If you need extra cash to furnish your home, give the best education to your child, plan a perfect wedding or are looking to buy a much desired gadget, you don’t have to wait to realize your dreams. Just apply for Silkbank Personal Loan to make your dreams come true because “Apnon kay liye kuch bhi”. It’s fast flexible and convenient.

Contents

- 1 Silk Bank Personal Loan

- 2 What is a Personal Loan?

- 3 Why Choose Silk Bank for Your Personal Loan?

- 4 Types of Personal Loans Offered via Silk Bank

- 5 Eligibility Requirements and Documents Needed

- 6 Interest Rates and Repayment Options

- 7 Benefits of Applying for a Personal Loan with Silk Bank

- 7.1 How to Apply for a Silk Bank Personal Loan

- 7.2 Silk Bank Personal Loan Interest Rates

- 7.3 Silk Bank Personal Loan Calculator

- 7.4 Repayment Terms and Conditions

- 7.5 Tips for Getting Approved for a Silk Bank Personal Loan

- 7.6 Silk Bank Personal Loan for Salaried Employees

- 7.7 Silk Bank Personal Loan for Self-Employed Individuals

- 7.8 Common Mistakes to Avoid When Applying for a Personal Loan

- 7.9 Things to Consider Before Taking Out a Personal Loan

- 7.10 Conclusion

- 7.11 FAQs About Silk Bank Personal Loans

- 7.12 Personal Installment Loan (PIL) – FAQ’s

- 7.13 What is processing fee of Silkbank Personal Installment Loan?

- 7.14 How will I get access to the sanctioned loan amount?

- 7.15 Can I pre-pay my Silkbank Personal Installment Loan?

- 7.15.1 How do I have to re-pay my Silkbank Personal Installment Loan?

- 7.15.2 What if I pay my Silkbank monthly installment late?

- 7.15.3 Can I increase my Loan limit?

- 7.15.4 Is there any charge related to this facility?

- 7.15.5 Will it increase my monthly installment?

- 7.15.6 Where is this loan offered?

- 7.15.7 What is Silkbank Personal Installment Loan for?

- 7.15.8 Is there any security required for obtaining Silkbank Personal Installment Loan?

- 7.15.9 What type of loan is this?

- 7.15.10 What is the tenor of the loan?

- 7.15.11 Do I have to pay the first installment upfront?

- 7.15.12 Am I eligible to apply for Silkbank Personal Installment Loan?

- 7.15.13 Do I have to be of a certain age to be eligible for Silkbank Personal InstallmentLoan?

- 7.15.14 What should be my minimum monthly salary to qualify?

- 7.15.15 What is the debt burden requirement for Silkbank Personal Installment Loan?

- 7.15.16 In how many days my case will be processed?

- 7.16 Personal Loan Smart Plan – FAQ’s

- 7.16.1 What is Personal Loan Smart Plan?

- 7.16.2 Is there any limitation / CAP to number of products that customer can choose?

- 7.16.3 Can customer choose multiple products from multiple partners?

- 7.16.4 What is the minimum and maximum loan amounts that I can get?

- 7.16.5 How the pricing of the loan is determined?

- 7.16.6 What is processing fee of Silkbank Personal Installment Loan?

- 7.16.7 What is the turnaround time for delivery of products?

- 7.16.8 How will I get access to the sanctioned loan amount?

- 7.16.9 Is there any security required for obtaining Silkbank Personal Installment Loan?

- 7.16.10 What type of loan is this?

- 7.16.11 How the EMI (equal monthly installment) is calculated?

- 7.16.12 What is the tenor of the loan?

- 7.16.13 Do I have to pay the first installment upfront?

- 7.16.14 Can I transfer funds from other banks to Silkbank Personal Loan?

- 7.16.15 Can I pre-pay my Silkbank Personal Installment Loan?

- 7.16.16 How do I have to re-pay my Silkbank Personal Installment Loan?

