Contents

- 1 Product Benefits & Features

- 2 Eligibility Criteria

- 3 Documentation Requirements

- 4 How to Apply for UBL Personal Loan Online

- 4.1 UBL Personal Loan Calculator

- 4.2 Interest Rates and Charges for UBL Personal Loan

- 4.3 Loan Repayment Options

- 4.4 Pros and Cons of Applying for UBL Personal Loan Online

- 4.5 Tips for a Successful UBL Loan Application

- 4.6 UBL Digital

- 4.7 Common Mistakes to Avoid When Applying Online

- 4.8 Conclusion

- 4.9 FAQs about UBL Personal Loan Apply Online

- 4.9.1 How long does it take to get approved for a UBL personal loan?

- 4.9.2 What is the maximum loan amount I can apply for?

- 4.9.3 Can I apply for a UBL personal loan if I am self-employed?

- 4.9.4 Is there a processing fee for the UBL personal loan?

- 4.9.5 Can I repay my UBL personal loan early?

- 4.9.6 Related posts:

- 4.9.7 QarzMitra Loan App

- 4.9.8 How to Get Interest-Free Loan from CashBazar Loan App in 2025

- 4.9.9 JazzCash Islamic Saving Account 2025 (Salaam Investment)

Introduction

Looking for a quick financial solution without visiting a bank branch? UBL (United Bank Limited) offers a personal loan you can apply for online from the comfort of your home. This guide will take you through everything you need to know about applying for a UBL personal loan online in Pakistan, including eligibility requirements, the application process, and tips for approval.

What is a UBL Personal Loan?

A UBL personal loan is an unsecured loan provided by United Bank Limited, one of the largest banks in Pakistan. It is designed to help individuals meet their financial needs, whether for education, medical emergencies, home improvements, or debt consolidation. Since it is an unsecured loan, you do not need to provide collateral, making it a convenient option for many.

Product Benefits & Features

- Maximum Limit: Up to Rs. 3 Million

- Tenor: 1 – 4 years

- Quick Processing

- Competitive Rates

- Flexible Repayment Terms

- Complimentary Credit Insurance

- Processing fee on approval

- Early Settlement option

- Loan top-ups/enhancements for more financing

- Balance transfer facility for outstanding personal loan(s)

Benefits of UBL Personal Loan

Applying for a UBL personal loan online comes with numerous advantages:

Flexible Loan Amounts

UBL offers a wide range of loan amounts that cater to different financial needs. Whether you need a small amount for a quick expense or a larger sum for major purchases, UBL has you covered.

Competitive Interest Rates

UBL interest rates are competitive, making it an attractive option compared to other lenders in the market. The bank often offers promotional rates, so keep an eye out for deals that could save you money.

Quick Disbursal

One of the standout features of the UBL personal loan is its fast disbursal process. Once your application is approved, the funds are transferred directly to your account, allowing you to access them without delay.

Eligibility Criteria

- Minimum Net Income: Rs. 40,000

- Age: 21 – 60 years

- Salaried individuals whose salaries are being credited to UBL or any other Bank in Pakistan

Eligibility Criteria for UBL Personal Loan

Before you apply for a UBL personal loan, it is important to understand the eligibility requirements.

Age Requirements

Applicants must be between 21 and 60 years old at the time of application.

Employment Status

Both salaried individuals and self-employed professionals can apply. However, you must have a stable income to qualify.

Income Requirements

There is a minimum income threshold that applicants must meet. This varies based on employment type, but generally, you should earn at least PKR 25,000 per month.

Documentation Requirements

- Signed application form

- Loan declaration form duly signed

- Letter of Irrevocable Standing Instructions & Authorization of Auto Debit

- Copy of CNIC

- Salary Slip (original or verified as original seen by Branch Manager) and/or

- Salary Certificate mentioning break up. Net salary credited in the account should be the same as mentioned in the break-up

- Employment letter/employment card/appointment letter confirming the required tenor

- 12 months’ bank statement reflecting consistent salary credit

Documents Required for UBL Personal Loan Application

Having the necessary documents ready can streamline your loan application process.

Identification Documents

You will need a valid CNIC (Computerized National Identity Card) as proof of identification.

Income Proof

For salaried individuals, salary slips or employment letters are required. Self-employed individuals may need to provide tax returns.

