Contents

- 1 Introduction to FINCA Microfinance Bank

- 2 What is FINCA Pay?

- 3 Types of Loans Offered by FINCA Microfinance Bank

- 4 FINCA Tractor Loan

- 5 Niswan Karza

- 6 Light Commercial Vehicle Loan

- 7 FINCA Karobari Karza

- 8 Kashtkar Karza

- 9 Maweshi Karza

- 10 Sunheri Karza

- 11 House Loan (Renovation/Improvement)

- 12 FINCA Motorcycle Loan

- 13 FINCA House Loan

- 14 Benefits of Taking a Loan from FINCA

- 15 Step-by-Step Guide to Applying for a FINCA Loan

- 16 How FINCA Pay Works for Loan Payments

- 17 Advantages of Using FINCA Pay

- 18 FINCA Pay Play Store

- 19 Customer Support and Assistance

- 20 Conclusion

- 21 FAQs about FINCA Microfinance Bank Loan – FINCA Pay

- 21.1 What is the interest rate for FINCA loans?

- 21.2 Can I use FINCA Pay for other payments besides loans?

- 21.3 How secure is FINCA Pay?

- 21.4 What happens if I miss a loan payment?

- 21.5 Is FINCA Microfinance Bank accessible in rural areas?

- 21.6 Related posts:

- 21.7 QarzMitra Loan App

- 21.8 How to Get Interest-Free Loan from CashBazar Loan App in 2025

- 21.9 JazzCash Islamic Saving Account 2025 (Salaam Investment)

Introduction to FINCA Microfinance Bank

A Brief Overview

FINCA Microfinance Bank is a well-known organization that helps people and small companies get access to credit, especially in areas that don’t have enough banks. With a reputation for giving people power through financial inclusion, FINCA has become a well-known name in microfinance.

The Mission and Vision

FINCA’s goal is to reduce poverty by helping business owners and giving people access to banking services. Its main goal is to find long-term financial answers that help communities and boost the economy.

What is FINCA Pay?

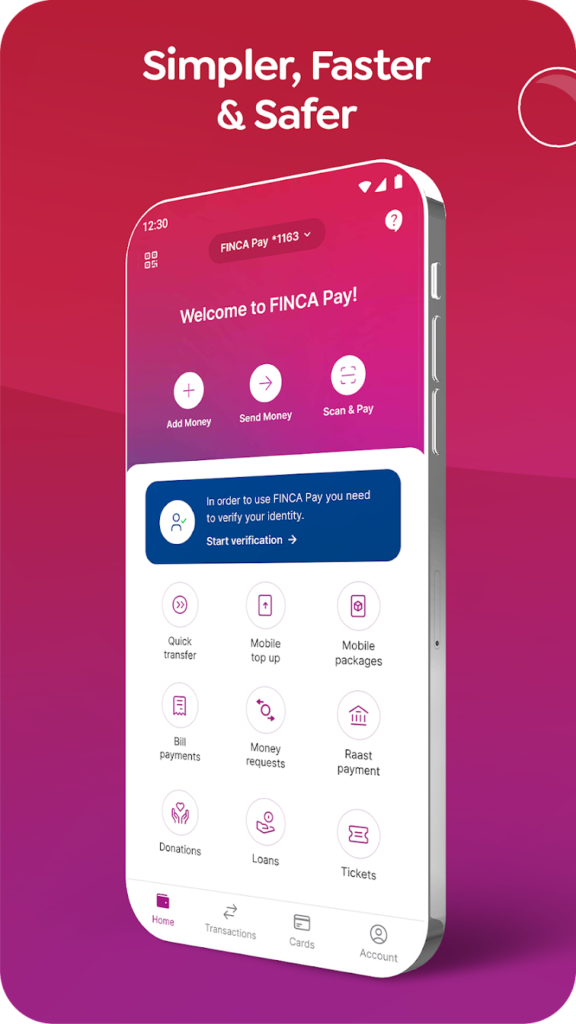

Features of FINCA Pay

The cutting-edge mobile app FINCA Pay makes it easier for people to do financial activities. The app’s easy-to-use interface makes banking quick and easy, from paying back loans to handling money.

Finca Microfinance Bank Branches in Pakistan Click Here

How FINCA Pay Enhances Financial Inclusion

When it comes to technology and banking, FINCA Pay makes it easy for people in both rural and urban places to use services. This new idea is a game-changer for making sure that everyone has access to money.

