Contents

- 1 Introduction to Daira Loan App

- 2 Daira Loan App About Us

- 3 How Daira Loan App Works

- 4 Daira Loan App Play Store

- 5 Benefits of Using Daira Loan App

- 6 Features of Daira Loan App

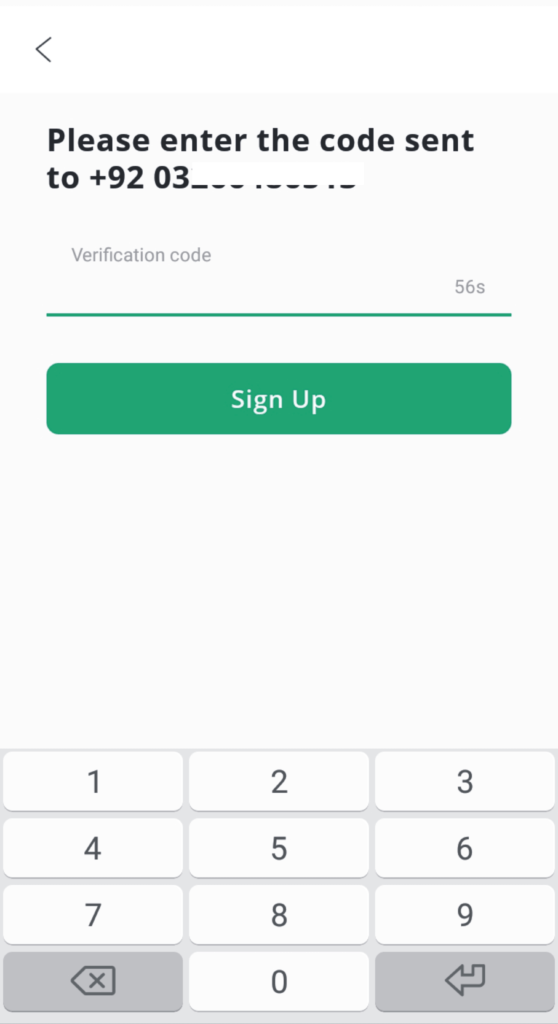

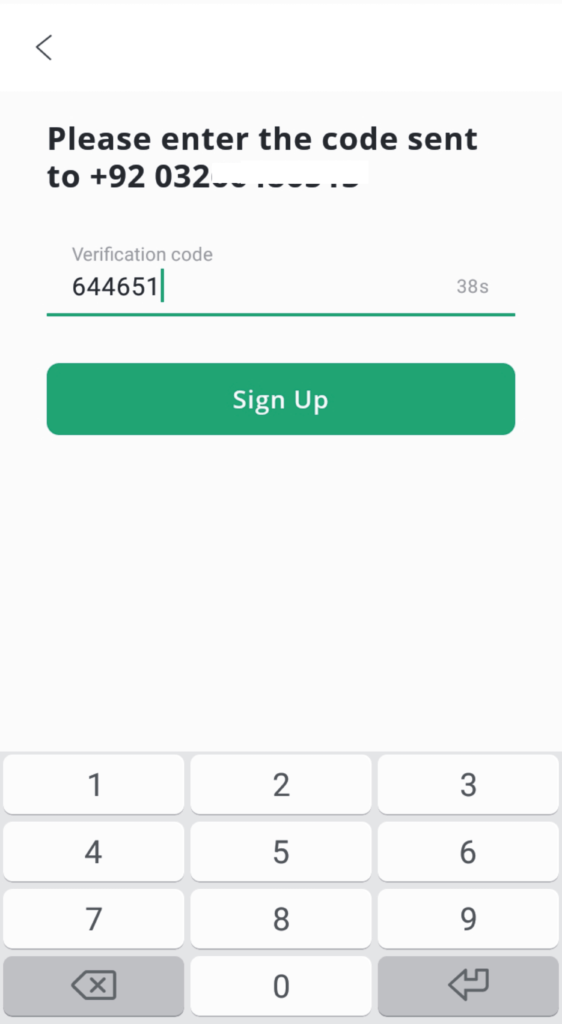

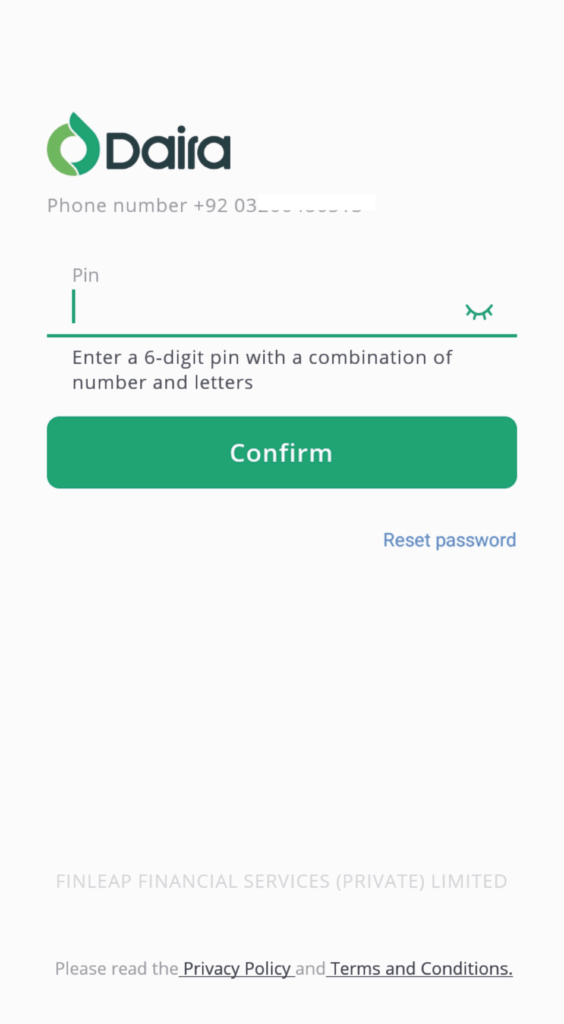

- 7 How to Apply for a Loan Using Daira Loan App

- 8 Daira Loan App Repayment Process

- 9 Customer Reviews and Ratings

- 10 Security and Privacy Concerns

- 11 Comparison with Other Loan Apps in Pakistan

- 12 Conclusion

- 13 FAQs about Daira Loan App

- 13.0.1 What is the minimum loan amount I can apply for on Daira Loan App?

- 13.0.2 How long does it take to get a loan approved?

- 13.0.3 Is Daira Loan App available for iOS users?

- 13.0.4 Can I repay my loan early?

- 13.0.5 What happens if I miss a repayment?

- 13.0.6 Related posts:

- 13.0.7 QarzMitra Loan App

- 13.0.8 How to Get Interest-Free Loan from CashBazar Loan App in 2025

- 13.0.9 Alkhidmat Foundation Loan App 2025

Introduction to Daira Loan App

Pakistan is a great place for this because it can be hard to get to regular banks. Loan tools have changed everything. One of the best places to apply for loans is through the Daira Loan App, which can be used on any smartphone. Daira is a quick and easy way to get the money you need, whether you need it for an unexpected cost or a business project.

Daira is a digital financial service that helps people who can’t use traditional banks or need cash quickly without having to fill out a lot of paperwork. Let’s look at how this app works and why it’s so popular in Pakistan.

Daira Loan App About Us

Welcome to Daira, your trusted partner in online lending. As an approved Nano Lending Platform in Pakistan, Daira is developed by a licensed NBFC, Finleap Financial Services (Private) Limited (License No.. SECP/LRD/150/FFSPL/2024), dedicated to providing you with convenient and flexible financial services.

What Sets Us Apart (Daira App)

Accessibility

We have designed our platform to be user-friendly and accessible to anyone with an internet connection. Applying for a loan with us is quick, easy, and can be done from the comfort of your own home.

Flexibility

We understand that one size doesn apost fit all when it comes to financial solutions. That aposs why we offer a range of loan options with flexible terms and repayment plans to suit your unique needs.

Transparency

We believe in full transparency throughout the lending process. You aposll always know the terms of your loan upfront, including any fees or charges, so there are no surprises later on.

Our Mission

At Daira, we understand that financial needs can arise unexpectedly, and traditional banking services may not always meet your immediate requirements. but, we are committed to offering quick and reliable lending solutions through our innovative digital platform.

Our Commitment

We are committed to a customer-centric approach, ensuring transparency and security in every transaction. Our services come with no hidden fees, aiming to provide you with a worry-free lending experience.

