Agahe Pakistan Loan App – In recent years, access to microfinance has become increasingly crucial for empowering low-income individuals, small business owners, and marginalized communities across Pakistan. The Agahe Pakistan Loan App is emerging as one of the most trusted platforms in 2025 for offering interest-free loans, easy online application, and digital financial services that are not only secure but also inclusive.

Whether you’re an aspiring entrepreneur, a student in need of educational support, or someone facing a financial emergency, the Agahe Loan App 2025 provides a user-friendly and accessible way to apply for loans directly from your mobile phone. This article will provide an in-depth guide on Agahe Pakistan’s loan services, eligibility criteria, loan types, benefits, application process, and how it compares with other personal loan apps in Pakistan.

Contents

- 1 What is the Agahe Pakistan Loan App?

- 1.1 Agahe Pakistan: An Overview

- 1.2 Key Features of Agahe Loan App 2025

- 1.3 Types of Loans Offered by Agahe Pakistan

- 1.4 Eligibility Criteria for Agahe Loan 2025

- 1.5 How to Apply for Agahe Pakistan Loan Online?

- 1.6 Agahe Pakistan Loan App Review (2025)

- 1.7 How to Check Your Loan Status on Agahe App

- 1.8 Why Choose Agahe Loan App Over Other Apps?

- 1.9 Benefits of Agahe Loan App 2025

- 1.10 Contact Us

- 1.11 Conclusion

- 1.12 FAQs about Agahe Pakistan Loan App 2025

- 1.12.1 Is Agahe Loan really interest-free?

- 1.12.2 Can I apply without visiting a branch?

- 1.12.3 What is the maximum loan limit?

- 1.12.4 Is there an iOS version of the app?

- 1.12.5 How many times can I apply for a loan?

- 1.12.6 Related posts:

- 1.12.7 QarzMitra Loan App

- 1.12.8 How to Get Interest-Free Loan from CashBazar Loan App in 2025

- 1.12.9 JazzCash Islamic Saving Account 2025 (Salaam Investment)

What is the Agahe Pakistan Loan App?

The Agahe Pakistan Loan App is a mobile-based digital loan platform developed by Agahe Pakistan, a renowned non-profit organization that promotes financial inclusion and social empowerment. The app allows users to apply for interest-free and low-interest microfinance loans across Pakistan.

Backed by Agahe Pakistan’s robust microfinance network, the app is designed to assist:

- Low-income families

- Women entrepreneurs

- Small business owners

- Farmers and agriculture workers

- Students needing financial aid

The goal is simple: to provide ethical, Shariah-compliant, and transparent financial solutions without exploiting the borrower.

Agahe Pakistan: An Overview

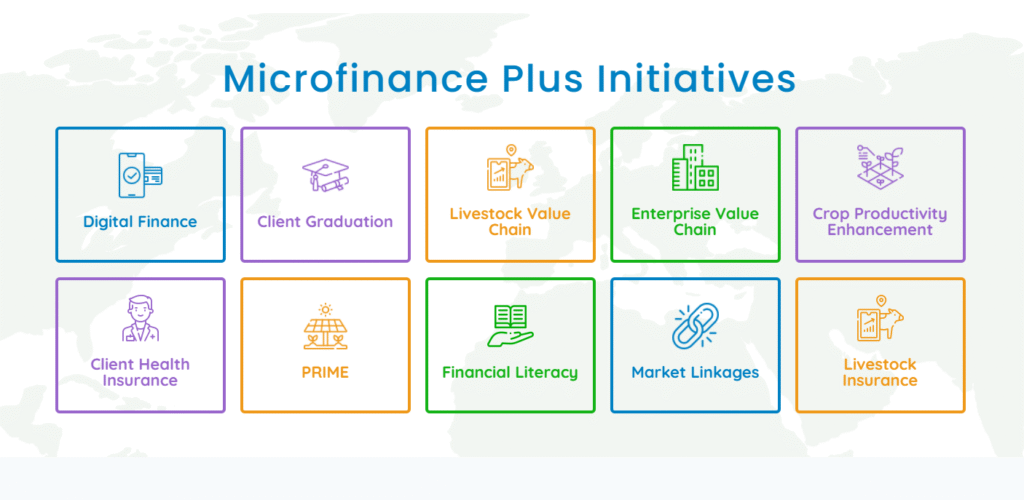

Established in 2011, Agahe Pakistan is a registered not-for-profit organization that provides financial and social services to promote self-reliance and economic stability among disadvantaged communities. It operates in multiple districts across Punjab and Sindh and has impacted the lives of thousands of individuals by offering:

- Interest-free microfinance loans

- Skill development programs

- Health and education financing

- Financial literacy training

In 2025, Agahe has taken a digital leap with its mobile app to reach more people efficiently and transparently.

