Contents

- 1 EasyPaisa Loan App – How to Get Loan from EasyPaisa App

- 2 EasyPaisa Loan App

- 2.1 What is EasyPaisa Loan App?

- 2.2 Key Features of EasyPaisa Loan App

- 2.3 Eligibility Criteria for EasyPaisa Loans

- 2.4 Types of Loans Available on EasyPaisa App

- 2.5 How to Download and Register on the EasyPaisa App

- 2.6 How to Apply for a Loan on EasyPaisa

- 2.7 Loan Approval Process and Timeframe

- 2.8 Repayment Methods and Options

- 2.9 Benefits of Using EasyPaisa Loan App

- 2.10 Potential Downsides of EasyPaisa Loan App

- 2.11 Tips for First-Time EasyPaisa Loan Users

- 2.12 Conclusion

- 2.13 FAQs about EasyPaisa Loan App

- 2.13.1 Is EasyPaisa Loan App safe to use?

- 2.13.2 Can I apply for a second loan if the first is unpaid?

- 2.13.3 How long does it take to receive loan funds?

- 2.13.4 Are there any hidden fees with EasyPaisa loans?

- 2.13.5 Can I repay my loan early to save on interest?

- 2.13.6 Related posts:

- 2.13.7 How to Get Interest-Free Loan from CashBazar Loan App in 2025

- 2.13.8 Alkhidmat Foundation Loan App 2025

- 2.13.9 Agahe Pakistan Loan App 2025

EasyPaisa Loan App – How to Get Loan from EasyPaisa App

Telenor Pakistan and Telenor Microfinance Bank’s EasyPaisa Loan Service is the best digital loan service for Pakistan’s thousands of unbanked citizens.

As long as you have an Easypaisa mobile account, you may get up to a $10,000 personal loan. Easypaisa loans are available for personal and corporate use without the need for complex paperwork or a guarantee.

Telenor Micro Finance Bank’s first online loan service has been launched by Telenor Micro Finance Bank. Users of Easypaisa and Telenor can now apply for quick loans instantly, right from their mobile phones.

Job Alerts: Join WhatsApp Group

Subscribe: YouTube Channel

Also Check: Zeta Loan Mobile App

Also Check: Zaroorat Cash Loan App

Also Check: Top 10 Loan Apps in Pakistan

Also Check: Sweet Loan Cash

Also Check: Jazz Cash Personal Loan Online Apply

Also Check: PK Loan Personal Online Loan

Also Check: Barwaqt Emergency App Loan

Customers using Telenor SIM cards can get an Easypaisa loan at this time. Your Easypaisa account decides both the loan amount and your eligibility.

However, the Easypaisa App offers a maximum loan sum of Rs. 10,000 and a minimum loan amount of Rs. 850. A late fee of 5% will be applied to any payment that is not received by the due date.

EasyPaisa Loan Service

EasyPaisa Loan Service will allow its subscribers to receive a short-term loan for seven, fourteen, and thirty days, respectively. The user’s EasyPaisa account will be credited with the loan amount.

Telenor Pakistan and Tameer Microfinance Bank’s Easy Paisa program are helping thousands of unbanked Pakistanis achieve financial inclusion. Digital Loans Are Now Available Through EasyPaisa.

Easypaisa Loan Code

For the first time, Telenor Micro Finance Bank has created a digital loan service. Users of Easypaisa and Telenor can now get quick loans online with their mobile phones.

A partnership between Telenor Pakistan and Tameer Microfinance Bank in Pakistan, EasyPaisa, is helping millions of individuals in the country who do not have bank accounts to get their finances in order. There is now a new digital loan option from EasyPaisa!

Simply dial the Easypaisa Loan Code *786*7# to apply for Telenor Microfinance’s loan of up to 10,000.

Easypaisa Loan Code *786*7#

Easypaisa Loan Details

For the time being, only Telenor customers can apply for an Easypaisa loan. The loan amount and eligibility are based on the balance in your Easypaisa account. There is only an Rs. 850 minimum loan amount that can be taken out via the Easypaisa App, while the highest amount that can be taken is Rs. 10,000. A 5% late fee will be applied if a person fails to pay on time.

Easypaisa Loan Charges

Interest rates for Easypaisa loans depend on the loan period and account type. The fees for an Easypaisa loan are as follows:

For the next seven days, 10 to 25%

For the next seven days, 12 to 35%

The loan amount plus the service charge will be taken from the account on the due date.

