Contents

- 0.1 Introduction

- 0.2 What is the DOST App?

- 0.3 Features of the DOST App

- 0.4 How to Get Started with the DOST App

- 0.5 Security Features of the DOST App

- 0.6 Advantages of Using the DOST App

- 0.7 DOST App for Entrepreneurs and SMEs

- 0.8 How the DOST App Supports Financial Inclusion

- 0.9 Comparing the DOST App with Other Banking Apps in Pakistan

- 0.10 User Reviews and Feedback

- 0.11 The Role of Mobilink Microfinance Bank in Pakistan Economy

- 0.12 Challenges Faced by the DOST App

- 0.13 Future Enhancements and Updates for the DOST App

- 0.14 Impact of the DOST App on Digital Banking in Pakistan

- 1 DOST – Powered by MMBL

- 1.1 Conclusion

- 1.2 FAQs about DOST App

- 1.2.1 Is the DOST App free to use?

- 1.2.2 Can I use the DOST App without internet access?

- 1.2.3 How secure is the DOST App?

- 1.2.4 Can I apply for a loan through the DOST App?

- 1.2.5 What sets the DOST App apart from other apps?

- 1.2.6 Related posts:

- 1.2.7 QarzMitra Loan App

- 1.2.8 How to Get Interest-Free Loan from CashBazar Loan App in 2025

- 1.2.9 JazzCash Islamic Saving Account 2025 (Salaam Investment)

Introduction

DOST App: Pakistan banking system is changing because of digital banking, and Mobilink Microfinance Bank is at the front of this change. With the DOST App, the bank hopes to give millions of people across the country easy, convenient, and new ways to handle their money. What is so great about the DOST App, though? Let us get started.

What is the DOST App?

DOST App, Mobilink Microfinance Bank made it easier for its customers to do their business on their phones. Its main goal is to provide safe and effective financial services so that citizens from all walks of life can use current banking tools.

Features of the DOST App

User-Friendly Interface

The app’s intuitive design ensures that even first-time users can navigate it effortlessly.

Account Management

Monitor your balances, transaction history, and account activities in real time.

Instant Fund Transfers

Send money to any bank account in Pakistan with just a few taps.

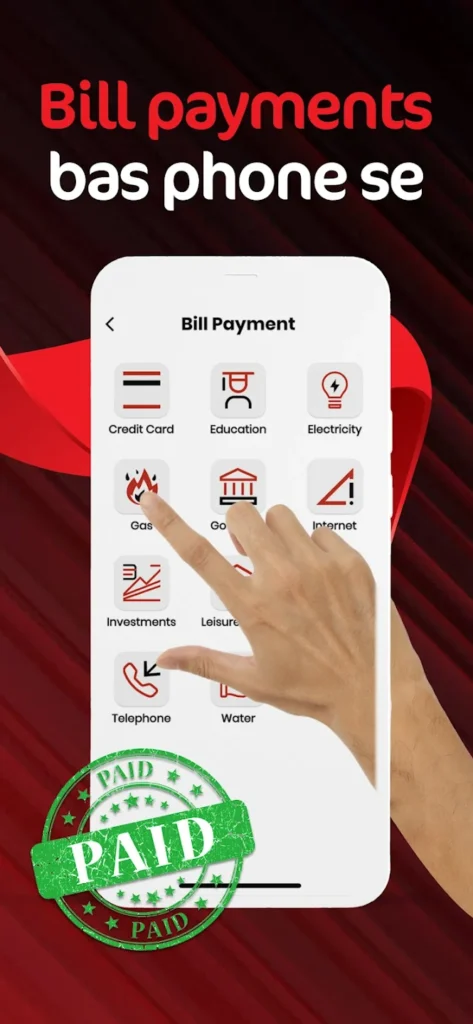

Bill Payments and Mobile Top-Ups

Pay utility bills and recharge mobile credits without visiting a bank or service center.

Loan Application and Management

Apply for micro-loans directly through the app and track repayments with ease.

How to Get Started with the DOST App

Steps to Download and Register

- Visit the Google Play Store or Apple App Store.

- Search for the DOST App and download it.

- Open the app and complete the registration process.

Account Creation Process

- Provide your CNIC and mobile number.

- Verify your identity through OTP.

- Set up your security credentials.

Security Features of the DOST App

Advanced Encryption

Your data is encrypted to prevent unauthorized access.

Biometric Login Options

Log in using your fingerprint or facial recognition for added security.

Real-Time Fraud Alerts

Receive instant notifications about suspicious activities.

Advantages of Using the DOST App

Accessibility and Convenience

Access banking services anytime, anywhere, eliminating the need for physical visits.

Cost-Effectiveness

Save on transaction fees and travel costs.

Financial Inclusivity

Empowers users in remote areas by providing financial services at their fingertips.

DOST App for Entrepreneurs and SMEs

The DOST App is a huge deal for small businesses. It makes deals easier and gives people access to microloans, which lets business owners grow their companies without any problems.

How the DOST App Supports Financial Inclusion

The app encourages people who do not have bank accounts to save money and learn about money, which is important for long-term economic growth.

Comparing the DOST App with Other Banking Apps in Pakistan

The DOST App is a leader in its field because it focuses on financial inclusion and microfinance solutions more than any of its rivals.