- 7.16.17 What if I pay my Silkbank monthly installment late?

- 7.16.18 Can I increase my Loan limit?

- 7.16.19 Is there any charge related to Top-up facility?

- 7.16.20 Where is this loan offered?

- 7.16.21 Am I eligible to apply for Silkbank Personal Installment Loan?

- 7.16.22 Do I have to be of a certain age to be eligible for Silkbank Personal InstallmentLoan?

- 7.16.23 What should be my minimum monthly salary to qualify?

- 7.16.24 What is the debt burden requirement for Silkbank Personal Installment Loan?

- 7.16.25 In how many days my case will be processed?

- 7.16.26 Related posts:

- 7.16.27 QarzMitra Loan App

- 7.16.28 JazzCash Islamic Saving Account 2025 (Salaam Investment)

- 7.16.29 Maryam Nawaz Loan Scheme: Youth Empowerment in Pakistan

Silk Bank Personal Loan

When you are in need of brief economic help, whether or not it’s for private projects, emergencies, or unplanned prices, a personal loan can be a lifesaver. Silk Bank, one in every of Pakistan’s leading financial institutions, offers a number of private mortgage options designed to meet the various wishes of individuals. But how precisely can a Silk Bank non-public loan assist you, and what need to you do not forget earlier than applying?

Are you facing an unexpected price or planning a full-size buy? A non-public mortgage may be the ideal technique to bridge that financial hole. With numerous alternatives to be had within the market, finding the right lender is essential. One call that stands proud is Silk Bank, acknowledged for its customer-centric approach and numerous services. In this article, we will discover the entirety you want to recognise about Silk Bank non-public loans from kinds of loans to be had to eligibility necessities supporting you are making an knowledgeable decision tailor-made for your monetary needs. Let’s dive into how Silk Bank may be your best accomplice to your adventure in the direction of economic freedom!

Personal Loan Get 10 Lakh to 75 Thousand

What is a Personal Loan?

A non-public mortgage is a flexible monetary product that permits individuals to borrow cash for numerous functions. Unlike unique loans, consisting of home or car loans, non-public loans may be used for whatever from consolidating debt to financing a marriage.

Typically unsecured, those loans do not require collateral, making them on hand to many debtors. Lenders verify your creditworthiness based on your credit rating and income before approving the loan.

Repayment terms vary but commonly variety from one to five years. Borrowers obtain a lump sum in advance and repay it in fixed monthly installments over the agreed duration.

Personal loans frequently come with lower hobby quotes as compared to credit score cards and offer predictable compensation schedules. This makes budgeting easier while allowing you to address instantaneous economic desires with out compromising lengthy-term balance.

Why Choose Silk Bank for Your Personal Loan?

Silk Bank stands proud inside the crowded marketplace of private loans. Their dedication to purchaser delight is unmatched. They prioritize tailoring solutions that match man or woman needs.

With a streamlined utility method, getting started out is brief and trouble-free. Many customers recognize how consumer-friendly their online platform is, making it easy to navigate thru options.

Silk Bank also offers competitive hobby fees compared to many other creditors. This can make a massive difference when coping with monthly payments and total mortgage charges.

Moreover, Silk Bank’s bendy repayment phrases cater to diverse financial conditions. Whether you need short-term relief or long-time period making plans, they offer personalised plans that in shape numerous existence.

Customer provider plays a important role too. The committed guide team is offered and geared up to help for the duration of your borrowing journey, making sure you feel confident each step of the manner.

Types of Personal Loans Offered via Silk Bank

Silk Bank offers a number of non-public loans tailored to meet numerous financial needs. One famous option is the unsecured private mortgage. This type would not require collateral, making it handy for people who might not have belongings to pledge.

For unique functions, Silk Bank presents specialized loans which include training financing and home maintenance loans. These merchandise are designed to help customers gain their dreams with out needless hurdles.