Key Features of Agahe Loan App 2025

The Agahe Pakistan Loan App is loaded with powerful and user-friendly features, including:

Interest-Free Loans

Agahe offers Qarz-e-Hasna (Islamic interest-free loans) for eligible individuals and groups. There are no hidden charges, penalties, or riba (interest).

100% Digital Application

Applicants can apply for a loan, upload documents, and check application status entirely through the mobile app.

Quick Disbursement

Loan approval and disbursement generally take 3 to 7 working days after document verification and eligibility screening.

Loan Tracking & Status Check

The app provides a real-time tracking feature to help you stay updated on your loan status, payment due dates, and balance.

Secure and Confidential

All user data is encrypted and handled according to the highest standards of digital security.

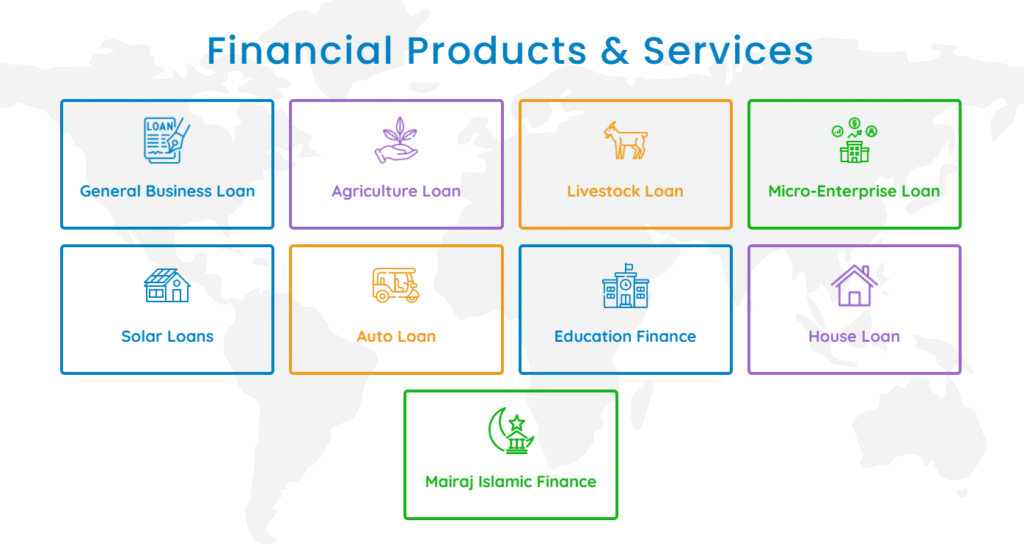

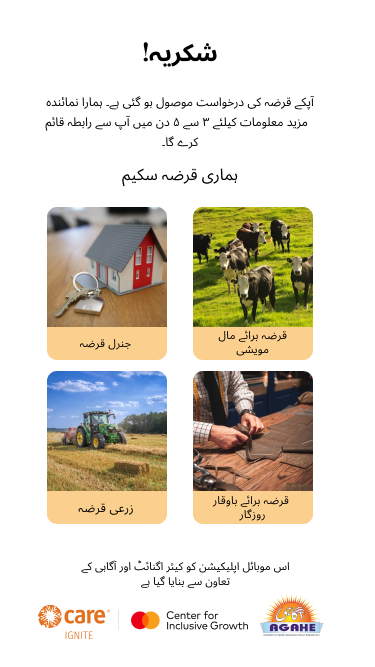

Types of Loans Offered by Agahe Pakistan

Agahe Pakistan offers a wide range of microfinance loan products tailored to meet the diverse needs of low-income individuals and small businesses. These include:

1. Personal Loans

For medical emergencies, household expenses, or sudden financial needs.

2. Women Empowerment Loans

Specifically designed for women entrepreneurs and home-based workers to help them start or expand small-scale businesses.

3. Business and Enterprise Loans

Targeted towards small business owners, vendors, and startups needing capital to grow their ventures.

4. Agricultural Loans

For farmers and rural workers to purchase seeds, fertilizers, livestock, or irrigation tools.

5. Education and Health Loans

To help families afford school tuition, books, uniforms, or healthcare expenses like surgeries and medications.

Eligibility Criteria for Agahe Loan 2025

To qualify for a loan through the Agahe Loan App, you must meet the following basic requirements:

- Be a Pakistani national with a valid CNIC

- Be between 18 and 60 years old

- Have a stable source of income or a small business

- Reside in an area where Agahe Pakistan operates (mainly Punjab and Sindh)

- Be able to provide one or two guarantors or a group (in case of group loans)

Eligibility may vary slightly depending on the type of loan being applied for.