Dubai Islamic Bank Personal Finance Loan in Pakistan

Standard Chartered Bank Personal Loan in Pakistan

DOST App by Mobilink Microfinance Bank

JS Bank Personal Loan in Pakistan

Types of Loans Offered by FINCA Microfinance Bank

Personal Loans

Personal loans from FINCA are flexible and can be used right away for things like emergencies, school, or other personal costs.

Business Loans

FINCA can help small businesses and entrepreneurs get loans for working cash, equipment, or growing their businesses.

Agricultural Loans

These loans are for farmers and help increase crop yields by paying for seeds, tools, and other necessary items.

FINCA Tractor Loan

A tractor is an essential necessity of farming; therefore, FINCA brings a Tractor Loan for farmers. It gives them the opportunity to buy a new or used tractor at low markup rates to help increase their agricultural yield.

Features & Specifications

- Credit Amount from PKR 500,000 to PKR 2,000,000

- Tenure from 1-5 years

- Easy Bi-Annual Installments

- 10% Down Payment

- Available for the purchase of new or old tractors

- Instant SMS alert on every transaction

- IBFT Facility

- 24/7 Call Center Assistance

Min Eligibility Requirements:

- Age between 21 yrs to 65 yrs (at the time of loan approval)

- Valid CNIC

- Experience in crop farming for >1 year

- Owns minimum 1-acre land

- Documents of Agricultural Land

- Personal & Business address within the zone/radius of the associated branch

Niswan Karza

A short to medium-term loan facility for female entrepreneurs.

A successful woman is one who can build a firm foundation. Niswan Karza helps women build that foundation with a loan for their business needs.

Features & Specifications

- Credit amount from PKR 25,000 to PKR 350,000

- Credit tenure: 6, 12, 15 and 18 months

- Repayment in Equal Monthly Installments (EMI)

- Convenient & easy to understand paperwork

- Instant SMS alerts on every transaction

- ABHI Pay – Digital Mobile Application

- IBFT Facility

- 24/7 Call Center Assistance

Min Eligibility Requirements:

- Resident Pakistani National.

- Hold a Valid CNIC (Computerized National Identity Card).

- Age between 21 to 62 Years (At the time of approval of loan).

- Not Part of Any Customer / Loan Exclusion / Negative List.

- Involved in Business for Last 01 Year.

- Running a Business at Current Location for Last 01 Year.

Light Commercial Vehicle Loan

This loan facility caters to the needs of business individuals involved in the transportation business.

ABHI Light Commercial Vehicle Loan / Lease facility caters to the needs of business individuals involved in the transportation business or requiring commercial vehicles to support their business activities.

Features & Specifications

- Credit Amount from PKR 500,000 to 2,000,000

- Tenure from 1 – 5 years

- Easy Monthly Installments

- 10% Down Payment

- Instant SMS alert on every transaction

- IBFT Facility

- 24/7 Call Center Assistance.

Min Eligibility Requirements:

- Age between 21 to 62 (at the time of Loan approval)

- 1 Passport size picture

- Valid CNIC

- Valid Evidence of Monthly Income

FINCA Karobari Karza

A loan facility that helps businessmen raise capital for their businesses.

Take your business to new heights with Karobari Karza which gives you a chance to fulfil your working capital/capital expenditure requirements for your business.

Features & Specifications

- Credit Amount ranges from PKR 25,000 to PKR 1,000,000

- Credit tenure can be 6, 12, 15, 18 or 24 months

- Repayment in Equal Monthly Installments (EMI)

- Convenient & easy to understand paperwork

- Instant SMS alerts on every transaction

- FINCA Pay – Digital Mobile Application

- IBFT Facility

- 24/7 Call Center Assistance

Min Eligibility Requirements:

- Age between 20 to 64 years (at the time of loan approval)

- Valid CNIC

- Operational business for >1 year

- Personal guarantor

Kashtkar Karza

A loan that meets a farmer’s financial needs to support expansion of their farming business.

Kashtkar Karza gives farmers the opportunity to expand their farming business. Repayment of this loan is synced with crop cycles to provide ease.

