Contents

- 1 Introduction

- 2 What is GrowPak e-Loan Manager?

- 3 Why Choose GrowPak e-Loan Manager in 2025?

- 4 Features of GrowPak e-Loan Manager

- 5 How to Download and Install GrowPak e-Loan Manager

- 6 Eligibility Criteria for Using GrowPak e-Loan Manager

- 7 How to Apply for a Loan on GrowPak e-Loan Manager

- 8 Types of Loans Offered by GrowPak e-Loan Manager

- 9 Interest Rates and Repayment Plans

- 10 Security Measures and Data Protection

- 11 User Testimonials and Reviews

- 12 Pros and Cons of GrowPak e-Loan Manager

- 13 Comparison with Other Loan Apps in Pakistan

- 14 Future of Digital Lending in Pakistan

- 15 Conclusion

- 16 FAQs about GrowPak e-Loan Manager Loan App in Pakistan

Introduction

As digital tools become more popular, they are changing how Money works in Pakistan in big ways. Financial services are easier to get to than ever before, thanks to more people having smartphones and faster mobile internet. Here comes GrowPak e-Loan Manager, a state-of-the-art loan app made to meet the wants of Pakistan growing number of tech-savvy people. In this piece, we will talk about what makes GrowPak e-Loan Manager a big deal in Pakistani digital lending in 2025.

What is GrowPak e-Loan Manager?

The GrowPak e-Loan Manager smartphone app makes it easy for people and small companies to apply for loans quickly and easily. It offers different types of loans, such as personal, business, and emergency loans, to meet the needs of all users.

Why Choose GrowPak e-Loan Manager in 2025?

The demand for digital lending solutions in Pakistan has skyrocketed, and GrowPak e-Loan Manager stands out for several reasons:

- Convenience: Apply for a loan from the comfort of your home.

- Speed: Get approval within minutes.

- Security: Your data is protected with top-notch encryption technology.

Features of GrowPak e-Loan Manager

User-Friendly Interface

The app is designed with a simple and intuitive interface, making it easy for users of all ages to navigate and apply for loans.

Quick Loan Approval

Unlike traditional banks that require lengthy paperwork, GrowPak e-Loan Manager streamlines the process with quick digital approvals.

Secure and Transparent Process

Transparency is key. GrowPak ensures that all terms and conditions are clear, with no hidden fees or charges.

24/7 Customer Support

Have questions? The customer support team is available around the clock to assist with any issues or inquiries.

How to Download and Install GrowPak e-Loan Manager

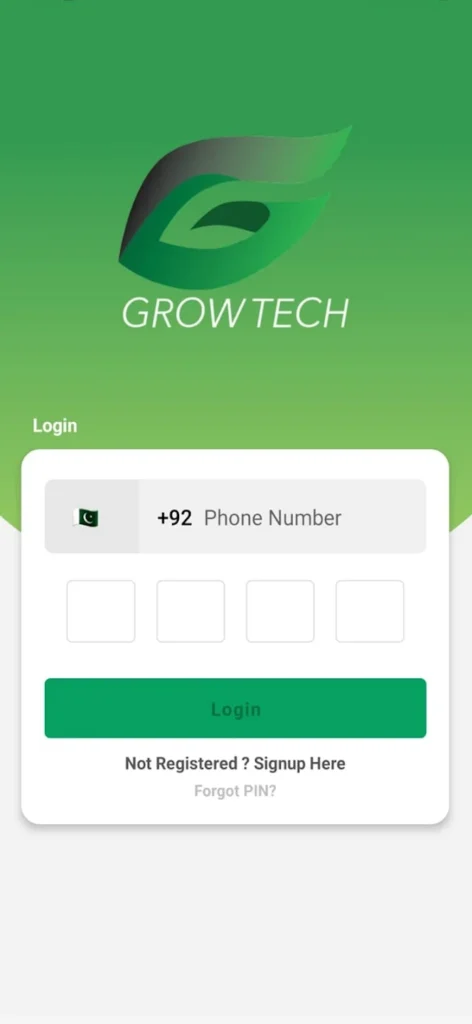

- Open the Google Play Store or Apple App Store on your smartphone.

- Search for “GrowPak e-Loan Manager.”

- Click on the download button.

- Once installed, open the app and register your account.