EasyPaisa Loan App

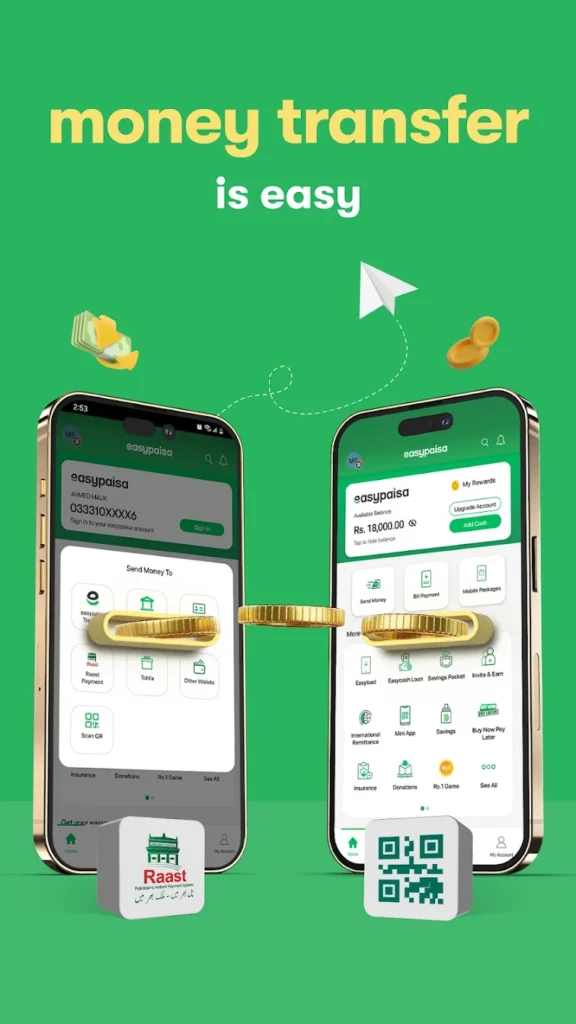

In recent years, getting quick loans has become simpler thanks to advancements in mobile finance solutions. One app that is revolutionizing how people in Pakistan access funds is the EasyPaisa Loan App. With a user-friendly interface and speedy loan approval processes, it has rapidly become a go-to for anyone in need of a quick financial boost.

What is EasyPaisa Loan App?

The EasyPaisa Loan App is part of the popular EasyPaisa mobile wallet platform, providing short-term loans directly through a smartphone app. It is designed to offer users an easy and efficient way to apply for and receive personal or business loans.

Key Features of EasyPaisa Loan App

- User-Friendly Interface: The app is designed to be easy to navigate, allowing users to apply for loans with minimal hassle.

- Quick Loan Processing: Loans are typically processed within hours, allowing users to access funds promptly.

- Flexible Repayment Options: EasyPaisa offers different repayment schedules to meet the needs of various users.

Eligibility Criteria for EasyPaisa Loans

To be eligible for a loan through EasyPaisa, users must meet a few basic requirements:

- Age Requirement: Users must be at least 18 years old.

- Income Requirement: Proof of a regular income source is required to demonstrate the ability to repay.

Types of Loans Available on EasyPaisa App

EasyPaisa offers a few different loan types to cater to varying needs:

- Personal Loans: Ideal for personal expenses or emergencies.

- Business Loans: Specifically tailored for small business owners.

- Emergency Loans: Quick access for urgent financial needs.

How to Download and Register on the EasyPaisa App

- Download the App: Head to Google Play or Apple App Store and download EasyPaisa.

- Register Your Account: Complete the registration process by entering your personal information and verifying your mobile number.

How to Apply for a Loan on EasyPaisa

- Log into Your Account: Open the app and navigate to the loan section.

- Choose Loan Type: Select the loan type based on your needs.

- Enter Loan Details: Fill in the amount and duration.

- Submit Application: Review your details and submit the application for approval.

Loan Approval Process and Timeframe

EasyPaisa typically approves loans within hours, provided all required information is correct. Factors such as loan amount and user profile may influence the approval timeframe.

Repayment Methods and Options

EasyPaisa offers multiple repayment methods, including direct bank transfers and in-app payments. You can also set up monthly installment options to simplify the repayment process.

Benefits of Using EasyPaisa Loan App

- Quick Access to Funds: Users can access funds in as little as a few hours.

- No Need for Physical Visits: Apply and receive funds without leaving home.

Potential Downsides of EasyPaisa Loan App

While EasyPaisa is convenient, it does have some limitations:

- Interest Rates: Interest rates on loans can be higher than traditional banks.

- Loan Amount Limitations: Some users may find the maximum loan amount insufficient for larger expenses.

Tips for First-Time EasyPaisa Loan Users

- Meet Eligibility Criteria: Ensure that all eligibility requirements are met before applying.

- Use Loans Responsibly: Only borrow what you need and plan repayments carefully.

Conclusion

The EasyPaisa Loan App makes quick, accessible loans possible for many Pakistanis. With its convenient application process and rapid approval, it is a great choice for short-term financial needs. While the app has some limitations, such as interest rates, it remains a solid option for those needing a quick financial boost.

FAQs about EasyPaisa Loan App

Is EasyPaisa Loan App safe to use?

Yes, EasyPaisa follows secure encryption standards to protect user data.

Can I apply for a second loan if the first is unpaid?

No, you must repay your first loan before applying for another.

How long does it take to receive loan funds?

Loan funds are usually transferred within hours of approval.

All fees are disclosed upfront; be sure to review terms before accepting.

Can I repay my loan early to save on interest?

Yes, EasyPaisa allows early repayment without penalty fees.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com