Contents

- 0.1 Introduction to Meezan Bank Personal Loan (Easy Home)

- 0.2 What is Easy Home by Meezan Bank?

- 0.3 Easy Home – Islamic House Finance

- 0.4 Why Choose Meezan Bank for Personal Loans?

- 0.5 Key Features of Meezan Bank Easy Home Loan

- 0.6 Eligibility Criteria for Meezan Bank Easy Home Loan

- 0.7 Documents Required for Easy Home Loan Application

- 0.8 Steps to Apply for Meezan Bank Easy Home Loan

- 0.9 Types of Financing Available Under Easy Home

- 0.10 How to Calculate Your Loan Amount and Payments

- 0.11 Benefits of Meezan Bank Easy Home Loan

- 0.12 Limitations of Meezan Bank Easy Home Loan

- 0.13 Meezan Bank Easy Home Loan vs Other Banks

- 0.14 Customer Reviews and Feedback

- 0.15 Eligibility Criteria for Non Resident Pakistanis (NRPs)

- 0.15.0.1 Citizenship

- 0.15.0.2 Product category

- 0.15.0.3 Segment

- 0.15.0.4 Co-applicant for Income clubbing

- 0.15.0.5 Age (Applicant & Co-applicant for calculation of financing amount)

- 0.15.0.6 Co-applicant Age (without income clubbing)

- 0.15.0.7 Income

- 0.15.0.8 Employment Tenure

- 0.15.0.9 Financing Tenor

- 0.15.0.10 Financing Range

- 1 Meezan Mobile Banking

- 1.1 FAQs About Meezan Bank Easy Home Loan

- 1.1.1 What is the maximum financing limit for Meezan Bank Easy Home loan?

- 1.1.2 Is Meezan Bank Easy Home loan Shariah-compliant?

- 1.1.3 Can I apply for Easy Home if I am self-employed?

- 1.1.4 How long does it take for loan approval?

- 1.1.5 Can I apply for Meezan Bank Easy Home loan online?

- 1.1.6 Why is the profit margin charged by Meezan Bank equal to conventional mortgage market trends?

- 1.1.7 Is there a room for a co-applicant in Easy Home and can Co-applicant’s income be considered for approval in limit enhancement?

- 1.1.8 What if I want to purchase the Bank’s share early i.e. before maturity?

- 1.1.9 What will happen to the property if the customer dies within the financing period?

- 1.1.10 Related posts:

- 1.1.11 JazzCash Islamic Saving Account 2025 (Salaam Investment)

- 1.1.12 Maryam Nawaz Loan Scheme: Youth Empowerment in Pakistan

- 1.1.13 Top 10 Things to Know Before Submitting Your Loan Application

- 1.1 FAQs About Meezan Bank Easy Home Loan

Introduction to Meezan Bank Personal Loan (Easy Home)

Do you want to buy a house in Pakistan, but you are unsure about your financing options? The Easy Home loan from Meezan Bank provides those looking for home financing with an option that complies with Shariah. Whether you want to build, purchase, or remodel a house, Meezan Bank offers affordable, adaptable financing alternatives that satisfy your requirements while adhering to Islamic law.

In this guide, we will walk you through everything you need to know about Meezan Bank Easy Home loan – from its features to how you can apply and secure your dream home.

What is Easy Home by Meezan Bank?

The Easy Home loan from Meezan Bank is a personal loan that is meant to help people buy homes. It’s different from regular loans because it follows the rules of Islamic finance. This makes it great for people who want interest-free, Halal financing. You can use Easy Home to buy a new home, build a house, or even fix up the one you already have.