Features & Specifications

- Credit amount from PKR 50,000 to PKR 500,000

- Tenure from 3 to 12 months (15 months for Sugarcane only)

- Lump Sum repayment

- Convenient & easy to understand loan process

- Instant SMS alerts on every transaction

- IBFT Facility

- 24/7 Call Center Assistance

Min Eligibility Requirements:

- Age between 21 to 62 years (at the time of approval of loan)

- Valid CNIC

- Experience in crop farming for >1 year

- Personal guarantor

Maweshi Karza

A convenient lending product that caters to the needs of livestock farmers.

A loan facility that is designed to meet the ever-growing financial needs of the livestock sector to increase productivity and fulfill capital requirements.

Features & Specifications

- Credit amount ranges from PKR 25,000 to PKR 500,000

- Repayment in Equal Monthly Installments or Lump Sum

- Tenure from 3 to 12 (Lump Sum); 6, 12, 15, 18, or 24 months (EMI)

- Convenient & easy-to-understand paperwork

- Instant SMS alerts on every transaction

- ABHI Pay – Digital Mobile Application

- Cheque Book

- Call Center assistance 24/7

Min Eligibility Requirements:

- Age between 21 to 62 years (at the time of approval of loan)

- Valid CNIC

- Operational Livestock business for >1 year

- Personal guarantor

Sunheri Karza

Convert your gold jewelry into working capital for your business needs.

Instead of selling your gold to finance or expand your business, you can now provide gold as security collateral against a loan while still keeping ownership of your gold.

Features & Specifications

- Credit Amount from PKR 40,000 to PKR 2,000,000

- Credit tenure can be 6 to 12 months (EMI); 3 to 12 months (Lump Sum)

- Repayment in Lump Sum or Equal Monthly Installments

- Convenient & easy-to-understand paperwork

- Instant SMS alerts on every transaction

- ABHI Pay – Digital Mobile Application

- IBFT Facility

- 24/7 Call Center Assistance

Min Eligibility Requirements:

- Valid CNIC

- Age between 18 to 70 years (at the time of loan approval)

- Gold (Ornaments or Bullion)

- Applicable Gold Rate:

- Weekly Average Rate of Gold: Rs. 30,333 Per Gram

- Effective: May 27, 2025

House Loan (Renovation/Improvement)

A medium to long-term loan facility for house renovation purposes.

House Loan is a medium to long-term loan facility. The product is designed for renovation, improvement, extension, restoration and enhancement of customer’s existing housing unit.

Features & Specifications

- Credit Amount from PKR 75,000 to PKR 2,000,000.

- Competitive Mark-up Rate.

- Credit Tenure: Up to 5 years (up to 24 months for unsecured).

- Easy monthly installments.

- Minimum documentation & Quick Loan Processing.

- Repayment in Equal Monthly Installments (EMI).

- Instant SMS alerts on every transaction.

- ABHI Pay – Digital Mobile Application

- IBFT Facility.

- 24/7 Call Center Assistance.

Min Eligibility Requirements:

- Age limit 21 to 62 years (up to 60 years for salaried individuals).

- 02 years of business/employment experience (03 years for contractual employees).

- Valid CNIC.

FINCA Motorcycle Loan

Motorcycle Loan is funded secured short to medium-term loan facility classified as business/conveyance loan and is designed to finance motorcycles (s) of reputed brands (s). The loan is payable in equal monthly installments. This facility will be extended for Business transportation needs of businesspeople/self-employed professionals & carriage needs of Milkman (Livestock dairy customers).

Features & Specifications

- Credit amount from PKR 30,000 to PKR 150,000.

- Credit tenure: 12, 24 & 36 months.

- Repayment in Equally Monthly Installments (EMI).

- Convenient & easy-to-understand paperwork.

- Instant SMS alerts on every transaction.

- Online Banking.

- IBFT Facility.

- 24/7 Call Center Assistance.

Min Eligibility Requirements:

- Resident Pakistani National.

- Hold a Valid CNIC (Computerized National Identity Card).

- Age between 21 to 62 Years (At the time of approval of loan).

- Not Part of Any Customer / Loan Exclusion / Negative List.

UBL Personal Loan Apply Online

FINCA House Loan

House Loan is a medium to long-term loan facility. The product is designed for renovation, improvement, extension, restoration and enhancement of customer’s existing housing unit.

Product Specification

- Credit Amount from PKR 75,000 to PKR 2,000,000.