Eligibility Criteria for Using GrowPak e-Loan Manager

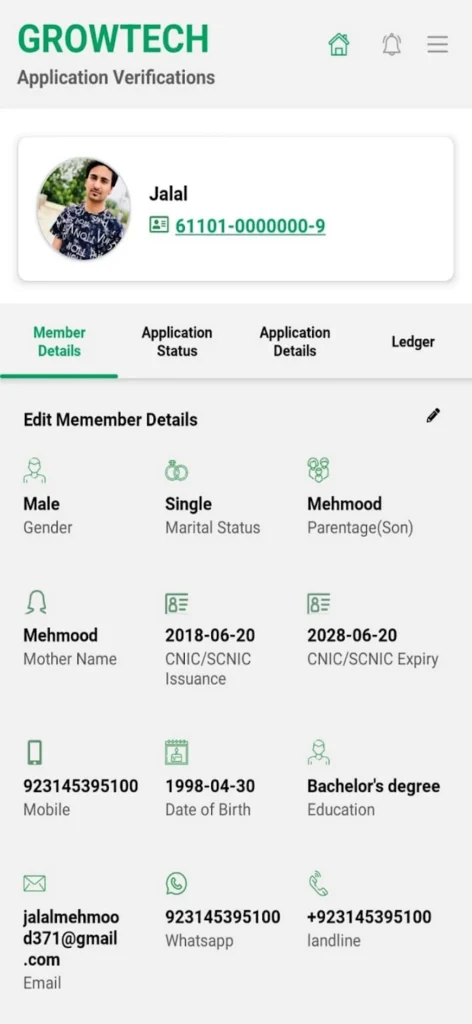

To apply for a loan, users need to meet the following requirements:

- Must be a Pakistani citizen.

- Aged between 18 and 60 years.

- Have a valid CNIC (Computerized National Identity Card).

- Provide proof of income.

How to Apply for a Loan on GrowPak e-Loan Manager

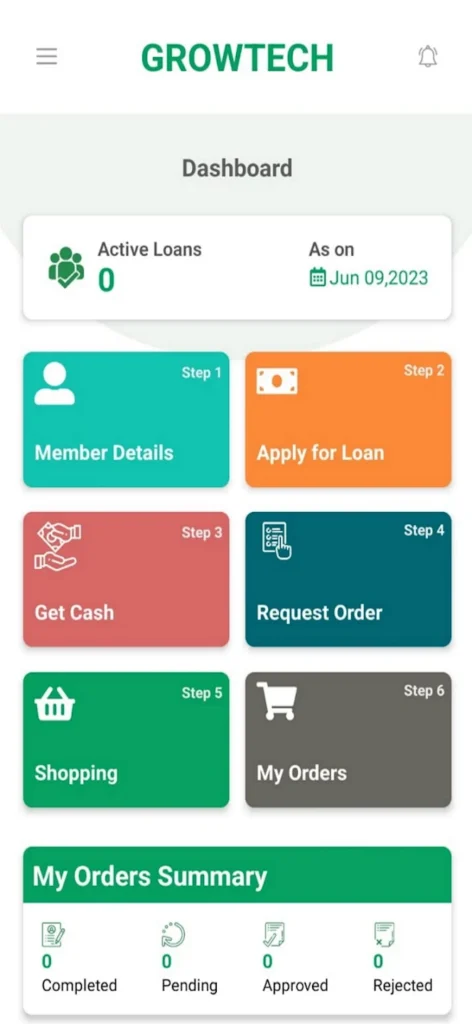

Applying for a loan is simple:

- Log in to your account.

- Choose the type of loan you want.

- Fill in the necessary details.

- Submit your application and wait for approval.

Tip: Ensure your information is accurate to increase the chances of quick approval.

Types of Loans Offered by GrowPak e-Loan Manager

Personal Loans

Ideal for covering personal expenses such as education or medical bills.

Business Loans

Designed to help small business owners expand their operations.

Emergency Loans

Quick loans for unforeseen expenses, available within hours.

Interest Rates and Repayment Plans

GrowPak offers competitive interest rates tailored to suit different financial needs. Users can select flexible repayment plans ranging from short-term to long-term, ensuring manageable payments.

Security Measures and Data Protection

Security is a top priority for GrowPak. The app uses advanced encryption to protect users’ personal and financial information, providing peace of mind for borrowers.

User Testimonials and Reviews

Many users have shared positive experiences:

- “I got my loan approved in just 10 minutes! Highly recommend GrowPak.” – Ali, Karachi

- “The app is easy to use, and the customer service is fantastic.” – Sarah, Lahore

Pros and Cons of GrowPak e-Loan Manager

Pros:

- Fast loan approval

- Multiple loan options

- Secure platform

Cons:

- Limited to Pakistani citizens

- Requires a stable internet connection

Comparison with Other Loan Apps in Pakistan

GrowPak e-Loan Manager differentiates itself by offering a wider variety of loan products and a more user-friendly experience compared to other loan apps available in Pakistan.

Future of Digital Lending in Pakistan

As digital adoption grows, apps like GrowPak are paving the way for financial inclusion, offering accessible credit to underserved segments of the population.

Conclusion

GrowPak e-Loan Manager is poised to be a leading player in the Pakistan digital lending market in 2025. Its user-friendly design, quick approvals, and robust security measures offer a reliable solution for individuals and businesses seeking financial support.

Best Online Loan App in Pakistan

Fauricash Loan App in Pakistan

PaisaYaar App Se Loan Lene Ka Tarika

FAQs about GrowPak e-Loan Manager Loan App in Pakistan

Is GrowPak e-Loan Manager safe to use?

Yes, it uses advanced encryption to protect user data.

What is the maximum loan amount I can apply for?

The maximum loan amount varies based on eligibility and credit history.

How quickly can I receive the loan?

Loans are usually disbursed within 24 hours of approval.

Does GrowPak offer loans for businesses?

Yes, business loans are available to help entrepreneurs grow their ventures.

What happens if I miss a repayment?

Late payments may incur additional charges, and it is advised to contact customer support for assistance.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com