HBL Loan App in Pakistan: Everything You Need to Know

Introduction

HBL Loan App in Pakistan: In today’s digital age, managing your finances has become easier than ever, thanks to mobile banking apps. One of the top banking apps in Pakistan is the HBL Loan App, designed to simplify loan applications and provide quick financial solutions. Whether you need a personal loan or are planning to buy a new car, the HBL Loan App could be your go-to financial tool. Let us dive deeper into what the app offers and how it can benefit you.

What is the HBL Loan App?

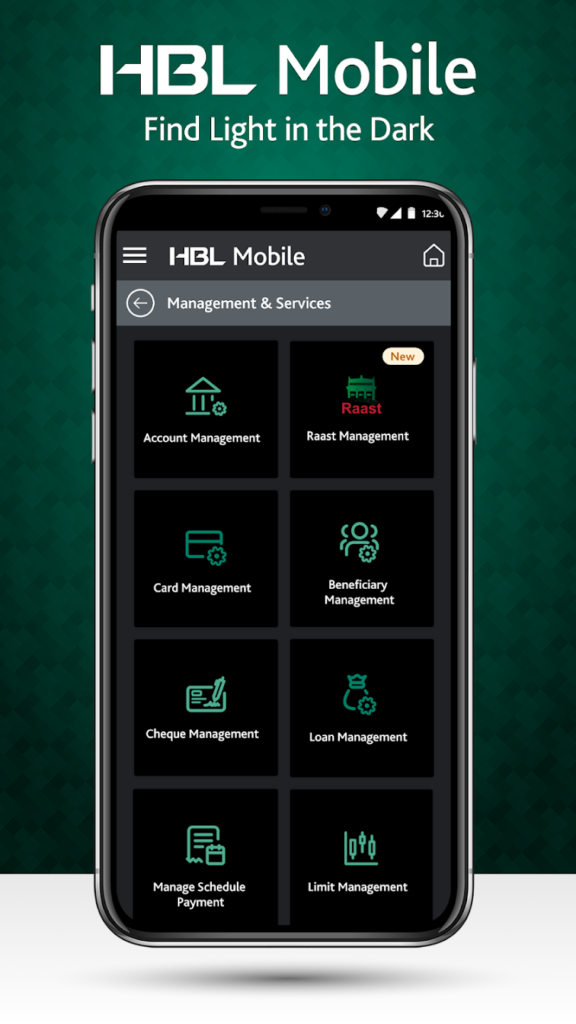

The HBL Loan App is a mobile application developed by Habib Bank Limited (HBL), one of the largest banks in Pakistan. It allows users to apply for loans, check loan eligibility, and manage their finances directly from their smartphones. The app aims to streamline the loan application process and provide easy access to financial services.

