Soneri Bank Loan – Soneri Bank Personal Loan – Soneri Bank Car Loan

Soneri Car Finance Loan

Soneri Ghar Finance Loan

Soneri Personal Finance Loan

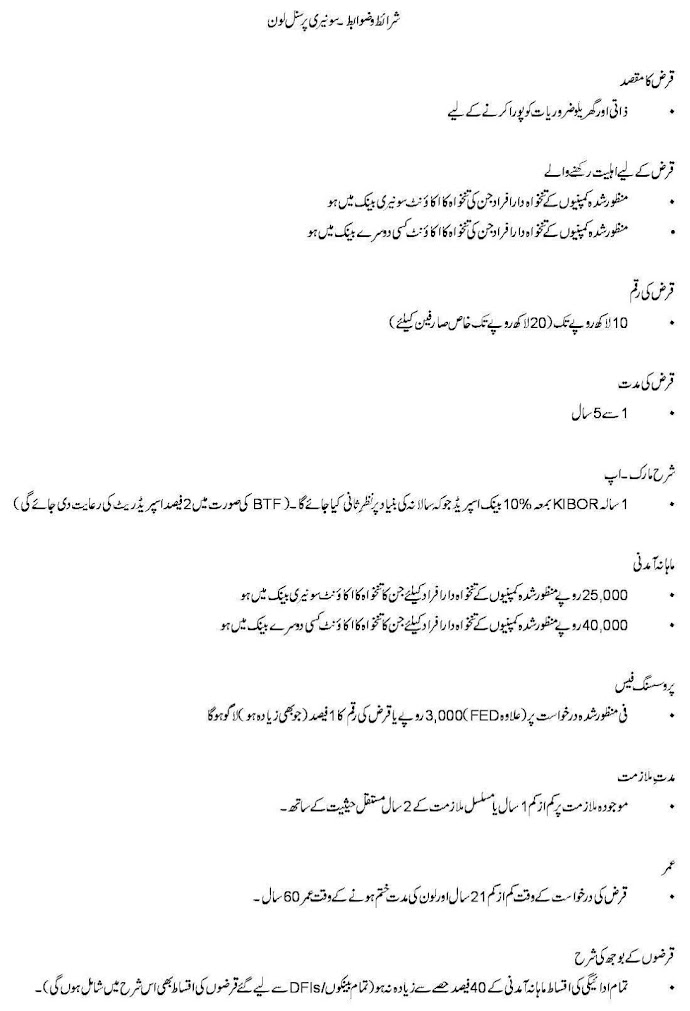

Terms & Conditions – Soneri Personal Finance

Terms & Conditions – Soneri Personal Finance Scheme

Currently only offered in Karachi, Lahore, Rawalpindi, Islamabad, and Hyderabad

Purpose of Finance

To meet personal, domestic, and household needs

Eligible Borrowers

Salaried individuals of approved companies (payroll accounts with Soneri Bank Limited)

Salaried individuals of approved companies (other than payroll accounts)

Financing Amount

Upto Rs.1 million (upto Rs.2 million for prime customers)

Tenure

1 Year to 5 Years

Also Check: Akhuwat Loan Scheme

Also Check: Prime Minister Youth Loan Scheme

Also Check: Prime Minister Laptop Scheme

Also Check: UBank Loan Pakistan

Mark-up Rate*

1 Year KIBOR plus 10% (in case of BTF, 2% rate break will be allowed/given)

Monthly Net Take-home Salary

Rs.25,000/- for salaried individuals of approved companies (payroll accounts with Soneri Bank Limited)

Rs.40,000/- for salaried individuals of the approved company (other than payroll accounts)

Length of Service

Min 1 year in current employment or 2 years of continuous employment with permanent status

Age

Minimum 21 years and maximum 60 years at the time of loan maturity

Debt Burden

Total monthly repayment installments not to exceed 40% of the net take-home salary (taking into

account other financing facilities availed from different banks/DFIs)

Processing Fee

Rs. 3,000/- (plus FED) or 1% of the finance amount whichever is higher, per approved application. No

processing fee on declined applications.

