Akhuwat Foundation interest-free loan program is for people with Pakistani citizenship and can apply all over Pakistan. Different loan products have different money ranges although it varies from 50000 to 150000 Rupees. The price of the application is 200 except for agriculture which does not have any application form rupees The first step for the loan, a man get the interest free loan Akhuwat Foundation loan application form from Qard-e-Hasan, and after the Download write down the required stuff, and send it to the AIM branch near your home.

The unit manager verifies your loan application, reviews any additional information that may be required, and verifies that all documents are necessary for loan approval.

Job Alerts: Join WhatsApp Group

For More Govt Jobs Information

International Jobs-Visa Information

Make Money At Home Information

Subscribe: YouTube Channel

Contents

- 1 Akhuwat PM Youth Business Loan

- 2 Loan Products Offred

- 3 Akhuwat Family Enterprise Loan

- 4 Akhuwat Agriculture Loan

- 5 Akhuwat Liberation Loan

- 6 Akhuwat Housing Loan

- 7 Akhuwat Education Loan

- 8 Akhuwat Health Loan

- 9 Akhuwat Marriage Loan

- 10 Akhuwat Emergency Loan

- 11 Akhuwat Loan Scheme

- 12 Prime Minister Low Cost Housing Scheme

- 12.1 Salient Features of the Scheme are as follows:

- 12.2 Eligibility Criteria for Low-Cost Housing Scheme

- 12.3 Ramzan Offer

- 12.4 Akhuwat All Branches List

- 12.5 Akhuwat Contact us

- 12.6 FAQs about Akhuwat Loan Scheme

- 12.6.1 What is Akhuwat?

- 12.6.2 Can I apply for an Akhuwat loan online?

- 12.6.3 What types of loans does Akhuwat offer?

- 12.6.4 What are the eligibility criteria for Akhuwat loans?

- 12.6.5 How do I apply for an Akhuwat loan online?

- 12.6.6 What documents are required for the loan application?

- 12.6.7 How long does it take to get approval for an Akhuwat loan?

- 12.6.8 Is there any collateral required for Akhuwat loans?

- 12.6.9 What is the repayment schedule for Akhuwat loans?

- 12.6.10 Are there any charges or fees for applying for an Akhuwat loan?

- 12.6.11 Can I apply for multiple Akhuwat loans simultaneously?

- 12.6.12 How do I contact Akhuwat for further assistance?

- 12.6.13 Related posts:

- 12.6.14 QarzMitra Loan App

- 12.6.15 JazzCash Islamic Saving Account 2025 (Salaam Investment)

- 12.6.16 Maryam Nawaz Loan Scheme: Youth Empowerment in Pakistan

Akhuwat PM Youth Business Loan

Introduction

Government of Pakistan, in collaboration with Pakistan Poverty Alleviation Fund (PPAF) and Partner Organizations (PO’s) has launched an Interest-Free Loan scheme under which low-income families whose Poverty score card up to 40 will be provided with interest-free loans up to Rs.50, 000. There is a steering committee that is overviewing the whole Project. Under the Prime Minister’s Interest-Free Loan (PM-IFL) Scheme, a total amount of Rs. 3.5 billion has been provided to PPAF and PPAF has disbursed that fund to Partner Organizations. In this regard, Akhuwat Islamic Microfinance (AIM) has been selected as a Partner Organization by PPAF.

Also Check:

Jazz Cash Personal Loan Online Apply

Eligibility Criteria:

Applicant having the proper business plan.

Applicant having Poverty Score Card up to 40.

Having an age between 18- 60 years.

Applicant should have valid CNIC.

Applicants should be economically active.

Applicant should not be convicted of any criminal offence in lieu of which proceeding are in progress.

Applicant should have good social and moral character in his community.

Applicant should have the capacity to provide two guarantors other than family members.

Salient Features of Project:

Interest free loan facility is only for specific UCs allocated as per NFC rules.

Maximum Loan size will be PKR. 50,000.

Loans will be provided to persons having Poverty Score Card 0-40.

Loans are disbursed in mosques/churches to ensure transparency and participation.

There is no mark-up or interest on these loans.

Loans are given after due scrutiny and appraisal according to an eligibility criterion, ona first come first serve basis.

Major Objectives of the Project:

Making interest free loans available to poor, vulnerable and marginalized people on a scale 0-40 on the Poverty Score Card.

Ensuring the loans are used for productive purposes to increase the income of borrowers/households.

Allocating 50% of loans to women for their inclusion in economic activities.

Encouraging behavioural change among beneficiaries of scheme.

