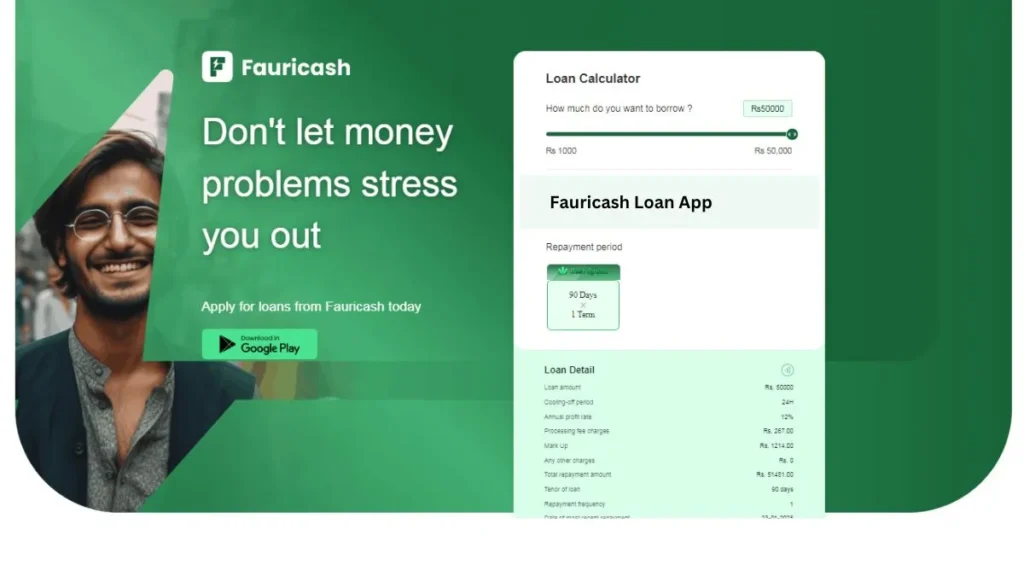

One of the most trusted and well-known ways to borrow money online in Pakistan is through the Fauricash Loan App. Short-term loans are available through this app for people who need money quickly but don’t want to deal with the long and complicated papers that banks require. There are a lot of people in Pakistan who like Fauricash’s easy-to-use loan service, which they use to cover unexpected costs or bridge a financial gap.

Contents

- 1 How Does Fauricash Work?

- 2 Features of Fauricash Loan App

- 3 Eligibility Requirements

- 4 Application Sonditions

- 5 Application Steps

- 6 How to Download and Register on Fauricash

- 7 Applying for a Loan on Fauricash

- 8 Loan Amounts and Terms Available

- 9 Interest Rates and Fees

- 10 Security and Privacy Measures

- 11 Pros and Cons of Fauricash Loan App

- 12 Customer Support and Assistance

- 13 User Reviews and Testimonials

- 14 Comparison with Other Loan Apps in Pakistan

- 15 Tips for Responsible Borrowing on Fauricash

- 16 Benefits of Using Fauricash

- 17 Future of Digital Lending in Pakistan

- 18 Fauri Cash: Rapid Cash Solution

- 19 Conclusion

- 20 FAQs about Fauricash Loan App

- 20.1 Who can get a money loan now?

- 20.2 How to get a loan?

- 20.3 Why does Fauricash need to collect your personal information?

- 20.4 Can I update my cash account information?

- 20.5 How to get a loan through a bank account?

- 20.6 What is our review process?

- 20.7 How quickly can I get my loan approved?

- 20.8 Is Fauricash safe to use?

- 20.9 What if I miss a payment?

- 20.10 Are there hidden fees in Fauricash?

- 20.11 Can I extend my loan repayment period?

- 20.12 Related posts:

- 20.13 How to Get Interest-Free Loan from CashBazar Loan App in 2025

- 20.14 Alkhidmat Foundation Loan App 2025

- 20.15 Agahe Pakistan Loan App 2025

How Does Fauricash Work?

The platform that Fauricash uses is easy to use, and you can ask for a loan right from your phone. From applying to getting approved, the whole process is meant to be quick and easy. To help you get started, here are a few quick steps:

- Download the app from the official app store.

- Register and create your profile by providing essential personal details.

- Apply for a loan by selecting the desired amount and repayment period.

- Await approval as Fauricash assesses your application.

With easy verification measures, Fauricash ensures a secure and reliable lending experience.

Features of Fauricash Loan App

Fauricash stands out for several unique features, which contribute to its popularity among Pakistani users:

- Quick Approval: Most applications are processed within minutes, making it ideal for urgent needs.

- Flexible Loan Amounts: You can borrow amounts that suit your needs, avoiding unnecessary debt.

- Competitive Interest Rates: Fauricash offers rates that are relatively lower than some other digital lending platforms, making it affordable.

Hakeem Loan App (Easy Finance)

Eligibility Requirements

Users must meet basic requirements in order to be eligible for a loan through Fauricash. This makes sure that the platform stays open and trustworthy. Here are the most important specs:

- Age: Applicants must be at least 18 years old.