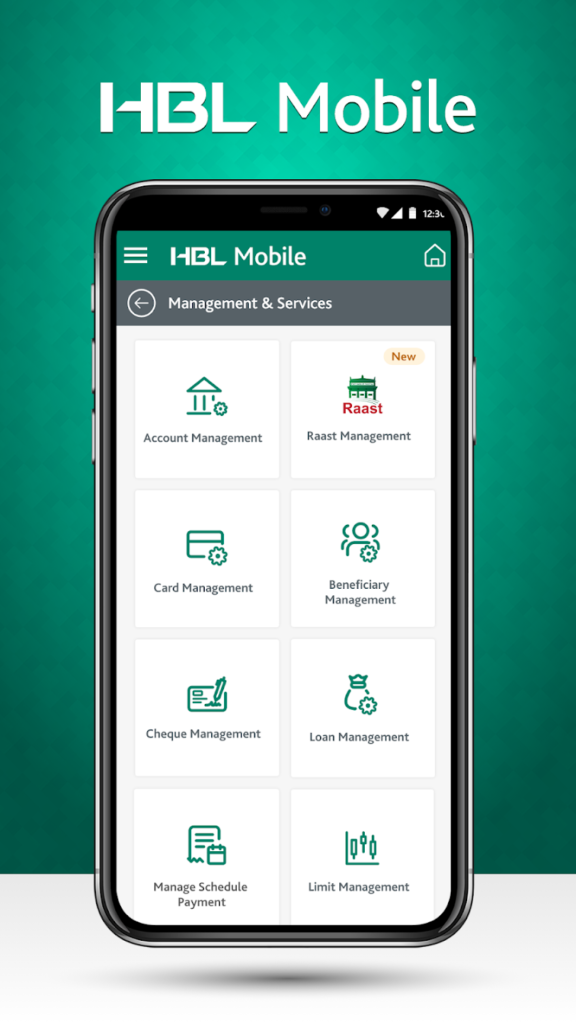

Features of the HBL Loan App

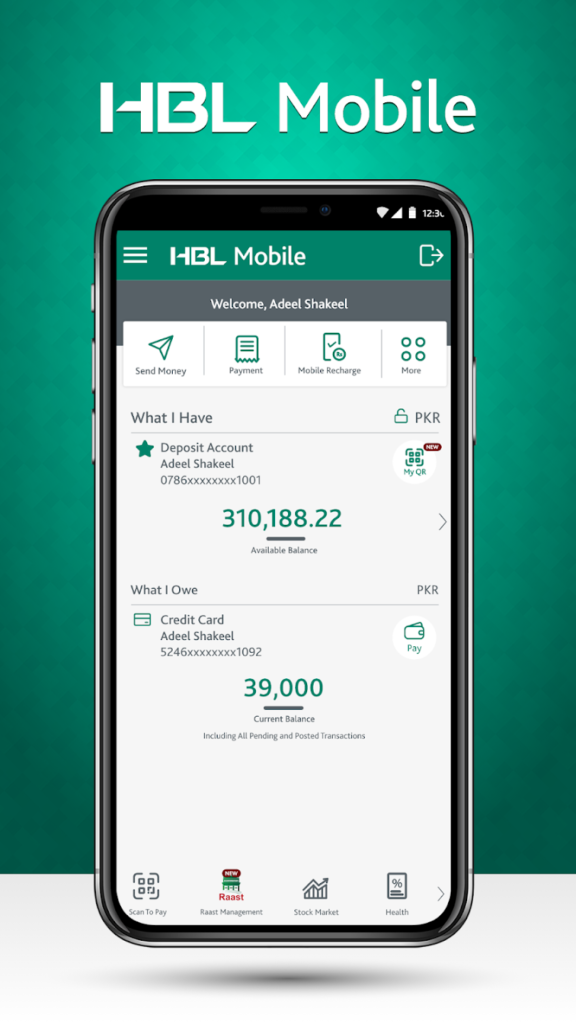

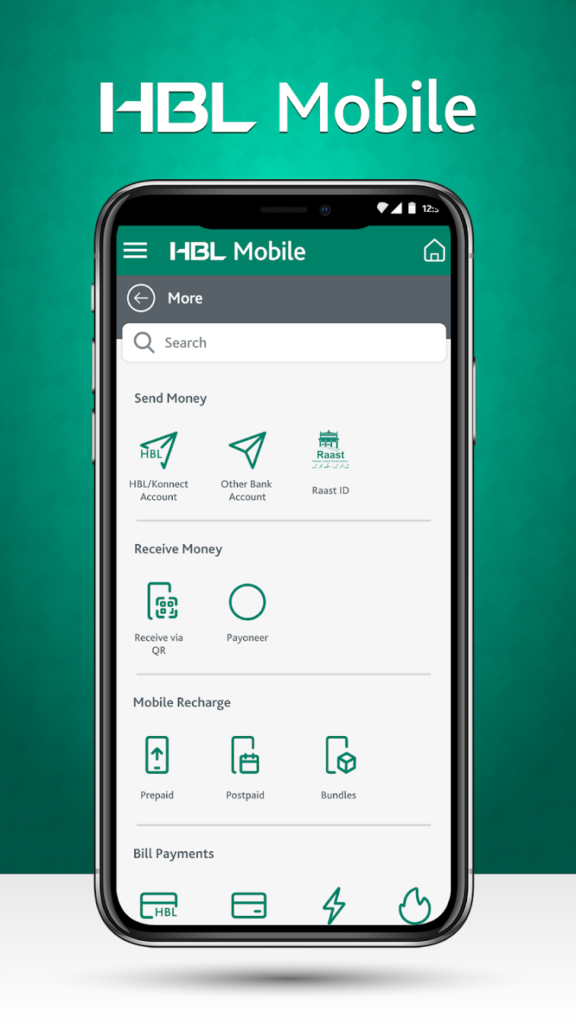

User-friendly Interface

The HBL Loan App boasts a clean, intuitive design that makes navigation simple for users of all ages. Even if you are not tech-savvy, you can easily explore the features and apply for a loan without any hassle.

Quick Loan Application

Gone are the days of long paperwork. With the HBL Loan App, you can apply for a loan in just a few taps. The entire process is digital, reducing the need for in-person visits to the bank.

Benefits of Using the HBL Loan App

- Convenience: Apply for loans anytime, anywhere, without visiting a bank branch.

- Speed: Get faster loan approvals compared to traditional methods.

- Transparency: Clear information about loan terms, interest rates, and repayment plans.

