Contents

- 1 How to Get a Loan from the PaisaYaar App

- 1.1 Introduction to PaisaYaar App

- 1.2 Benefits of Using PaisaYaar for Loans

- 1.3 Eligibility Criteria for Applying

- 1.4 Documents Required

- 1.5 How to Download and Install PaisaYaar App

- 1.6 Step-by-Step Guide to Apply for a Loan

- 1.7 Loan Application Process in Detail

- 1.8 Loan Approval Time

- 1.9 How Much Can You Borrow on PaisaYaar?

- 1.10 Interest Rates and Fees

- 1.11 Repayment Terms

- 1.12 How to Repay the Loan

- 1.13 Tips for Fast Loan Approval

- 1.14 Common Issues During Loan Application

- 1.15 Conclusion

- 1.16 FAQs about PaisaYaar App Se Loan Lene Ka Tarika

- 1.16.1 Can I apply for more than one loan on PaisaYaar?

- 1.16.2 How long does it take for the loan to get disbursed?

- 1.16.3 What happens if I miss an EMI payment?

- 1.16.4 Is there any prepayment penalty?

- 1.16.5 What if my loan application gets rejected?

- 1.16.6 Related posts:

- 1.16.7 QarzMitra Loan App

- 1.16.8 How to Get Interest-Free Loan from CashBazar Loan App in 2025

- 1.16.9 Alkhidmat Foundation Loan App 2025

How to Get a Loan from the PaisaYaar App

PaisaYaar App Se Loan Lene Ka Tarika – In today’s fast-paced world, getting access to instant financial help is a necessity. One of the leading apps providing easy access to personal loans is PaisaYaar. If you are wondering how to use PaisaYaar to get a loan, you are in the right place! This guide will walk you through the step-by-step process, important details, and tips to ensure a smooth experience when applying for a loan via PaisaYaar.

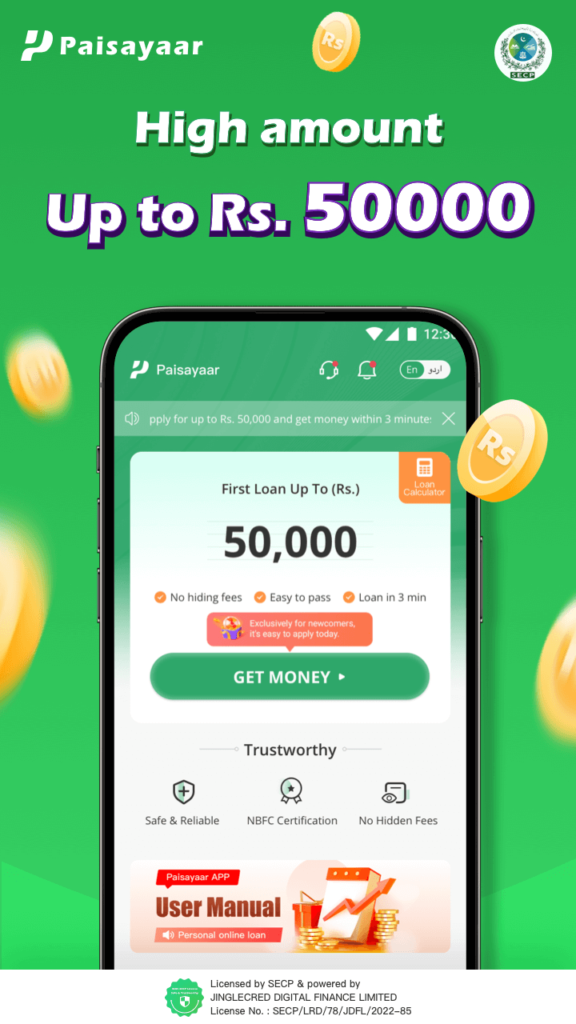

Introduction to PaisaYaar App

PaisaYaar is a fintech app designed to make personal loans more accessible to individuals in need of quick financial assistance. Whether it’s an emergency, personal expense, or any other urgent need, PaisaYaar allows users to apply for loans directly through their smartphone without any hassle of visiting a bank.

Online Urgent Loan in Pakistan

Benefits of Using PaisaYaar for Loans

- Quick Processing: One of the major advantages of PaisaYaar is its fast loan approval and disbursement process.

- Easy Application: You can apply for a loan within minutes.

