When you need money quickly and easily, it can save you a lot of trouble in today’s busy world, especially when you have to pay for something unexpected. Here comes the Sarmaya Loan App, a digital lending tool made just for Pakistanis to make getting the money they need easy and quick. People in Pakistan who want easy loans often choose this app because it offers quick loan approvals, simple processes, and features that focus on the customer.

What is Sarmaya Loan App?

The Sarmaya Loan App is a mobile app that lets you get quick loans for a wide range of reasons, from personal costs to business needs. It’s for people who might not be able to get to a regular bank or who need quick cash without having to fill out a lot of paperwork. Sarmaya is meant to make getting a loan easier by letting people get money with just a few clicks on their phones.

How Does Sarmaya Loan App Work?

Getting a loan through the Sarmaya Loan App is remarkably straightforward. Here is a quick step-by-step guide:

- Download the app from the Google Play Store or App Store.

- Create an account by entering personal details and verifying your phone number.

- Fill in the application with required financial information.

- Submit the application and wait for approval.

- Receive funds directly in your bank account upon approval.

The application process is designed to be intuitive, and users receive prompt updates on the status of their loan applications.

| Join WhatsApp | Click Here |

| More Govt Jobs | Click Here |

| International Job/Visa | Click Here |

| Make Money At Home | Click Here |

| Subscribe YouTube | Click Here |

| Click Here | |

| Click Here |

Benefits of Sarmaya

Using the Sarmaya Loan App has many perks besides just being convenient. For people who want to borrow money, it’s a way to get it without the problems that usually come with bank loans. This ease of access can be especially helpful when things are changing quickly in the business world and old ways of doing things may not be able to keep up.

In a larger sense, Sarmaya is also good for Pakistan financial sector because it encourages people to be creative and use technology. It gets other banks to rethink their methods and think about adding similar digital solutions by using new technologies and making their displays easier to use. This push for modernization can help Pakistan financial services business reach new heights, making it more competitive and making customers happier.

It’s easy to see the benefits for the end customer. Sarmaya users get more than just money; they also get a helper in their growth. The apps dedication to safety and openness makes people trust it even more, so borrowers feel safe and informed throughout the whole loan process. Samaya is more than just a loan company; it’s also a force for growth in peoples lives and in the economy as a whole.

Benefits of Using Sarmaya Loan App

Why should you consider using the Sarmaya Loan App? Here are some standout benefits:

- Quick Approvals and Disbursements: Sarmaya prides itself on its speedy approval process, ensuring that users receive their funds within hours of approval.

- No Collateral Requirement: Unlike traditional loans, Sarmaya does not require collateral, making it accessible to more people.

- Flexible Repayment Terms: Users have options when it comes to repayment, ensuring they can pay back loans without financial strain.

Who Can Use the Sarmaya Loan App?

Sarmaya is accessible to a wide range of individuals. However, certain eligibility criteria need to be met:

- Age Requirement: Users must be 18 years or older.

- Pakistani Citizens: Currently, the app only serves Pakistani nationals.

- Documentation: Basic ID verification is required, along with proof of income.

Types of Loans Available on Sarmaya Loan App

Sarmaya offers various loan types to cater to diverse financial needs:

- Short-Term Personal Loans: For smaller, immediate expenses.

- Business Loans: For entrepreneurs and small business owners.

- Emergency Loans: Quick financing for unforeseen emergencies.

Interest Rates and Repayment Terms

Interest rates on the Sarmaya Loan App vary based on the loan type and amount. Here is what users can generally expect:

- Competitive Interest Rates: Rates are designed to be reasonable and competitive within the market.

- Flexible Repayment Options: Sarmaya offers a range of repayment terms, allowing users to select the option that best suits their financial situation.

How to Download and Set Up the Sarmaya Loan App

The Sarmaya Loan App is available on both Android and iOS platforms:

- Download the app from the relevant app store.

