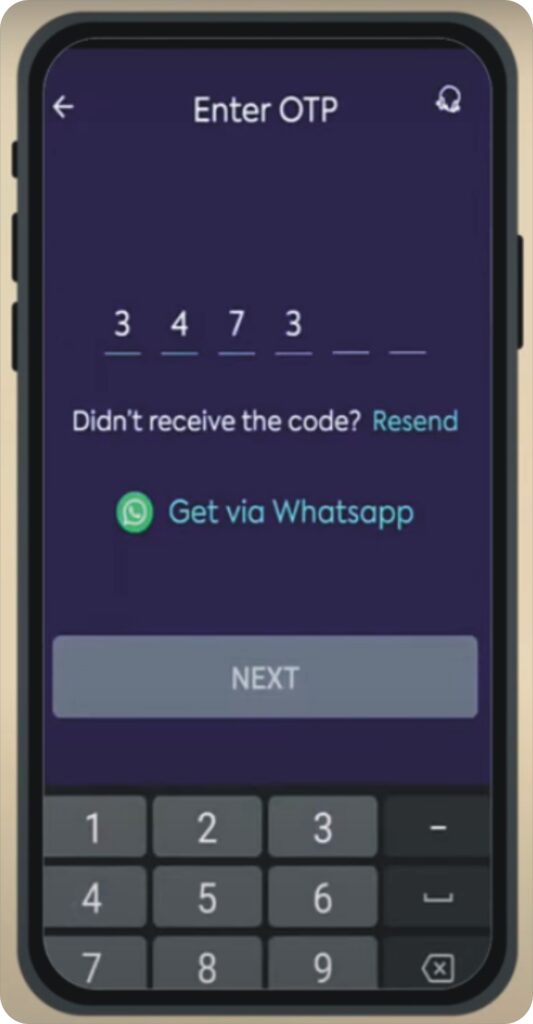

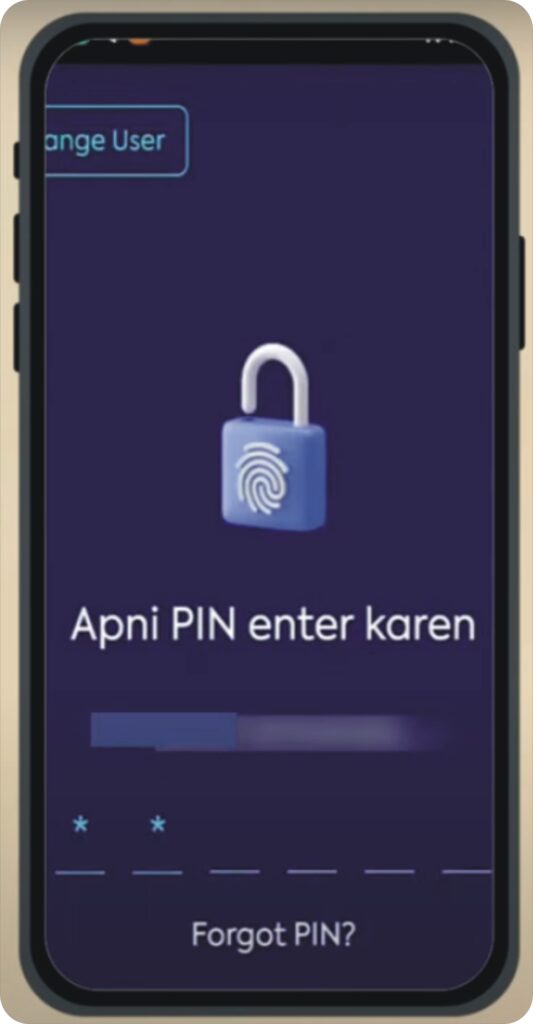

Login with your CNIC (after your company is registered with us). Request the amount you want to withdraw from your earned salary. You can transfer the money into your salary bank account. The total transacted amount + transaction charges will automatically be deducted from your next months salary. For more information visit www.abhi.com.pk or drop us an email at connect@abhi.com.pk.

NOTE: As per the regulatory framework, EWA is not a loan and repayment is made in the next months payroll cycle irrespective of the day you withdraw, and there is no APR associated with it, only fixed transaction charges for using the service that the employee consent to before transaction.

Why Abhi Loan is a Game-Changer for Pakistan

Tackling the Debt Culture in Pakistan

Abhi Loan model reduces the need for traditional, often expensive loans, helping Pakistanis avoid getting trapped in debt cycles.

Empowering Financial Freedom for Employees

With Abhi, employees gain greater financial control, enabling them to navigate financial emergencies without compromising their long-term stability.