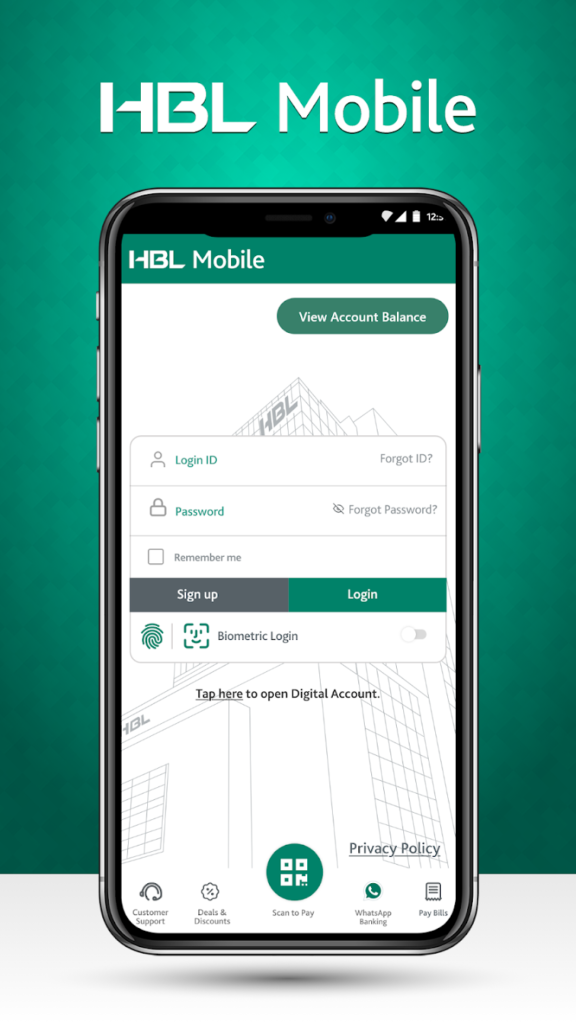

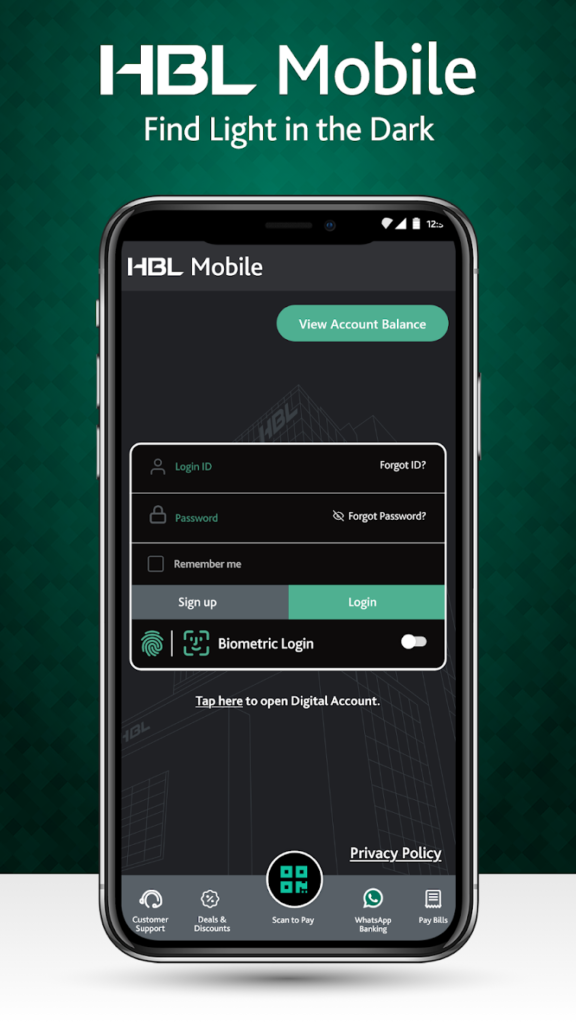

How to Download the HBL Loan App

The HBL Loan App is available on both Google Play Store and Apple App Store. Simply search for “HBL Loan App,” click on the download button, and install it on your device. Ensure your phone meets the app’s requirements for smooth functioning.

Eligibility Criteria for HBL Loans

To qualify for a loan using the HBL Loan App, you must meet certain eligibility criteria, such as:

- Being a Pakistani citizen with a valid CNIC.

- Having a stable source of income.

- Being over 18 years of age.

Types of Loans Offered by HBL Loan App

Personal Loans

HBL offers personal loans that can be used for various purposes, such as medical expenses, education, or travel. The loan amount and interest rates are tailored based on your profile and credit score.