Compliance and Trust

Daira holds a license issued by the financial regulatory authority of Pakistan, under license number License No. SECP/LRD/150/FFSPL/2024. This not only attests to our compliance but also serves as the foundation of the trust you place in our services.

PaisaYaar App Se Loan Lene Ka Tarika

Hakeem Loan App (Easy Finance)

How Daira Loan App Works

Daira Loan App simplifies the process of borrowing money. Here is a step-by-step guide to how it functions:

- Download the App: The Daira app is available for both Android and iOS users.

- Create an Account: You need to sign up using your basic personal information, such as your name, CNIC number, and phone number.

- Check Eligibility: Before applying, make sure you meet the eligibility criteria, which usually include being a Pakistani citizen and having a valid source of income.

- Select Loan Type: Daira offers different types of loans, such as personal loans, business loans, and emergency loans.

- Apply for Loan: Fill in the loan application with required details and submit it for approval.

- Receive Loan: Once approved, the amount is credited directly to your bank account.

Daira Loan App Play Store

About this app

Welcome to Daira, your trusted partner in online lending. As an approved Nano Lending Platform in Pakistan, Daira is developed by a licensed NBFC, Finleap Financial Services (Private) Limited (License No. SECP/LRD/150/FFSPL/2024), dedicated to providing you with convenient and flexible financial services.

Personal information security DECLARATION:

We collect necessary information in accordance with the laws of Pakistan only to evaluate your credit score, and we will only contact CustomerService@Finleap.com.pk

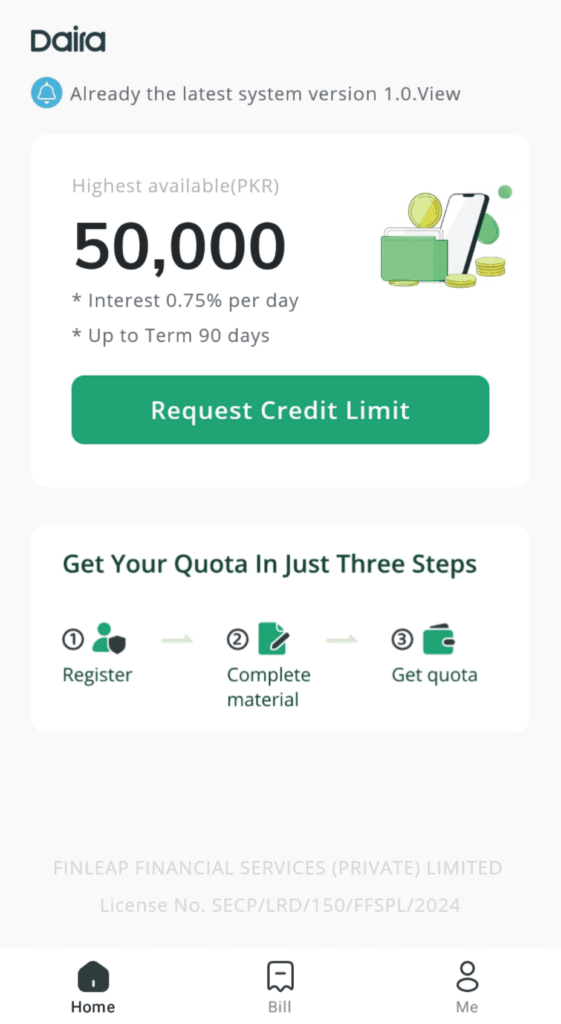

Benefits of Using Daira Loan App

One of the best things about Daira Loan App is that it can approve loans right away. With Daira, you can get the money in your account in hours, while with traditional banks it can take days or even weeks. Some other benefits are:

- Flexible Repayment Options: You can choose from different repayment plans that suit your financial situation.

- Low Interest Rates: Compared to other online loan apps and even some traditional banks, Daira offers competitive interest rates, making it a budget-friendly option for borrowers.

Features of Daira Loan App

Daira Loan App comes packed with features that make it user-friendly and secure:

- User-Friendly Interface: The app is easy to navigate, even for people who are not tech-savvy.

- Secure Transactions: Daira uses encryption technology to ensure your personal and financial data is safe.

- Quick Loan Disbursement: Once approved, the loan is disbursed swiftly, so you are not left waiting for funds.