If you are searching out flexibility, remember their payday mortgage alternatives. These loans cater to short-time period cash shortages and include short approval processes.

There are debt consolidation loans available. These can simplify your price range by means of combining a couple of debts into one plausible charge, often at a decrease interest price than existing obligations.

Types of Personal Loans Offered by means of Silk Bank

Silk Bank offers main styles of non-public loans:

- Unsecured Personal Loans: These loans don’t require collateral, making them ideal for those who don’t have property to pledge.

- Secured Personal Loans: If you have got an asset to provide as collateral, which include a automobile or belongings, you may opt for a secured loan, which often comes with decrease hobby quotes.

Eligibility Requirements and Documents Needed

When thinking about a Silk Bank personal loan, knowledge eligibility requirements is vital. Applicants typically need to be at least 21 years vintage and possess a consistent source of earnings. This ensures that you have the approach to repay the mortgage easily.

Silk Bank additionally seems for individuals with a good credit history. A strong credit score not best boosts your possibilities of approval but also can lead to better hobby quotes.

As for documentation, count on to offer identification along with your CNIC or passport. Proof of profits like income slips or bank statements is essential too.

If you are self-employed, you could want additional documents like enterprise registration papers and tax returns. Having these geared up can streamline the utility technique extensively, making it simpler for each you and the financial institution.

Eligibility Criteria for Silk Bank Personal Loans

Before making use of for a Silk Bank private loan, it’s critical to recognise if you are eligible. Here is what Silk Bank appears for:

- Age: Applicants need to be among 21 and 65 years old.

- Income: You need to satisfy the financial institution’s minimal profits requirement, which varies depending on whether you are salaried or self-employed.

- Credit History: A true credit rating increases your probabilities of approval.

- Employment: Stable employment is a key component. Salaried individuals and self-hired specialists are eligible.

Required Documentation

- CNIC (Computerized National Identity Card)

- Proof of profits (salary slips or enterprise financials for self-employed people)

- Bank statements (typically for the closing 6 months)

- Proof of house (which include software payments)

Eligibility

- Pakistani residents

- Foreign nationals with approved company guarantee

- Salaried individuals

- Age: 21-65 years

- Income: minimum Rs. 40,000/- monthly

- Offered in major cities of Pakistan: Karachi, Lahore, Rawalpindi, Islamabad, Hyderabad, Peshawar, Multan & Faisalabad.

Flexible

- Monthly installments with Pre-payment and Partial Payment Facility

To apply for Silkbank Personal Loan, email at personal.loan@silkbank.com.pk or visit your nearest Silkbank Branch.

Key Benefits of Silk Bank Personal Loans

Why must you recall Silk Bank on your personal loan wishes? Here are a few key advantages:

- Competitive Interest Rates: Silk Bank offers competitive hobby costs, making it more less expensive to borrow.

- Flexible Repayment Terms: Choose a compensation period that suits your financial state of affairs.

- Quick Approval Process: If you have all of your files so as, the mortgage approval manner may be notably fast.

Types of Personal Loans Offered by way of Silk Bank

- Unsecured Personal Loans: No collateral wished, however hobby fees might be barely higher.

- Secured Personal Loans: Lower interest charges with collateral.

EMI CALCULATOR

emi calculator

Interest Rates and Repayment Options

When considering a silk bank non-public mortgage, expertise hobby costs is essential. Silk Bank offers competitive fees that modify based totally on the kind of loan and your credit profile. This flexibility allows borrowers to find a plan that great suits their financial situation.

Repayment options are designed with comfort in thoughts. Borrowers can pick out from various phrases, often ranging from one to five years. This diversity enables people manipulate month-to-month payments correctly.

Additionally, the choice for early reimbursement with out consequences is an attractive function. It encourages accountable borrowing at the same time as permitting you to repay your debt faster if situations allow.