- Competitive Mark-up Rate.

- Credit Tenure: Up to 5 years (up to 24 months for unsecured).

- Easy monthly installments.

- Minimum documentation & Quick Loan Processing.

- Repayment in Equal Monthly Installments (EMI).

- Instant SMS alerts on every transaction.

- FINCA Pay – Digital Mobile Application

- IBFT Facility.

- 24/7 Call Center Assistance.

Eligibility Criteria

- Age limit 21 to 62 years (up to 60 years for salaried individuals).

- 02 years of business/employment experience (03 years for contractual employees).

- Valid CNIC.

Benefits of Taking a Loan from FINCA

Easy Application Process

Applying for a FINCA loan is straightforward, requiring minimal paperwork and quick approvals.

Competitive Interest Rates

FINCA offers some of the most competitive interest rates in the microfinance industry, ensuring affordability.

Flexible Repayment Options

Borrowers can enjoy tailored repayment schedules that suit their financial circumstances.

Step-by-Step Guide to Applying for a FINCA Loan

Eligibility Criteria

Applicants need to meet specific criteria, such as age and income stability, to qualify for a loan.

Required Documentation

Documents like a valid ID, proof of income, and a completed application form are mandatory.

Application Process

The process involves submitting documents, undergoing evaluation, and receiving approval—all of which can be done digitally via FINCA Pay.

How FINCA Pay Works for Loan Payments

Setting Up FINCA Pay

Download the FINCA Pay app, create an account, and link it to your FINCA loan account for seamless integration.

Making Loan Payments

Use the app to schedule and pay installments on time, avoiding penalties.

Managing Transactions Securely

FINCA Pay employs advanced encryption to ensure secure and transparent transactions.

Advantages of Using FINCA Pay

Convenience at Your Fingertips

Say goodbye to long queues—FINCA Pay lets you manage finances from your phone.

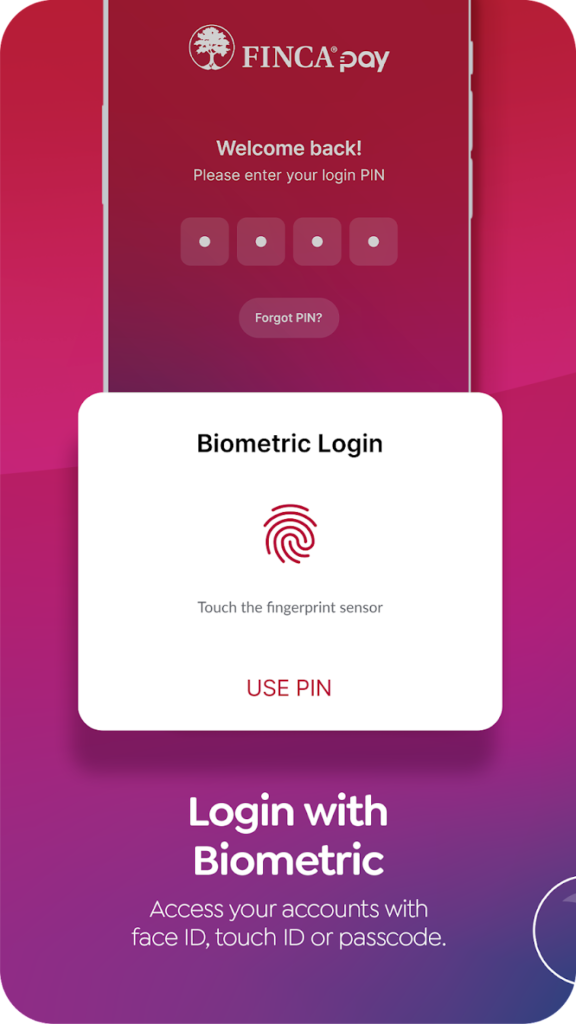

Enhanced Security Features

With biometric authentication and end-to-end encryption, your data stays safe.

Transparency in Transactions

Track your payments and get instant notifications for every transaction.

FINCA Pay Play Store

About this app

SimSim has been renamed as FINCA Pay!

Here’s what we have in store for you:

FEATURES

• Sign up in a few clicks to experience banking on the go!

• No minimum balance requirement, no paperwork!