- Employment Status: While employed individuals are preferred, self-employed individuals may also qualify.

- Documents: Valid CNIC, proof of income, and a bank account are required.

Application Sonditions

The conditions for applying for a loan are relatively flexible.

18 years or older

Have a stable source of income and a good credit history.

Application Steps

- Download and install Fauricash and complete the account registration process.

- Provide necessary personal information such as your monthly income and expenses.

- This information will help us evaluate your financial situation and make the decision to approve your loan application.

- Select the amount and term you want to borrow, confirm and send your request.

- After submitting your application, you will be notified of the result within a few hours.

- If your application is approved, the loan amount will be transferred directly to your bank account.

How to Download and Register on Fauricash

Getting started with Fauricash is easy. Follow these steps:

- Download the Fauricash app from Google Play Store or the Apple App Store.

- Create an account by providing your basic personal details.

- Complete your profile with necessary information such as CNIC and income proof.

Applying for a Loan on Fauricash

Applying for a loan is a straightforward process:

- Log in to your Fauricash account.

- Select the loan amount and repayment period that suits your needs.

- Submit your application and wait for the automated review.

Approval can often take as little as a few minutes, depending on your profile and the amount requested.

Loan Amounts and Terms Available

Fauricash offers various loan options to suit different needs:

- Minimum Loan: Typically starts at a 3,000 PKR to 5,000 PKR.

- Maximum Loan: Can go up to a limit set based on eligibility.

- Repayment Periods: Usually ranges from a few weeks to a few months.

Fauricash also provides an option to request a loan extension if needed.

Interest Rates and Fees

Transparency is a core aspect of Fauricash’s services. Here is a look at its costs:

- Interest Rate: The rate varies based on the amount and repayment period.

- Processing Fee: A small fee is typically charged during loan disbursement.

- Late Fees: In case of delayed payments, late fees may apply, so timely repayment is encouraged.

Security and Privacy Measures

Fauricash employs stringent security protocols to protect users’ personal information. Through encryption and secure data storage practices, the app ensures that your sensitive information remains safe.

Pros and Cons of Fauricash Loan App

Here is a breakdown of Fauricash’s benefits and potential drawbacks:

Pros

- Fast approval: Ideal for emergencies.

- No complex paperwork: Fully digital process.

- Transparency in fees: No hidden charges.

Cons

- Limited loan amounts for new users.

- Higher interest rates for short-term loans.

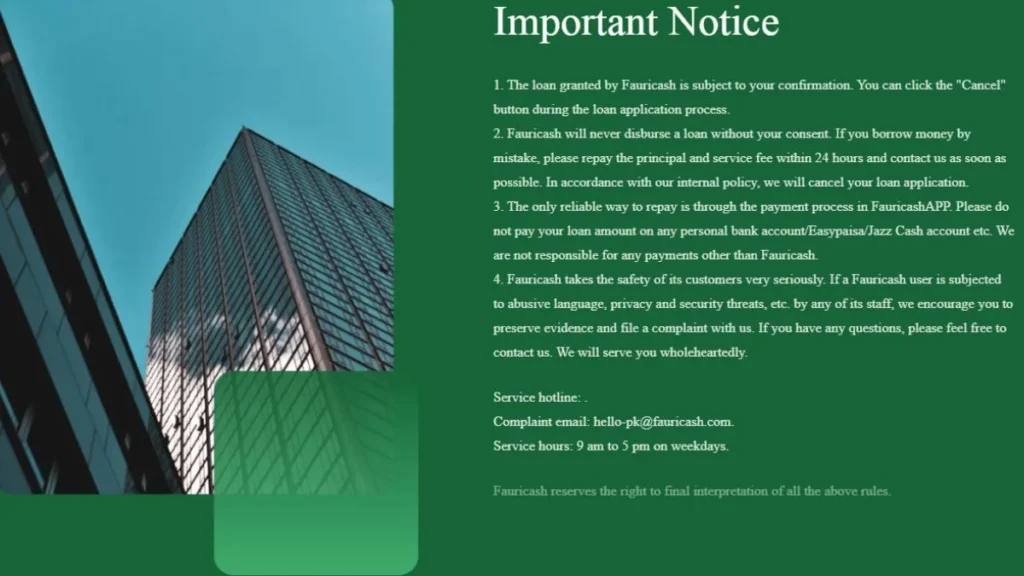

Customer Support and Assistance

Fauricash has a specialized helpline, in-app chat, and email support as well as other ways for customers to get help. Response times are usually quick, which helps users solve problems quickly.

Contact US

If you have any questions, please feel free to contact us. We will serve you wholeheartedly.

hello-pk@fauricash.com

Service hours: 9 am to 5 pm on weekdays.

User Reviews and Testimonials

The app mostly gets good reviews for how easy it is to use and how quickly it works. A lot of users like how convenient it is, and others say that the clear fee structure is one of the best things about it.

Comparison with Other Loan Apps in Pakistan

When you compare Fauricash to other loan apps in Pakistan, it stands out because it is easy to use and has clear fees. There are other platforms that offer similar services, but Fauricash is the best because it has the best rates and the most customizable terms.

