HBL Personal Loan – HBL Student Loan For Study Abroad – HBL Study Abroad Loan

Contents

- 1 FAQs about HBL Personal Loan – HBL Student Loan For Study Abroad – HBL Study Abroad Loan

- 1.1 HBL Personal Loan FAQs:

- 1.1.1 What is the HBL Personal Loan?

- 1.1.2 Who is eligible for an HBL Personal Loan?

- 1.1.3 What is the maximum loan amount I can apply for?

- 1.1.4 What is the tenure for repayment of an HBL Personal Loan?

- 1.1.5 What documents are required to apply for an HBL Personal Loan?

- 1.1.6 How long does it take for loan approval?

- 1.1.7 Can I prepay my loan before the tenure ends?

- 1.1.8 What are the interest rates for an HBL Personal Loan?

- 1.2 HBL Student Loan for Study Abroad FAQs:

- 1.2.1 What is the HBL Student Loan for Study Abroad?

- 1.2.2 Who is eligible for the HBL Student Loan for Study Abroad?

- 1.2.3 What expenses are covered by the HBL Student Loan for Study Abroad?

- 1.2.4 What is the maximum loan amount I can apply for?

- 1.2.5 What is the repayment schedule for an HBL Student Loan?

- 1.2.6 What is the interest rate for the HBL Student Loan for Study Abroad?

- 1.2.7 Do I need a co-signer for the student loan?

- 1.2.8 Can I apply for the loan if I am already studying abroad?

- 1.2.9 What documents are required to apply for the loan?

- 1.3 HBL Study Abroad Loan FAQs:

- 1.3.1 What is the HBL Study Abroad Loan?

- 1.3.2 How is the HBL Study Abroad Loan different from the HBL Personal Loan?

- 1.3.3 What is the eligibility criteria for the HBL Study Abroad Loan?

- 1.3.4 Can I combine the HBL Study Abroad Loan with scholarships?

- 1.3.5 Can the HBL Study Abroad Loan cover the full cost of my education?

- 1.3.6 How can I apply for the HBL Study Abroad Loan?

- 1.3.7 What is the interest rate for the HBL Study Abroad Loan?

- 1.3.8 What is the loan repayment period?

- 1.3.9 Is there a grace period before I start repaying the loan?

- 1.3.10 Does HBL provide any financial counseling for study abroad?

- 1.3.11 Related posts:

- 1.3.12 JazzCash Islamic Saving Account 2025 (Salaam Investment)

- 1.3.13 Maryam Nawaz Loan Scheme: Youth Empowerment in Pakistan

- 1.3.14 Top 10 Things to Know Before Submitting Your Loan Application

- 1.1 HBL Personal Loan FAQs:

OVERVIEW

A loan facility that provides you financial assistance whenever you need it. This will help you finance your dreams as well as be your support in difficult times.

HBL Personal Loan

A loan for every dream

Also Check: Silk bank Personal Loan Free apply Online

Also Check: Meezan Bank Personal Loan Build Your Dream Home

Also Check: Akhuwat Foundation Loan New Update

FEATURES

Financing limit between PKR 25,000 to PKR 3,000,000

Repayment tenure(s) ranging from 12 to 60 months

Availability of top-up facility after every 12 months

Life insurance coverage

LOANS VIA MOBILE APP

Get an HBL PersonalLoan by logging on to the HBL Mobile App. HBL is now offering a quick and hassle free personal loan through the HBL Mobile App.

BENEFITS

Easy – avail loan through quick and easy steps

Paperless – no need to fill forms, submit documents or go through verification process

Convenience – get a loan through the HBL Mobile App, while sitting at home

Join Free Whatsapp Loan Group Click Here

QUICK EVALUATION

Your personal loan application in the HBL Mobile App is evaluated and upon completion of the evaluation you will be informed about your application status, through an SMS on your registered mobile number.

ELIGIBILITY CRITERIA

The service is offered to selected customers maintaining a salary account with HBL

CRITERIA

Salaried individual whose salary is being credited to HBL account

Applicant to be 21 years or more at the time of loan application and 60 years or less at the time of loan maturity.

