Paisayaar Loan App in Pakistan – Need a quick loan in Pakistan? The Paisayaar Loan App might be the solution. With the rise of digital lending, getting emergency funds has become easier. But is it safe? How does it work? Let us dive into a detailed review of the Paisayaar Loan App in 2025.

Contents

- 1 What is Paisayaar Loan App?

- 1.1 How Does Paisayaar Loan App Work?

- 1.2 Eligibility Criteria

- 1.3 Registration Process

- 1.4 Loan Approval & Disbursement

- 1.5 Features of Paisayaar Loan App

- 1.6 Loan Amount & Repayment Terms

- 1.7 Interest Rates and Fees

- 1.8 Advantages of Using Paisayaar Loan App

- 1.9 Disadvantages and Limitations

- 1.10 Is Paisayaar Loan App Safe & Legit in Pakistan?

- 1.11 User Reviews & Ratings

- 1.12 Comparison with Other Loan Apps in Pakistan

- 1.13 How to Repay a Paisayaar Loan?

- 1.14 Tips for Responsible Borrowing

- 1.15 Alternatives to Paisayaar Loan App

- 1.16 Personal information security

- 1.17 Contact Us

- 1.18 Conclusion

- 2 FAQs about Paisayaar Loan App

- 2.0.1 How long does it take for Paisayaar to approve a loan?

- 2.0.2 Can I extend my repayment date?

- 2.0.3 Does Paisayaar require collateral?

- 2.0.4 What happens if I miss my repayment?

- 2.0.5 Is the Paisayaar Loan App available on iOS?

- 2.0.6 Related posts:

- 2.0.7 How to Get Interest-Free Loan from CashBazar Loan App in 2025

- 2.0.8 Alkhidmat Foundation Loan App 2025

- 2.0.9 Agahe Pakistan Loan App 2025

What is Paisayaar Loan App?

Paisayaar is a mobile-based loan application available in Pakistan. It provides instant personal loans with minimal paperwork, making borrowing simple and convenient.

How Does Paisayaar Loan App Work?

Paisayaar simplifies the lending process by offering hassle-free, online applications. Here is a step-by-step guide:

Eligibility Criteria

- Must be a Pakistani citizen

- Age: 18-60 years

- Have a valid CNIC

- Active mobile number & bank account

Registration Process

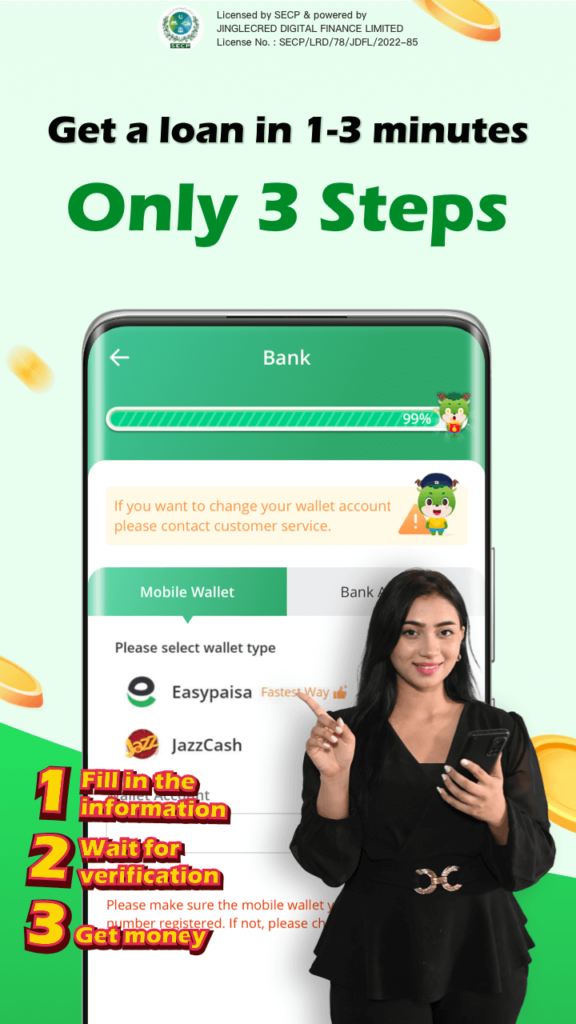

- Download the Paisayaar Loan App from the Google Play Store.

- Sign up using your CNIC and phone number.

- Complete the verification process.

Loan Approval & Disbursement

- Submit the loan request.

- Wait for approval (usually within minutes to hours).

- Upon approval, the loan amount is transferred to your bank or mobile wallet.