Easy Loan Mobile App Without Interest

Barwaqt Emergency Loan in Pakistan

Jazz Cash Personal Loan Online Apply

Loan Products Offred

There are various products through which AIM provides interest-free loans which are tailored to meet specific needs of the borrower. These products are outlined below:

Products

Family Enterprise Loan

Agriculture Loan

Liberation Loan

Housing Loan

Education Loan

Health Loan

Marriage Loan

Emergency Loan

Also Check: Prime Minister Youth Loan Scheme

Also Check: UBank Loan Pakistan

Also Check: Click Here

Smart Qarza Safe Easy Cash Loan App

Akhuwat Family Enterprise Loan

Range: From Rs. 10,000 to Rs.50,000

Duration: 10 – 36 months

Profit Rate: 0%

Interest Rate: None

Initial Application fee: Up to Rs. 200

Post Approval Application fee: None

Mutual Support Fund Contribution: Optional 1% of loan amount

Akhuwat Agriculture Loan

Range: From Rs. 10,000 to Rs 50,000

Duration: 4-8 months

Profit Rate: 0%

Interest Rate: None

Initial Application fee: None

Post Approval Application fee: None

Mutual Support Fund Contribution: Optional 1% of loan amount

Akhuwat Liberation Loan

Range: From Rs. 10,000 to Rs.100,000

Duration: 10-36 months

Profit Rate: 0%

Interest Rate: None

Initial Application fee: Up to Rs. 200

Post Approval Application fee: None

Mutual Support Fund Contribution: Optional 1% of loan amount

Akhuwat Housing Loan

Range: From Rs. 30,000 to Rs.100,000

Duration: Up to 36 months

Profit Rate: 0%

Interest Rate: None

Initial Application fee: Up to Rs. 200

Post Approval Application fee: None

Mutual Support Fund : Optional 1% of loan amount

Akhuwat Education Loan

Education Level: Post Matriculation up to Masters

Range: From Rs. 10,000 to Rs. 50,000

Duration: 10 – 24 months

Profit Rate: 0%

Interest Rate: None

Initial Application fee: Up to Rs. 200

Post Approval Application fee: None

Mutual Support Fund Contribution: Optional 1% of loan amount

Akhuwat Health Loan

Range: From Rs. 10,000 to Rs. 50,000

Duration: 10 – 24 months

Profit Rate: 0%

Interest Rate: None

Initial Application fee: Up to Rs. 200

Post Approval Application fee: None

Mutual Support Fund Contribution: Optional 1% of loan amount

Akhuwat Marriage Loan

Range: From Rs. 10,000 to Rs.50,000

Duration: 10 – 24 months

Profit Rate: 0%

Interest Rate: None

Initial Application fee: Up to Rs. 200

Post Approval Application fee: None

Mutual Support Fund Contribution: Optional 1% of loan amount

Akhuwat Emergency Loan

Range: From Rs. 10,000 to Rs. 50,000

Duration: 10 – 24 months

Profit Rate: 0%

Interest Rate: None

Initial Application fee: Up to Rs, 200

Post Approval Application fee: None

Mutual Support Fund Contribution: Optional 1% of loan amount

Akhuwat

Loan Scheme – Akhuwat Loan Online Application – Akhuwat

Foundation Contact Number – Akhuwat Home Loan – Akhuwat

Interest Free Loan

Akhuwat Loan Scheme

LOAN PROCESS

Eligibility Criteria for Loans

- Applicant should have valid CNIC.

- Having the ability to run/initiate business activity having age between 18-62 years.

- Applicants should be economically active.

- Applicant should not be convicted of any criminal offense instead of which proceeding are in progress.

- Applicant should have good social and moral character in his community.

- Applicant should have the capacity to provide two guarantors other than family members.

- Applicant should be resident of the operational area of the branch office which might be around 2-2.5 KM radius.

- Note: – Project-specific eligibility criteria may be varied.

Application Submission

The loan process will start with the submission of the application. The application fee may vary from scheme to scheme. The unit manager will then evaluate the application through eligibility criteria. Thus, these loans will be given out on social collateral. The following steps will be followed in application submission.

The applicant will visit the nearest AIM branch along with his/her relevant documents (mentioned below) for the submission of a loan application.

The unit manager will discuss with the applicant to check whether the applicant falls under the eligibility criteria of the scheme.

Potential candidate will submit loan application on a prescribed form. The loan application will be provided and filled by AIM staff in a branch office.

Unit manager will check documents and application will be processed after completion of required documents.

1. Personal responsibility

2. Two guarantors

3. Postdated cheques

4. Any additional collateral in a special case.

Prime Minister Low Cost Housing Scheme

Salient Features of the Scheme are as follows:

Financing size up to Rs. 500,000/-

Repayment period is from 13 to 60 months. An early repayment will be welcomed.

Average Monthly rental amount is up to Rs. 10,000/-

Financing will be given for the following purposes:

Entire New Construction or Lanter for a new house.

Addition of rooms, kitchen & bathroom etc.

Renovation & up gradation.

The application processing fee will be zero.

Eligibility Criteria for Low-Cost Housing Scheme

To be eligible under the said scheme, the applicant must meet the following criteria of having;

Valid CNIC

Age up to 60 years

Applicant must be the owner of the land/house

Valid ownership title or evidence of land/house (may include Registry, Internal, Fard, Allotment letter, or any other valid evidence deemed appropriate)

Land size of 5 Marla or less or covered area which is not more than 1,360 sq ft.

Good social and moral character in a community

Monthly household income up to Rs. 60,000.

Residence in the operational area of AIM’s branch.

Should have a clear credit history (if any).