Always do not forget to review every option carefully before making a decision. Evaluating both hobby quotes and reimbursement plans will ensure you pick the most useful direction on your needs at Silk Bank.

Benefits of Applying for a Personal Loan with Silk Bank

Silk Bank offers a number blessings for the ones considering a private mortgage. One essential advantage is the fast approval procedure. Customers can receive finances promptly, permitting them to cope with urgent economic needs immediately.

Another attractive component is the bendy reimbursement options to be had. Borrowers can pick plans that fit their monetary state of affairs, making it simpler to control month-to-month bills.

Moreover, Silk Bank often affords competitive interest quotes as compared to other lenders. This method you may shop greater over the existence of your mortgage.

Additionally, their customer support group is understood for being responsive and useful. This aid makes navigating your loan adventure smoother and much less stressful.

Applying online simplifies the complete enjoy. You can entire the whole thing from the consolation of domestic without unnecessary trips to a branch workplace.

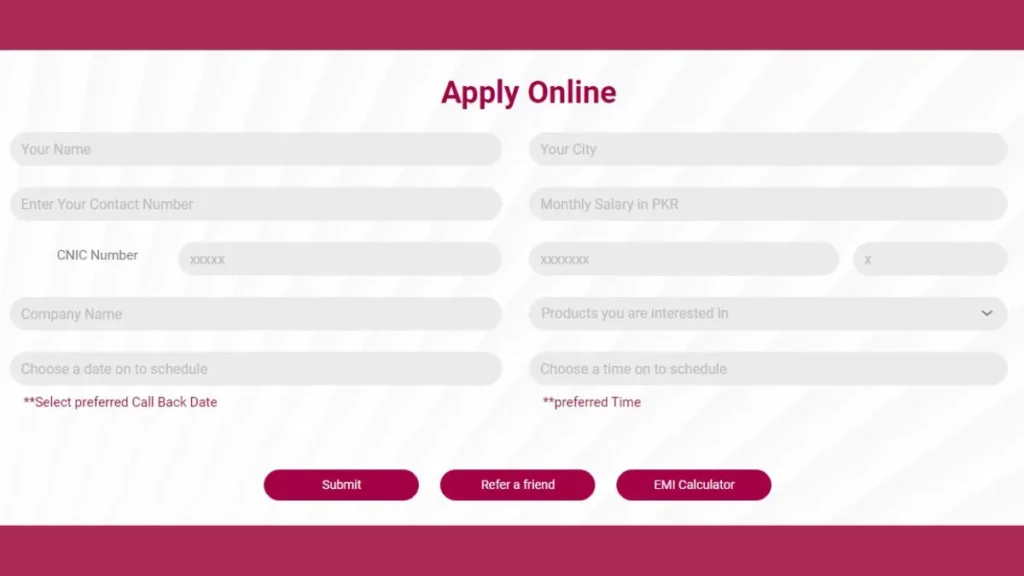

How to Apply for a Silk Bank Personal Loan

Silk Bank makes the utility system straightforward. Here is how you could observe:

- Step 1: Gather the required documents.

- Step 2: Visit the nearest Silk Bank branch or follow online thru their internet site.

- Step 3: Submit your application with all important information.

- Step four: Wait for approval and disbursement of funds.

Silk Bank Personal Loan Interest Rates

Interest rates for private loans can range, and Silk Bank offers both fixed and variable interest rate options. A constant fee approach your payments continue to be the same for the duration of the mortgage time period, even as a variable fee can range with the market.

Silk Bank Personal Loan Calculator

Before making use of, it’s an amazing idea to use Silk Bank’s private mortgage calculator to be had on their website. This tool allows you estimate your monthly payments, hobby costs, and total compensation quantity, supporting you are making an knowledgeable decision.

Repayment Terms and Conditions

Silk Bank offers bendy compensation phrases, generally ranging from 12 to 60 months. Monthly installments will rely on the mortgage quantity, hobby charge, and tenure. It’s critical to make sure you are making well timed payments to avoid late fee consequences.

