Hakeem Loan App (Easy Finance) Nobody can deny the fact that, today life has wrapped all its elements just in one go and managing over financial activities at fingertips is something (for which we had only dreamt of). Today with the raise of mobile world securing loans was never been so easy on the tap as these are now. One such platform and making waves is the Hakeem Loan App with Easy Access to Loans So, if you are in need of a small amount as a personal loan for an immediate expense or want some funds to support your business. The Hakeem Loan App brings the complete process right at your fingertips which means that you can apply now instantly from anywhere with the use of just a smart phone!

But why exactly is this app gaining so much popularity in the finance industry? Let’s dive in and explore the ins and outs of the Hakeem Loan App, its features, and how it stands out in the crowded fintech space.

Contents

- 1 What is Hakeem Loan App?

- 2 How Does Hakeem Loan App Work?

- 3 Key Features of Hakeem Loan App

- 4 Types of Loans Offered by Hakeem Loan App

- 5 Eligibility Criteria

- 6 Step-by-Step Guide to Using Hakeem Loan App

- 7 Benefits of Using Hakeem Loan App

- 8 Hakeem Loan App vs Traditional Banks

- 9 Customer Support and Service Quality

- 10 User Reviews and Ratings

- 11 How Safe is Hakeem Loan App?

- 12 Limitations and Drawbacks

- 13 Conclusion

- 13.1 FAQs about Hakeem Loan App (Easy Finance)

- 13.1.1 How long does loan approval take?

- 13.1.2 What is the maximum loan amount available?

- 13.1.3 Is Hakeem Loan App available internationally?

- 13.1.4 What happens if I miss a payment?

- 13.1.5 Can I repay my loan early?

- 13.1.6 What is the Hakeem Loan App?

- 13.1.7 How can I download the Hakeem Loan App?

- 13.1.8 What are the eligibility criteria for getting a loan?

- 13.1.9 What types of loans are available?

- 13.1.10 How much can I borrow?

- 13.1.11 How do I apply for a loan?

- 13.1.12 How long does it take to get approved?

- 13.1.13 How do I receive the loan?

- 13.1.14 What is the interest rate?

- 13.1.15 How do I repay the loan?

- 13.1.16 What happens if I miss a payment?

- 13.1.17 Can I extend or restructure my loan?

- 13.1.18 Is my personal information secure?

- 13.1.19 How do I contact customer support?

- 13.1.20 Can I reapply if my loan is rejected?

- 13.1.21 Related posts:

- 13.1.22 How to Get Interest-Free Loan from CashBazar Loan App in 2025

- 13.1.23 Alkhidmat Foundation Loan App 2025

- 13.1.24 Agahe Pakistan Loan App 2025

- 13.1 FAQs about Hakeem Loan App (Easy Finance)

What is Hakeem Loan App?

