Need quick cash? The SmartQarza Loan App might be the perfect solution for you. This app offers instant loans with an easy application process. Let us dive into how it works and whether it is the right choice for you.

Contents

- 1 What is SmartQarza Loan App?

- 2 How Does SmartQarza Work?

- 3 Key Features of SmartQarza

- 4 How to Download and Install SmartQarza App?

- 5 Eligibility Criteria for SmartQarza Loan

- 6 Step-by-Step Loan Application Process

- 7 Loan Amount and Interest Rates

- 8 SmartQarza Loan Repayment Options

- 9 Pros and Cons of SmartQarza Loan App

- 10 Is SmartQarza Loan App Safe?

- 11 Comparison with Other Loan Apps

- 12 Customer Reviews and Ratings

- 13 Contact information

- 14 SmartQarza Customer Support

- 15 Conclusion

- 16 FAQs about SmartQarza Loan App

- 16.1 Is SmartQarza available worldwide?

- 16.2 How long does it take to get a loan?

- 16.3 What happens if I miss a payment?

- 16.4 Can I apply for multiple loans at once?

- 16.5 Is SmartQarza a legitimate loan provider?

- 16.6 Related posts:

- 16.7 QarzMitra Loan App

- 16.8 How to Get Interest-Free Loan from CashBazar Loan App in 2025

- 16.9 Alkhidmat Foundation Loan App 2025

What is SmartQarza Loan App?

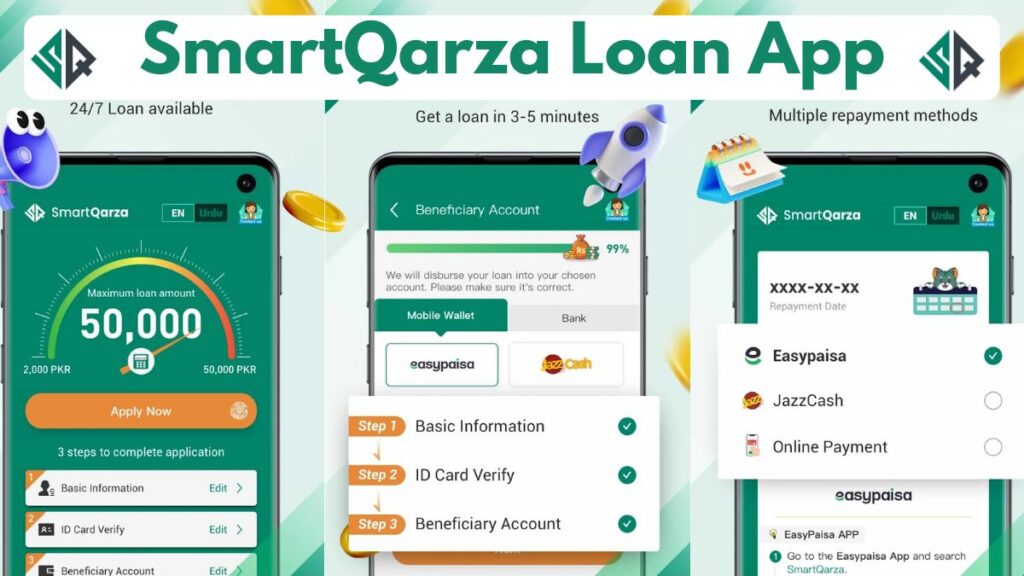

SmartQarza is a digital loan provider that allows users to apply for and receive loans directly to their bank accounts in minutes. It is designed for people needing emergency funds without the hassle of traditional bank loans.

How Does SmartQarza Work?

The app operates on a simple and transparent loan process. Users just need to register, submit documents, and get approval within minutes. The loan is then credited instantly to their account.

| Join WhatsApp | Click Here |

| More Govt Jobs | Click Here |

| International Job/Visa | Click Here |

| Make Money At Home | Click Here |

| Subscribe YouTube | Click Here |

| Click Here | |

| Click Here |

Key Features of SmartQarza

Instant Loan Approval

No long queues or waiting periods SmartQarza approves loans within minutes.

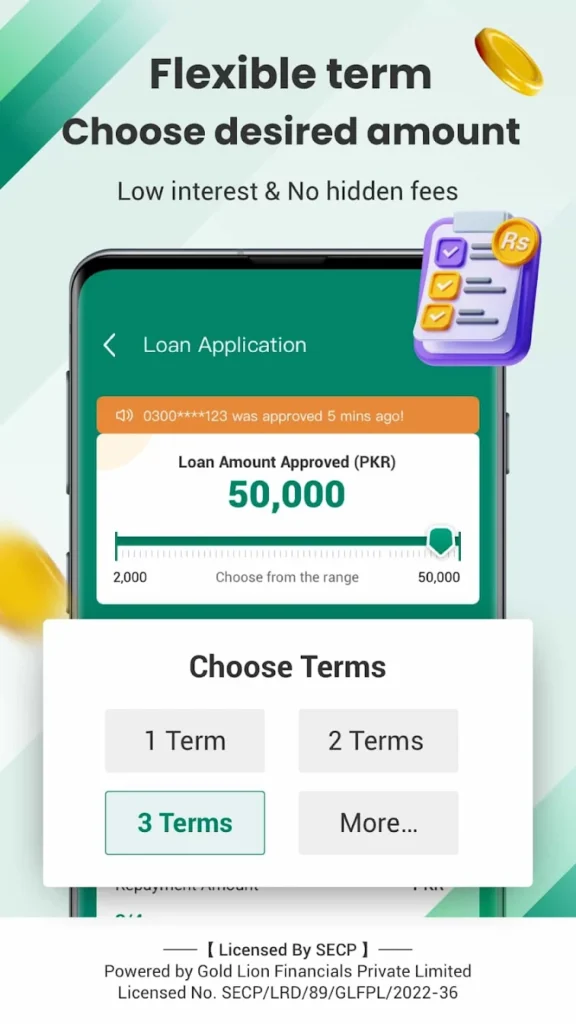

Flexible Repayment Options

Choose from multiple repayment plans to suit your financial situation.