Tips for Getting Approved for a Silk Bank Personal Loan

- Improve Your Credit Score: The better your credit score, the much more likely you are to get approved.

- Provide Complete Documentation: Missing or incomplete documentation can postpone the manner.

- Avoid Over-Borrowing: Only borrow what you want to make certain you can manipulate payments.

Silk Bank Personal Loan for Salaried Employees

If you are a salaried person, Silk Bank has unique benefits for you. Those with earnings accounts at Silk Bank can frequently revel in quicker approval instances and preferential hobby fees.

Silk Bank Personal Loan for Self-Employed Individuals

Self-employed experts also have get admission to to personal loans, but the documentation process may be barely exceptional. You will need to offer enterprise financials and tax returns to show your income.

Common Mistakes to Avoid When Applying for a Personal Loan

- Over-borrowing: Borrowing more than you need can cause pointless monetary stress.

- Ignoring the Fine Print: Always read the phrases and conditions carefully to keep away from surprises later.

I Need 20,000 Rupees Loan Urgently in Pakistan

How to Get Zong Loan in Pakistan

Things to Consider Before Taking Out a Personal Loan

Before applying for a personal loan, check your monetary scenario. Understand how a good deal you want and why. This clarity enables in choosing the right amount.

Consider the interest rates related to the loan. A decrease price can save you money over time, even as a better fee increases your overall fee.

Review your credit rating too. It drastically influences your eligibility and phrases offered by way of banks, consisting of Silk Bank.

Think approximately compensation alternatives as properly. Ensure they align along with your month-to-month price range to keep away from future stress or defaults.

Investigate any hidden fees or charges which could apply. Transparency in borrowing is important for keeping good economic fitness.

Conclusion

When considering a personal loan, Silk Bank stands proud as an brilliant preference. With a variety of merchandise tailored to meet diverse needs, aggressive hobby costs, and bendy compensation options, it caters to both salaried people and self-employed specialists. The honest eligibility requirements make sure that most candidates can find the help they need.

Before making your selection, it’s sensible to evaluate your financial state of affairs cautiously. Understand the terms of compensation and assess whether or not you could control monthly bills comfortably. A non-public loan is a extensive commitment; ensuring it aligns with your long-term desires is important.

Exploring all these components will help you make knowledgeable choices about getting rid of a Silk Bank personal loan. Whether you are making plans for schooling expenses or domestic renovations, their services may just provide the monetary improve you have been searching out.

FAQs About Silk Bank Personal Loans

How long does it take to get accepted?

The approval manner can take anywhere from some days to per week, relying at the completeness of your application.

Can I prepay my mortgage?

Yes, Silk Bank allows early reimbursement, however you may incur a small penalty.

What occurs if I miss a payment?

Missing a fee can bring about consequences and negatively have an effect on your credit score.

What is the most mortgage quantity I can practice for?

The mortgage quantity relies upon for your profits and creditworthiness, normally up to a certain more than one of your month-to-month earnings.

Are there any processing expenses?

Yes, Silk Bank expenses a small processing price, which is deducted from the loan quantity at disbursement.

Personal Installment Loan (PIL) – FAQ’s

What is the minimum and maximum loan amounts that I can get?

You can get any loan amount ranging from Rs. 50,000 to Rs. 2 million depending on

your income level and overall debt burden ratio.

How the pricing of the loan is determined?

The mark-up rate is composed of 12 months KIBOR and a pre-defined spread. The

KIBOR will change every year however the spread will remain fixed over the tenor of the loan.

However, if your loan is applied between March 1st and April 30th, you will be eligible to avail markup waivers as per below criteria (Term & Condition apply).

- Last 12 months markup waiver if your loan tenure is for 5 years

- Last 6 months markup waiver if your loan tenure is for 4 years

- Last 3 months markup waiver if your loan tenure is for 3 years

- No waivers if loan tenure is for less than 3 years

What is processing fee of Silkbank Personal Installment Loan?