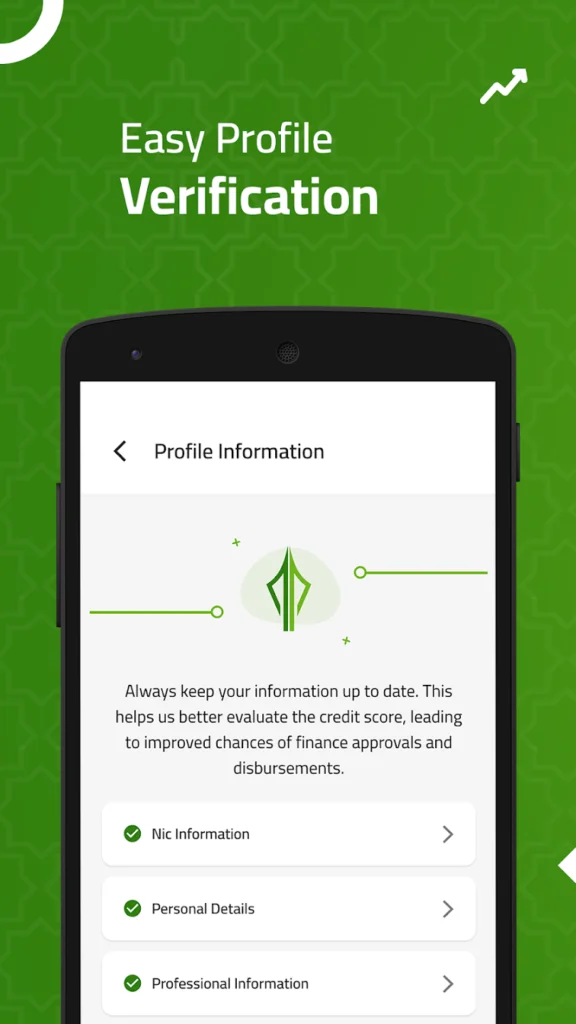

The Hakeem Loan App is a financial tool designed to offer quick and hassle-free loans to individuals and businesses alike. With its user-friendly interface and simplified application process, it allows users to access funds at the tap of a button.

Developed by a leading fintech company, Hakeem Loan App was created with the goal of providing financial freedom to those who need it most. Whether it’s a personal emergency, business cash flow issues, or educational needs, Hakeem Loan App offers a wide range of loan solutions that cater to diverse financial requirements.

How Does Hakeem Loan App Work?

The Hakeem Loan App makes applying for a loan easier than ever. The process is straightforward, allowing users to apply for loans in just a few clicks:

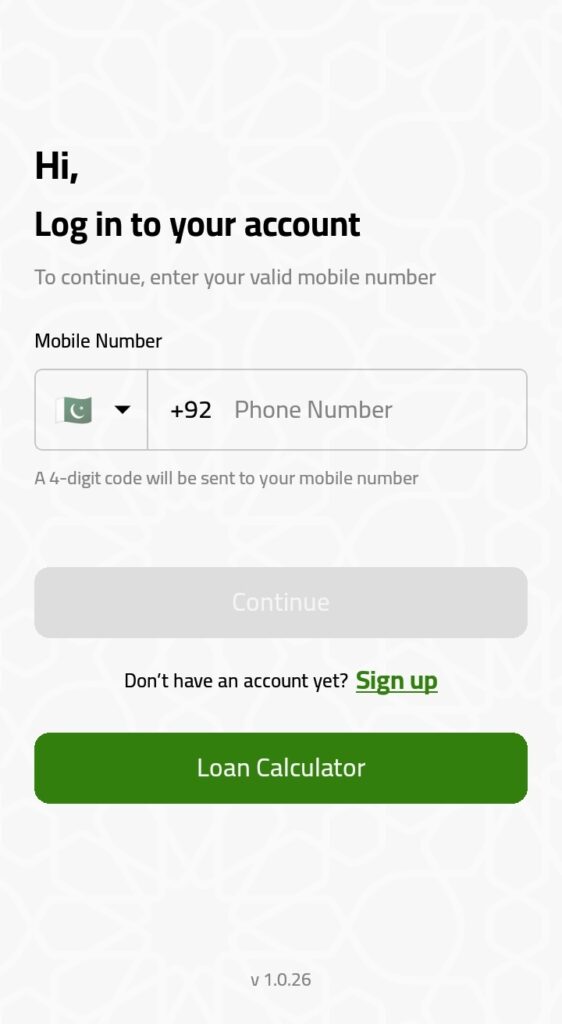

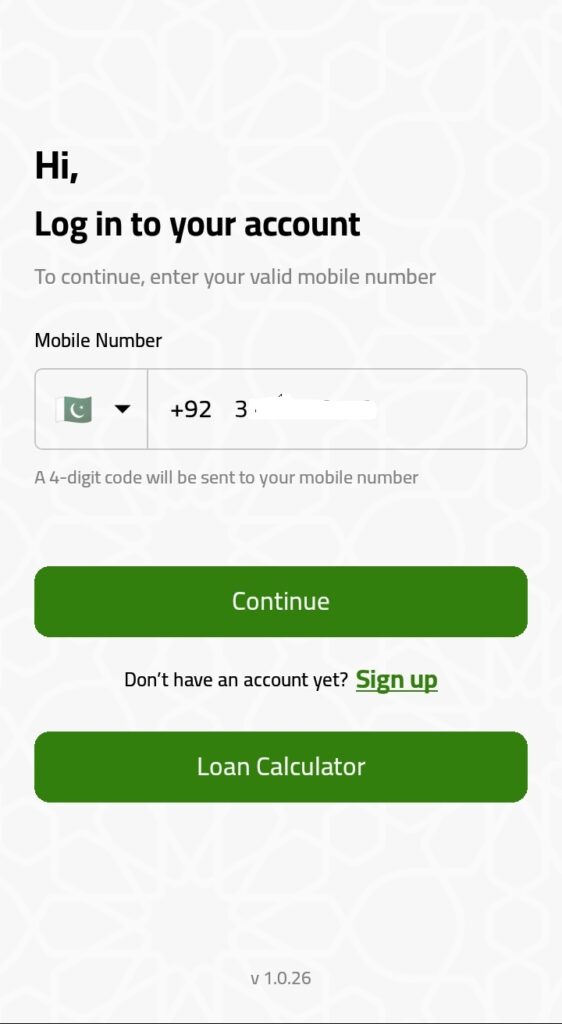

- Download the App: Available on both Android and iOS platforms, users can easily download the app from their respective app stores.