Loan Limits and Interest Rates

Daira lets you borrow different amounts of money to meet your different cash needs. The least you can borrow is usually PKR 5,000, but based on your credit score, the most you can borrow is PKR 50,000. The interest rates change depending on the loan amount and the length of time you have to pay it back, but they are usually cheaper than those of many other loan apps in Pakistan.

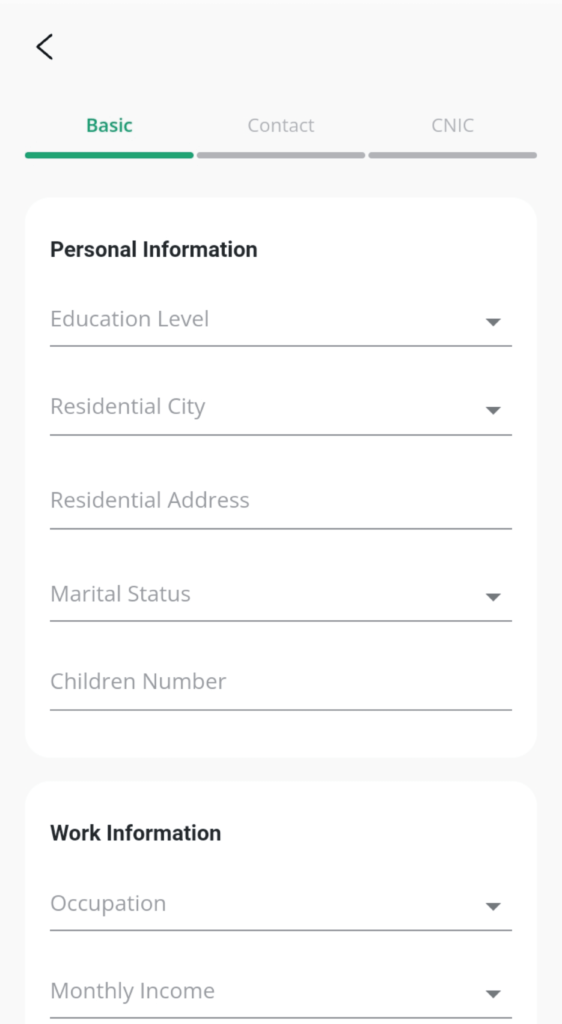

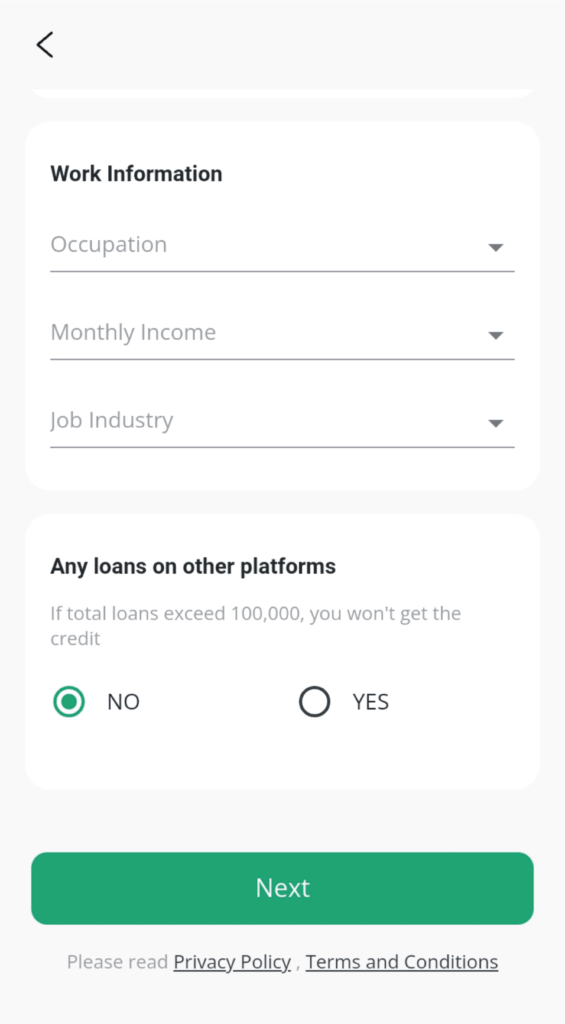

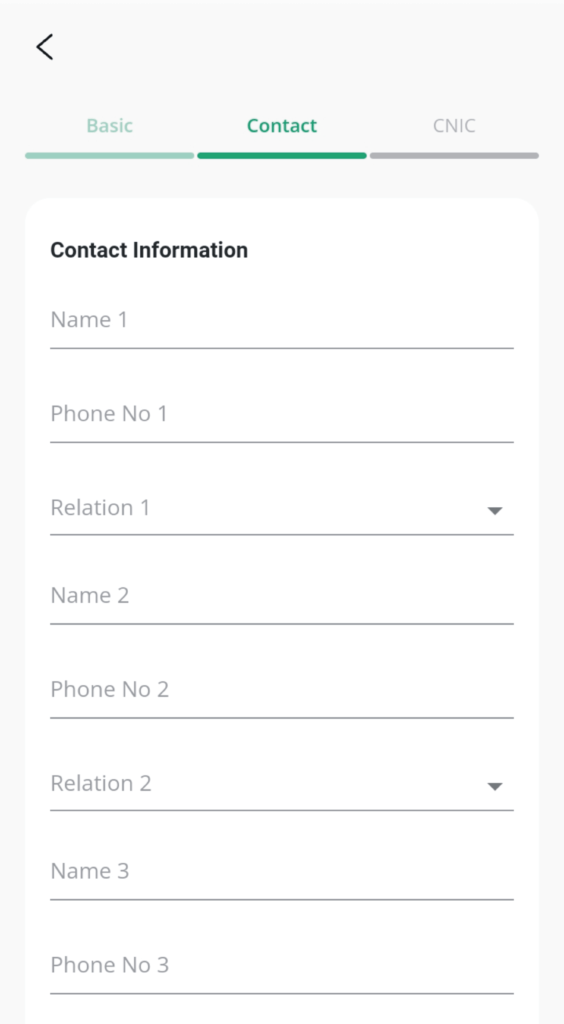

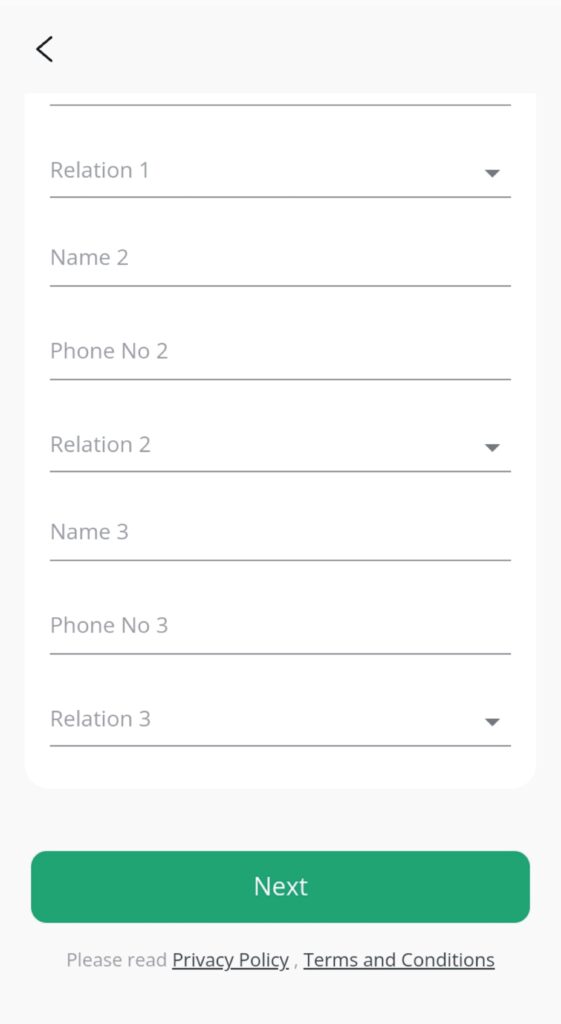