A processing fee of Rs 4,000 or 1% of loan amount (whichever is higher) plus FED % is charged subject to loan approval.

How will I get access to the sanctioned loan amount?

If you are a fresh customer to the bank, the amount will be transferred directly to the

account details provided by you. However, if you are applying for our Top-up and

Balance Transfer Facility a Pay Order will be issued to you.

Can I pre-pay my Silkbank Personal Installment Loan?

Yes. You can pre-pay your Silkbank Personal Installment Loan subject to a penalty. The

penalty is levied on outstanding balance. Please refer to the following grid for prepayment penalty.

Full penalty charges as per the following grid

1st Year 10%, 2nd Year7%, 3rd Year5% & on wards

Partial penalty charges as per following grid

1st Year 10%, 2nd Year7%, 3rd Year5% & on wards

Penalty will be charged on the outstanding balance in case of full settlement and on

adjusted amount in case of partial settlement. A year is equal to 12 installments from

the date of disbursal and only 1 partial payment is allowed in a year and no partial

payments are allowed in 1st year.

How do I have to re-pay my Silkbank Personal Installment Loan?

You have to deposit the monthly installment in your re-payment Irrevocable Standing

Instructions (ISI) a/c on or before the due date.

What if I pay my Silkbank monthly installment late?

Late payment charges up to Rs. 1,500/- per missed installment will be applicable.

Can I increase my Loan limit?

Yes, you can apply for Loan limit enhancement.

An enhancement fee of Rs 4,000 or 1% of the top-up amount (whichever is higher) plus FED % is charged subject to loan approval.

Will it increase my monthly installment?

You can reduce your monthly loan installment by increasing the tenor of the loan. (Upto maximum of 5 years)

Where is this loan offered?

It is offered in Karachi, Lahore, Rawalpindi, Islamabad, Faisalabad, Peshawar,

Hyderabad and Multan.

What is Silkbank Personal Installment Loan for?

Silkbank Personal Installment Loan can be used for meeting any needs except for

subscription in an Initial Public Offering (IPO). You can also transfer your outstanding

loans at other banks to Silkbank and can even get cash top-up with same monthly

installment.

Is there any security required for obtaining Silkbank Personal Installment Loan?

No. This loan is unsecured.

What type of loan is this?

It is term finance. You have to repay it back in equal monthly installments.

What is the tenor of the loan?

From 1 year to a maximum of 5 years.

Do I have to pay the first installment upfront?

No. The first installment will be due after a month of disbursal of your Personal

Installment Loan.

Am I eligible to apply for Silkbank Personal Installment Loan?

You are eligible to apply for Silkbank Personal Installment Loan if you are a salaried

individual and meet the minimum criteria.

Do I have to be of a certain age to be eligible for Silkbank Personal Installment

Loan?

Salaried: 21 years to 65 years or verified retirement age (whichever is earlier at loan maturity). The maximum age would be 62 years if retirement age could not be verified.

What should be my minimum monthly salary to qualify?

For Salaried: PKR 40,000/-

What is the debt burden requirement for Silkbank Personal Installment Loan?

50% aggregate debt burden (DB) as per SBP.

In how many days my case will be processed?

Your case will be processed in 7 days time from the date all documents have been

submitted.

Personal Loan Smart Plan – FAQ’s

What is Personal Loan Smart Plan?

Personal Loan Smart Plan is an unique term-based facility which not only offers variety

of products on discounted price but also, facilitate customers with cash against the

remaining unutilized approved limit via PO / IBTF.

Is there any limitation / CAP to number of products that customer can choose?

No, customer is free to choose multiple products if the accumulative amount of the

products remains within the approved limit communicated by the bank.

Can customer choose multiple products from multiple partners?