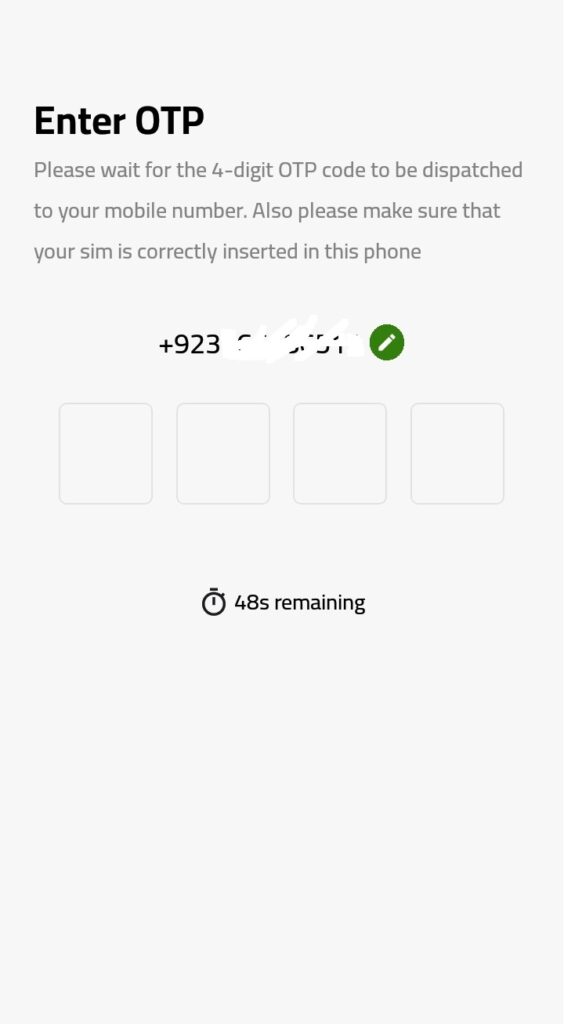

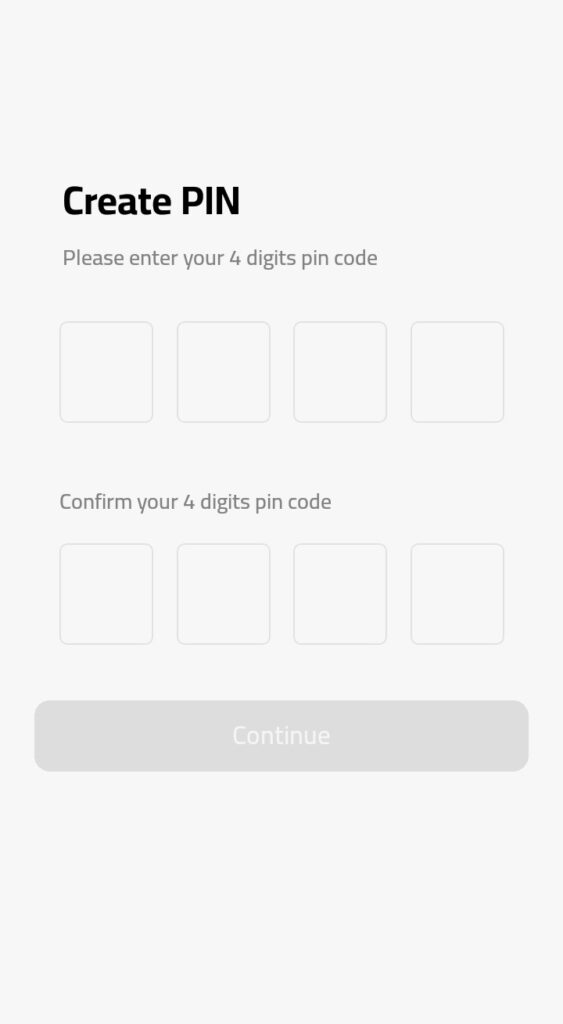

- Create an Account: Once installed, users can create an account by providing some basic information.

- Choose Loan Type: Whether you need a personal, business, or educational loan, you can select the type that suits your needs.

- Apply for a Loan: After selecting the loan type, fill in the required information and submit the application.

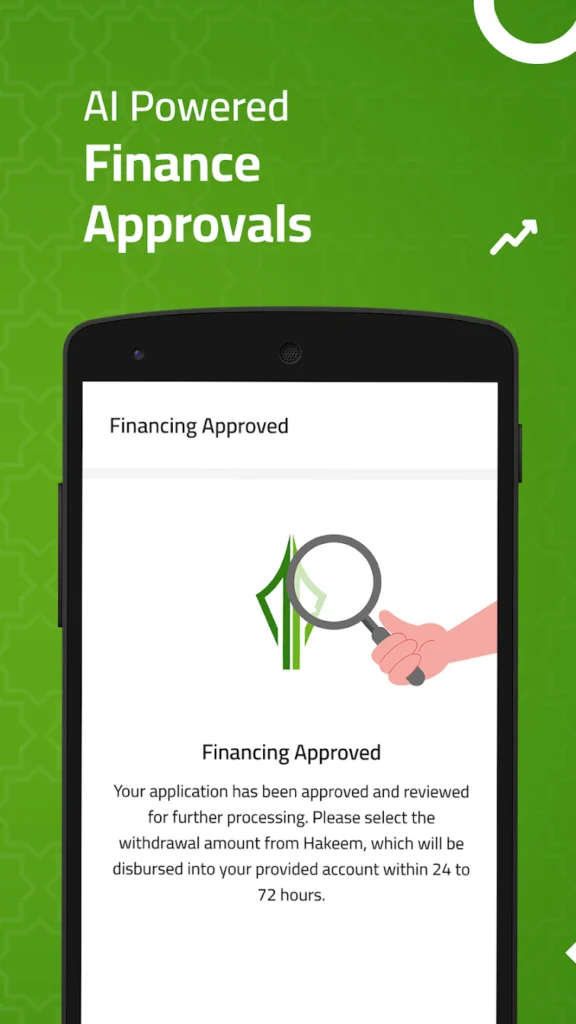

- Approval and Disbursement: Loans are approved quickly, and funds are deposited directly into your account.

The app’s seamless user experience ensures that even those unfamiliar with technology can navigate through the process with ease.