Ramzan Offer

If you are unemployed. If you are worried about Iftar and Sehri rations in Ramadan, we will tell you. If you are eligible, you can get rations for Ramadan from an Akhuwat foundation that will provide you Ramadan rations for free. I will give you full details of what you need to do to join this ration program.

Akhuwat All Branches List

Akhuwat is a non-profit microfinance organization based in Pakistan, known for providing interest-free loans to impoverished communities. Established in 2001, Akhuwat has grown significantly and operates through a vast network of branches across the country. Below is an overview of Akhuwat’s branch network and operational structure:

Akhuwat Contact us

Head Office

19 Civic Center, Sector A2, Township, Lahore, Pakistan

Emails

For queries:

info@akhuwat.org.pk

For complaints:

complaints@akhuwat.org.pk

Akhuwat Loan Contact Number

+042 111 448 464

+92 42 35122743

Akhuwat Contact Us Complaint Form: Click Here

FAQs about Akhuwat Loan Scheme

What is Akhuwat?

Akhuwat is a microfinance organization based in Pakistan that provides interest-free loans to individuals and small businesses to alleviate poverty and promote economic empowerment.

Can I apply for an Akhuwat loan online?

Yes, you can apply for an Akhuwat loan online through their official website or mobile app.

What types of loans does Akhuwat offer?

Akhuwat primarily offers Qarz-e-Hasna (interest-free) loans for various purposes, including education, healthcare, and small business development.

What are the eligibility criteria for Akhuwat loans?

Eligibility criteria may vary depending on the specific loan program, but generally, you need to be a low-income individual or family to qualify for an Akhuwat loan.

How do I apply for an Akhuwat loan online?

To apply online, visit the Akhuwat website or download their mobile app. Follow the instructions to create an account, complete the application form, and submit the required documents.

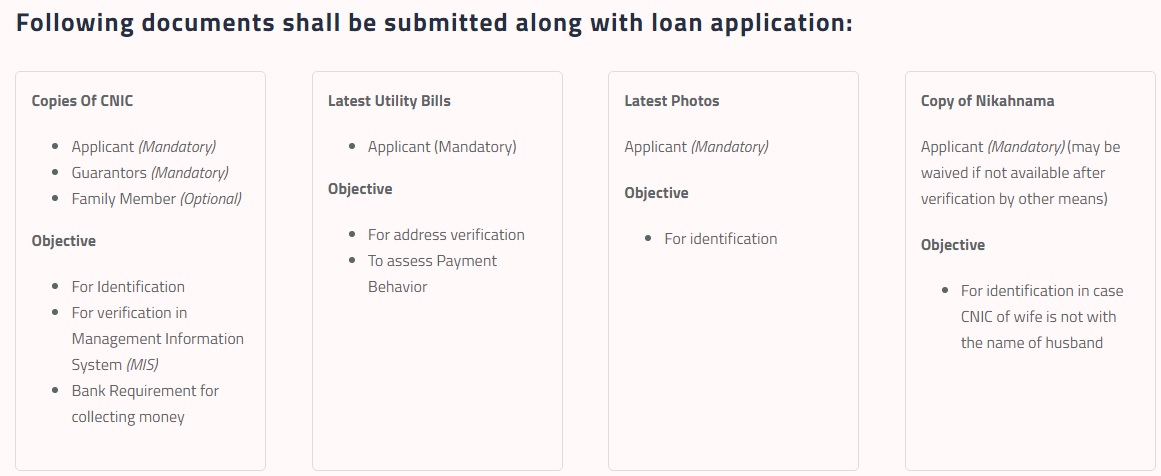

What documents are required for the loan application?

Typical documents include your CNIC (Computerized National Identity Card), proof of income, utility bills, and any other documents requested by Akhuwat.

How long does it take to get approval for an Akhuwat loan?

The processing time can vary, but you will usually receive a response within a few weeks of submitting your application.

Is there any collateral required for Akhuwat loans?

No, Akhuwat loans are interest-free and unsecured, meaning you do not need to provide collateral.

What is the repayment schedule for Akhuwat loans?

The repayment schedule depends on the specific loan program and the amount borrowed. Akhuwat will provide you with the details of your repayment plan when your loan is approved.

Are there any charges or fees for applying for an Akhuwat loan?

Akhuwat does not charge interest or any application fees for their loans. However, they may have administrative charges, which vary depending on the loan program.

Can I apply for multiple Akhuwat loans simultaneously?

The eligibility for multiple loans may depend on your repayment history and the specific loan program. You should check with Akhuwat for their policies on multiple loans.

How do I contact Akhuwat for further assistance?

You can contact Akhuwat through their official website, customer service hotline, or by visiting one of their branches for in-person assistance.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com

This blog post provided a clear and comprehensive overview of the Akhuwat Loan Scheme. I appreciate the step-by-step guidance on the online application process. It’s good to see initiatives like this that support those in need. Looking forward to seeing more updates on how these loans are helping individuals and communities!

Thank you for providing such detailed information about the Akhuwat Loan Scheme. It’s inspiring to see how accessible it is for those in need. I appreciate the step-by-step guidance on the online application process. Looking forward to seeing how this initiative impacts our communities!