In a world where access to financial resources often determines one’s ability to thrive, the Akhuwat Foundation stands out as a beacon of hope. Established in 2001, Akhuwat is a non-profit organization in Pakistan that provides interest-free microfinance to underserved communities. By 2025, the Akhuwat Loan Scheme aims to expand its reach, empowering even more individuals and families to break the cycle of poverty and achieve financial independence.

BankIslami Loan Online Apply in Pakistan

Contents

- 1 What is the Akhuwat Loan Scheme?

- 2 Eligibility Criteria for Loans

- 3 How to Apply for the Akhuwat Loan Scheme 2025?

- 4 Following Documents Shall be Submitted Along With Loan Application:

- 5 Social Appraisal

- 6 Business Appraisal

- 7 Second Appraisal:

- 8 Guarantors of Loans

- 9 Loan Approval Committee (LAC)

- 10 Fund Request & to head office

- 11 Loan Disbursement

- 12 Social Guidance

- 13 Recovery & Follow up

- 14 Summary of Loan process

- 15 Akhuwat All Branches List

- 16 Akhuwat Contact us

- 17 Conclusion

- 18 FAQs about Akhuwat Loan

- 18.1 Is Akhuwat Loan interest-free?

- 18.2 How long does it take to get loan approval?

- 18.3 What is the maximum loan amount?

- 18.4 Can I apply online for an Akhuwat Loan?

- 18.5 Do I need a guarantor for the loan?

- 18.6 Related posts:

- 18.7 QarzMitra Loan App

- 18.8 JazzCash Islamic Saving Account 2025 (Salaam Investment)

- 18.9 Maryam Nawaz Loan Scheme: Youth Empowerment in Pakistan

What is the Akhuwat Loan Scheme?

The Akhuwat Loan Scheme is a revolutionary initiative that offers interest-free loans (Qard-e-Hasan) to low-income individuals, particularly those who are excluded from traditional banking systems. The loans are designed to support small businesses, education, healthcare, and housing, enabling borrowers to improve their quality of life and contribute to their communities.

Unlike conventional lending systems, Akhuwat operates on the principles of compassion, equity, and social justice. The foundation’s unique model is rooted in Islamic finance, which prohibits interest (riba) and emphasizes ethical lending practices.

Key Features of the Akhuwat Loan Scheme 2025

- Interest-Free Loans:

Akhuwat provides loans without any interest, ensuring that borrowers are not burdened by additional financial stress. This approach aligns with Islamic principles and promotes ethical financing. - Inclusive Lending:

The scheme targets marginalized groups, including women, rural communities, and individuals with limited access to formal financial services. By 2025, Akhuwat aims to further expand its outreach to underserved regions. - Diverse Loan Products:

Akhuwat offers a variety of loan products tailored to meet different needs:- Microenterprise Loans: For small business owners and entrepreneurs.

- Education Loans: To support students in pursuing their academic goals.

- Health Loans: For medical emergencies and healthcare expenses.

- Housing Loans: To help families build or renovate their homes.

- Simple and Transparent Process:

The loan application process is straightforward and transparent. Borrowers can apply through Akhuwat’s website (https://akhuwat.org.pk/loan-process) or visit one of their branches. The foundation ensures that all terms and conditions are clearly communicated. - Community-Based Approach:

Akhuwat operates through local mosques, churches, and community centers, fostering a sense of trust and collaboration. This approach not only reduces operational costs but also strengthens community bonds. - Focus on Social Impact:

Beyond financial assistance, Akhuwat provides borrowers with training, mentorship, and support to help them succeed. The foundation also promotes values of empathy, responsibility, and self-reliance.

Eligibility Criteria for Loans

Following general points are compulsory for eligibility of loan:

- Applicant should have valid CNIC.

- Having the ability to run/initiate business activity having age between 18-62 years.

- Applicant should be economically active.

- Applicant should not be convicted of any criminal offence in lieu of which proceeding are in progress.

- Applicant should have good social and moral character in his community.

- Applicant should have capacity to provide two guarantors other than family members.

- Applicant should be resident of operational area of branch office which might be around 2-2.5 KM radius.

- Note: – Project specific eligibility criteria may be varied.

Lending Methodology

- AIM’s lending policy involves disbursement of interest free or Qard-e-Hasan loans through Group Lending

- Individual Lending

- However, decision of lending methodology depends upon the loan product as well as project specific requirements.

Group Lending

Group Lending includes disbursement of Qard-e-Hasan loans among groups of men and women who are looking forward to enhance their family income but are unable to do so due to scarce resources. In group lending methodology groups of 3 to 6 members will be formed, and all group members would guarantee loans and credentials of each other. Group Lending enables group members to resolve their social and economic problems through mutual understanding and decision-making. Before applying for a loan, an applicant is supposed to constitute a group of 3 to 6 members residing nearby to each other and members shouldn’t be close relatives to each other.

