Contents

- 1 What is the LoanLado Loan App?

- 1.1 Why Choose LoanLado for Personal Loans?

- 1.2 LoanLado – Easy Personal Loan

- 1.3 How LoanLado Works?

- 1.4 LoanLado Loan Features

- 1.5 Documents Required for Loan Approval

- 1.6 How to Download and Install LoanLado Loan App?

- 1.7 Security and Privacy of LoanLado Loan App

- 1.8 LoanLado Customer Support

- 1.9 Pros and Cons of LoanLado

- 1.10 LoanLado vs. Other Loan Apps in Pakistan

- 1.11 Common Reasons for Loan Application Rejection

- 1.12 Tips to Improve Your Chances of Getting Approved

- 1.13 Conclusion

- 1.14 FAQs about LoanLado Loan App

- 1.15 What happens if I miss a repayment?

- 1.16 Can I reapply if my loan is rejected?

Introduction

Are you in need of quick cash in Pakistan? The LoanLado Loan App makes it easier than ever to get a personal loan without the hassle of traditional banking. LoanLado guarantees a simple and safe borrowing experience, regardless of the purpose—an emergency or a scheduled expense.

What is the LoanLado Loan App?

A digital lending platform called LoanLado offers Pakistani consumers quick personal loans via an easy online application process. With minimal documentation and fast approvals, LoanLado has emerged as one of the most convenient loan apps in the country.

Why Choose LoanLado for Personal Loans?

Quick Approval Process

Unlike traditional banks, LoanLado offers a fast and digital loan approval process that can get funds into your account within hours.

No Collateral Required

Because LoanLado offers unsecured personal loans, you can borrow money without having to surrender any assets.

User-Friendly Interface

Everyone can use the LoanLado loan app. You may use the app with ease and apply for a loan in a matter of minutes, even if you are not tech-savvy.

Bank of Punjab Digital Loan App

LoanLado – Easy Personal Loan

About this app

LoanLado offers safe instant personal loans with quick approvals and flexible repayment options. Apply online anytime, anywhere to resolve your urgent financial needs.

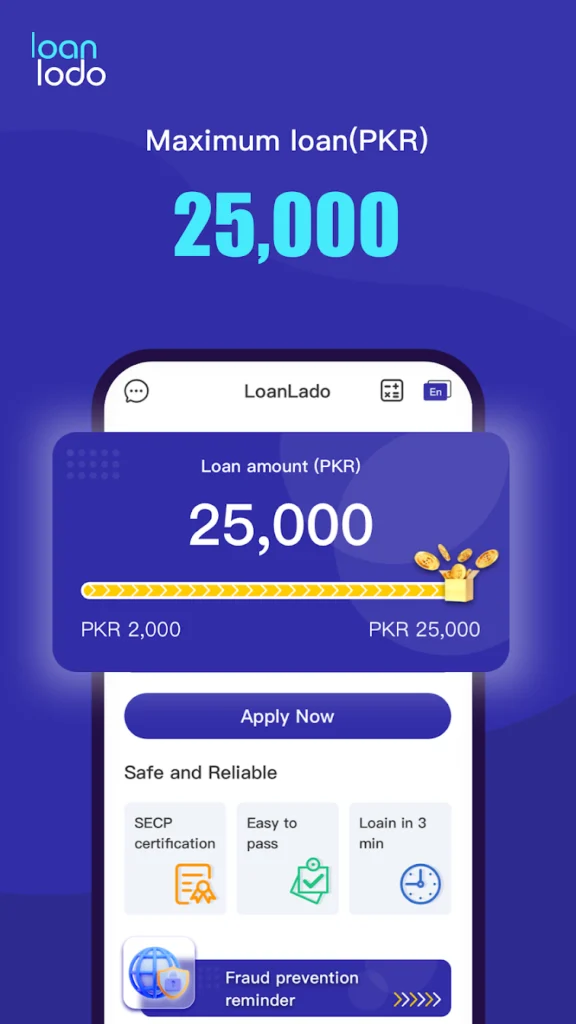

Details of the loan

Loan amount: from PKR 2,000~PKR 25,000

Loan term: 60-90 days

Mark up rate: 0.01%~0.75% per day

Annual percentage rate (APR): 3.65%~273.75%

For example

If you apply for a loan with the loan amount of PRK 10,000 and the loan term is 90 days, the interest rate is 0.01% per day, then you need to pay as follows:

Loan amount disbursed in hand: 10,000

Total interest : 10,000*0.01%*90=90

The total payable amount : 10,000+90=10,090

Monthly repayment amount=10,090/3=3,363

If you are a Pakistani citizen with a valid ID card and are over 18 years old, you can apply for a loan through the following methods:

1. Register with your mobile number.

2. Enter your basic details and submit.

3. Get instant online approval

4. Get the loan amount disbursed within minutes

Security and Privacy Protection

When you use our services, we may ask you to provide some data permissions to help us determine whether you are eligible to apply for a loan and provide you with more suitable services. All data will be protected by bank-level security and will never be disclosed to any third party without your consent.

If you have any questions, please contact our customer service support@loanlado.com

Company name: EASY FINANCE (PRIVATE) LIMITED

Website: https://loanlado.com

Principal Business: Nano Lendings

Status of company: NBFC (Investment Finance Service)

License NO.SECP/LRD/138/EFPL/2024-257

Paisayaar Loan App in Pakistan

How LoanLado Works?

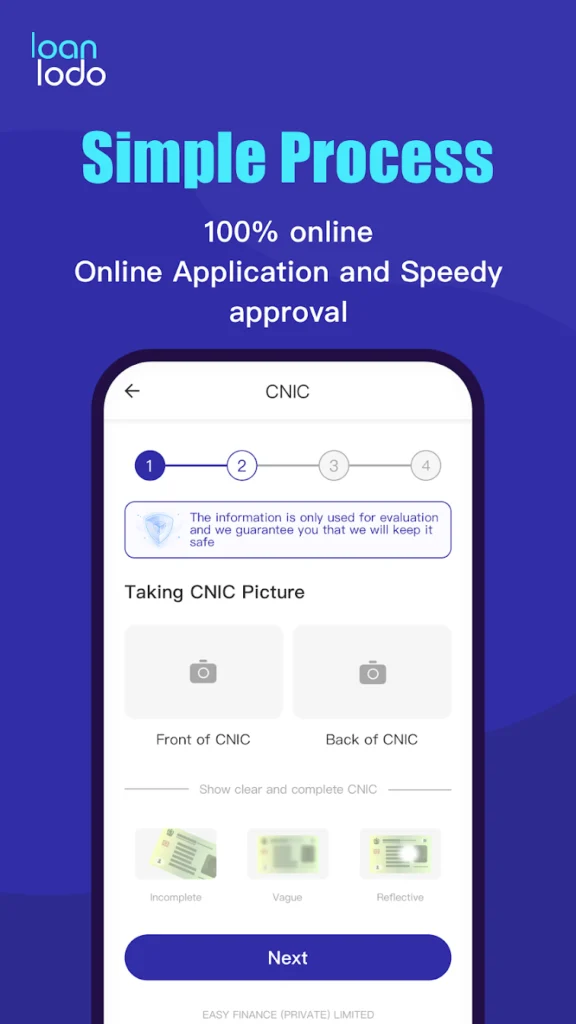

Step-by-Step Application Process

- Download the LoanLado loan app from the Google Play Store.

- Sign up with your mobile number and create an account.

- Fill in personal details like CNIC, employment information, and monthly income.

- Upload necessary documents (e.g., CNIC and salary proof).

- Submit your loan request and wait for approval.

- Get the money transferred directly into your bank account.

Eligibility Criteria

- Must be a Pakistani citizen

- Age between 21 to 60 years

- Have a stable source of income

- Must own a valid CNIC and bank account

Nova Finance Loan App

LoanLado Loan Features

Loan Amount and Tenure

LoanLado offers personal loans ranging from PKR 5,000 to PKR 200,000 with flexible repayment tenures of up to 12 months.

Interest Rates

The interest rate varies based on your profile but typically ranges from 2.5% to 3.5% per month.