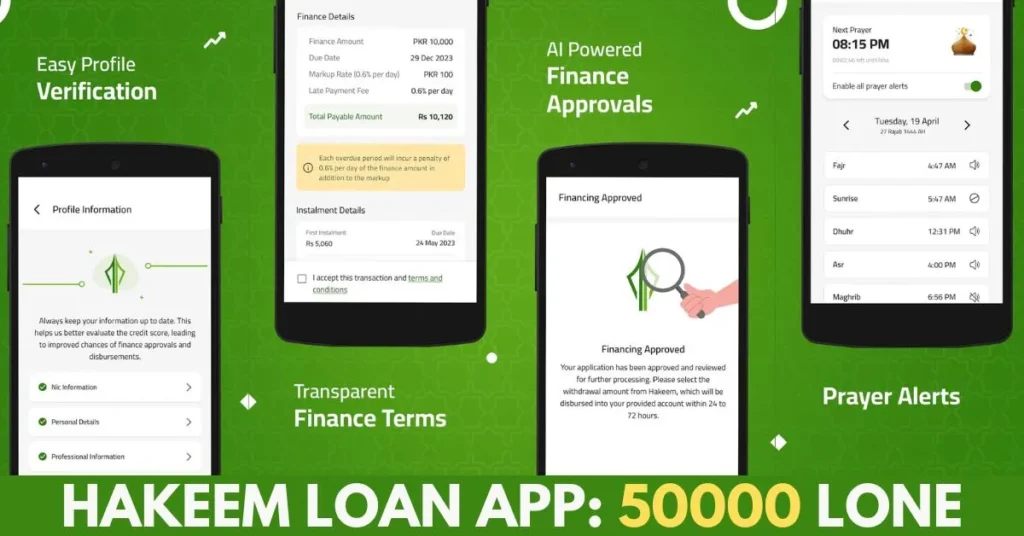

Key Features of Hakeem Loan App

The Hakeem Loan App offers several key features that set it apart from other loan applications:

- Instant Loan Approval: In many cases, loan approval takes only a few minutes, so you can get your funds when you need them the most.

- Flexible Repayment Options: You can choose from different repayment plans, depending on your financial situation, ensuring that repaying the loan is as convenient as possible.

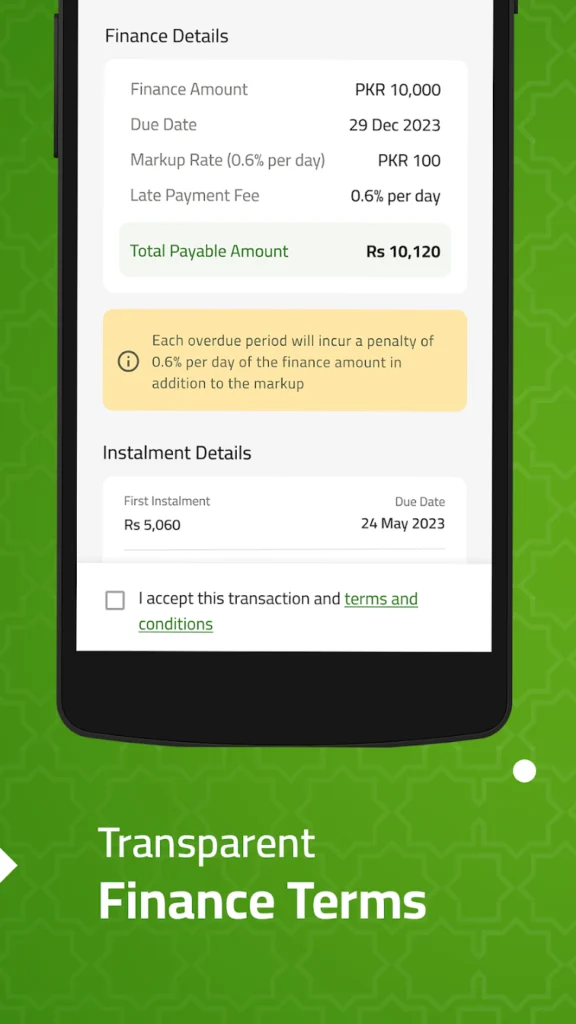

- Low-Interest Rates: Competitive interest rates make it easier for borrowers to manage their loans without accruing excessive debt.

Types of Loans Offered by Hakeem Loan App

Hakeem Loan App offers a variety of loan types to meet different financial needs:

- Personal Loans: Perfect for emergencies, vacations, or major purchases.

- Business Loans: Ideal for small businesses looking to cover expenses or invest in growth.

- Education Loans: Students can use these loans to cover tuition fees, books, or other education-related costs.

- Smart Qarza Safe Easy Cash Loan App

- UdharPaisa Safe and Reliable Loan App

- How to Get Ready Cash Loan

- Asaan Qarza Mobile Loan App

- PK Loan Personal Online Loan

- Easy Loan Mobile App

Eligibility Criteria

To be eligible for a loan via the Hakeem Loan App, applicants must meet certain criteria:

- Age: Applicants must be at least 18 years old.

