Contents

- 1 Introduction

- 2 Understanding Personal Loans

- 3 Standard Chartered Bank Personal Loan Features

- 4 Eligibility & Documents

- 5 Eligibility Criteria

- 6 Required Documents

- 7 How to Apply for a Standard Chartered Bank Personal Loan?

- 8 Advantages of Standard Chartered Bank Personal Loans

- 9 Potential Challenges and How to Overcome Them

- 10 Comparison with Other Banks

- 11 Real-Life Success Stories

- 12 Conclusion

- 13 SC Mobile Pakistan App in PlayStore

- 14 FAQs About Standard Chartered Bank Personal Loans

- 14.1 What are the minimum and maximum loan amounts?

- 14.2 How much time will it take for my loan to be approved?

- 14.3 What are the loan tenure options?

- 14.4 What is the maximum tenure?

- 14.5 How is the interest rate calculated?

- 14.6 Are there any penalties for early repayment?

- 14.7 Can self-employed individuals apply?

- 14.8 What are the processing fees?

- 14.9 Related posts:

- 14.10 QarzMitra Loan App

- 14.11 JazzCash Islamic Saving Account 2025 (Salaam Investment)

- 14.12 Maryam Nawaz Loan Scheme: Youth Empowerment in Pakistan

Introduction

In Pakistan fast-paced financial world, Standard Chartered Bank has made a name for itself as a reliable and forward-thinking bank. As we move into 2025, the need for personal loans keeps growing. These loans help people get the money they need for things like weddings, school, medical problems, or consolidating their debt. Let us look at why Standard Chartered Bank is Pakistan best bank for personal loans.

Understanding Personal Loans

What is a Personal Loan?

Personal loans are loans that do not need collateral and are not backed by anything. It can be used for many things, from paying for unexpected costs to making long-term dreams come true.

Why People Choose Personal Loans

People like personal loans because they let them get money quickly without having to fill out a lot of forms or find guarantors. With flexible payment choices, they are a useful way to handle short-term money problems.

| Join WhatsApp | Click Here |

| More Govt Jobs | Click Here |

| International Job/Visa | Click Here |

| Make Money At Home | Click Here |

| Subscribe YouTube | Click Here |

| Click Here | |

| Click Here |

Standard Chartered Bank Personal Loan Features

Loan Amount Range

Standard Chartered Bank offers personal loans ranging from PKR 50,000 to PKR 5 million, making it suitable for small to large financial needs.

Competitive Interest Rates

The bank provides competitive interest rates, ensuring affordability for borrowers while maintaining financial sustainability.

Flexible Repayment Options

Borrowers can enjoy flexible repayment tenures ranging from 1 to 5 years, tailored to their financial convenience.

Quick Processing and Disbursement

With a streamlined application process, Standard Chartered Bank ensures that approved loans are disbursed swiftly, often within 48 hours.

JS Bank Personal Loan in Pakistan

Faysal Bank Personal Loan Online

Eligibility & Documents

Residents

Application Eligibility

- You have to be at least 21 years of age if you are salaried or 25 years of age if you are self employed

- Must have a valid and active email ID

- Have a valid Pakistan mobile number

Documents Required

- CNIC

- Income Proof

Eligibility Criteria

Who Can Apply?

Individuals aged between 21 and 60 years with a stable income can apply for a personal loan from Standard Chartered Bank.

Minimum Income Requirements

The minimum income requirement is PKR 50,000 per month, making it accessible for salaried and self-employed individuals.

Employment Status and Age Limits

Applicants must have a stable job or a verifiable source of income. Retired individuals with pensions may also qualify.

Required Documents

- Identity Proof: CNIC or passport

- Income Proof: Salary slips or tax returns for self-employed individuals

- Employment Details: A letter from the employer or proof of business ownership

How to Apply for a Standard Chartered Bank Personal Loan?

Online Application Process

- Visit the official Standard Chartered Bank website.

- Fill out the application form with accurate details.

- Upload the required documents.

- Submit and wait for the verification process.

In-Branch Application Process

Applicants can also visit the nearest branch with the necessary documents and apply directly.

Tips for a Successful Application

- Double-check all your documents for accuracy.

- Ensure you meet the eligibility criteria.

- Familiarize yourself with the terms and conditions to avoid surprises.

Advantages of Standard Chartered Bank Personal Loans

- Transparency: No hidden charges.

- Flexibility: Tailored repayment plans to suit individual needs.

- Customer Service: Dedicated support to assist with applications and queries.

Potential Challenges and How to Overcome Them

Common Issues Faced by Applicants

- Incomplete documentation

- Failing to meet income requirements

Solutions

- Use the bank checklist to ensure all requirements are met.

- Seek guidance from bank representatives if needed.

Comparison with Other Banks

Standard Chartered Bank stands out from other banks because of how easy it is to apply, how competitive its interest rates are, and how great its customer service is.

Real-Life Success Stories

A lot of satisfied customers have talked about how Standard Chartered Bank personal loans helped them reach their objectives, like starting a business or paying for unexpected costs.

