How to apply for Faysal Bank personal loan online – As one of the best banks in Pakistan, Faysal Bank offers a variety of personal loan options to meet a wide range of financial needs. A personal loan can come in handy when you need to pay for an unexpected cost, plan a wedding, or consolidate debt. This piece will walk you through the steps of applying for a personal loan from Faysal Bank online, making sure that the process goes smoothly.

Contents

- 1 What is a Personal Loan?

- 2 Why Choose Faysal Bank for a Personal Loan?

- 3 Eligibility Criteria for Faysal Bank Personal Loan

- 4 Features and Benefits of Faysal Bank Personal Loans

- 5 Step-by-Step Guide to Apply for a Faysal Bank Personal Loan Online

- 6 Tips for a Successful Loan Application

- 7 Common Mistakes to Avoid When Applying Online

- 8 Conclusion

- 9 FAQs about Faysal Bank Personal Loan

- 9.1 How can I apply for the Faysal Islami Personal Finance?

- 9.2 How much of a limit can be assigned to me if I apply for Faysal Islami Personal Finance?

- 9.3 What profit rate option do I have on Faysal Islami Personal Finance?

- 9.4 Is there any processing fee applicable on Faysal Islami Personal Finance?

- 9.5 What is the tenure of the Faysal Islami Personal Finance?

- 9.6 How can I make the repayment of the facility?

- 9.7 Can you repay facility before the maturity?

- 9.8 Are there any early payment charges on early pay-off of Faysal Islami Personal Finance?

- 9.9 How will I know my monthly installments?

- 9.10 What will be my monthly payment due date?

- 9.11 Where can I lodge my complaint?

- 9.12 What is the maximum loan amount offered by Faysal Bank?

- 9.13 How long does it take to get loan approval?

- 9.14 Can I apply for a loan if I am self-employed?

- 9.15 Are there any prepayment penalties?

- 9.16 Is the online application process secure?

- 9.17 Related posts:

- 9.18 JazzCash Islamic Saving Account 2025 (Salaam Investment)

- 9.19 Maryam Nawaz Loan Scheme: Youth Empowerment in Pakistan

- 9.20 Top 10 Things to Know Before Submitting Your Loan Application

What is a Personal Loan?

A personal loan is an unsecured loan that banks give to people to help them meet their financial needs without needing evidence. It is a versatile money tool that can be used for many things, such as:

- Home renovations

- Medical emergencies

- Higher education

- Travel expenses

Why Choose Faysal Bank for a Personal Loan?

Faysal Bank stands out because it puts the customer first and offers a variety of loan choices. If you need a personal loan, here are some strong reasons to go with Faysal Bank:

- Competitive Interest Rates: Borrowers benefit from affordable interest rates, making repayments easier on the wallet.

- Flexible Repayment Options: You can choose from a variety of repayment plans that suit your financial situation.

- Trusted Institution: With a solid reputation in the banking industry, Faysal Bank ensures a safe and reliable borrowing experience.

Key Features

- Islamic Mode: Tawarruq

- Financing: Minimum PKR 50,000 – Maximum up to PKR 4,000,000

- Tenure: Financing tenure between 1 to 4 years

- Profit type: Fixed

- Repayments: Fixed & Equal Monthly Installment Plan

- Non Refundable Processing Fee: PKR 7,000 + FED (Fixed)

- Charity (Late Payment): PKR 500 on every missed installment

Eligibility Criteria:

- Age: Minimum 18 years and Max. 70 years (70 years at the time of maturity of financing).

- Maximum age of 70 years not applicable to Senior Citizens.

- Minimum Income Requirement:

Salaried Individual: PKR 50,000

Self Employed Individual: PKR 100,000

Eligibility Criteria for Faysal Bank Personal Loan

Basic Eligibility Requirements

To qualify for a personal loan from Faysal Bank, you must meet certain basic criteria:

- Age: Applicants should be between 18 and 70 years old.