- Income Proof: Some loans may require proof of a stable income.

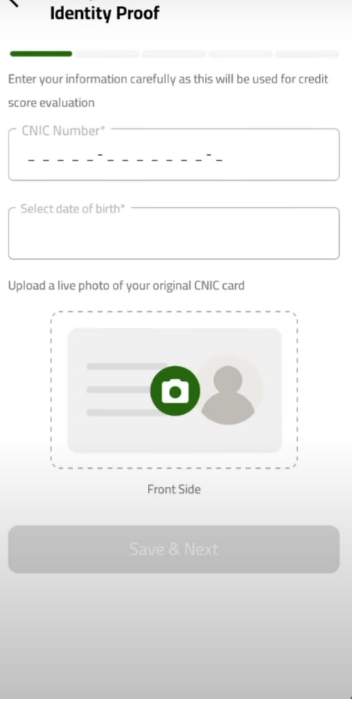

- Valid Identification: Government-issued IDs are typically required.

- Credit Score: While not mandatory, having a good credit score can improve your chances of approval and may lead to better loan terms.

Step-by-Step Guide to Using Hakeem Loan App

- Download and Install the App: Available on both Android and iOS.

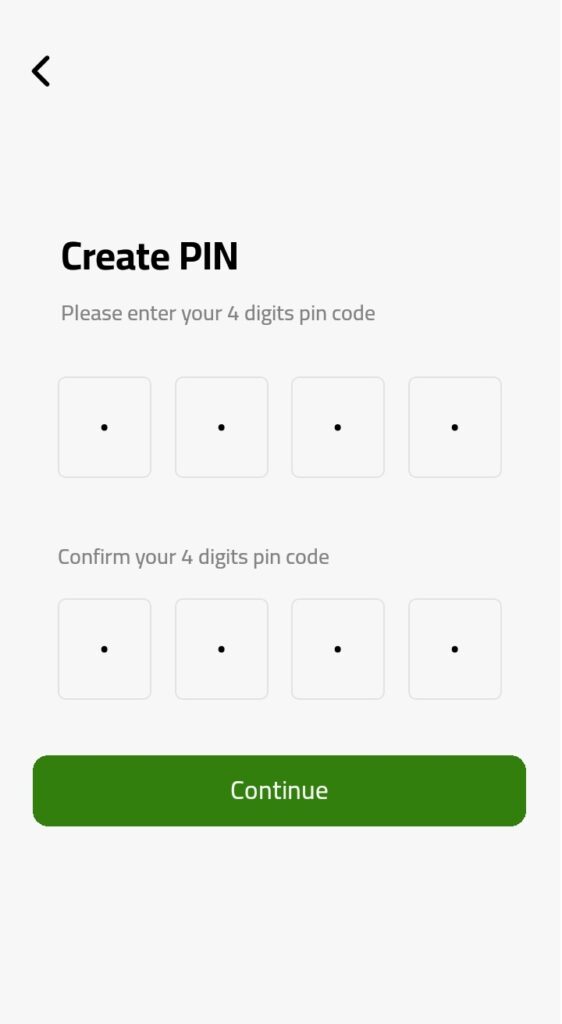

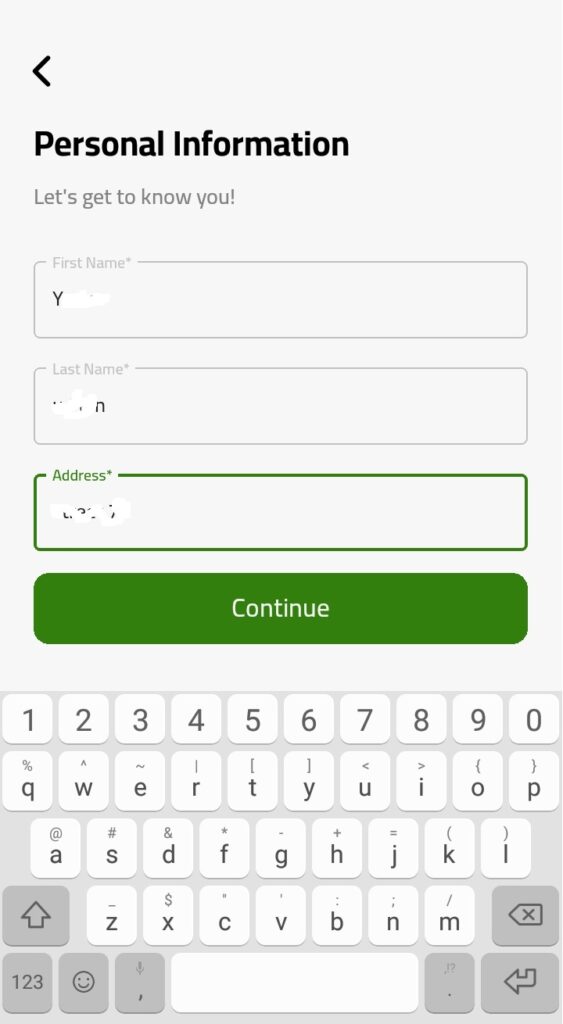

- Create an Account: Sign up using your phone number or email.

- Select Loan Type: Choose from personal, business, or educational loans.

- Fill Out the Application: Provide the necessary information.

- Submit and Wait for Approval: The process is fast, often taking only a few minutes.

- Receive Funds: Once approved, the funds are disbursed directly to your account.

Benefits of Using Hakeem Loan App

The Hakeem Loan App provides several advantages over traditional lending options:

- Convenience and Speed: Loans can be applied for and approved within minutes, all from the comfort of your own home.

- No Hidden Fees: What you see is what you get. The app is transparent about its fees and charges.

- Secure Transactions: With advanced encryption technology, your personal and financial data is safe.

Hakeem Loan App vs Traditional Banks

The app provides several advantages over traditional bank loans:

- Faster Loan Processing: Traditional banks can take days or even weeks to approve a loan, while Hakeem Loan App completes the process within minutes.

- Less Paperwork: The app requires minimal documentation compared to banks.

- More Accessible: The app is available 24/7, making it more accessible than banks, which operate during specific hours.

Customer Support and Service Quality

Hakeem Loan App prides itself on offering excellent customer service. You can reach the support team via phone, email, or live chat. Most users report prompt responses and helpful service, making it easy to resolve issues.

User Reviews and Ratings