Individual Lending

Individual Lending includes disbursement of Qard-e-Hasan loans among individuals. Loans are offered to certain individuals who fulfill the eligibility criteria of a scheme to facilitate them to meet their needs through interest-free loans. In case of individual lending, two guarantors will be provided by an applicant for availing of interest free loan.

Application Submission

The loan process will start with the submission of application. The application fee may vary from scheme to scheme. The unit manager will then evaluate the application through eligibility criteria. Thus, these loans will be given out on social collateral. The following steps will be followed in application submission.

Applicant will visit nearest AIM branch along with his/her relevant documents (mentioned below) for submission of a loan application.

Unit manager will discuss with the applicant to check whether applicant falls under eligibility criteria of the scheme.

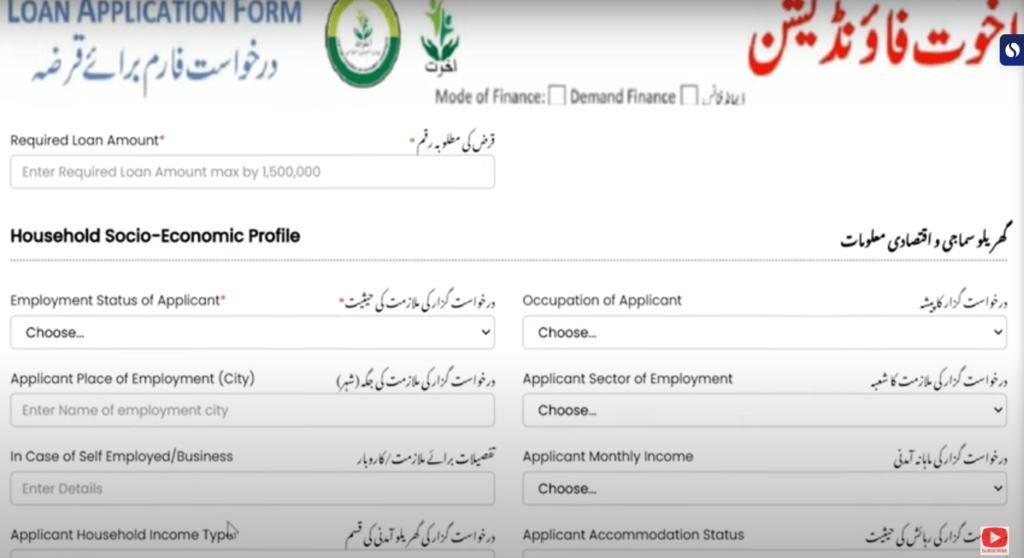

Potential candidates will submit loan applications on a prescribed form. Loan applications will be provided and filled by AIM staff in a branch office.

Unit manager will check documents and application will be processed after completion of required documents.

The following are the details of collaterals that may be applied for loans:

1. Personal responsibility

2. Two guarantors

3. Postdated cheques

4. Any additional collateral in a special case.

Dubai Islamic Bank Personal Finance Loan

How to Apply for the Akhuwat Loan Scheme 2025?

Step-by-Step Application Process

- Visit the nearest Akhuwat Loan Center

- Submit the loan application form with required documents

- Application review and verification

- Loan approval and disbursement

Documents Required

- National Identity Card (CNIC)

- Business plan (for business loans)

- Education admission letter (for education loans)

Loan Approval Process

- Verification through Akhuwat officers

- Approval takes 2-4 weeks

Standard Chartered Bank Personal Loan

Following Documents Shall be Submitted Along With Loan Application:

Copies Of CNIC

- Applicant (Mandatory)

- Guarantors (Mandatory)

- Family Member (Optional)

Objective

- For Identification

- For verification in Management Information System (MIS)

- Bank Requirement for collecting money

Latest Utility Bills

- Applicant (Mandatory)

Objective

- For address verification

- To assess Payment Behavior

Latest Photos

Applicant (Mandatory)

Objective

- For identification

Copy of Nikahnama

Applicant (Mandatory) (may be waived if not available after verification by other means)

Objective

- For identification in case CNIC of a wife is not with the name of husband

Note: – Additional documents may be demanded according to scheme’s requirements.

Social Appraisal

Social appraisal aims to verify character and credibility of the applicant by visiting his residential place. After receiving the Application, unit manager performs social appraisal through following methods.

- Information from existing borrowers

- From the living style of the applicant

- Views of neighbors about the applicant

- Personal interview/ family interview

Business Appraisal

Through the scrutiny of business plans the business idea of the intended borrower will be evaluated to see if it is viable and whether it can generate income beyond the household expenses sufficient for loan repayment. Business requirement is evaluated in business appraisal. This will also help fine-tune the applicant’s business idea itself. The applicant’s family will also be interviewed to make sure that they know about the loan and support the business idea.