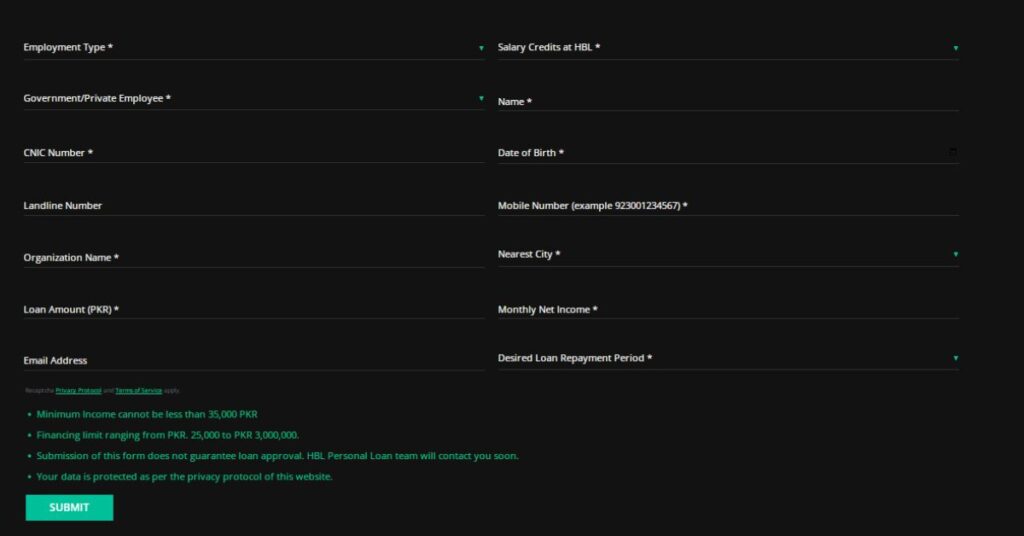

- Minimum Income cannot be less than 35,000 PKR

- Financing limit ranging from PKR. 25,000 to PKR 3,000,000.

- Submission of this form does not guarantee loan approval. HBL Personal Loan team will contact you soon.

- Your data is protected as per the privacy protocol of this website.

HOW TO APPLY APPLICANT TO PROVIDE:

Verified copy of CNIC

Verified copy of salary slip

Letter from employer (if applicable)

Terms and conditions apply.

HBL PERSONALLOAN FAQS

Q. Am I Eligible For HBL PersonalLoan?

A: You are eligible to apply for HBL PersonalLoan if you fall under any of the following categories

- Top-up customers the Existing HBL PersonalLoan customers with a good repayment history

- Salary transfer customers Individuals who earn more than PKR 15,000 monthly and whose salary are being transferred to an HBL account

Click Here Apply Now

This website, https://www.hbl.com/ (the “Website”) is owned and controlled by Habib Bank Limited (“HBL”). By visiting the Website, you accept and agree to the practices described in this privacy protocol (the “Privacy Protocol”). HBL respects the privacy of visitors/surfers and clients to its Website and advises all visitors/surfers and clients to read and understand our Privacy Protocol HBL reserves the right to amend the Privacy Protocol in accordance with the terms hereunder.

When you visit this Website, HBL may collect personal data about you by asking you to provide the data directly or may gather and analyse information regarding usage of this Website by you, including domain name, the number of hits, the pages visited by you, previous/subsequent sites visited and length of user session. HBL is committed to safeguarding all data collected hereunder and will only use such data for the purposes set forth in this Privacy Protocol in respect of the Website.

hbl personal loan

hbl personal loan documents required

hbl business loan

hbl loan scheme

hbl personal loan via mobile

hbl personal loan

hbl personal loan calculator

hbl loan scheme

hbl personal loan documents required

personal loan calculator Pakistan

bank alfalah student loan for study abroad

FAQs about HBL Personal Loan – HBL Student Loan For Study Abroad – HBL Study Abroad Loan

HBL Personal Loan FAQs:

What is the HBL Personal Loan?

The HBL Personal Loan is an unsecured loan that can be used for various personal needs such as medical expenses, education, travel, or debt consolidation.

Who is eligible for an HBL Personal Loan?

Salaried individuals, self-employed professionals, and business owners who meet the bank’s eligibility criteria, including age and income requirements, are eligible for the HBL Personal Loan.

