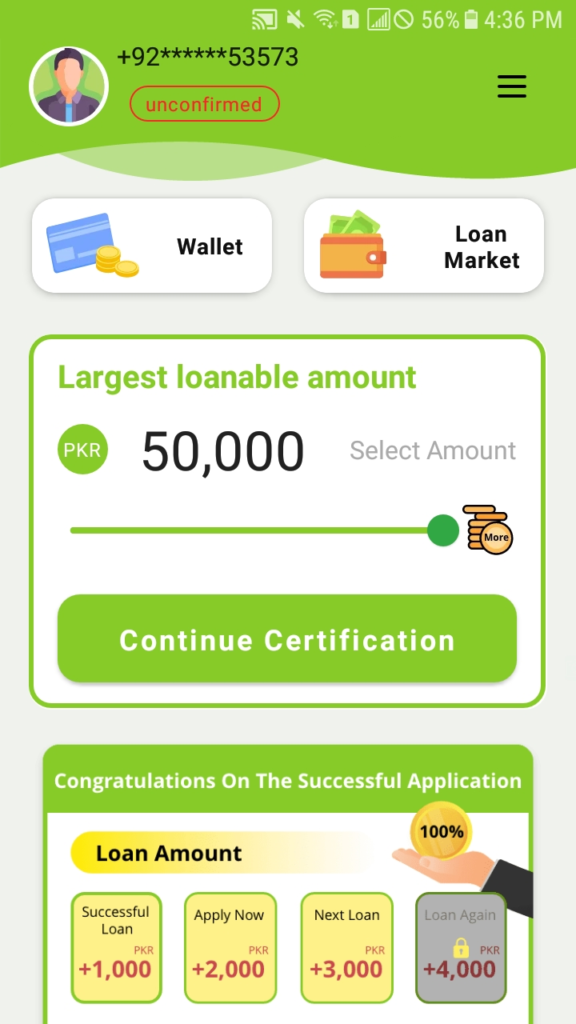

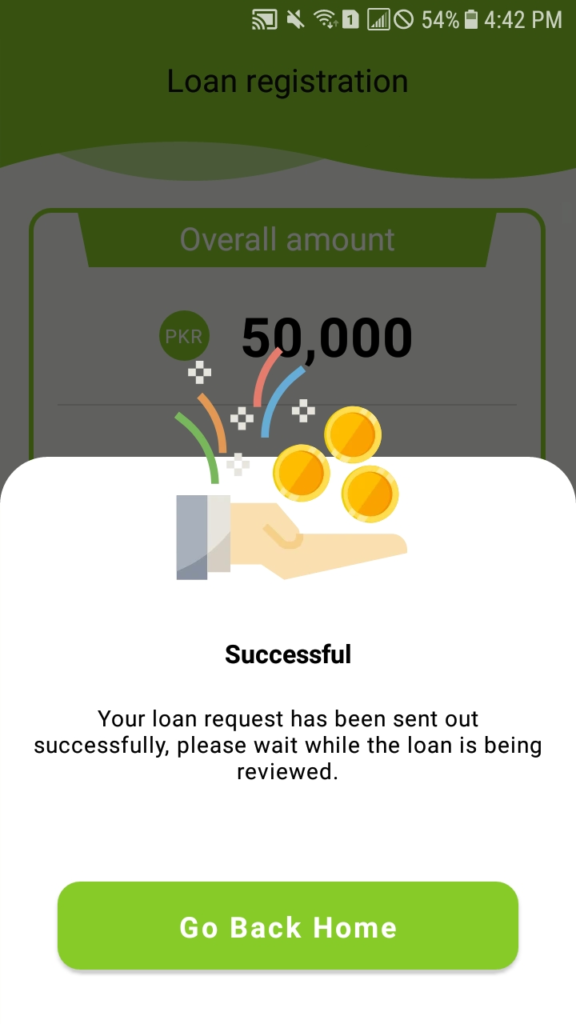

Golden Rupiye Loan App in Pakistan 100% Online Loan for Everyone Golden Rupiye is a personal Fast Easy Online Loan app for Pakistan which allows users to request personal loans of up to Rs.50,000, anytime and any time. Users have to provide their personal details only.