Second Appraisal:

After initial appraisal by the unit manager, the application will be forwarded to Branch Manager who will appraise the social and business appraisal process once again and conduct a meeting with a borrower and their guarantors.

Guarantors of Loans

In cases of individual lending, every applicant will provide two guarantors who vouch for his/her credentials and accept the responsibility of monitoring the borrower and give assurance to persuade the borrower for timely payment of loan. Whereas in group lending the members of the group would guarantee each other and thus formally constitute a group.

Loan Approval Committee (LAC)

Every branch will have its own Loan Approval Committee (LAC). The committee is headed by the Area Manager, and other members of the committee are unit managers and Branch managers. All credit cases will be reviewed by the committee. If the committee approves the case, a loan is finalized and is ready to be disbursed. The whole process takes almost 3 to 4 weeks.

Fund Request & to head office

Once loans are approved by the LAC, the required amount of funds is requested to the Head Office through the Regional Manager. The head office makes necessary arrangements for transfer of funds.

How to Apply Online for an Allied Bank Personal Loan

Loan Disbursement

Disbursement takes place once a month and loans are distributed through an event usually held at a mosque or church. In case the of individuals, lending applicant has to be accompanied by at least one guarantor. In case of group lending, all group members are to be present at the time of disbursement. Funds are transferred through Cash Over Counter (COC) facility, where beneficiary will visit the counter of concerned Bank and will receive the money. However, disbursement may also be made by direct transfer of money into respective bank account of beneficiary depending upon the nature of the project and amount of the loan. For disbursement purposes, any other verifiable mechanism may be adopted on the discretion of the AIM.

Social Guidance

Social Guidance is also briefed simultaneously at the disbursement events in which the capacity of borrowers will be built to carry on their work more efficiently and effectively particularly keeping in view the Islamic or ethical principles.

Social agenda items include:

- Emphasis on girls’ education

- Serving the community at large

- Protection and improvement of environment

- Importance of plantation

- Observance of traffic rules and local laws

- Following highest ethical values in business

Recovery & Follow up

Once the loan is disbursed, the unit manager monitors the client with regular visits at his place of work. The loan repayment has to be made at the branch till the 7th of each month. If payment is not received by the 10th, the unit manager visits the client to remind and if repayment is still not made the guarantors are contacted and asked to make the payment.

Summary of Loan process

Following table provides brief summary of loan process and steps with precise objectives and their place of occurrence.

| STEPS | OBJECTIVE | LOCATION |

| Programme Introduction | Awareness | Branch/Mosque |

| Application submission | Process initiation | Office / Mosques |

| Social Appraisal | Social & ethical screening | Place of residence |

| Business Appraisal | Business requirement Screening | Business place |

| Second appraisal | To verify social & business appraisal | Residence & business place |

| Guarantors of loans | To ensure guarantee of loans | Mosque |

| Loan Approval committee (LAC) | To approve loan | Mosque/Branch |

| Loan Disbursement | Delivery of loan & social Guidance | Mosque / Church |

| Recovery Deposit | Ensuring recovery and social guidance | Branch |

| Monitoring | Monitoring | Business place |

Akhuwat All Branches List

Akhuwat is a non-profit microfinance organization based in Pakistan, known for providing interest-free loans to impoverished communities. Established in 2001, Akhuwat has grown significantly and operates through a vast network of branches across the country. Below is an overview of Akhuwat’s branch network and operational structure:

Akhuwat Contact us

Head Office

19 Civic Center, Sector A2, Township, Lahore, Pakistan

Emails

For queries:

info@akhuwat.org.pk

For complaints:

complaints@akhuwat.org.pk

Akhuwat Loan Contact Number

+042 111 448 464

+92 42 35122743

Akhuwat Contact Us Complaint Form: Click Here

Conclusion

The Akhuwat Loan Scheme 2025 is a game-changer for low-income families in Pakistan. By providing interest-free loans, Akhuwat is empowering people to become financially independent. If you are looking for a trustworthy, interest-free financing option, Akhuwat Foundation is the way to go!

How to Apply for Faysal Bank Personal Loan Online

How to Apply for a UBank Loan Online in Pakistan

UBL Personal Loan Apply Online in Pakistan

FAQs about Akhuwat Loan

Is Akhuwat Loan interest-free?

Yes, all loans are 100% interest-free.

How long does it take to get loan approval?

Usually 2-4 weeks after verification.

What is the maximum loan amount?

Up to PKR 500,000, depending on loan type.

Can I apply online for an Akhuwat Loan?

No, you must visit a loan center physically.

Do I need a guarantor for the loan?

Yes, a guarantor is required for approval.

MCB Personal Loan: How to Get Quick and Easy Credit

Meezan Bank Personal Loan (Easy Home) in Pakistan

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com