Yes, customer is free to multiple products a single alliance partner or multiple products from multiple alliance partners if the accumulative amount of the products remains within the approved limit communicated by the bank.

What is the minimum and maximum loan amounts that I can get?

You can get any loan amount ranging from Rs. 50,000 to Rs. 2 million depending on your income level and overall debt burden ratio.

How the pricing of the loan is determined?

The mark-up rate is composed of 12 months KIBOR and a pre-defined spread. The

KIBOR will change every year however the spread will remain fixed over the tenor of the loan.

What is processing fee of Silkbank Personal Installment Loan?

A processing fee of Rs 2,500 or 1% of loan amount (whichever is higher) plus FED is

charged subject to loan approval.

What is the turnaround time for delivery of products?

Products will be delivered within 7 working days to the correspondence address provided by the customers. Incase of any delay at the alliance partner’s end revised TAT will be communicated to the customers.

How will I get access to the sanctioned loan amount?

The amount will be transferred directly to the account details provided by you or Pay order can be issued in your favour upon request.

Is there any security required for obtaining Silkbank Personal Installment Loan?

No. This loan requires no collateral and no security.

What type of loan is this?

It is a term finance. You have to repay it back in equal monthly installments.

How the EMI (equal monthly installment) is calculated?

EMI is calculated based on the total amount of your loan, the loan tenure, and the annual interest rate.

What is the tenor of the loan?

From 1 year to a maximum of 5 years.

Do I have to pay the first installment upfront?

No. The first installment will be due after a month of disbursal of your Personal Installment Loan.

Can I transfer funds from other banks to Silkbank Personal Loan?

Yes, you can. At the time of loan application, you need to mention the bank (s) and loan amount (s) which need to be transferred to Silkbank Personal Loan.

Can I pre-pay my Silkbank Personal Installment Loan?

Yes. You can pre-pay your Silkbank Personal Installment Loan subject to a penalty. The

penalty is levied on outstanding balance. Please refer to the following grid for prepayment penalty.

Full penalty charges as per the following grid

1st Year 10%, 2nd Year7%, 3rd Year5% & on wards

Partial penalty charges as per following grid

1st Year 10%, 2nd Year7%, 3rd Year5% & on wards

Penalty will be charged on the outstanding balance in case of full settlement and on

adjusted amount in case of partial settlement. A year is equal to 12 installments from the date of disbursal and only 1 partial payment is allowed in a year and no partial payments are allowed in 1st year.

How do I have to re-pay my Silkbank Personal Installment Loan?

You have to deposit the monthly installment in your re-payment Irrevocable Standing

Instructions (ISI) a/c on or before the due date. You can use following modes of payment.

- Cash

- Cheque

- Funds transfer by using IBFT feature

What if I pay my Silkbank monthly installment late?

Late payment charges up to Rs. 1,000/- per missed installment will be applicable.

Can I increase my Loan limit?

Yes, you can apply for a loan top-up after 6 months.

A top-up fee of Rs 2,500 or 1% of the top-up amount (whichever is higher) plus 16% FED is charged subject to approval.

Where is this loan offered?

It is offered in Karachi, Lahore, Rawalpindi, Islamabad, Faisalabad, Peshawar,

Hyderabad and Multan.

Am I eligible to apply for Silkbank Personal Installment Loan?

You are eligible to apply for Silkbank Personal Installment Loan if you are a salaried

individual and meet the minimum criteria.

Do I have to be of a certain age to be eligible for Silkbank Personal Installment

Loan?

Salaried: 21 years to 65 years or verified retirement age (whichever is earlier at loan maturity). The maximum age would be 62 years if retirement age could not be verified.

What should be my minimum monthly salary to qualify?

For Salaried: PKR 40,000/-

What is the debt burden requirement for Silkbank Personal Installment Loan?

50% aggregate debt burden (DB) as per SBP.

In how many days my case will be processed?

Your case will be processed in 7 to 10 working days from the date all documents have

been submitted.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com