Many users have shared positive experiences with the Hakeem Loan App, praising its quick approval process and ease of use. While some users have pointed out areas for improvement, such as the need for more repayment flexibility, the overall feedback is highly favorable.

How Safe is Hakeem Loan App?

Security is a top priority for Hakeem Loan App. The app uses encryption to protect user data and complies with industry standards to ensure the privacy of your personal and financial information.

Limitations and Drawbacks

While the app offers many advantages, it’s not without limitations. Some users have reported:

- Strict Eligibility Requirements: Not everyone may qualify for a loan.

- Limited Loan Amounts: The maximum loan amount may not be sufficient for larger needs.

Conclusion

In conclusion, the Hakeem Loan App is a fantastic solution for anyone looking for quick and easy access to loans. With its user-friendly design, instant approval process, and flexible repayment options, it’s a game-changer in the fintech world. Whether you need a personal loan, business loan, or education loan, the Hakeem Loan App offers a convenient and secure way to manage your finances.

FAQs about Hakeem Loan App (Easy Finance)

How long does loan approval take?

Approval typically takes just a few minutes, depending on the loan type and your eligibility.

What is the maximum loan amount available?

The maximum loan amount varies but is typically designed to meet most personal and small business needs.

Is Hakeem Loan App available internationally?

Currently, the app operates in specific countries, so it’s essential to check if it’s available in your region.

What happens if I miss a payment?

Missing a payment may result in additional fees and could impact your credit score. It’s best to contact customer support if you are facing difficulties.

Can I repay my loan early?

Yes, the app allows early repayment without any penalties.

What is the Hakeem Loan App?

The Hakeem Loan App is a mobile application that provides easy access to quick loans. Users can apply for personal loans, track their loan status, and manage their repayments conveniently through the app.