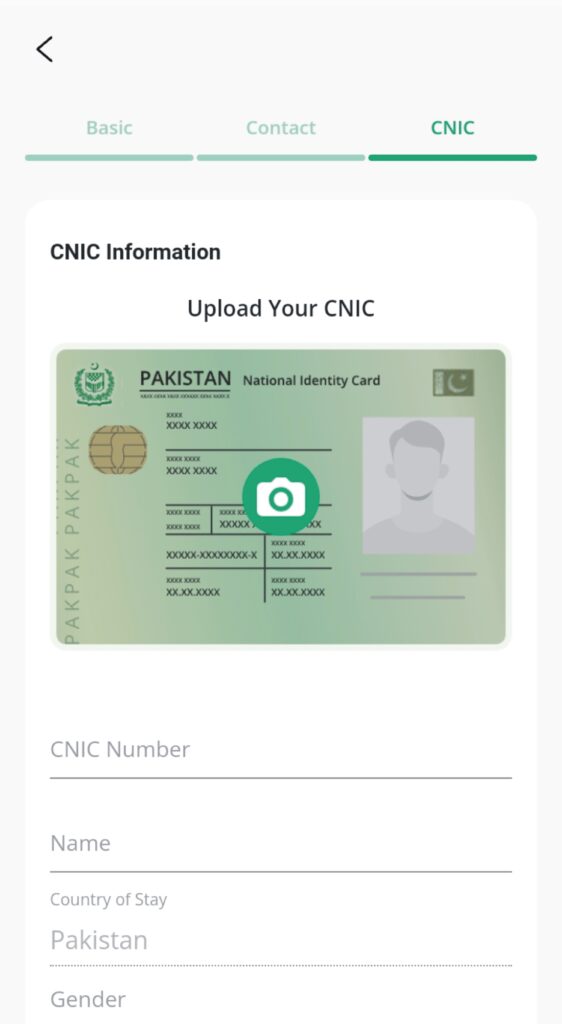

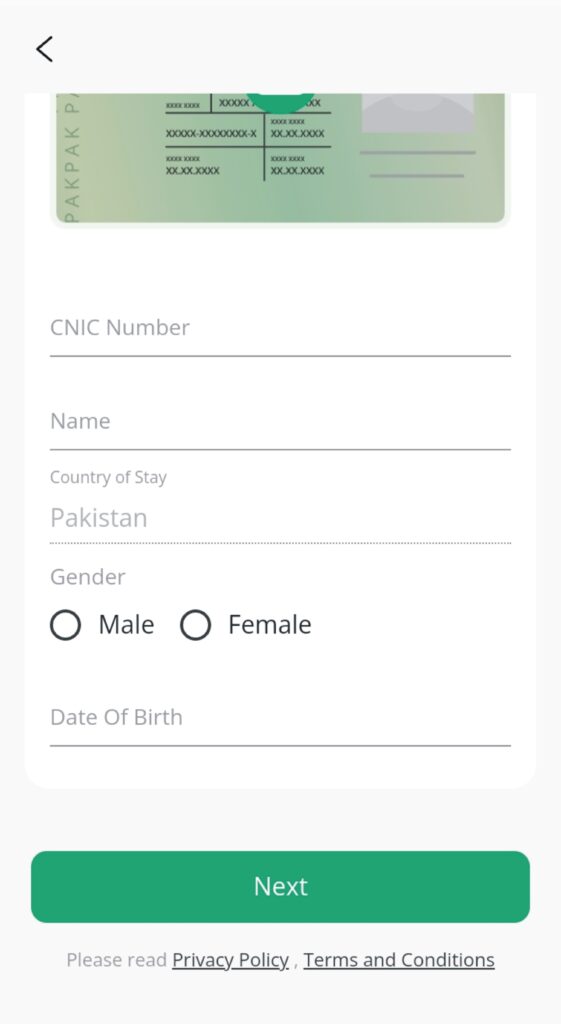

Daira Loan App Requirements

To apply for a loan through Daira, you will need the following:

- A valid CNIC (Computerized National Identity Card)

- Proof of income (salary slip or business revenue details)