- No Collateral Required: PaisaYaar provides unsecured loans, which means you don’t need to offer collateral or security.

- Flexible Loan Amounts: Whether you need a small loan or a larger amount, PaisaYaar has options that fit your needs.

- User-Friendly Interface: The app is simple and easy to navigate, making it convenient even for first-time users.

Eligibility Criteria for Applying

Before applying for a loan on PaisaYaar, you need to make sure that you meet the basic eligibility criteria:

- Age: You must be between 21 to 60 years old.

- Pakistan Citizenship: The app is currently available only to residents of Pakistan.

- Income Proof: You need to provide proof of a regular income.

- Credit Score: A healthy credit score increases your chances of getting a loan approved faster.

Documents Required

To ensure a smooth loan application process, keep these documents handy:

- Aadhaar Card (for KYC verification)

- PAN Card

- Income Proof (salary slips or bank statements)

- Bank Account Details (for loan disbursement)

How to Download and Install PaisaYaar App

- Open the Google Play Store or Apple App Store.

- Search for “PaisaYaar.”

- Click on Install to download the app.

- Once downloaded, open the app and grant the required permissions.

About this app

Paisayaar is an excellent financial service platform registered in Pakistan. NBFC license authorized by SECP. Provide fast, flexible and secure loan services for Pakistani citizens. Users can apply for personal loans up to Rs 50,000 anytime, anywhere through mobile phones.

Details of the loan are as follows:

Term of Loan: 60-90 days

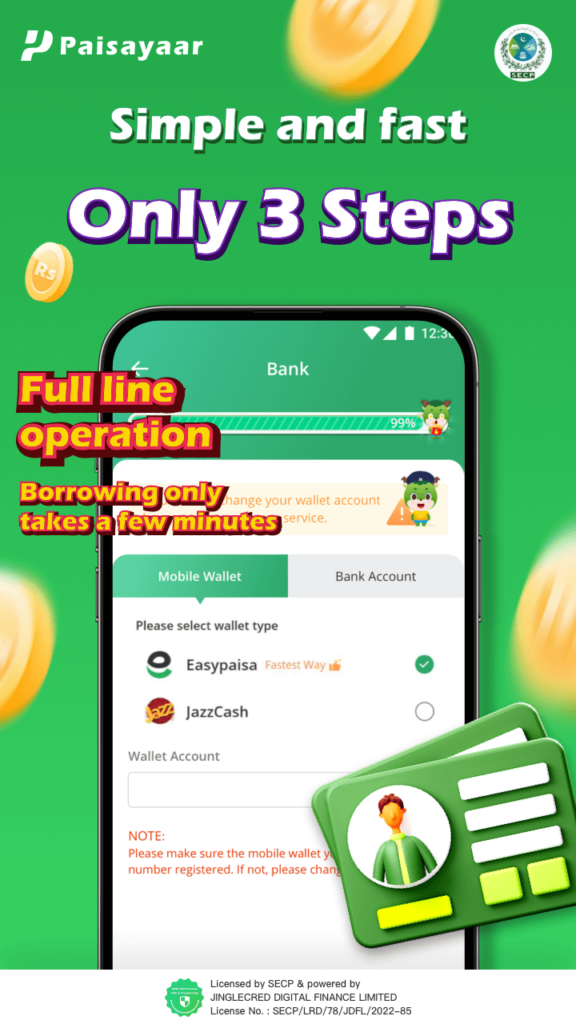

Step-by-Step Guide to Apply for a Loan

1. Creating Your Account

- Open the app and click on Sign Up.

- Enter your mobile number and verify it using the OTP (One-Time Password) sent to your phone.

2. Filling in Personal Details

- After account creation, you will be required to fill in your personal details like name, date of birth, and residential address.

3. Selecting Loan Amount

- Use the slider or enter the exact amount you want to borrow. PaisaYaar offers flexible loan amounts to meet your needs.

Hakeem Loan App (Easy Finance)

Smart Qarza Safe Easy Cash Loan App

I Need 20,000 Rupees Loan Urgently in Pakistan

Loan Application Process in Detail

1. KYC Verification

- Upload your Aadhaar and PAN card for verification. This is a mandatory step to confirm your identity.

2. Income Proof Submission

- To finalize your application, you will be asked to upload recent salary slips or bank statements as proof of income. This helps PaisaYaar evaluate your repayment capacity.