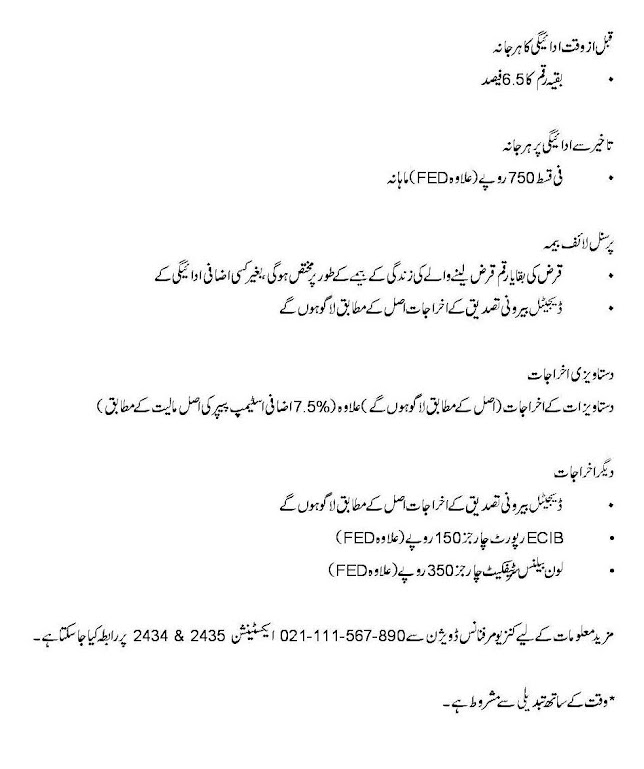

Pre-Payment/Balloon Payment Charges

6.5% pre-payment charges on the principal amount being prepaid

Late Payment Charges

Rs. 925/- (plus FED) per installment per month

Documentation Charges

At actual (Additional 7.50% service charges on the actual cost of stamp papers / adhesive stamps)

Other Charges

Digital External Verification Charges: At actual

ICB Report Charges: At actual

Issuance of Loan Balance Certificate: Rs.350/- (plus FED)

Personal Life Insurance

Free of cost, upto outstanding finance amount

Fatwa

All Pakistani residents, aged between 21 and 45 years with entrepreneurial potential are eligible to apply for the loan. For IT/ E-Commerce related businesses, the lower age limit is 18 years. Youth Entrepreneurship Scheme is for both startups and the expansion of existing businesses across Pakistan. Loan applications have to be submitted online (hyperlink) only through our website.

Loans provided under YES are segregated into 3 tiers.

Tier 1

The range is 100,000 up to 1 million PKR with a 3% markup. No Security is required for a loan in this tier.

Tier 2

The range is above 1 Million up to 10 Million PKR with a 4% markup.

Tier 3

The range is above 10 Million up to 25 Million PKR with a 5% markup.

Eligibility Criteria / Target Market

Men/Women aged between 21 & 45 years with entrepreneurial potential

For IT/E-Commerce related businesses, the lower age limit will be 18 years

25% will go to women borrowers

All sectors and products, including agriculture, are eligible.

FAQs about Soneri Bank Loan

What types of loans are available?

There are several types of loans available, such as personal loans, home loans, car loans, business loans, and student loans. Each loan type has its own set of eligibility criteria, interest rates, and repayment terms.

How much can I borrow?

The amount you can borrow depends on several factors, including your credit score, income, and expenses. Lenders usually have a minimum and maximum loan amount, and the amount you can borrow will also depend on the type of loan you are applying for.

What is the interest rate?

The interest rate is the amount of money you will pay in addition to the loan amount. The interest rate varies depending on the lender, loan type, and creditworthiness. The interest rate can be fixed or variable, and it is important to understand how it will affect your monthly payments and total loan cost.

What are the repayment terms?

The repayment terms are the length of time you have to repay the loan. The terms can range from a few months to several years, depending on the loan type and the lender’s policies. It is important to understand the repayment terms before taking out a loan to ensure you can make the monthly payments on time.

What happens if I can not make my loan payments?

If you can not make your loan payments on time, it can result in late fees, penalties, and damage to your credit score. It is important to communicate with your lender if you are having difficulty making payments to discuss alternative options, such as a loan modification or forbearance.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com