How can I download the Hakeem Loan App?

You can download the Hakeem Loan App from the Google Play Store (for Android) or the Apple App Store (for iOS).

What are the eligibility criteria for getting a loan?

To be eligible for a loan, you need to:

- Be at least 18 years old.

- Have a valid ID or government-issued identification.

- Provide proof of income or employment.

- Have an active bank account or mobile money account for receiving the funds.

What types of loans are available?

The app offers different types of personal loans, such as:

- Payday loans

- Short-term loans

- Installment loans

How much can I borrow?

The loan amount varies depending on your credit history and the information provided during the application. Typically, first-time users may borrow smaller amounts, with the opportunity to borrow more after successful repayments.

How do I apply for a loan?

- Download the app from the relevant app store.

- Register with your phone number and fill out your personal details.

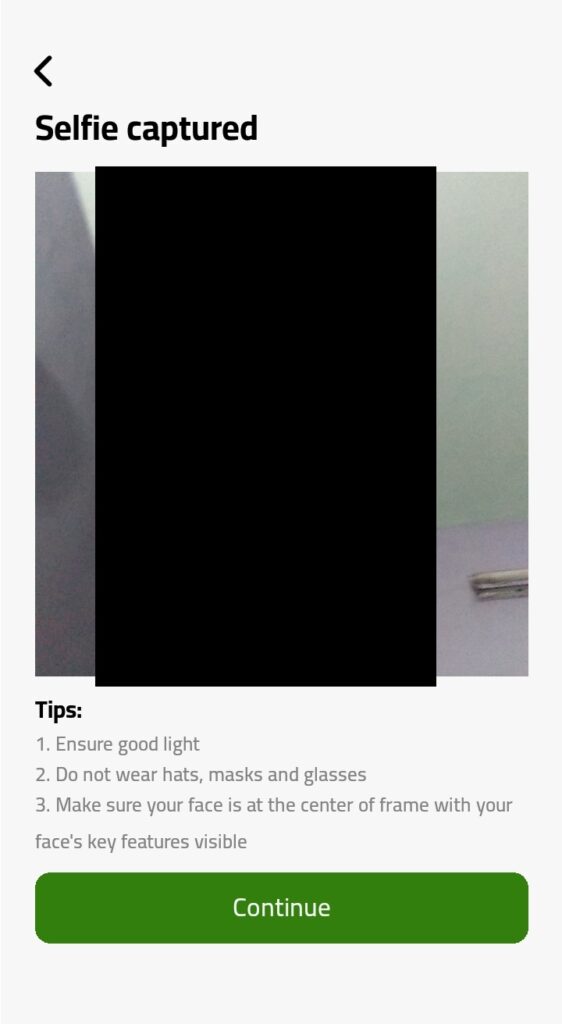

- Submit required documents (e.g., ID, proof of income).

- Choose the loan amount and repayment terms.

- Submit your application for approval.

How long does it take to get approved?

Loan approvals can take anywhere from a few minutes to a few hours, depending on the verification process.

How do I receive the loan?

Once approved, the loan amount will be disbursed directly to your registered bank account or mobile money account.

What is the interest rate?

The interest rate depends on the loan amount, duration, and your credit profile. Detailed loan terms, including interest rates, will be displayed before you confirm the loan request.

How do I repay the loan?

You can repay the loan through:

- Bank transfer

- Mobile money

- Direct debit from your account The repayment method can be chosen in the app.

What happens if I miss a payment?

If you miss a payment, you may incur late fees or penalties. Your credit score within the app might also be affected, making it harder to apply for future loans.

Can I extend or restructure my loan?

Yes, in some cases, you can request an extension or restructuring of your loan. Contact customer service within the app for assistance.

Is my personal information secure?

Yes, the app uses advanced encryption to ensure the security of your personal and financial information.

How do I contact customer support?

You can contact customer support through the in-app chat feature, email, or by calling the hotline number provided in the app.

Can I reapply if my loan is rejected?

Yes, you can reapply, but it’s recommended to check the reasons for the rejection and improve any areas needed before submitting a new application.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com