User Reviews and Feedback

Users like how easy it is to use and how many features it has. Some people have said that making people more dependent on the Internet would make things work better in rural places.

The Role of Mobilink Microfinance Bank in Pakistan Economy

Mobilink Microfinance Bank is a key player in supporting digital banking and improving the financial health of people in both cities and rural areas.

Challenges Faced by the DOST App

The app has problems, like not having enough internet connection in some areas and the need to teach users how to use it properly.

Future Enhancements and Updates for the DOST App

Mobilink wants to improve the user experience and security by using AI-driven data and blockchain technology.

Impact of the DOST App on Digital Banking in Pakistan

With the DOST App, Pakistan digital banking is taking the next big step toward a cashless economy.

DOST – Powered by MMBL

About this app

Introducing the Enhanced DOST App – Powered by Mobilink Microfinance Bank Limited (MMBL), Pakistan’s largest digital bank, designed to offer convenient, secure, and accessible online banking services to MMBL account holders nationwide. 🏦

At MMBL, we are committed to staying at the forefront of providing inclusive financial services to our valued customers.

Now, effortlessly send up to PKR 1,500,000 per day from anywhere, at any time 💵💵. Watch your savings grow with yearly profits at the market’s best rates 🤑. Apply for loans right from the comfort of your home, pay your bills with ease 💸, and top up your mobile phone in seconds 📱. For our female customers, female-centric app layout is available 💁🏻♀️, and Gold Loan customers can quickly renew their loans with ease 💯. Experience hassle-free banking and save valuable time with the New DOST app.

MMBL customers can access a wide range of functions offered by the new DOST app 24/7. 🔂🔄

Access to all of your account information is available in real-time. Key elements include:

* New and Improved UI with New Logo (New Feature) 📲

* Account title fetched (New Feature)

* Guest mode for Non-Account Holders

* Account maintenance certificate

* Statement downloads with date range selection (New Feature)

* Withholding tax certificate & Bank statement download up to 2 years

* In App Biometric verification

* Face ID

* Customized Women Centric theme (New Feature) 🙋🏻♀️

* Repay and Repurchase Gold based loans from Dost app, without branch visit.

* Open a New Account ✅

* Login (with Existing Account)

* Signup (with Existing Account)

* Account Summary ✅

* Customer Profile Management

* Branch & ATM Locator 🏧

*Contact us via email, WhatsApp or phone number 📧 📞

* Money Transfer to MMBL 💸

* Money Transfer Other Bank Accounts 💸 💸

* Loan Application 💵 💵

* Fori cash, Fori cash Plus, just click on Loans section

* Earn from Investment in Term Deposits (TDR) 💵 💸

* Earn Profit UI Changed-TDR (New Feature)

* Available in English & Urdu language

* View MMBL loan products on login screen under product tab

* Utility Bill Payment 🧾

* Mobile Top-up 📲

* Favorites Management

* Request for Instrument

* Block Cheque 🚫

* Loan Summary

* Debit Card Management 💳

* PIN Changing

* Temporary Card Blocking 🚫

* Card Unblocking

* Permanent Card Blocking 🚫

* Complaint Registration

* Password Changing/Reset

With the enhanced UI design, MMBL customers can access a wide array of digital banking services and perform various transactions with ease using the New DOST App. Manage money transfers, bill payments, mobile top-ups, loan details, e-statements, check and debit card management, and much more, all with just a few clicks. 💸 📲

The New DOST App provides access to over a hundred billers, including utility providers, telecom companies, government institutions, the Securities and Exchange Commission of Pakistan (SECP), airlines, internet service providers (ISPs), educational institutions, and more.

In addition, the New DOST app provides 24/7 continuous and quick access to the MMBL Customer Support Team via instant WhatsApp Chat, email and Contact number which can be accessed from the homepage of the app.

DOST-Aapka Mukammal Digital Bank empowers you with the convenience of digital banking wherever you are, as soon as you download the app. 🏦

For Internet banking, you can also use the same set of features by going to dost.mobilinkbank.com from your browser.

To learn more about our products and services and have an effortless digital banking experience, visit www.mobilinkbank.com or connect with us on

Facebook: https://web.facebook.com/MobilinkMicrofinanceBankLimited

Twitter: https://twitter.com/mobilinkbank

LinkedIn: https://www.linkedin.com/company/mobilink-microfinance-bank-ltd

YouTube Channel: https://www.youtube.com/@mobilinkmicrofinancebank2901

Tiktok Channel: https://www.tiktok.com/@mobilinkbank2

Conclusion

The DOST App by Mobilink Microfinance Bank is more than just a banking app; it is a way for millions of people to get access to and control over their money. The app is very useful and convenient for everyone, whether you are a person or a small business owner.

FAQs about DOST App

Is the DOST App free to use?

Yes, downloading and using the app is free. However, there may be small fees for certain services.

Can I use the DOST App without internet access?

To use most of the tools, you need to be connected to the internet. For future updates, offline alternatives are being thought about.

How secure is the DOST App?

The app uses advanced encryption and biometric security to ensure your data is safe.

Can I apply for a loan through the DOST App?

Yes, the app allows users to apply for micro-loans and manage repayments.

What sets the DOST App apart from other apps?

It is different from other digital banks in Pakistan because it focuses on lending solutions, financial inclusion, and user-friendly features.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com