- Employment Status: Both salaried individuals and self-employed professionals are eligible.

- Minimum Income: The bank requires a specific minimum monthly income, depending on your employment type.

Documentation Requirements

Having the right documents ready can speed up your loan application process. Key documents include:

- A copy of your CNIC (Computerized National Identity Card)

- Latest salary slips or income proof

- Bank account statements from the past six months

Features and Benefits of Faysal Bank Personal Loans

Loan Amount and Tenure

Faysal Bank gives consumers a lot of options for loan amounts and payback terms that last up to five years. This gives consumers the freedom they need.

Quick Disbursement Process

Once you are accepted, the money is sent to your account right away, so you can meet your financial obligations right away.

No Collateral Required

Personal loans from Faysal Bank are unsecured, which means you do not have to put up any collateral.

Flexible Repayment Plans

It is simple to handle loans when consumers can choose payment plans that work with their income and cash flow.

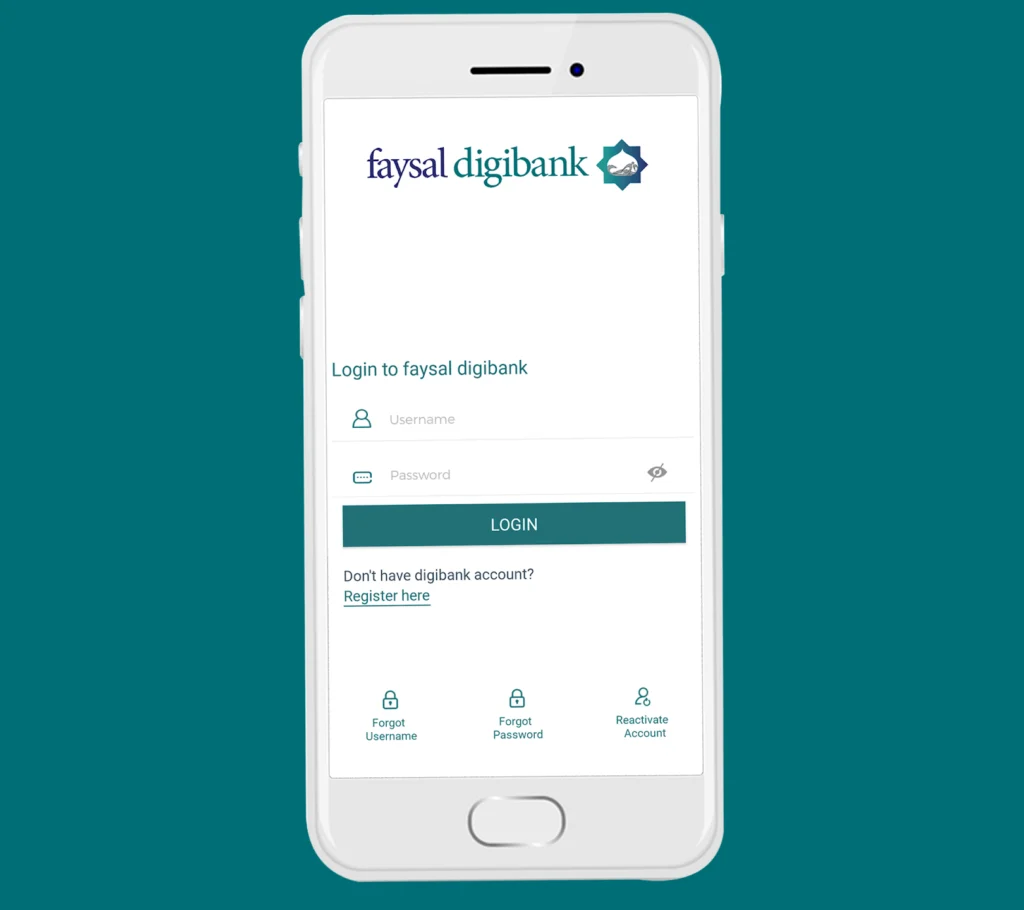

Step-by-Step Guide to Apply for a Faysal Bank Personal Loan Online

Step 1: Visit the Official Website

Go to the official Faysal Bank website. Ensure you are on the genuine site to avoid scams.