Easy Home – Islamic House Finance

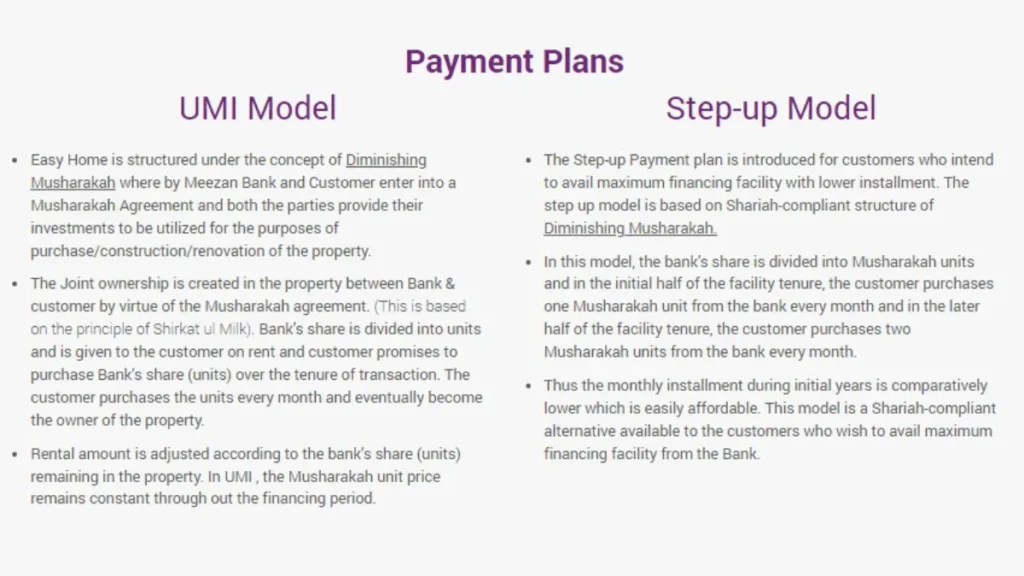

Easy Home is a completely interest (Riba) free solution to your home financing needs. Unlike a conventional house loan, Meezan Bank’s Easy Home works through the Diminishing Musharakah where you participate with Meezan Bank in joint ownership of your property. The nature of the contract is co-ownership and not a loan. This is because the transaction is not based on lending and borrowing of money but on joint ownership of a house. Meezan Bank, thus shares the cost of the house being purchased. Creating joint ownership and then gradually transferring ownership to the consumer instead of simply lending money is the major factor that makes Easy Home Shariah-compliant.

With Easy Home you participate with Meezan Bank in joint ownership of your property, where the Bank will provide a certain amount of financing. You agree to a monthly payment to the Bank of which one component is rent for the home, and another for your equity share. In fact, the total monthly payment is reduced regularly as your share in the property grows. When you have made the full investment, which had been agreed upon, you become the sole owner with a clear title to the property.

Why Choose Meezan Bank for Personal Loans?

In Pakistan, Meezan Bank was the first bank to offer Islamic banking. They have a variety of personal loan options that are all in line with Shariah law. If you choose Meezan Bank Easy Home loan, you will not only get good rates, but you will also have peace of mind knowing that your loan is in line with Islamic law. This is what makes Meezan Bank stand out:

- Shariah-compliant financing: No Riba (interest) involved.

- Flexible terms: Customized payment plans to suit your financial situation.

- Widespread network: With branches across Pakistan, Meezan Bank is easily accessible.

- Transparent processing: No hidden charges or complications.

Key Features of Meezan Bank Easy Home Loan

Shariah-compliant financing

The Easy Home loan from Meezan Bank follows the rules of Islamic finance, which says that interest (Riba) should not be paid. Instead, the loan works with a system called Diminishing Musharakah, in which both the customer and the bank own the land.

Flexible payment plans

The bank offers flexible repayment terms ranging from 1 to 20 years, depending on the financing amount and customer’s preference.

Competitive profit rates

Meezan Bank offers competitive profit rates that align with the current market, ensuring that customers get an affordable financing solution.

Financing for both urban and rural areas

Easy Home provides financing for properties in both urban centers and rural areas across Pakistan, making it accessible to a wide range of customers.

Silk Bank Personal Loan in Pakistan

Eligibility Criteria for Meezan Bank Easy Home Loan

Before applying for Meezan Bank Easy Home loan, you need to ensure that you meet their eligibility criteria:

Citizenship

Pakistani National (Resident or Non-Resident) as per the Bank’s policy

Age requirements

In case of applicant & co-applicant (with income clubbing):

- Minimum 25 years and maximum 65 years* at the time of financing maturity

In case of co-applicant (without income clubbing):

- Minimum 21 years and maximum 70 years at the time of financing maturity

*For salaried person, the age of applicant must not exceed 65 years OR retirement age, whichever is earlier. (Normal retirement age will be considered as 60 years if not mentioned otherwise).

Customer / Applicant

- Primary (or Single) & Co-applicant allowed.

- Co-applicant must be an immediate family member*.