Conclusion

Standard Chartered Bank personal loan offerings in 2025 are designed to empower individuals with financial flexibility and confidence. With its customer-centric approach, competitive rates, and quick processing, it is the ideal choice for borrowers in Pakistan.

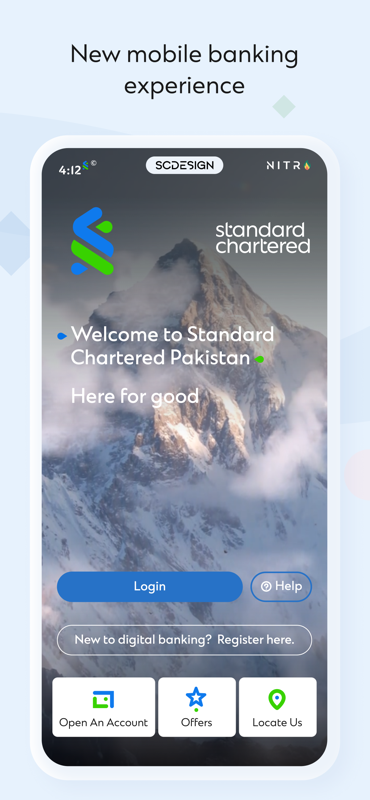

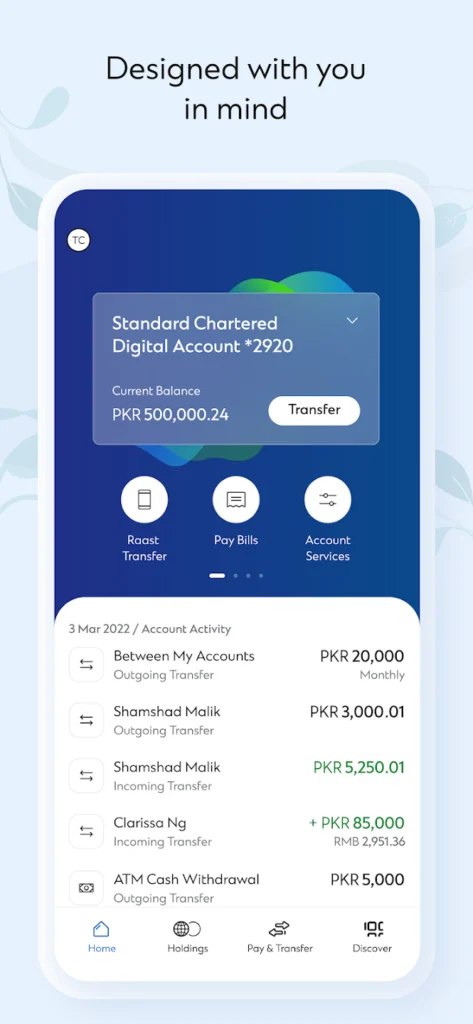

SC Mobile Pakistan App in PlayStore

About this app

The new and improved SC mobile app offers a fast, secure, and user-friendly mobile banking experience, designed to take care of its customers banking needs on the go anytime, anywhere ! Indulge in effortless app interface to get customized alerts, quick access to statements, dashboards, cards management, making online bank transfers & much more.

About SC Mobile:

The new and improved SC mobile app offers a fast, secure, and user-friendly mobile banking experience, designed to take care of its customers banking needs on the go anytime, anywhere ! Indulge in effortless app interface to get customized alerts, quick access to statements, dashboards, cards management, making online bank transfers & much more.

Prime features & services:

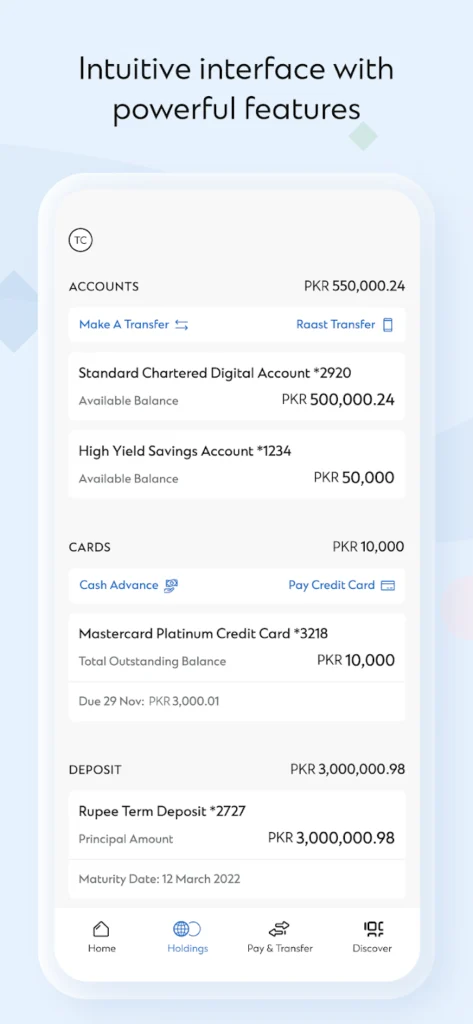

Home with Glance:

With just one swipe, get quick access to transactions of all the financial assets you hold. Make transfer, pay bills, manage your accounts and cards from home screen, view real-time total account balance enquiry pay, credit card bills, utility bills and much more.