Under the loans section, click on “Personal Loans” to access detailed information about the product.

Step 3: Fill Out the Online Application Form

Complete the application form with your personal and financial details. Double-check for accuracy to avoid delays.

Step 4: Upload Required Documents

Upload scanned copies of the required documents, such as your CNIC and proof of income.

Step 5: Submit the Application

Review your application one last time and hit the “Submit” button.

Step 6: Wait for Approval

The bank will review your application, and upon approval, you will receive the funds in your account.

Tips for a Successful Loan Application

Maintain a Good Credit Score

A high credit score increases your chances of approval and may even help you secure a lower interest rate.

Provide Accurate Information

Ensure that all details you provide are correct and up to date to avoid complications.

Ensure All Documents are Complete

Incomplete documentation is one of the main reasons for application rejection. Check everything carefully before submission.

Common Mistakes to Avoid When Applying Online

Incomplete Forms

Leaving sections of the application form incomplete can lead to delays or rejection.

Ignoring Terms and Conditions

Always read the terms and conditions carefully to understand your obligations and rights.

Providing Incorrect Information

Falsifying information can not only lead to rejection but may also harm your credibility.

How to avail of this facility:

To apply, please visit our branches or call the Contact Center at 021 111 06 06 06 or SMS “IPF” space “City Name” space “CNIC” at 9181

Conclusion

It is easy to apply for a Faysal Bank personal loan online, and the loan can help you meet your financial goals. The application process will go more smoothly if you follow the steps in this piece and do not make the common mistakes. Before you sign anything, read all the terms and conditions and keep all your paperwork in order.

FAQs about Faysal Bank Personal Loan

How can I apply for the Faysal Islami Personal Finance?

To apply, please visit our branches or call Contact Center at 021 111 06 06 06 or SMS “IPF” space “City Name” space “CNIC” at 9181

Or you can visit our website https://www.faysalbank.com/en/islamic/.

How much of a limit can be assigned to me if I apply for Faysal Islami Personal Finance?

You can avail a facility amount from a minimum Rs. 50,000/- to Rs. 4,000,000 (Up to Rs. 4 Million subject to income and DBR).

What profit rate option do I have on Faysal Islami Personal Finance?

You can avail of only fixed profit rate option. Installment amount will remain the same during the entire facility tenor.

Is there any processing fee applicable on Faysal Islami Personal Finance?

Processing Fee of Rs. 7,000/- + FED is applicable.

What is the tenure of the Faysal Islami Personal Finance?