*Spouse, parents, adult children, brothers & sisters only.

Income requirements

Salaried & Self Employed Professional (SEP)*

- Minimum Gross Income of PKR 50,000** per month.

- 100% co-applicant’s income may be clubbed in case of spouse only.

Self-Employed / Business Person

- Minimum Gross Income of PKR 100,000 per month.

*Self Employed Professional includes doctors, engineers, auditors & architects.

**In case of contractual employees, minimum PKR 100,000 per month will be required

Nationality and residency criteria

Pakistani National (Resident or Non-Resident) as per the Bank’s policy.

Employment Tenure

Salaried

- Permanent job with a minimum 2 years continuous work history in the same industry / field.

- For contractual employment, a minimum 2 years continuous work history in the same industry / field along with having a total experience of 4 years.

Self-Employed / Business Person

Minimum 3 years in current business / industry.

Note: In line with State Bank of Pakistan’s regulatory requirement, negative history (i.e. overdue/ late payment/ write-off/ waiver) of consumer/individual customers will be reflected in e-CIB reports for two years after settlement.

I Need 20,000 Rupees Loan Urgently in Pakistan

Documents Required for Easy Home Loan Application

When applying for Meezan Bank Easy Home loan, you need to prepare several documents:

- CNIC (Computerized National Identity Card)

- Proof of income (salary slips, bank statements)

- Property-related documents (title deeds, property valuation)

- Completed loan application form

- Two passport-sized photographs

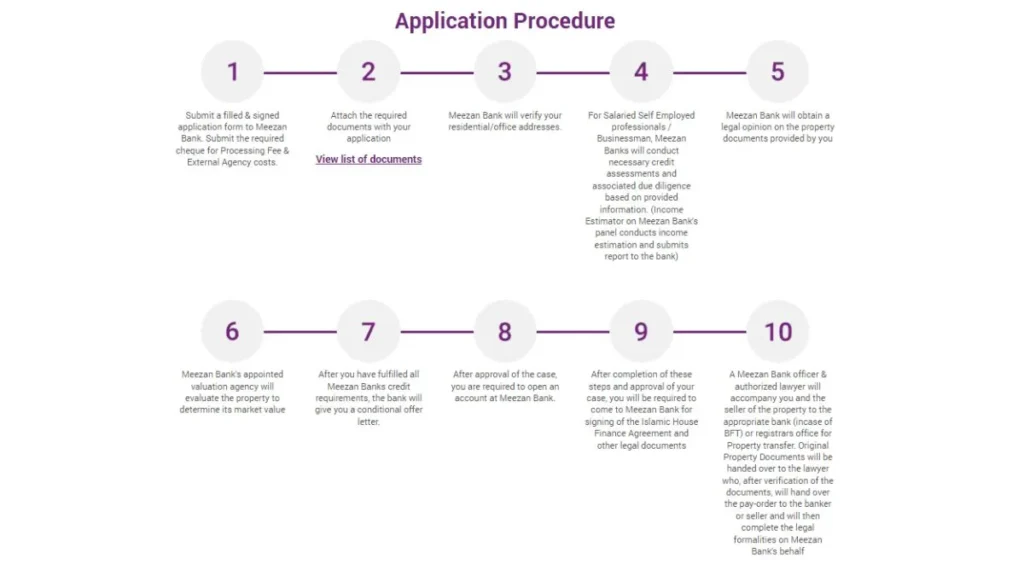

Steps to Apply for Meezan Bank Easy Home Loan

Applying for the Easy Home loan is a simple and straightforward process:

- Visit a Meezan Bank branch: You can initiate your application by visiting the nearest branch.

- Consult with a loan officer: The officer will guide you through the available options and help you understand the loan terms.

- Submit documents: Provide the necessary documentation for verification.

- Property assessment: Meezan Bank will evaluate the property for which you are seeking financing.

- Approval and disbursement: Once approved, the bank will release the funds according to the agreed terms.

Types of Financing Available Under Easy Home

Meezan Bank Easy Home loan offers various financing options to cater to different needs:

Home purchase financing

For individuals looking to buy a new home, Easy Home offers the necessary funds to make the purchase.

Home construction financing

For those building a new home, Easy Home provides financing that covers construction costs.

Renovation financing

If you need to upgrade or renovate your current home, you can apply for renovation financing under the Easy Home scheme.

