Al Baraka Bank Personal Loan Online Apply – Al Baraka Bank Loan Mera Pakistan Mera Ghar

Al Baraka Bank along with the Government of Pakistan and with the support of the State Bank of Pakistan offers an affordable and flexible Housing Finance Scheme. With the help of this scheme, you can turn your dream of owning a home into a reality and secure your future.

Avail this facility through our Conventional and Islamic Banking branches.

A Key to your comfort Al Baraka Bank (Pakistan) limited offers the home finance facility for low cost housing program, “Mera Pakistan Mera Ghar“, under the guidance of State Bank of Pakistan & with the support from Government of Pakistan, through a Shariah-compliant home financing scheme, with attractive features.

Eligibility Criteria:

Product Category

a)- Purchase of a complete residential property (Apartment /flat/ House) b)- Construction c)- Purchase of plot/Land Plus Construction thereon

Segment

a)- Salaried b)- Self Employed Businessman c)- Self Employed Professional

Eligibility Criteria

a)- All Men/women holding valid CNIC b)- One individual can have subsidized house loan facility under this scheme only once c)- First time Home Owner d)- First transaction on the property/Asset

Al Baraka Al Bait Home Finance Offers

At Baraka Al Bait Home Finance, is the solution to your home financing needs. You can own your dream home, renovate and even construct one. Our Shariah compliant Al Baraka At Bait Home Finance provides you the following options: 1. Purchase of House – Outright Purchase 2. Land + Construction 3. Construction 4. Home Improvement/ Renovation 5. Asset Transfer Facility

Key Features

- Shariah Compliant

- Minimum Financing amount – Rs. 0.3 million

- Maximum Financing-up to Rs. 35 million

- Financing up to 80% of property value

- Minimum Monthly Net take home Rs 50,000/- (for salaried)

- Minimum Monthly Net take home Rs 80,000/- (for SEP/SEB)

- Quick processing time

- Affordable monthly payment

- Term Rescheduling Option

- Early & Partial settlement options as per the applicable terms

How to apply:

This facility can be availed through selected branches in selected cities. For more information, call our 24/7 helpline 021-111-113-442.

To visit SBP Service Desk Portal

You may also call 24/7 joint call center for all your queries related to process and financing – 033-77-786-786

FAQs

For further details you may please contact us at 111-113-442 or visit www.albaraka.com.pk

Mera Pakistan Mera Ghar: Click Here

Home Loan: Click Here

FAQs about Al Baraka Bank Personal Loan Online Apply & Mera Pakistan Mera Ghar Loan

What is Al Baraka Bank’s Personal Loan?

Al Baraka Bank offers a Shariah-compliant personal financing solution that can be used for a variety of personal needs, such as education, healthcare, travel, or home renovation.

How can I apply for Al Baraka Bank’s Personal Loan online?

You can apply for Al Baraka Bank’s personal loan by visiting the official website and filling out the online application form. Alternatively, you can visit a nearby branch for assistance with the application process.

What are the eligibility criteria for applying online?

Applicants must be Pakistani residents, between the ages of 21 and 60 (for salaried individuals) or 65 (for self-employed individuals), with a stable income source and the required documentation.

What documents are required to apply for the personal loan online?

Required documents include a completed application form, CNIC copy, proof of income (salary slips for salaried individuals or business financials for self-employed), and bank statements. Additional documents may be requested based on your profile.

What is the maximum amount I can borrow with Al Baraka’s Personal Loan?

The loan amount varies depending on your income and eligibility. Generally, Al Baraka Bank offers personal loans of up to PKR 2 million.

What is the repayment tenure for the personal loan?

The repayment tenure ranges from 1 to 5 years, depending on the loan amount and your preference.

Is Al Baraka Bank’s Personal Loan interest-free?

Yes, since Al Baraka Bank operates under Islamic banking principles, the loan is interest-free. Instead, it uses a profit-sharing or rental-based model in accordance with Shariah guidelines.

How long does it take to process an online personal loan application?