Home Loans

Looking to buy a new home or renovate your existing one? The HBL Loan App provides flexible home loan options with competitive interest rates and flexible repayment terms.

Auto Loans

Thinking of buying a car? With HBL’s auto loan, you can finance your dream vehicle with ease. The app provides a loan calculator to help you estimate monthly installments.

How to Apply for a Loan Using the HBL Loan App

Step-by-Step Guide

- Open the HBL Loan App on your phone.

- Log in with your account credentials or register a new account.

- Navigate to the “Loans” section.

- Choose the type of loan you want to apply for.

- Fill in the required details and upload the necessary documents.

- Submit your application and wait for the bank’s response.

Interest Rates and Repayment Options

The HBL Loan App offers competitive interest rates, which may vary based on the type of loan and your credit profile. The app also provides flexible repayment options, allowing you to choose a plan that suits your financial situation.

Documents Required for Loan Application

When applying for a loan through the HBL Loan App, you will need:

- A copy of your CNIC

- Proof of income (salary slips or bank statements)

- Recent utility bills for address verification

Security and Privacy of the HBL Loan App

HBL takes the privacy and security of its users seriously. The app uses advanced encryption and multi-factor authentication to protect your personal and financial data.

Common Issues and Troubleshooting Tips

- Login Issues: Ensure you have a stable internet connection and correct login details.

- App Crashes: Update the app to the latest version or reinstall it.

- Loan Application Errors: Double-check all entered information and ensure required documents are uploaded.

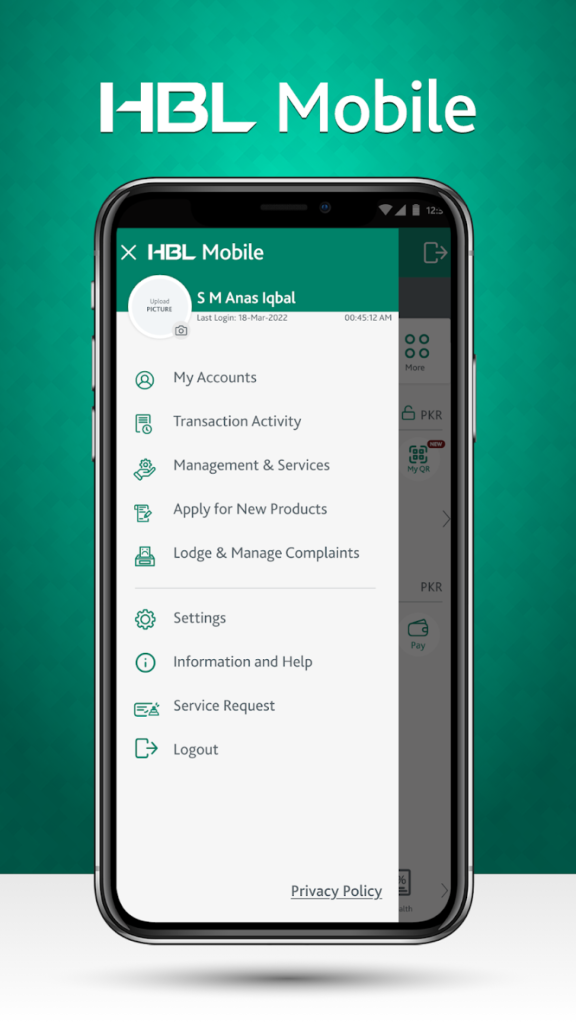

Customer Support and Help Center

If you face any issues or have questions about the HBL Loan App, you can reach out to HBL’s customer support via:

- Phone: HBL Helpline

- Email: support@hbl.com

- Live Chat: Available on the app

Pros and Cons of the HBL Loan App

Pros:

- Easy to use

- Quick loan approval

- Secure and reliable

Cons:

- It may not be available for non-HBL account holders

- Limited loan options for low-income users

Conclusion

The HBL Loan App is an excellent tool for anyone looking to access quick and convenient financial services in Pakistan. It offers a range of loan options, a user-friendly interface, and robust security features, making it a top choice for digital banking in the country.

HBL Personal Loan via Mobile App 2025 (HBL Loan App)

FAQs about HBL Loan App

Is the HBL Loan App free to use?

Yes, the app is free to download and use. However, loan processing fees may apply.

Can I apply for a loan without an HBL account?

Typically, you need an HBL account to use the app’s loan services.

How long does it take to get loan approval?

Loan approval usually takes a few hours to a couple of days, depending on your application details.

Is my data safe on the HBL Loan App?

Yes, HBL uses advanced encryption to protect your data.

What should I do if my loan application is rejected?

You can reapply after improving your credit profile or contact customer support for assistance.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com