Features of Paisayaar Loan App

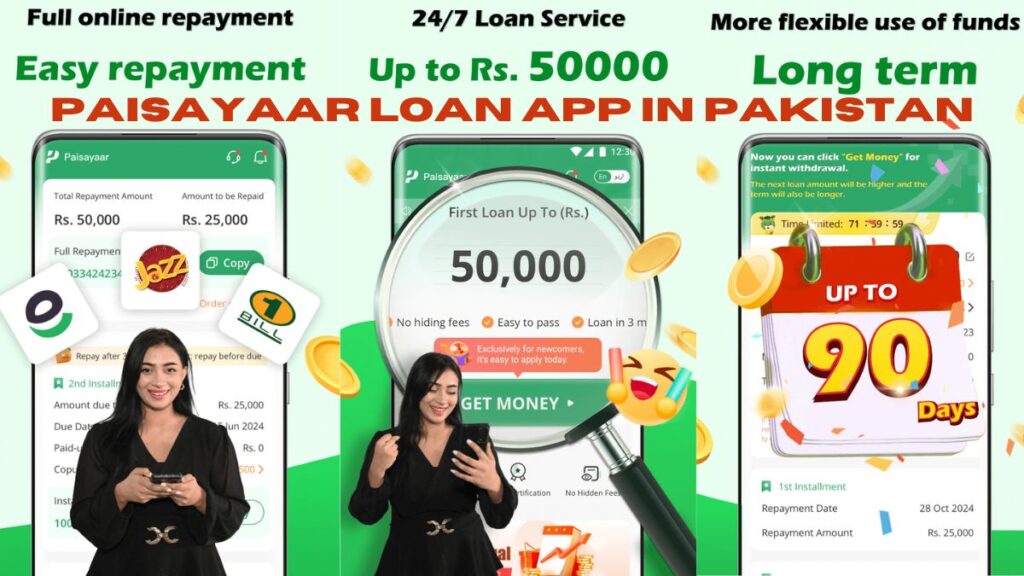

- Quick Loan Disbursement – Get money in minutes.

- Paperless Process – No lengthy paperwork.

- Flexible Repayment Plans – Choose from multiple options.

- 24/7 Accessibility – Apply anytime, anywhere.

Loan Amount & Repayment Terms

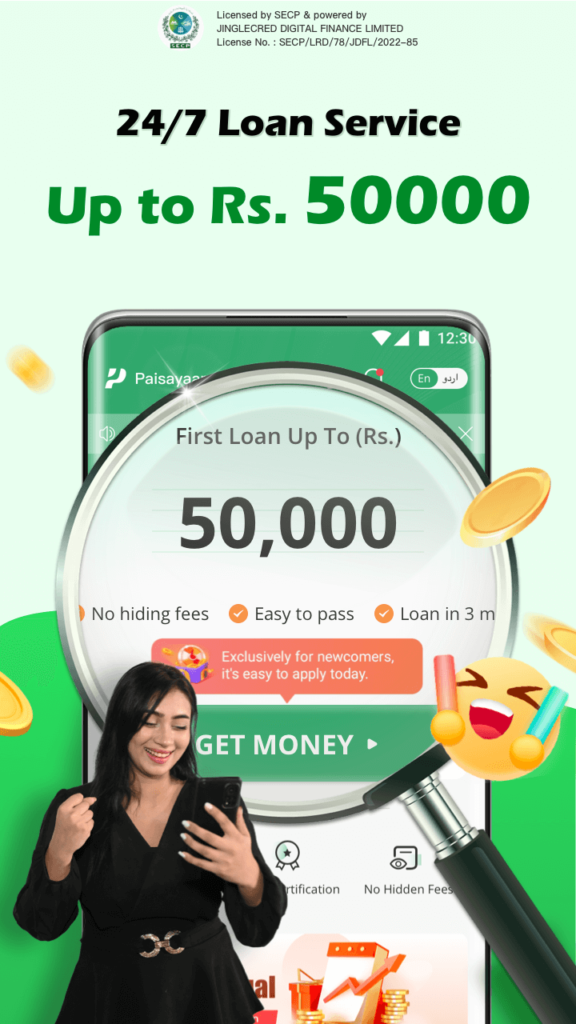

Paisayaar provides loans ranging from PKR 5,000 to PKR 50,000 with repayment periods from 7 days to 180 days, depending on eligibility and loan type.

Interest Rates and Fees

Interest rates vary from 2% to 30% per month, depending on the loan amount and repayment duration. Some additional charges may apply, such as:

- Processing Fee – 2% to 5% of the loan amount.

- Late Payment Penalty – Extra charges if payments are delayed.

Advantages of Using Paisayaar Loan App

- Instant Approval – No long waiting periods.

- No Collateral Required – Borrow without assets.

- User-Friendly Interface – Simple & easy-to-use app.

- No Need for Bank Visits – 100% digital process.

Disadvantages and Limitations

- High-Interest Rates – Short-term loans can be expensive.

- Limited Loan Amount – Only small loans are available.

- Strict Repayment Schedule – Late fees can be high.

PaisaYaar App Se Loan Lene Ka Tarika

Paisayaar Loan App in Pakistan

Is Paisayaar Loan App Safe & Legit in Pakistan?

Yes, Paisayaar is a registered and regulated digital lender in Pakistan. However, always read the terms before borrowing.

