Bank Islami Loan | Naya Pakistan Housing Scheme Loan | Bank Islami Car Loan | Bank Islami

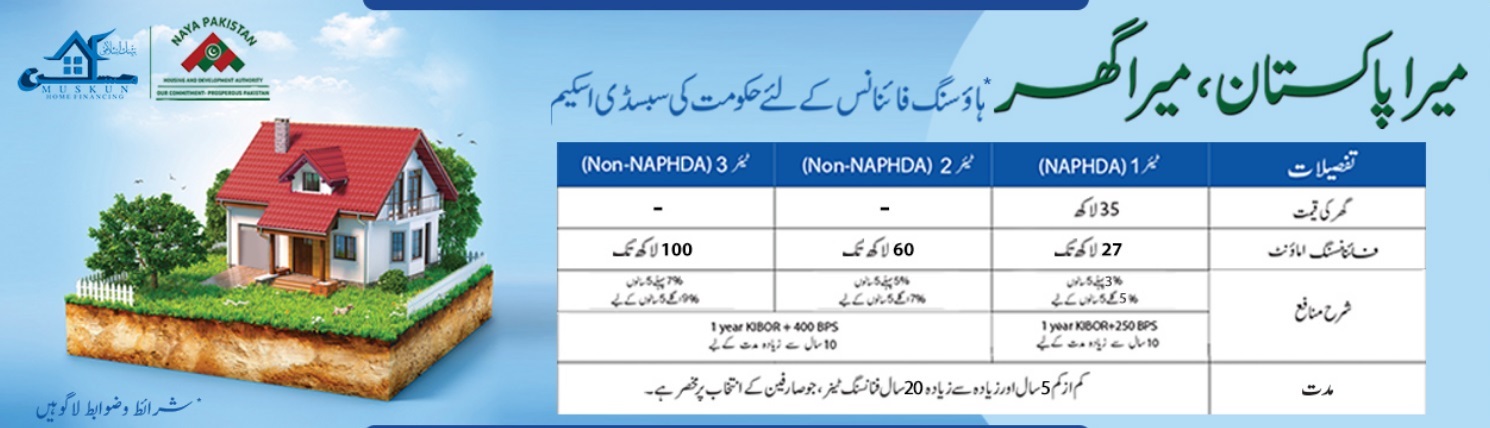

House Value Tier Wise:

Maximum Price of Housing Units

Maximum Price (Market Value) of a single housing unit at the time of approval of financing, as under

Tier 1 (TI) – Rs. 3.5 Million

Tier 2 (TII) – No Cap

Tier 3 (TIII) – No Cap

Financing Amount Tier Wise:

Maximum Financing Size

Maximum size of the financing of a single housing unit, as under

Tier 1 (TI) – No Minimum Requirement to Maximum PKR 2.7 million

Tier 2 (TII) – No Minimum Requirement to Maximum Rs. 6.0 Million

Tier 3 (TIII) – No Minimum Requirement to Maximum Rs. 10.0 Million

Subsidized Profit Rate Tier Wise:

Tiers

Customer Pricing

Tier 1 (TI)

3% for first 05 years & 5% for next 05 years

Tier 2 (TII)

5% for first 05 years & 7% for next 05 years

Tier 3 (TIII)

7% for first 05 years & 9% for next 05 years

For financing exceeding 10 years, the Bank pricing will be applicable for the period exceeding 10 years.

Tenure Tier Wise:

Tenure for all the tiers

Minimum 5 years and maximum 20 years financing tenure, depending upon choice of customer.

Bank Islami Car Loan

BankIslami’s Islami Auto Finance offers you the Convenience to get the car of your choice, the Shariah Compliant way.

Special Offer – For all new locally assembled & noncommercial vehicles

Vehicles For Residual Value Ijarah: Suzuki, Toyota & Honda

Period of facility 1, 2, 3, 4, 5, 6 & 7 years

Advance Rent /Security deposit Minimum 15% of the cost of the vehicle

Required Documents

Application form duly filled and signed by the applicant

Copy of recent pay slip/certificate showing – For Salaried individuals.

Business Proof – such as bank certificate confirming proprietorship, NTN, business Association letter or tax return etc. is required – For businessman.

Copy of last six months bank statements

One recent photograph.

Specimen Signature card preferably on bank’s prescribed format

Citizenship Pakistani

Income Minimum Rs. 40,000 to 50,000 (Net Disposable)

Age Limit For Salaried:

Minimum 21 Year (At the time of Booking/ Financing)

Maximum 60 Years (at the time of Maturity)

For Businessmen/ Self Employed Professionals (SEP’s)

Minimum 21 Years (At the time of Booking/ Financing)

Maximum 65 Years (At the time of Maturity)

Bank Islami Loan | Naya Pakistan Housing Scheme Loan | Bank Islami Car Loan | Bank Islami

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com