How to Get Started with the Abhi Loan App

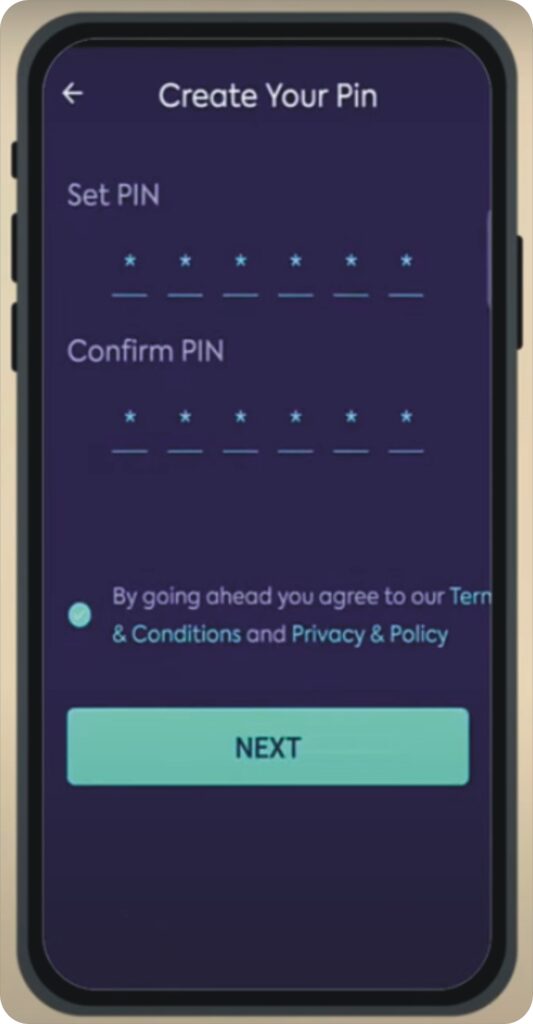

Step-by-Step Guide to Download and Register

- Download the Abhi Loan App from your smartphone app store.

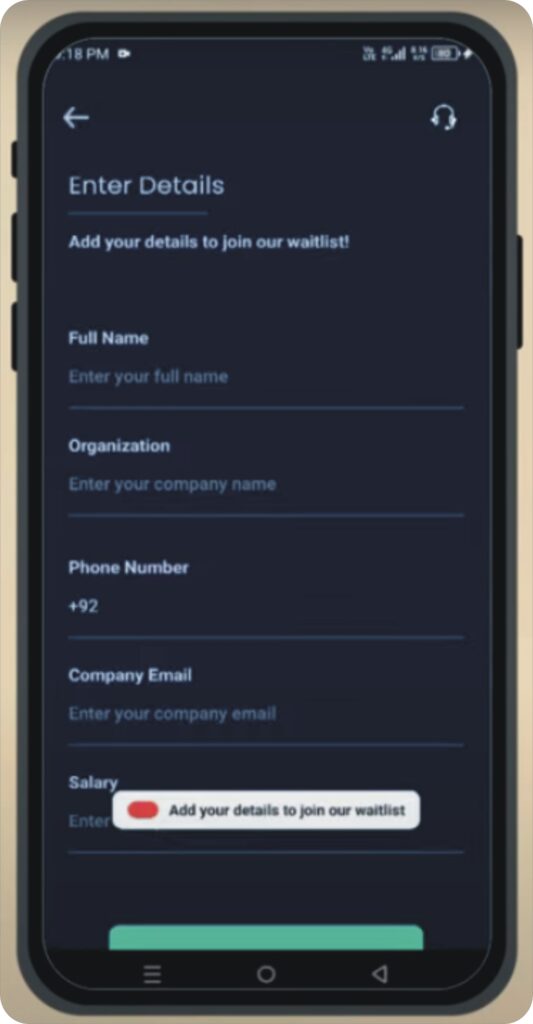

- Register by entering your personal and employment information.

- Follow the prompts to verify your employment details.

Setting Up Your Account and Applying for Salary Access

After registration, you will be able to request an advance whenever needed, making Abhi an accessible option for everyone with a stable income.

Abhi Loan vs. Traditional Payday Loans

Lower Fees and Interest Rates

Abhi Loan offers a more affordable solution compared to payday loans, which often come with high interest rates and hidden fees.

Faster Access to Funds

The process of obtaining a salary advance through Abhi is faster and more convenient, making it ideal for time-sensitive situations.

Tips for Responsible Use of Abhi Loan App

Budgeting for Loan Repayments

Using Abhi responsibly includes planning your budget to accommodate repayments without affecting your monthly expenses.

Avoiding Dependency on Salary Advances

While Abhi is helpful, it is essential not to rely solely on salary advances and maintain good financial habits.

Smart Qarza Safe Easy Cash Loan App

FAQs about Abhi Loan App in Pakistan

Can I apply for a salary advance multiple times?

Yes, you can apply for multiple advances as long as you meet the criteria and do not exceed your limit.

What are the fees for using Abhi Loan App?

Abhi Loan App has a transparent fee structure, and you can find all applicable fees within the app before requesting an advance.

Is Abhi Loan App secure?

Absolutely. Abhi Loan App employs industry-standard encryption to protect user data and ensure secure transactions.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com