How to Apply for Agahe Pakistan Loan Online?

Here is a step-by-step guide on how to apply for a loan using the Agahe Loan App:

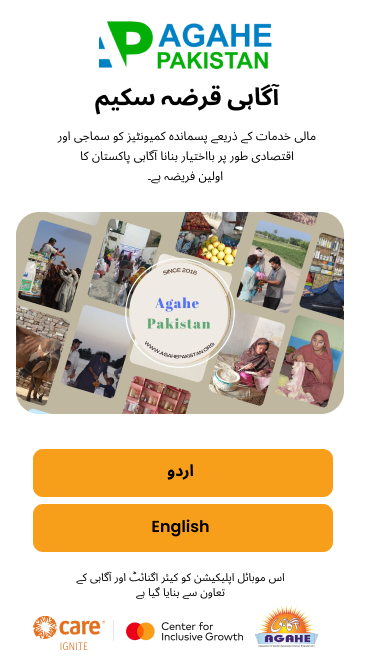

Step 1: Download the App

Go to the Google Play Store and search for “Agahe Pakistan Loan App” or use this link to install the app.

Step 2: Register an Account

Sign up using your CNIC number, mobile number, and create a password. Verify your identity using an OTP code sent to your phone.

Step 3: Complete the Loan Application

Select the loan type you need (personal, business, etc.) and fill in the required fields, including:

- Personal details

- Income sources

- Loan amount needed

- Guarantor information

Step 4: Upload Required Documents

Attach scanned or photographed copies of:

- CNIC (front and back)

- Proof of income/business

- Utility bill or proof of residence

- Any additional documents requested

Step 5: Submit and Wait for Approval

Once submitted, the application will be reviewed by Agahe Pakistan’s field team or branch office. If approved, you’ll be contacted for disbursement arrangements.

Agahe Pakistan Loan App Review (2025)

The Agahe Loan App has gained positive feedback on the Google Play Store, with users praising its ease of use, fast loan approval, and interest-free financing.

How to Check Your Loan Status on Agahe App

You can track your application status in real-time by:

- Logging into the app

- Navigating to the “Loan Status” tab

- Viewing details such as application stage, loan amount approved, and expected disbursement date

This helps maintain transparency and removes the need for multiple branch visits.

Why Choose Agahe Loan App Over Other Apps?

There are several loan apps in Pakistan, but Agahe stands out because:

- It is a registered, non-profit organization

- Offers interest-free, ethical microfinance

- Focuses on community development and poverty alleviation

- Provides dedicated programs for women and farmers

- Has minimal documentation and fast processing time

Unlike commercial lenders or private loan apps that may charge excessive interest or hidden fees, Agahe follows a social impact model to support long-term financial sustainability.

Benefits of Agahe Loan App 2025

Here’s a quick summary of the key benefits of using the Agahe Pakistan Loan App:

| Benefits | Details |

|---|---|

| Interest-Free Loans | Shariah-compliant, no riba |

| Fast Approvals | 3-7 days turnaround |

| Digital Application | Apply from home |

| Women-Centric | Empowering female entrepreneurs |

| Secure & Transparent | Track everything in-app |

Contact Us

Head Office:

House No. 3, Block A, Judicial Colony Phase II, Raiwind Road, Lahore, Pakistan.

042-35291211

Regional Office:

House No. 790, Opposite to Street No. 15 Defense View, Vehari, Pakistan.

067-3366860

For Complaints

complaints@agahepakistan.org

0332-3030005

For Queries

info@agahepakistan.org

042-35291211

Conclusion

The Agahe Pakistan Loan App 2025 offers a simple, secure, and ethical alternative for those in need of financial support. With a focus on interest-free lending, social impact, and women empowerment, it has quickly become one of the best loan apps in Pakistan without interest.

If you’re looking for a personal, business, or education loan without falling into a debt trap, applying through Agahe Pakistan could be the right step toward achieving financial stability.

App Download: Click Here

Website: Click Here

FAQs about Agahe Pakistan Loan App 2025

Is Agahe Loan really interest-free?

Yes, Agahe Pakistan offers Qarz-e-Hasna, which is an Islamic model of interest-free financing.

Can I apply without visiting a branch?

Yes, you can complete the entire process through the mobile app, from registration to approval.

What is the maximum loan limit?

It depends on the loan product but usually ranges from PKR 10,000 to PKR 100,000+.

Is there an iOS version of the app?

Currently, the app is only available for Android users.

How many times can I apply for a loan?

If your first loan is successfully repaid, you can apply again with a higher loan limit.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com