Land purchase financing

If you wish to purchase land to build your home in the future, Meezan Bank offers financing specifically for land purchases.

How to Calculate Your Loan Amount and Payments

Meezan Bank provides a loan calculator on their website that helps you estimate your loan amount and monthly payments based on your income and the propertys value. The bank offers up to 75% financing of the total property value, allowing you to budget effectively.

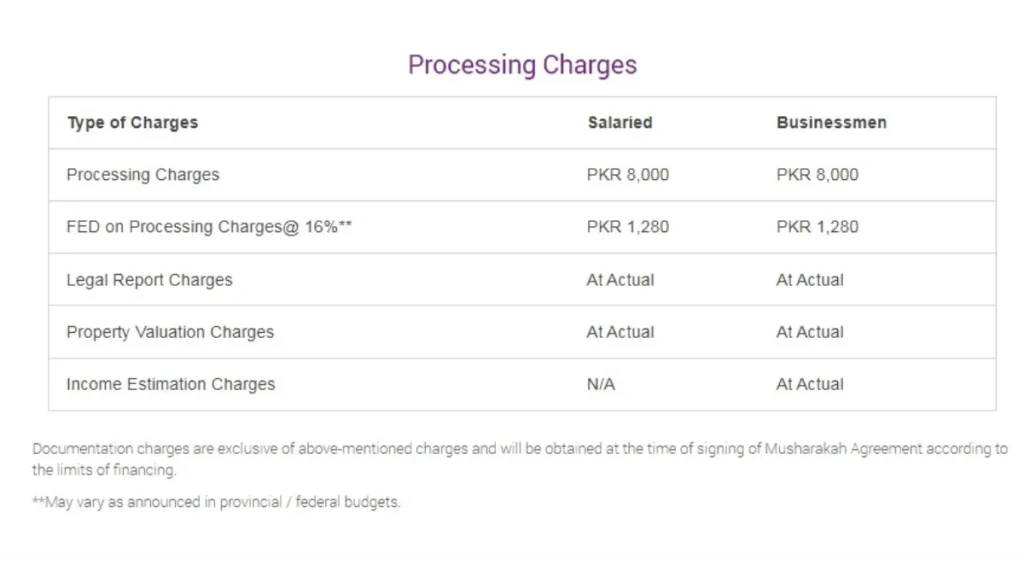

Benefits of Meezan Bank Easy Home Loan

- Shariah-compliant financing.

- Customizable repayment plans.

- Low processing fees.

- Widespread accessibility across Pakistan.

Limitations of Meezan Bank Easy Home Loan

- Strict eligibility criteria.

- Longer processing time compared to conventional loans.

- Not available for overseas Pakistanis.

Meezan Bank Easy Home Loan vs Other Banks

Easy Home from Meezan Bank stands out because it follows Shariah law and has open terms. Other banks may offer loans that are similar, but they usually charge interest. Meezan Bank is the best choice for people who want to do Islamic banking.

Customer Reviews and Feedback

Customers who have used Meezan Bank Easy Home loan appreciate its transparency and the ease of the application process. Many find the customer service to be excellent, though some note that the approval process can be slow.

Meezan Bank Car Ijarah Eligibility Criteria (Car Financing)

Eligibility Criteria for Non Resident Pakistanis (NRPs)

Citizenship

Must be a Pakistani national

Product category

Buyer, Builder, Renovation & Replacement

Segment

Salaried Individuals

Co-applicant for Income clubbing

100% co-applicant income club in case of spouse.

Age (Applicant & Co-applicant for calculation of financing amount)

25 to 60 years. (Maximum 60 years at the time of maturity)

Co-applicant Age (without income clubbing)

25 to 70 years. (Maximum 70 years at the time of maturity)

Income

Minimum income must be equivalent to PKR 250,000/- or above.

Employment Tenure

Two years (minimum) regular experience in same industry. At least one year work experience in existing job in the same country.

Financing Tenor

3 to 20 Years.

Financing Range

PKR 0.5M – PKR 50M.

Meezan Bank Loan Apni Bike Financing

Meezan Mobile Banking

Manage your finances on the move and around the clock with Meezan Bank’s secure Mobile Banking App.

Packed with smart features, Meezan Mobile App provides secure, on-the-go access to your accounts with built-in powerful and intuitive tools for managing them.