Bank Statements

Most applications will also require recent bank statements (last 6 months) to verify your financial stability.

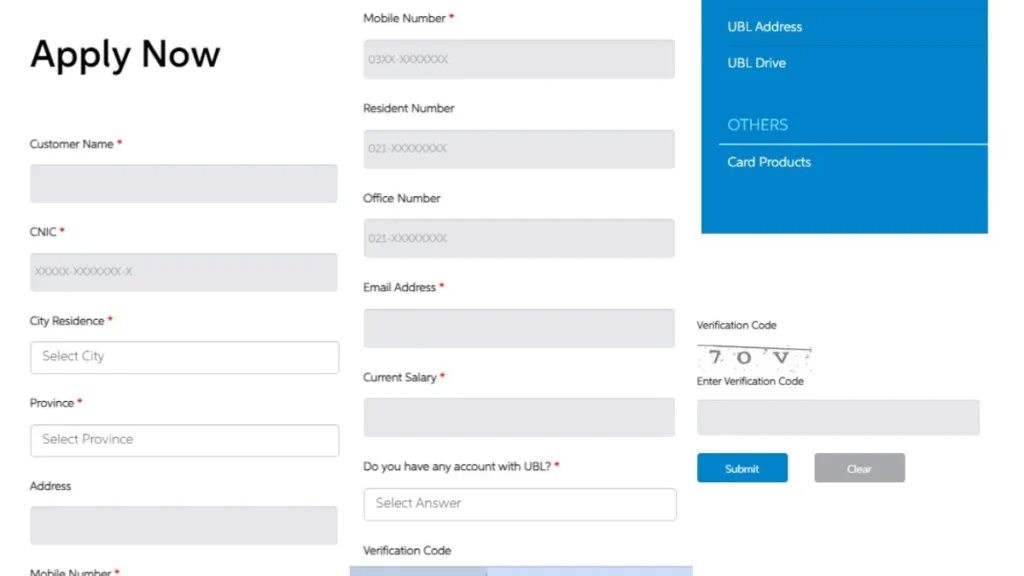

How to Apply for UBL Personal Loan Online

Applying for a UBL personal loan online is simple and can be done in just a few steps.

Step-by-Step Guide

- Visit the UBL official website.

- Navigate to the “Personal Loan” section.

- Click on the “Apply Now” button.

- Fill out the online application form with your personal and financial details.

- Upload the necessary documents.

- Submit the application.

Submitting Your Application

Once you have submitted your application, UBL will review it. You may be contacted for further information or documentation if needed.

UBL Personal Loan Calculator

Using the UBL personal loan calculator can help you estimate your monthly instalments and total repayment amount.

How to Use the Calculator

Input the loan amount, interest rate, and repayment tenure to get an estimate of your monthly instalment.

Benefits of Using a Loan Calculator

The calculator helps you plan your finances better by providing a clear picture of your monthly commitments.

Interest Rates and Charges for UBL Personal Loan

Understanding the interest rates and charges associated with the loan is crucial for budgeting.

Types of Interest Rates

UBL offers fixed interest rates, ensuring your monthly payments remain consistent throughout the loan tenure.

Additional Charges

Be aware of processing fees, late payment charges, and prepayment penalties.

Loan Repayment Options

UBL offers multiple repayment options, making it easier for you to manage your finances.

Flexible Repayment Terms

You can choose a repayment term ranging from 1 to 5 years, depending on your financial situation.

Early Repayment and Prepayment Options

UBL allows you to repay your loan early, though there may be prepayment charges.

Pros and Cons of Applying for UBL Personal Loan Online

Pros:

- Convenient and time-saving

- Quick approval and disbursal

- No collateral required

Cons:

- High interest rates for some applicants

- Potential prepayment penalties

UBL All Locations Click Here

Tips for a Successful UBL Loan Application

- Ensure all documents are accurate and up-to-date.

- Use the loan calculator to understand your repayment obligations.

- Maintain a good credit history to increase your chances of approval.