After submitting all required documents, it typically takes around 5 to 7 working days for loan processing and approval.

Can I prepay the loan before the tenure ends?

Yes, you can make early or partial payments before the loan tenure ends, though some conditions may apply. It’s best to consult with the bank for details regarding prepayment terms.

How do I check the status of my online loan application?

You can track your loan application status by contacting Al Baraka Bank’s customer service or visiting the branch where you applied. Online updates may also be available on the bank’s website.

Al Baraka Bank Mera Pakistan Mera Ghar Loan – FAQs

What is the Mera Pakistan Mera Ghar (MPMG) Loan offered by Al Baraka Bank?

Mera Pakistan Mera Ghar is a government-backed housing finance scheme that allows eligible individuals to purchase, construct, or renovate a home at subsidized rates, offered through participating banks like Al Baraka.

Who is eligible for the Mera Pakistan Mera Ghar Loan?

Pakistani citizens with no prior ownership of a house are eligible. Both salaried individuals and self-employed professionals can apply, provided they meet the income and eligibility requirements.

What types of housing can be financed under the Mera Pakistan Mera Ghar Loan?

The loan can be used for purchasing a new or existing house, constructing a house on your own land, or renovating an existing house.

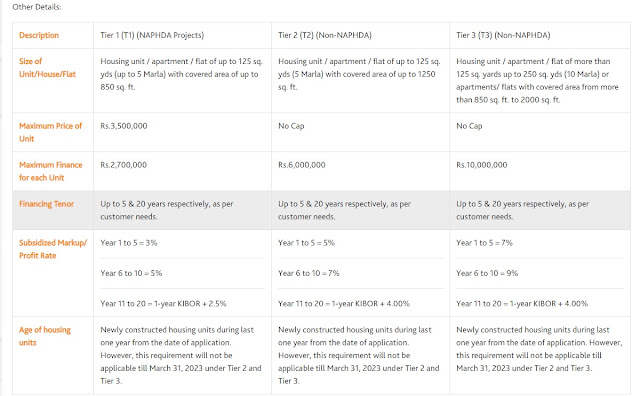

What is the maximum loan amount for Mera Pakistan Mera Ghar?

The loan amount varies depending on the type of housing. The maximum loan limit for Mera Pakistan Mera Ghar is up to PKR 10 million, depending on the customer’s financial profile and the property’s location.

What is the repayment tenure for the Mera Pakistan Mera Ghar Loan?

The repayment tenure can be up to 20 years, providing long-term, affordable financing for home ownership.

What are the profit rates for the Mera Pakistan Mera Ghar Loan?

The profit rate is subsidized by the government to make home financing more affordable. For the first 5 years, the rate is as low as 5%, and for the next 5 years, it increases to 7%. After 10 years, the market-based rate will apply, but it remains capped.

What documents are required to apply for the Mera Pakistan Mera Ghar Loan?

Documents include CNIC, proof of income, employment or business details, bank statements, property documents, and any other information requested by Al Baraka Bank for processing the loan application.

Can I apply for the Mera Pakistan Mera Ghar Loan online?

While the loan application process begins online with basic information, you may need to visit the nearest branch to complete the paperwork and submit required documents for final approval.

How long does it take to process the Mera Pakistan Mera Ghar Loan?

The processing time depends on the complexity of the case but generally takes around 2 to 4 weeks after submission of all necessary documents.

Is there an option for early repayment of the Mera Pakistan Mera Ghar Loan?

Yes, early repayment is allowed. However, the terms for prepayment may vary, so it’s advisable to discuss this with Al Baraka Bank when applying for the loan.

What are the government incentives for this loan?

The government provides subsidies on profit rates, making the loan more affordable for first-time homebuyers. It also offers additional incentives to encourage home ownership among low and middle-income groups.

Can non-resident Pakistanis (NRPs) apply for the Mera Pakistan Mera Ghar Loan?

Yes, non-resident Pakistanis are also eligible for this loan, subject to additional documentation, such as proof of overseas employment or income.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com