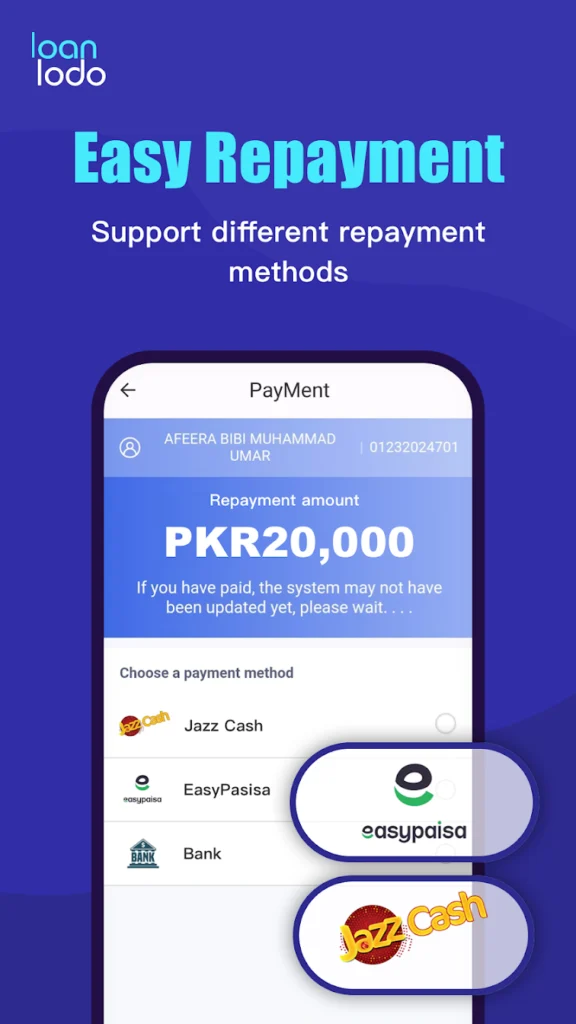

Repayment Options

- Bank Transfer

- Mobile Wallets (JazzCash, Easypaisa, etc.)

- Debit/Credit Card Payments

Documents Required for Loan Approval

- Copy of CNIC

- Bank statement (last 3 months)

- Salary slip (for salaried individuals)

- Proof of business (for self-employed individuals)

How to Download and Install LoanLado Loan App?

- Open the Google Play Store on your Android device.

- Search for LoanLado and tap the Install button.

- Open the app and follow the registration process.

Security and Privacy of LoanLado Loan App

LoanLado follows strict data encryption protocols to ensure your personal information is safe. They comply with local financial regulations to protect borrowers.

EduFi Loan App in Pakistan

LoanLado Customer Support

You can reach out to LoanLado’s customer support via:

- In-app chat

- Email support

- Helpline number

Pros and Cons of LoanLado

Advantages

✔️ Quick approval & disbursement

✔️ No collateral needed

✔️ Flexible repayment options

✔️ 100% online application process

Disadvantages

❌ Higher interest rates than banks

❌ Limited loan amount for new users

❌ Available only on Android (iOS not supported yet)

LoanLado vs. Other Loan Apps in Pakistan

Compared to other loan apps, LoanLado stands out due to its fast approvals, flexible repayment, and strong customer support.

Common Reasons for Loan Application Rejection

- Low credit score

- Unstable income source

- Incorrect personal details

- Existing unpaid loans

Tips to Improve Your Chances of Getting Approved

- Maintain a good credit score

- Provide accurate and complete information

- Ensure a stable monthly income

- Pay off previous loans before applying

SmartQarza Loan App

Conclusion

LoanLado is an excellent option for quick personal loans in Pakistan. With a user-friendly app, minimal paperwork, and fast disbursement, it has become a go-to solution for many Pakistanis in need of urgent funds. If you need instant cash, LoanLado is worth considering!

FAQs about LoanLado Loan App

Is LoanLado a safe and legal platform?

Yes, LoanLado follows all regulatory guidelines in Pakistan and ensures data protection.

How long does it take to get loan approval?

Most users receive loan approval within a few hours of applying.

Can I apply for a loan without a bank account?

No, a bank account is required to receive the loan amount.

What happens if I miss a repayment?

Missing payments may result in penalty charges and affect your credit score.

Can I reapply if my loan is rejected?

Yes, you can reapply after improving your eligibility (e.g., updating income proof or repaying existing loans).

Can I apply for a loan without a bank account?

No, a bank account is required to receive the loan amount.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com