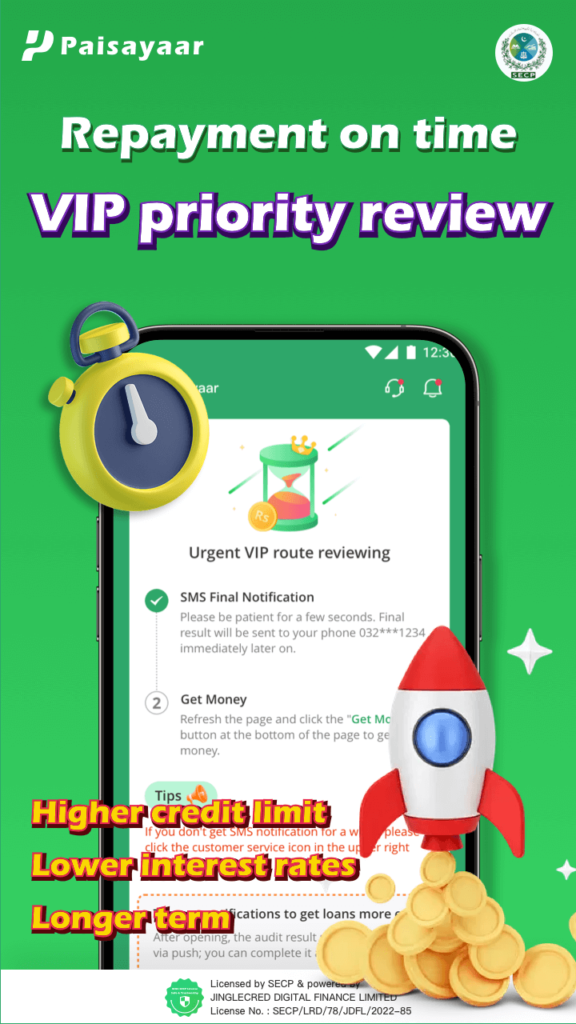

Loan Approval Time

Once all your documents are submitted, PaisaYaar typically takes anywhere from 24 to 48 hours to approve the loan. The approval time may vary depending on the verification process.

How Much Can You Borrow on PaisaYaar?

PaisaYaar allows you to borrow anywhere between 5,000 to 2,00,000, depending on your eligibility and credit profile.

Interest Rates and Fees

Interest rates on PaisaYaar loans range from 1.5% to 2.5% per month, based on your credit score and loan amount. Additionally, a small processing fee may be charged, which will be deducted from the loan disbursement.

Repayment Terms

Loan Tenure

- The tenure for loan repayment can vary from 3 months to 24 months, depending on the loan amount and your ability to repay.

EMI Breakdown

- After loan approval, you will be provided with a detailed EMI (Equated Monthly Installment) breakdown, including interest and principal components.

How to Repay the Loan

Repaying your loan is easy with PaisaYaar. The app offers various repayment options:

- Auto-Debit from Bank Account

- UPI Payments

- Net Banking

You can also set up automatic EMI deductions from your bank account to avoid missing any payments.

Tips for Fast Loan Approval

- Maintain a good credit score.

- Provide accurate and complete documents.

- Ensure your income proof reflects steady earnings.

- Apply for a realistic loan amount.

Common Issues During Loan Application

Sometimes, loan applications may face delays or rejections due to:

- Incomplete KYC Verification.

- Discrepancies in income proof.

- Poor credit score.

If you encounter any issues, reach out to PaisaYaar’s customer support for guidance.

Conclusion

Getting a loan from the PaisaYaar app is simple, fast, and convenient. By following the steps outlined in this guide, you can successfully apply for a loan and meet your financial needs without any hassle. Always ensure you are eligible, have all the necessary documents ready, and apply for a loan amount that fits your repayment capacity.

FAQs about PaisaYaar App Se Loan Lene Ka Tarika

Can I apply for more than one loan on PaisaYaar?

No, you can only have one active loan at a time.

How long does it take for the loan to get disbursed?

Once approved, the loan is typically disbursed within 24 hours.

What happens if I miss an EMI payment?

Missing an EMI payment may lead to penalties and could affect your credit score.

Is there any prepayment penalty?

No, PaisaYaar does not charge a prepayment penalty if you wish to repay your loan early.

What if my loan application gets rejected?

You can reapply after improving your credit score or addressing the reasons for rejection.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com