Low Interest Rates

Compared to other loan apps, SmartQarza offers competitive interest rates.

Secure Transactions

All transactions are encrypted, ensuring your personal and financial details remain safe.

User-Friendly Interface

Even first-time users can easily navigate the app and apply for a loan hassle-free.

How to Download and Install SmartQarza App?

- Visit the Google Play Store.

- Search for SmartQarza Loan App.

- Click Install and wait for the download to complete.

- Open the app and register to get started.

Jazz Cash Personal Loan Online Apply

Eligibility Criteria for SmartQarza Loan

To qualify for a loan, you must:

- Be at least 18 years old.

- Have a valid ID and proof of income.

- Own a bank account for loan disbursement.

- Maintain a good credit score (if applicable).

Step-by-Step Loan Application Process

1. Registering on the App

Sign up using your mobile number and verify your identity.

2. Submitting Documents

Upload necessary documents like ID proof, bank details, and income proof.

3. Getting Loan Approval

SmartQarza will analyze your application and approve it within minutes.

4. Loan Disbursement

Once approved, the loan amount is credited directly to your bank account.

Loan Amount and Interest Rates

- Loan amounts range from PKR 20,000 to PKR 50,000.

- Interest rates vary based on creditworthiness and tenure.

- Loan repayment periods are flexible, from 7 days to 12 months.

Product Introduction:

- Loan Amount: from PKR 2,000 to PKR 50,000

- Loan Term: from 91 days to 180 days

- APR (Annual interest rate): 5%-10%

Loan Example

If you apply for a loan with the principal amount of PRK 5,000 and the loan term is 91 days (3 months), the annual interest rate is 10%, and other fees is 0, then you need to pay as follows:

- Loan amount disbursed in hand: 5,000

- Total interest payable: 5,000*10%*91/365=124.66

- Daily interest: 5,000*10%/365=1.37

- The total payable amount: 5,000+124.66=5,124.66

- Monthly payment amount: 5,124.66/3=1,708.22

How to Apply With US?

1. Install SmartQarza from Google Play and register an account with your mobile number.

2. Fill out the basic application forms online within 3-5 minutes.

3. Submit your application and get approved soon.

4. Loan disbursed instantly into your bank account.

5. Repay your loan on time.

6. Get another loan with a higher amount, longer term and lower fees.

Eligibilities:

You are 19-55 years old.

You need to be a Pakistani citizen

You hold a valid ID Card

You have a stable source of income or employment

SmartQarza Loan Repayment Options

- Automatic Bank Deduction

- Manual Payment via the App

- Mobile Wallet Transfers

- Early Repayment with No Extra Fees

Pros and Cons of SmartQarza Loan App

Pros:

✅ Quick loan approval

✅ Flexible repayment terms

✅ No collateral required

✅ Safe and secure transactions

Cons:

❌ High interest rates for short-term loans

❌ Late payment penalties

Is SmartQarza Loan App Safe?

Yes! SmartQarza uses bank-level encryption to protect your financial information.

Comparison with Other Loan Apps

| Feature | SmartQarza | Other Loan Apps |

|---|---|---|

| Approval Time | Instant | 24-48 hours |

| Interest Rate | Competitive | High |

| Repayment Terms | Flexible | Fixed |

| Security | Encrypted | Varies |

Customer Reviews and Ratings

Most users praise SmartQarza for its fast approval and easy repayment options. However, some users mention that interest rates can be high for short-term loans.

Contact information

Online customer service: We recommend you to contact us by our online customer service within our APP. We will respond to your request.

Customer care email: customerservice@smartqarza.com

Customer service hotline: 0518105004

Customer service working hours: 8 AM – 8 PM (Monday – Sunday)

Customer service office address: Office number 02 and 04, 2nd Floor Rajpoot Plaza GT Road Wah Cantt Tehsil Taxila Distt Rawalpindi, Punjab, Pakistan

Company website: https://www.goldlionpk.com/

Best Online Loan App in Pakistan

Fauricash Loan App in Pakistan

SmartQarza Customer Support

Need help? Contact SmartQarza support team through:

- Email: support@smartqarza.com

- Live Chat on the app

- Phone Support (available 24/7)

Risk warning statement: You must understand the potential risk of over-indebtedness. Borrow responsibly and only take loans that you can comfortably repay within the agreed timeframe to avoid financial difficulties. Always read the terms and conditions carefully before availing of any loan.

Your financial well-being is our priority.

Conclusion

The SmartQarza Loan App is an excellent option for those in need of quick financial help. With fast approvals, flexible repayments, and secure transactions, it stands out among other loan apps. However, always check the interest rates and repayment terms before borrowing.

Click Here: SmartQarza App

FAQs about SmartQarza Loan App

Is SmartQarza available worldwide?

Currently, it is available in select countries. Check the app store for availability in your region.

How long does it take to get a loan?

Most loans are approved and credited within minutes.

What happens if I miss a payment?

Late payments may incur penalties and affect your credit score.

Can I apply for multiple loans at once?

No, you must repay your existing loan before applying for another one.

Is SmartQarza a legitimate loan provider?

Yes, it is a registered financial service provider with secure loan processes.

HBL Personal Loan via Mobile App

GrowPak e-Loan Manager Loan App

UBL Personal Loan Apply Online

Navigating the Fast Urgent Loans

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com