Fast, Secure & Easy Access:

Quickly log into your account with just your touch/face ID without the need of any PIN or password with new enhanced digital security, biometrics, and authentication features for greater convenience.

New modern look and feel with simplified navigation and faster loading times so that banking becomes a quick and easy experience.

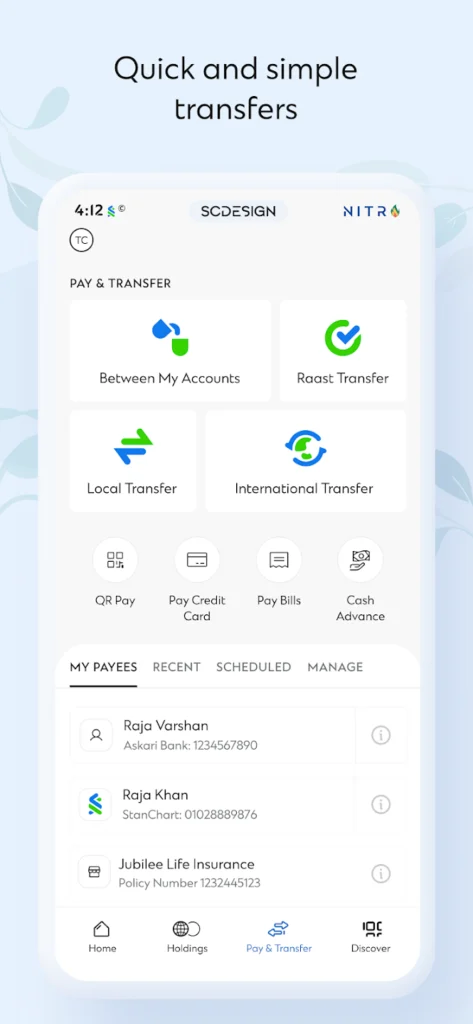

QR Pay:

Make the best of the QR pay for quick & easy payments at merchant

Hassel-free Payment:

Transfer funds instantly between your SC account or other accounts by selecting Local Transfer & other payment methods; Add beneficiary at ease and transfer funds without registering a beneficiary (RAAST).

Manage Cards Easily:

Apply for a credit card right from the app, pay credit card bills & even block/hotlist credit or debit card.

All Products under one roof:

Enjoy the convenience of digital banking at your fingertips, open & apply for Cards, Accounts, Fixed Deposits & term Deposits and other product offerings in the market without any hassle.

Effortless & Convenient Bill Payments:

Pay utility bills, Credit Card bills, Electricity bills, Insurance bill & Mobile bills & pay for recharge, instantly. Even set up scheduled funds transfer and set standing orders

Insta Account Opening:

Non-SC Bank customers can now instantly open an account through the SC Mobile App. Open app –> Open an Account

And SC Bank customers can apply for product of their choice with their data pre-filled for the convenience of easy application submission.

Locate us:

Locate nearest Standard Chartered ATM or Branch by just over a click

Other Services:

Our new services on SC Mobile App allow you to bank on your fingertips without having to visit a branch or calling the client centre. Register for SC Mobile today and enjoy unlimited convenience. Learn more on the new release:

- Order a Cheque Book & Activate – You can order a cheque book through SC Mobile and receive at your mailing address. You can also activate your cheque book through the app.

- Stop Cheque – You can instantly stop your cheques , single or multiple, or the entire cheque book through the app. We strive to keep your finances safe and secure.

- Manage Debit Card – Control your card usage at your convenience. Choose yourself to enable/disable channels or increase/decrease your limits – all in just a few taps.

- Debit Card issuance – order a new card or replace the damaged card on your fingertips

- Credit Card Block and Replacement – Credit Card lost or stolen? You can now block your Credit Card instantly and get it replaced through the app.

- Signature Capture – New to a bank? Want to update your signature? You can add or update your signature for all your accounts through the app.

- Pay Order – Request for Pay Order through SC Mobile App, save yourself a trip to a branch.

- Bank Certificates – Request for Account maintenance, Withholding tax, PRC certificates from SC Mobile App & receive them at your email address!

FAQs About Standard Chartered Bank Personal Loans

What are the minimum and maximum loan amounts?

You can avail of loans ranging from PKR 30,000 to PKR 4 mn depending on your eligibility, income and repayment capacity.

How much time will it take for my loan to be approved?

Your loan will be disbursed within 10 working days after receipt of all required documents.

What are the loan tenure options?

The loan can be repaid over a period of 12 to 60 months.

What is the maximum tenure?

Up to 5 years.

How is the interest rate calculated?

Based on the loan amount, tenure, and applicant’s creditworthiness.

Are there any penalties for early repayment?

No, Standard Chartered Bank allows early repayment without hefty penalties.

Can self-employed individuals apply?

Yes, with verifiable income proof.

What are the processing fees?

Typically 1-2% of the loan amount, subject to terms.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com