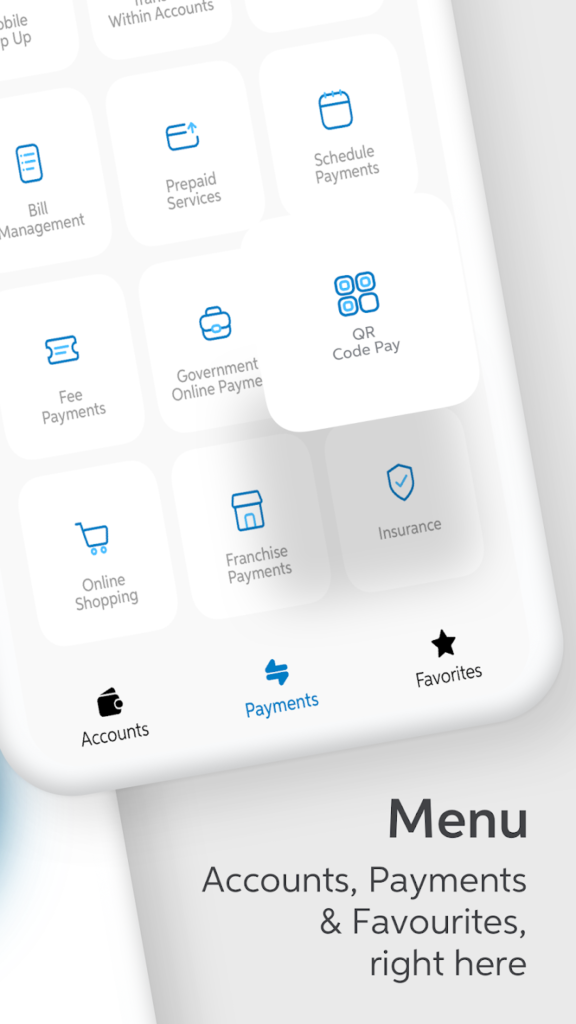

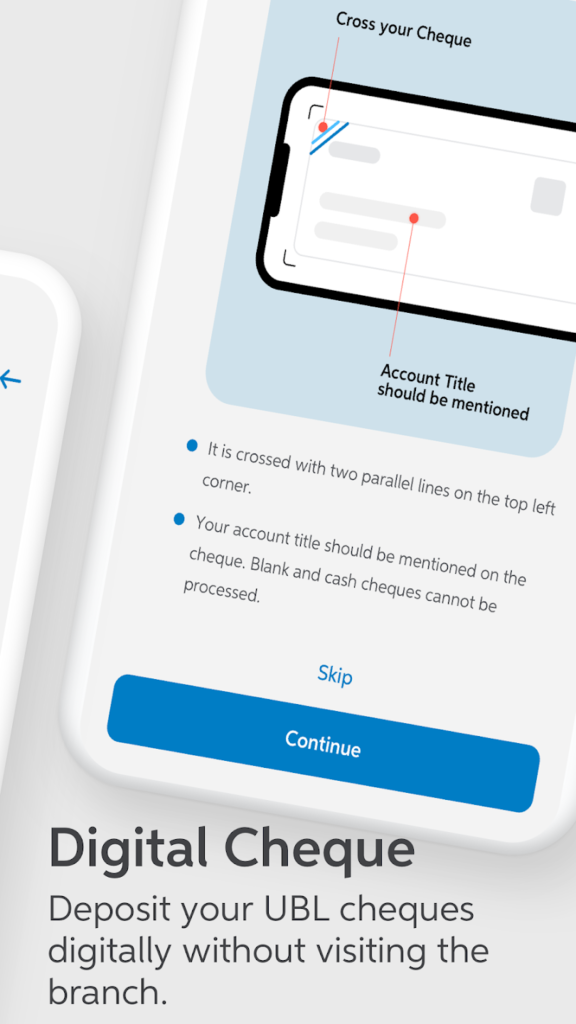

UBL Digital

UBL Digital App brings the exciting features of Digital banking on smartphones and Wear OS. UBL Digital enhances the financial liberty of our customers and enables them to manage their digital lifestyle anytime, anywhere, while on the go.