Minimum 12 months to Maximum 48 months

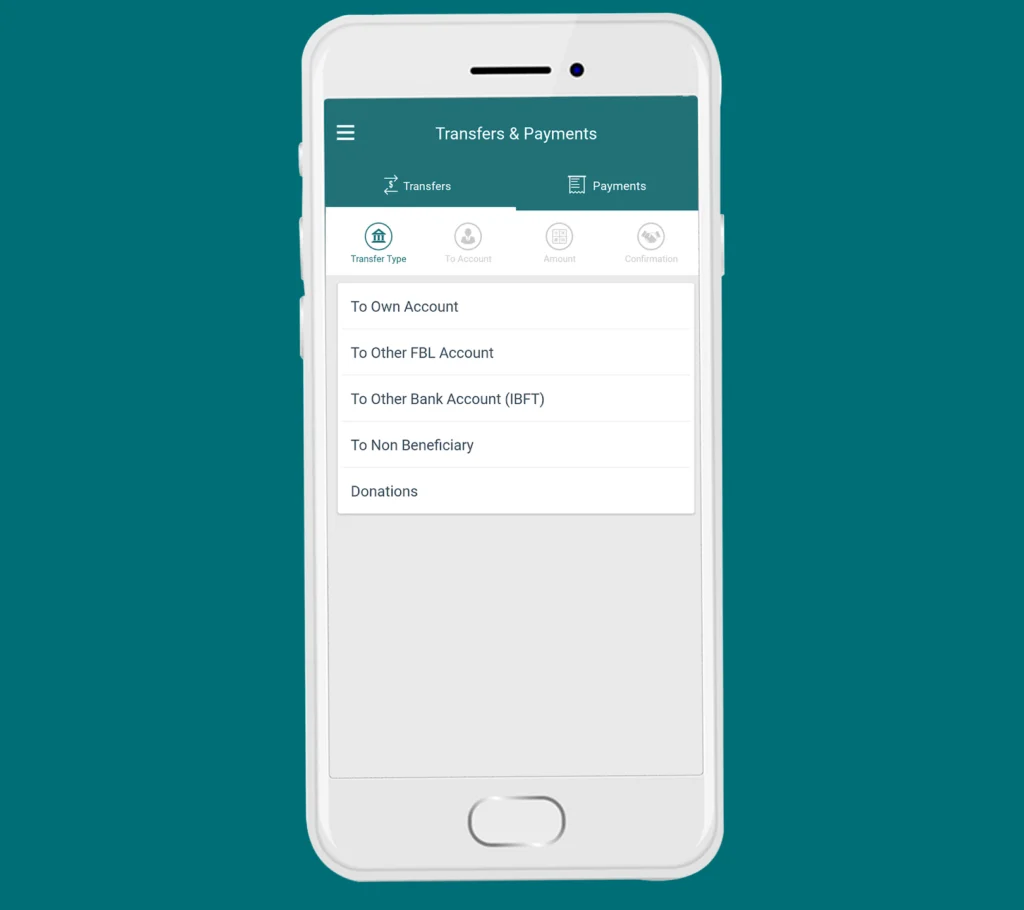

How can I make the repayment of the facility?

Following options are available for the repayment of the facility;

- You can deposit funds into the designated linked account

- Make over-the-counter payment by walking in the Branch

- Dropping a cheque in Drop Box

- Via Funds transfer if you have an account in FBL

- You can repay the installment via Faysal Digibank app or via Internet banking

Can you repay facility before the maturity?

You can repay the outstanding facility amount (i.e. remaining Principle & Profit amount) before maturity by depositing funds into your specified repayment account along with a facility closure request and handing it over to our Asset Help Desk Officer in designated branches or by calling our Contact Center at 021 111 06 06 06 for further assistance.

Failure to submit the facility closure request, funds will remain in the account and will not be used to close/ settle the account.

Are there any early payment charges on early pay-off of Faysal Islami Personal Finance?

No early settlement charges are applicable. However, you will have to pay the entire outstanding (Principal + Profit) amount for early settlement. Also, no waiver of profit will be granted

How will I know my monthly installments?

You will receive the Repayment Schedule in a Welcome Pack after the disbursal of the facility.

What will be my monthly payment due date?

There are two options for the monthly installment payments i.e. 1st or 15th of the month. You can select one of these options in the application form.

Where can I lodge my complaint?

You can avail one of the following options to lodge your complaint:

- Visit the branch and submit a written complaint

- Use the complaint box placed in the branches

- Call at our contact center at 021 111 06 06 06

- Send an email to customercomplaint@faysalbank.com

What is the maximum loan amount offered by Faysal Bank?

Faysal Bank offers personal loans up to PKR 2,000,000, depending on your eligibility.

How long does it take to get loan approval?

Loan approval typically takes a few working days, provided all documentation is complete.

Can I apply for a loan if I am self-employed?

Yes, self-employed individuals can apply, provided they meet the income criteria.

Are there any prepayment penalties?

Faysal Bank allows early repayments, but specific terms and conditions may apply.

Is the online application process secure?

Yes, Faysal Bank ensures a secure online application process to protect your personal and financial information.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com