User Reviews & Ratings

Users appreciate its quick approval process, but some complain about high interest rates and penalties for late payments.

Comparison with Other Loan Apps in Pakistan

| Features | Paisayaar | Barwaqt | EasyPaisa Loan |

|---|---|---|---|

| Loan Amount | PKR 5,000 – 50,000 | PKR 3,000 – 25,000 | PKR 1,000 – 30,000 |

| Interest Rate | 2% – 30% | 3% – 28% | 5% – 25% |

| Repayment Tenure | 7 – 180 days | 7 – 120 days | 7 – 90 days |

| Approval Time | Minutes | Hours | Hours |

How to Repay a Paisayaar Loan?

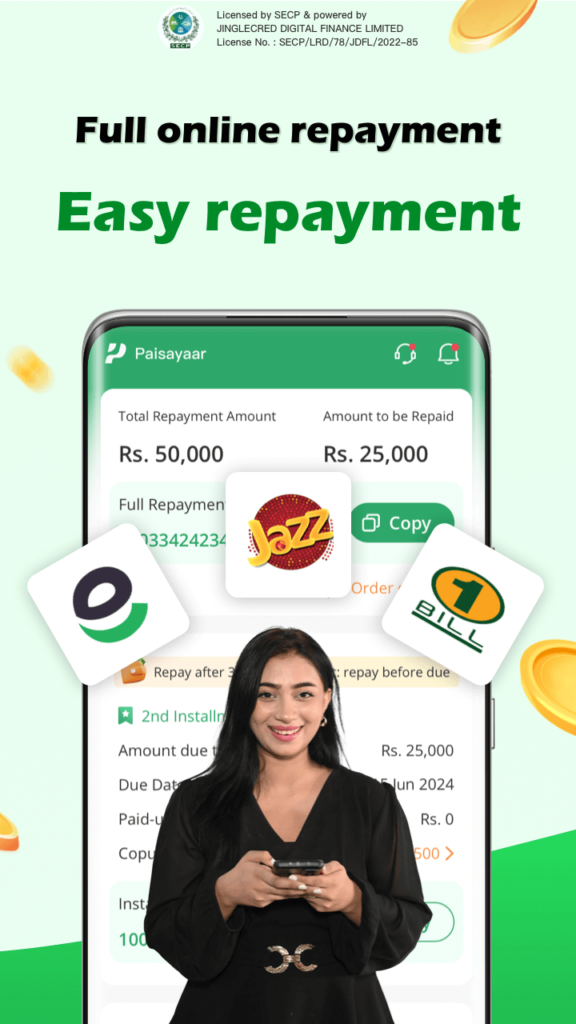

You can repay using:

- Easypaisa/JazzCash

- Bank Transfer

- Debit Card Payments

Tips for Responsible Borrowing

- Borrow only what you can repay

- Check all terms and conditions

- Repay on time to avoid extra charges

Alternatives to Paisayaar Loan App

- Barwaqt Loan App

- EasyPaisa Loan

- JazzCash Loan Services

Personal information security

We have passed the review of the Securities and Exchange Commission of Pakistan (SECP) and obtained relevant loan qualifications. We guarantee your information security and provide reliable credit loan services.

For Paisayaar, your information security is the most important thing for us. We have strict data protection and verification procedures, and we will never provide your information to third parties without your consent. This Privacy Agreement may be changed from time to time. You should check this Privacy Policy regularly, our Privacy Policy link is: https://www.paisayaar.pk/h5/privacidad.html

If you have any questions about our Privacy Policy, you can contact us by customer service phone number, email, etc. We have a professional customer service team to answer your questions. You are obliged to understand and review this Agreement. If you have any questions, please send your feedback to our official email support@paisayaar.pk).

Contact Us

Please contact us if you need help:

Company name: JingleCred Digital Finance Limited

Principal Business: Nano Lendings

Status of company: NBFC (Investment Finance Service)

License No. : SECP/LRD/78/JDFL/2022-85

Product name: Paisayaar

Contact us by Email: support@paisayaar.pk

Contact us by phone: 051-111-883-883

Service Time: 9:00-18:00

Address: Apartment #3, 2nd Floor, Jispal Plaza, Plot #5, Sector G-8/4, Islamabad.

Conclusion

Paisayaar Loan App is a convenient option for emergency cash in Pakistan. While it offers quick and easy loans, the high interest rates and strict repayment terms require careful consideration. Always borrow responsibly and explore alternative financial solutions.

FAQs about Paisayaar Loan App

How long does it take for Paisayaar to approve a loan?

Approval usually takes a few minutes to a few hours, depending on the verification process.

Can I extend my repayment date?

Some users may be eligible for extensions, but it might come with additional fees.

Does Paisayaar require collateral?

No, Paisayaar provides unsecured loans, meaning no collateral is required.

What happens if I miss my repayment?

Late payments result in penalty fees and may impact your credit score.

Is the Paisayaar Loan App available on iOS?

Currently, Paisayaar is only available on Android devices via the Play Store.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com