- Set Up an Account: Enter your personal details, such as name, phone number, and CNIC.

- Verification: Complete the verification process, which includes confirming your phone number.

Fauricash Loan App in Pakistan

Application Process for a Loan

Once you have set up your account, applying for a loan is straightforward:

- Select Loan Type: Choose from personal, business, or emergency loans.

- Complete the Application Form: Provide necessary information, including income and financial details.

- Submit: After completing the form, submit your application for review.

Approval Process and Timeframe

After submission, the Sarmaya Loan App reviews your application based on the provided details. The timeframe for approval can range from a few hours to a full business day, depending on the loan type and amount requested.

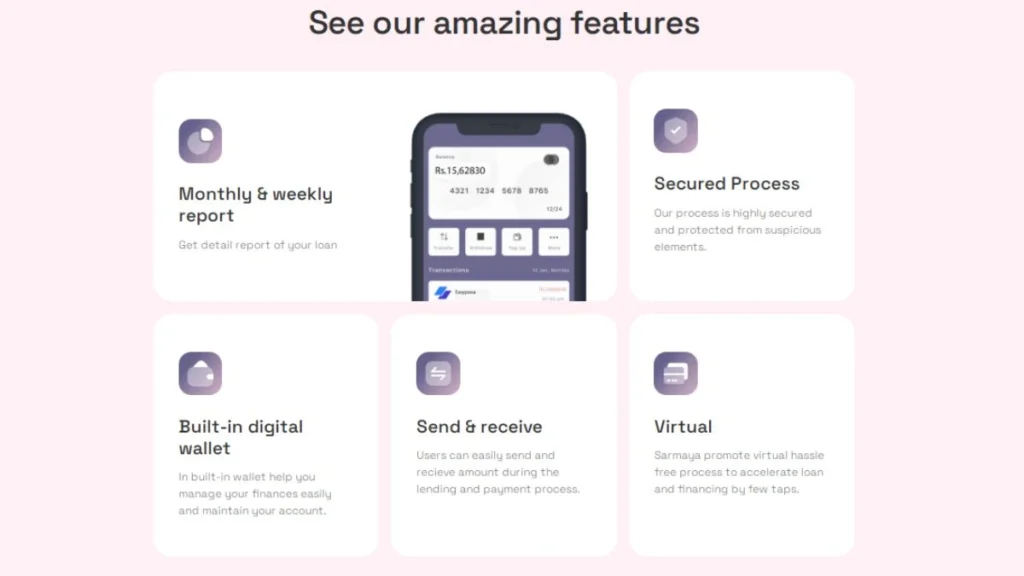

Security Features of Sarmaya Loan App

Sarmaya prioritizes user security. Key security features include:

- Data Encryption: Protects personal and financial information.

- Two-Factor Authentication: Ensures only authorized users can access the app.

Customer Support and Assistance

Sarmaya offers multiple ways for users to get help if they encounter issues:

- In-App Chat Support: Reach customer service directly within the app.

- Email and Phone Support: Contact options are available for more complex inquiries.

Best Online Loan App in Pakistan

Comparing Sarmaya Loan App with Other Loan Apps in Pakistan

Compared to other loan apps in Pakistan, Sarmaya stands out for its:

- Quick Approval Times: Faster than most competitors.

- No Collateral Requirements: Provides easy access to financing.

Common Challenges with Using Sarmaya Loan App

While the app is user-friendly, some users report occasional issues, including:

- Technical Glitches: Such as app crashes or slow loading times.

- Delayed Approvals: During peak times, approval may take longer than usual.

User Experience

The stories of Sarmaya users may be the best way to show how it has changed lives. Let’s look at Aisha, who runs a small business in Karachi. Aisha needed money quickly because she had to open more bakeries because people were wanting to buy them. With Sarmaya, she got the money she needed in just a few days, which let her buy new tools and hire more staff. Aisha story of success is just one way that Sarmaya is helping business owners all over the country.