Funds Transfer & Payments:

- Pay your Credit Card & Loan Accounts

- Pay Utility, Broadband & Mobile Bills

- Buy Prepaid Vouchers & Top-ups

- Pay to Online Shopping Companies

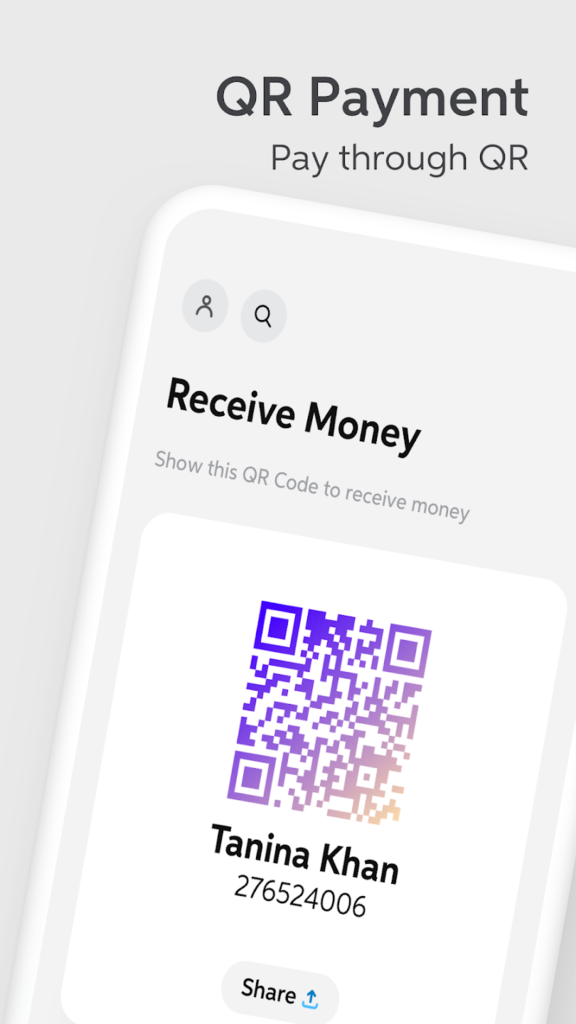

- Send & Receive Funds via QR Code

- Transfer within own Accounts

- Transfer Funds to UBL Accounts, 1 Link member Banks and UBL Omni Accounts

- Top-up WIZ Cards

- QR Code Payments

- Experience banking on your Wear OS

Discount & Offers:

- Search & Navigate to the nearby deals and discounts offered by UBL

Locate nearby ATMs/Branches:

- Find the nearby UBL ATMs and Branches

Basic features:

- Login through secure Fingerprint ID

- Manage Multiple Accounts

- Experience Account Statement with graphical illustration

- Order new Debit Cards

- Beneficiary Management

- Payee Management, with transaction history for each payee

- Manage your Debit card(s) without going to a branch

- Manage your Cheque(s) from within the app

- Manage viewing your balance, make payments to favourites, lock your debit card, and check transaction history from your Wear OS

Feedback:

- Leave a message and one of our customer care representatives will get back to you

- Let us know your feedback regarding the App

Follow us – @ubldigital all channels!

https://www.facebook.com/UBLUnitedBankLtd

https://www.instagram.com/ubldigital

https://twitter.com/ubldigital

https://www.linkedin.com/company/united-bank-limited

Common Mistakes to Avoid When Applying Online

- Providing incorrect information

- Not reading the terms and conditions

- Failing to check your credit score

Conclusion

Applying for a UBL personal loan online in Pakistan is a convenient way to secure the funds you need quickly. Understanding the process, meeting the eligibility criteria, and providing accurate information can increase your chances of a successful application. Whether you need the loan for personal or emergency purposes, UBL flexible terms and competitive rates make it a great choice.

Online Urgent Loan in Pakistan

UBL Personal Loan Apply Now

FAQs about UBL Personal Loan Apply Online

How long does it take to get approved for a UBL personal loan?

Approval can take anywhere from a few hours to a few days, depending on the completeness of your application.

What is the maximum loan amount I can apply for?

The maximum loan amount varies but can reach PKR 2 million, depending on your income and credit history.

Can I apply for a UBL personal loan if I am self-employed?

Yes, UBL offers personal loans to both salaried and self-employed individuals, provided they meet the income requirements.

Is there a processing fee for the UBL personal loan?

Yes, UBL charges a processing fee, typically around 1-2% of the loan amount.

Can I repay my UBL personal loan early?

Yes, you can repay the loan early, but there may be a prepayment penalty.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com