- A registered phone number and email address

How to Apply for a Loan Using Daira Loan App

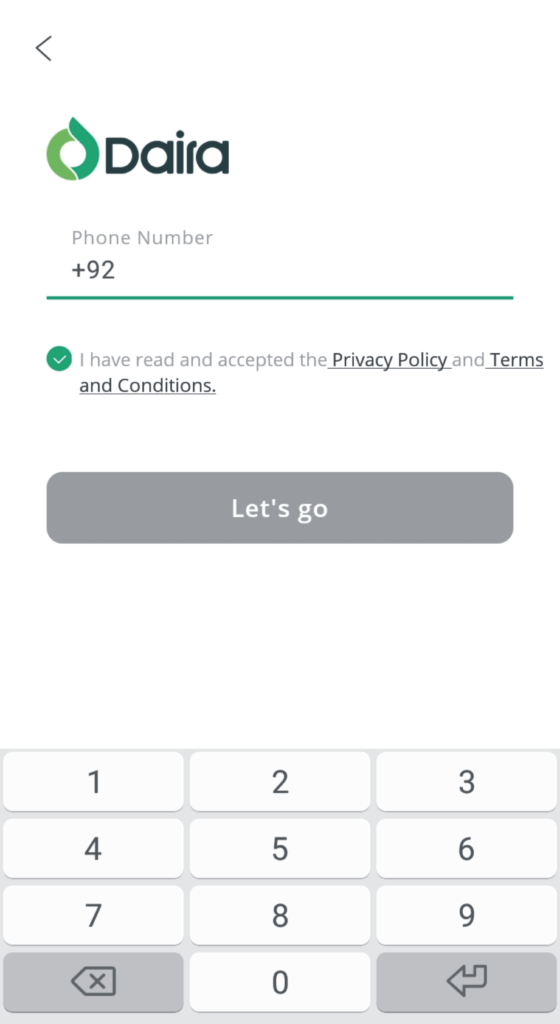

Applying for a loan via the Daira app is straightforward. Follow these steps:

- Download and Install: Head to the Google Play Store or Apple App Store and download the app.

- Register: Sign up using your Mobile Number and CNIC and other required details.

- Choose Your Loan: Select the type and amount of loan you want to apply for.

- Submit: Once you have filled out the application, submit it for approval. You will be notified if your loan is approved within a few hours.

Daira Loan App Repayment Process

Daira offers multiple repayment options to make the process hassle-free. You can repay your loan through:

- Bank transfer

- Mobile wallet (JazzCash, EasyPaisa)

- Direct debit from your account

To avoid any penalties, it’s essential to repay the loan on time. Daira also sends reminders, ensuring you don’t miss a payment.

Reach Us: Address

Daftarkhwan Vanguard, 5-A Constitution Ave, F-5/1 F-5, Islamabad Capital Territory

CustomerService@Finleap.com.pk

What Happens if You Miss a Payment?

If you miss a payment, you might have to pay extra fees and your credit score could go down. If you think you might not be able to meet your repayment date, you should get in touch with Daira’s support team to talk about other ways to pay them back.

Customer Reviews and Ratings

Users of the Daira Loan App have mostly said good things about it. Most customers like how quickly they can get a loan and how easy it is to use the app. Some people have said, though, that the interest rates are lower than those of some competitors, but they can still be hard to get for longer-term loans.

Security and Privacy Concerns

Daira values a lot about security and privacy. Your personal information is kept safe by advanced security protocols, and all of your activities are encrypted. To keep your data safe, the app uses best practices that are common in the business.

Comparison with Other Loan Apps in Pakistan

When compared to other loan apps, Daira stands out due to its quick disbursement and lower interest rates. While apps like EasyPaisa or JazzCash may offer similar services, Daira is often preferred for its user-centric approach and transparency in loan terms.

Why Choose Daira Over Traditional Banks?

Daira offers a convenient and fast alternative to traditional banking. Instead of going through long paperwork and waiting days for approval, Daira’s online platform lets you get a loan within hours. The process is less cumbersome, making it ideal for emergencies.

Conclusion

With the Daira Loan App, it’s easier than ever to borrow money in Pakistan. It is a good choice for people who need money quickly because it is easy to use, approval times are quick, and repayment options are open. Daira has an answer for everyone, whether you are an entrepreneur who needs money or someone who has to pay for something unexpected.

FAQs about Daira Loan App

What is the minimum loan amount I can apply for on Daira Loan App?

The minimum loan amount you can apply for is PKR 5,000 to PKR 50,000.

How long does it take to get a loan approved?

Loan approvals usually take a few hours, and the funds are disbursed the same day.

Is Daira Loan App available for iOS users?

Yes, the app is available for both Android and iOS users.

Can I repay my loan early?

Yes, Daira allows early repayment without any penalties.

What happens if I miss a repayment?

Missing a repayment can result in late fees and a negative impact on your credit score.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com