• Safe & Secure Banking with FINCA Microfinance Bank, a fully regulated bank, trusted by millions of Pakistanis

• View your balance & apply for e-statements

• Login with Face ID, Touch ID, or Passcode

• Send and receive money instantly, anytime, anywhere, 24/7

• Manage bills for 500+ billers from the comfort of your home

• Instant Mobile Top-ups

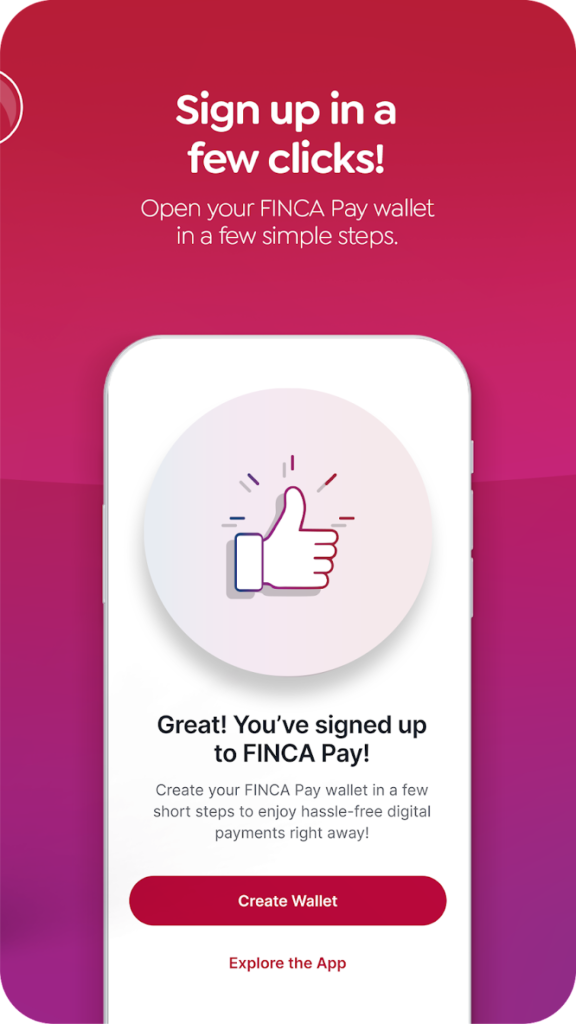

HOW TO OPEN A FINCA PAY ACCOUNT

• After downloading the application, enter your mobile number & OTP to sign up.

• Verify your identity by entering a few personal details

• Set up your 4-digit login PIN

• Viola! Your FINCA Pay account has been created.

ABOUT FINCA

FINCA Pay is the digital mobile wallet by FINCA Microfinance Bank Ltd (FMBL) – a fully regulated bank, trusted by millions of Pakistanis. FMBL became a part of FINCA Impact Finance (FIF) network in 2013. FIF is an international network of 16 microfinance institutions and banks offering innovative, responsible and impactful financial services. Since 1985, we have helped 40 million people build their financial health globally.

Customer Support and Assistance

Dedicated Helpline

A responsive helpline is available to resolve queries and provide guidance.

FINCA MICROFINANCE BANK LIMITED

NTN 3207258-9

Head Office

36-B, Khayaban-e-Iqbal, XX Block DHA Phase-III

Lahore, Pakistan

CUSTOMER SUPPORT CENTER

Helpline: (042) 111-111-562

Support Through FINCA Pay App

Users can access customer support directly within the app, ensuring quick issue resolution.

Conclusion

The FINCA Microfinance Bank and its FINCA Pay app are great examples of how the financial industry can be innovative and open to everyone. FINCA helps people and groups reach their goals by making loans easy to get and using cutting-edge technology.

FAQs about FINCA Microfinance Bank Loan – FINCA Pay

What is the interest rate for FINCA loans?

FINCA offers competitive interest rates, varying by loan type and applicant eligibility.

Can I use FINCA Pay for other payments besides loans?

Yes, FINCA Pay supports bill payments, fund transfers, and more.

How secure is FINCA Pay?

FINCA Pay utilizes advanced security protocols, including biometric login and encryption.

What happens if I miss a loan payment?

Late payments may incur penalties, but FINCA offers flexible solutions to manage repayments.

Is FINCA Microfinance Bank accessible in rural areas?

Absolutely! FINCA’s services are designed to cater to both urban and rural populations.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com