Banking should be simple, quick and convenient and that is the idea behind the Meezan Mobile Banking App.

Key Features:

– Fastest Biometric login

– View account statement & transaction details

– Pay Utility, Mobile & Internet bills and manage payees

– Pay Schools & University Fees Instantly

– Topup your Jazz Cash & Easypaisa wallet accounts

– Transfer funds to any Bank in Pakistan for Free

– Pay Zakat & Donations to renowned charitable organization

– Block or unblock debit cards

– Find nearby Meezan Bank banking offices and ATMs

– Look out for discounts and new promotions

– Qibla locator

FAQs About Meezan Bank Easy Home Loan

What is the maximum financing limit for Meezan Bank Easy Home loan?

Meezan Bank offers financing up to PKR 75 million, depending on the value of the property.

Is Meezan Bank Easy Home loan Shariah-compliant?

Yes, it follows the Diminishing Musharakah model, which is fully Shariah-compliant.

Meezan Bank’s Easy Home works through Diminishing Musharakah and conforms to Shariah laws specifically related to financing, ownership and trade. The nature of the contract is co-ownership and not a loan because the transaction is not based on lending and borrowing of money but on joint ownership in a house. Meezan Bank shares the cost of the house being purchased. Creating joint ownership and then gradually transferring ownership to the consumer instead of simply lending money is the major factor that makes Easy Home Shariah-compliant.

With Easy Home, the Bank will finance up to 65% and 75% of the property price to businessmen and salaried individuals respectively. The customer agrees to a monthly payment to the Bank, part of which is for use of the house and part for purchasing the bank’s share in the house. When the customer has made the full payment which had been agreed upon, he becomes the sole owner with a free and clear title to the property. The profit charged by Meezan Bank is therefore payment for use of its share of the house during the life of the contract. Your payments to Meezan Bank are hence completely Riba-Free.

Can I apply for Easy Home if I am self-employed?

Yes, both salaried and self-employed individuals can apply, provided they meet the income requirements.

How long does it take for loan approval?

The approval process can take anywhere between 3 to 6 weeks, depending on the complexity of the application.

Can I apply for Meezan Bank Easy Home loan online?

You can begin the process online, but a visit to the bank is required for documentation and final approval.

Why is the profit margin charged by Meezan Bank equal to conventional mortgage market trends?

At Meezan Bank, the profit margin is directly linked to market trends to provide a competitive product to our customers. Shariah allows the use of any market factor as a benchmark todetermine the profit rate of a particular product. The mere fact that the applied profit rate of our product is similar to the rates applied for conventional mortgages does not render the transaction or the contract invalid from a Shariah perspective; neither does it make the transaction an interest-bearing one; rather, it is the underlying structure of the product that determines its Shariah-compliance.

Is there a room for a co-applicant in Easy Home and can Co-applicant’s income be considered for approval in limit enhancement?

Yes, the immediate family member (selective relations) can become co-applicant in Easy Home case. Co-applicant’s 50% income can be clubbed for approval in limit enhancement. Incase co-applicant is spouse, then 100% income can be clubbed for income computation.

Easy Home offers the flexibility of Early Unit purchase/Termination anytime during the tenure of the facility but one month after availing the facility in Easy Buyer cases. In the case of Easy Builder, Easy Renovate & Easy Replace – a period of 12 month will be required to lapse from the last disbursement/purchase of share by the Bank before any Unit purchase can take place. This restriction is due to the Shariah requirement of avoiding Bai Inah or buy back. Early termination can only take place on your specific repayment date. If you want to avail of the facility, you will have to give a 10-days prior notice to the Bank. Incase of appreciation of property price, musharakah units will be sold at 3% higher price. If the market price remains the same or decreased, then no additional payment will be taken and musharakah units will be sold at face value.

(To assess the variation in property price, valuation will be conducted at customer’s cost)

What will happen to the property if the customer dies within the financing period?

MBL gives option to all the customers to obtain Shariah Compliant Life Takaful* Coverage at very compatible takaful contribution on monthly basis. As per this arrangement, in the event of the accidental or natural death of a customer, the Takaful benefit will cover the outstanding amount on the date of death. The Takaful cover will also be available incase of customer’s natural or accidental disability.

(*Takaful is Islamic alternative of Insurance).

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com