What is the maximum loan amount I can apply for?

HBL offers personal loans up to PKR 3 million, subject to your income and other eligibility factors.

What is the tenure for repayment of an HBL Personal Loan?

The loan repayment tenure ranges from 1 to 5 years, depending on the loan amount and customer preference.

What documents are required to apply for an HBL Personal Loan?

Basic documents include a completed application form, CNIC copy, salary slips or proof of income, bank statements, and any other documents requested by HBL.

How long does it take for loan approval?

The approval time can vary, but typically it takes 3 to 5 business days after submission of all required documents.

Can I prepay my loan before the tenure ends?

Yes, you can make early repayments, but there may be prepayment charges. It is advisable to check with HBL for specific terms.

What are the interest rates for an HBL Personal Loan?

The interest rate varies based on market conditions, loan tenure, and customer profile. Contact HBL for the current rate.

HBL Student Loan for Study Abroad FAQs:

What is the HBL Student Loan for Study Abroad?

HBL offers a student loan to finance higher education abroad, covering tuition fees, living expenses, and other related costs.

Who is eligible for the HBL Student Loan for Study Abroad?

Students who have secured admission to an accredited foreign university are eligible. Eligibility also depends on the co-applicant’s (parent/guardian’s) financial status.

What expenses are covered by the HBL Student Loan for Study Abroad?

The loan can cover tuition fees, accommodation costs, travel expenses, and other education-related expenses such as books and study materials.

What is the maximum loan amount I can apply for?

The loan amount depends on the cost of the education program and the financial assessment of the co-signer. Contact HBL for specific details.

What is the repayment schedule for an HBL Student Loan?

Typically, the repayment starts after the student completes the course or a grace period post-graduation. The tenure can be up to 7 years or longer depending on the loan terms.

What is the interest rate for the HBL Student Loan for Study Abroad?

The interest rate varies based on factors like the loan amount, repayment period, and market conditions. You can inquire about the current rate from HBL.

Do I need a co-signer for the student loan?

Yes, a co-signer (usually a parent or guardian) is required to guarantee the loan repayment in case the student is unable to repay.

Can I apply for the loan if I am already studying abroad?

HBL typically offers loans for new students enrolling in a foreign university. However, you may contact HBL to check if they can accommodate your situation.

What documents are required to apply for the loan?

Documents include proof of admission, tuition fee structure, CNIC of both student and co-signer, income proof of co-signer, bank statements, and other documents requested by HBL.

HBL Study Abroad Loan FAQs:

What is the HBL Study Abroad Loan?

The HBL Study Abroad Loan is a specialized loan designed to provide financial support for students pursuing higher education at foreign universities.

How is the HBL Study Abroad Loan different from the HBL Personal Loan?

The Study Abroad Loan specifically targets educational expenses for international studies, while the Personal Loan can be used for a broader range of personal needs.

What is the eligibility criteria for the HBL Study Abroad Loan?

Eligibility depends on the student securing admission to a recognized foreign institution and the co-signer’s financial strength. HBL reviews factors such as academic background and the reputation of the university.

Can I combine the HBL Study Abroad Loan with scholarships?

Yes, you can use the loan in combination with scholarships or financial aid to cover any additional expenses not covered by other sources.

Can the HBL Study Abroad Loan cover the full cost of my education?

The loan may cover up to 100% of the educational expenses, depending on the student’s eligibility and the financial assessment of the co-signer.

How can I apply for the HBL Study Abroad Loan?

You can apply by visiting your nearest HBL branch or through their online banking portal. You will need to submit the required documents and complete the application process.

What is the interest rate for the HBL Study Abroad Loan?

The interest rate depends on market conditions and your loan terms. For the most accurate rate, it’s best to contact HBL directly.

What is the loan repayment period?

The repayment period generally begins after the completion of the degree, with a flexible tenure that can extend to 7 years or more.

Is there a grace period before I start repaying the loan?

Yes, a grace period is usually provided, allowing students to begin repayments after completing their education.

Does HBL provide any financial counseling for study abroad?

Yes, HBL may offer financial counseling to help students and their families plan for the expenses associated with studying abroad.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com