Tips for Responsible Borrowing on Fauricash

To avoid debt pitfalls, here are some tips:

- Only borrow what you need: Avoid overextending financially.

- Set a repayment plan: Ensure timely payments to avoid late fees.

- Consider the interest rate: Weigh the total cost before applying.

Benefits of Using Fauricash

Fauricash has a number of benefits that make it different from other ways to get loans. The app’s quick review processes make sure that users get money when they need it the most. This speed is very important in situations, when waiting at a bank for a long time is not an option.

Furthermore, Fauricash offers a variety of repayment choices so users can pick the ones that work best for their budgets. This freedom helps keep finances from getting too tight, which makes it easier for people to borrow money. The app lets users keep track of their plans and make sure they don’t miss any payments by managing their repayments.

Another big benefit is security. Fauricash uses strong protections to keep user info and transactions safe. All of your personal and financial information is kept safe by the app’s encryption and other security measures. Focusing on security helps users trust each other, which gets more people to use digital loans.

Future of Digital Lending in Pakistan

Pakistan is about to see a lot of growth in digital banking. More people can use digital banking services now that more people have smartphones and can connect to the internet. This trend is likely to keep going, with apps like Fauricash leading the way to a more open banking system.

But there are still problems. To make sure that growth lasts, problems like digital literacy, cybersecurity, and regulatory systems need to be fixed. To get past these problems and build a strong digital lending environment, financial institutions, tech companies, and the government will need to work together.

Even with these problems, the future looks bright. Digital loans could completely change Pakistan’s economy by giving everyone access to financial services like never before. Fauricash and other sites like it can help shape the future by continuing to come up with new ideas and change with the times.

Fauri Cash: Rapid Cash Solution

About this app

Fauri Cash by Pakisnova Microfinance Company (Private) Limited, a SECP licensed NBFC company with License No. SECP/LRD/109/PMCPL/2023/102. We strictly adhere to Pakistani regulations and laws No. SC/NBFC-1-196/Circular/2024/76 to operation and committed to provide safe, transparent and reliable lending services.

Fauri Cash offers the convenience of applying for a personal loan in Pakistan. Anyone who fulfills the basic criteria is eligible to apply with us. Fauri Cash connects you with a team of experts to facilitate a hassle-free and expedited loan approval process. Simply complete the basic information online, and you can then reap the benefits associated with the loan. Select the loan that best suits your needs and have the funds securely transferred to your account immediately upon approval. Allow us to assist you throughout the process!

Security and Privacy Protection

When utilizing our application, we may request certain permissions related to your mobile device information to enhance your experience and provide better assistance. This process also aids in assessing your eligibility for the application. We ensure that all data is safeguarded with bank-level security measures, and we pledge that your data will never be shared with any third parties without your explicit consent.

privacy policy:

https://www.fauricash.com/privacy-policy

Product information:

Loan Amount: from PKR 1,000 to PKR 50,000

Loan Term: from 61 days to 90 days

APR (Annual interest rate): 5%-12%

Loan Example:

If you apply for a loan with the principal amount of PRK 3,000 and the loan term is 90 days, the annual interest rate is 12%, other fees is 0, then you need to pay as follows:

Loan amount in hand: 3,000

Total interest payable: 3,000*12%*90/365=89

Daily interest: 3,000*12%/365=0.98

The total payable amount : 3,000+89=3,089

Eligibilities:

You are 18-60 years old

You need to be a Pakistani citizen

contact us:

Pakisnova Microfinance Company (Private) Limited

Office 410,Fifth,Floor,Gulberg Business Centre,Civic Centre,Gulberg Green,Islamabad

Email: hello-pk@fauricash.com

Conclusion

In conclusion, the Fauricash Loan App is a safe and effective option for Pakistanis who need short-term cash help. It’s no surprise that Fauricash has become popular—it has quick approvals, an easy application process, and tools that are easy for anyone to use. Remember to be smart about how you use loans; plan your finances to make sure you can pay them back on time and stay out of debt traps.

Online Urgent Loan in Pakistan

PaisaYaar App Se Loan Lene Ka Tarika

FAQs about Fauricash Loan App

Who can get a money loan now?

18-year-old citizen and own bank account

How to get a loan?

Download it from Google Play store and fill in the required personal information with your mobile number. You can get a loan after passing the review

Why does Fauricash need to collect your personal information?

Provide you with better loan services and evaluate your credit history

Can I update my cash account information?

Before applying for a loan, you can modify your bank card data

How to get a loan through a bank account?

Select your registered bank and enter your account data

What is our review process?

We will check your credit history against the information referenced by the automated risk assessment

How quickly can I get my loan approved?

Approval typically takes only a few minutes, depending on your profile and loan amount.

Is Fauricash safe to use?

Yes, Fauricash implements security measures like encryption to protect your data.

What if I miss a payment?

Late fees may apply, but Fauricash offers options for loan extensions if needed.

No, all fees are clearly disclosed, with no hidden charges.

Can I extend my loan repayment period?

Yes, Fauricash offers extensions on a case-by-case basis.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com