Bilal, another user, needed a personal loan to pay for unexpected medical costs. Traditional banks turned him down because they had strict rules and took a long time to process his application. Sarmaya, on the other hand, saved the day because it was easy to apply for and quickly approved. Bilal was able to handle his money well, which helped him deal with his stress during a tough time.

Testimonials from users like Aisha and Bilal show how Sarmaya has helped people in the real world. Their stories show how important the app is for getting quick financial help and making life easier. Sarmaya has become a recognized name in digital lending through good interactions with users and consistent performance.

Online Urgent Loan in Pakistan

How Sarmaya Enhances Financial Inclusion

One of the most important things Sarmaya does is help more people in Pakistan get access to banking services. There are still a lot of places in the country that don’t have access to standard banking services. Sarmaya fills this gap by providing a tool that allows people from all walks of life to use, even if they have never used a bank before.

The app is made to help people who might not be able to get loans through normal methods get the money they need. Sarmaya can reach people in remote areas by using mobile technology. This means that more people can improve their financial positions. Including everyone in this way is a key step toward making Pakistan banking system more fair.

Sarmaya is also committed to being welcoming to everyone who uses it. The app comes in many languages and has an easy-to-use interface, so people with different levels of computer literacy can use it. Sarmaya is making it easier for people all over the country to get loans and participate in the economy by removing obstacles and making the loan process simpler.

Sarmaya Impact on the Economy

Sarmaya is very important for Pakistan economic growth, and not just for its users. The app helps small and medium-sized businesses (SMEs), which are very important to the country’s GDP, by making it easier for them to get access to cash. The money that Sarmaya gives to these businesses, which are often called the “backbone” of the economy, is very helpful.

As a result of Sarmaya actions, more jobs are being created as businesses grow and hire more staff. This rise not only helps keep the economy stable, but it also makes life better for many Pakistani families. Sarmaya is creating a climate that is good for innovation and economic growth by giving entrepreneurs and businesses more power.

Sarmaya has a bigger impact on the business because it encourages people to think digitally first. The economy as a whole becomes more efficient and productive as more people and companies use digital financial solutions. This move toward digital banking is very important for Pakistan future because it makes the country more competitive on the world market.

PaisaYaar App Se Loan Lene Ka Tarika

Future of Sarmaya

Looking ahead, Sarmaya is set to keep growing and coming up with new ideas. The people who made the app are always looking for new technologies and ways to make it better so that the loan process is even easier and the user experience is better. Sarmaya wants to stay at the top of digital banking by using cutting edge data analytics and machine learning algorithms.

Sarmaya wants to serve even more people in Pakistan and beyond in the future, so one of its plans is to grow its reach. For the app to have a bigger effect and offer even more financial products and services, it wants to work with local and foreign banks to form partnerships.

Sarmaya wants to be a leader in financial inclusion by giving people and companies the tools they need to reach their goals. Sarmaya is going to have a big effect on the financial services industry and the lives of its users for a long time by coming up with new ideas and changing with the times.

Conclusion

People in Pakistan who want quick, easy access to money without the trouble of traditional banking will find the Sarmaya Loan App very useful. Sarmaya is making waves in the world of online loans with its easy application process, flexible payback terms, and focus on the customer. Samaya could be the answer you have been looking for if you need a quick loan for personal reasons, to grow your business, or to deal with an emergency.

FAQs about Sarmaya Loan App

What documents are needed to apply for a loan on Sarmaya?

Just a valid CNIC and proof of income are typically required.

How fast can I get my loan approved?

Approval usually takes a few hours to a business day, depending on the loan type.

Is Sarmaya Loan App secure?

Yes, the app uses encryption and other security measures to protect user data.

Can I apply for a loan if I am self-employed?

Yes, self-employed individuals can apply as long as they meet the income requirements.

Does Sarmaya charge any hidden fees?

No, all fees and charges are transparent and provided in the application terms.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com