The loan will be credited to the account of the bank within five minutes after completion and approval of the required documents.

Also Check: Asaan Qarza Mobile Loan App

Also Check: Golden Rupiye Loan App

Also Check: AI Cash Loan App

Also Check: Jazz Cash Personal Loan Online Apply

Also Check: PK Loan Personal Online Loan

Also Check: Duck Loan App

Also Check: Barwaqt Emergency App Loan

Also Check: Fori Cash Loan App

Also Check: Mojaz Foundation App Interest Free Loan

Also Check: HBL Personal Loan App

Job Alerts: Join WhatsApp Group

For More Loan App Information

Subscribe: YouTube Channel

Contents

- 1 FAQs about Golden Rupiye Loan App in Pakistan

- 1.1 What is the Golden Rupiye Loan App?

- 1.2 How do I apply for a loan through the Golden Rupiye Loan App?

- 1.3 What are the eligibility criteria for obtaining a loan?

- 1.4 How long does it take to get a loan approval?

- 1.5 What documents are required for the loan application?

- 1.6 What is the repayment process for loans taken through the Golden Rupiye Loan App?

- 1.7 Are there any hidden charges or fees?

- 1.8 Is my personal and financial information secure with the Golden Rupiye Loan App?

- 1.9 What happens if I miss a loan repayment?

- 1.10 How can I contact customer support for assistance?

- 1.11 Related posts:

- 1.12 How to Get Interest-Free Loan from CashBazar Loan App in 2025

- 1.13 Alkhidmat Foundation Loan App 2025

- 1.14 Agahe Pakistan Loan App 2025

Golden Rupiye App Information on loans:

- Amount of loan: 91-365.

- Amount of loan: Rs10,000-50,000

- Annual rate of interest on loans: 10.95%

- Service charge: Rs 0-500

FAQs about Golden Rupiye Loan App in Pakistan

What is the Golden Rupiye Loan App?

The Golden Rupiye Loan App is a financial application that provides loans to users in Pakistan. It aims to offer quick and convenient access to funds for various purposes.

How do I apply for a loan through the Golden Rupiye Loan App?

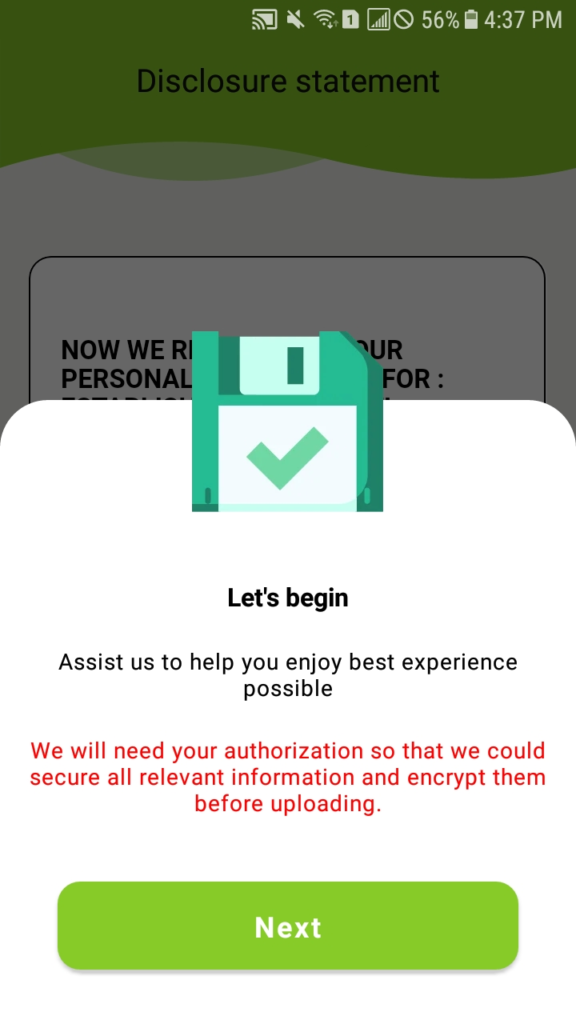

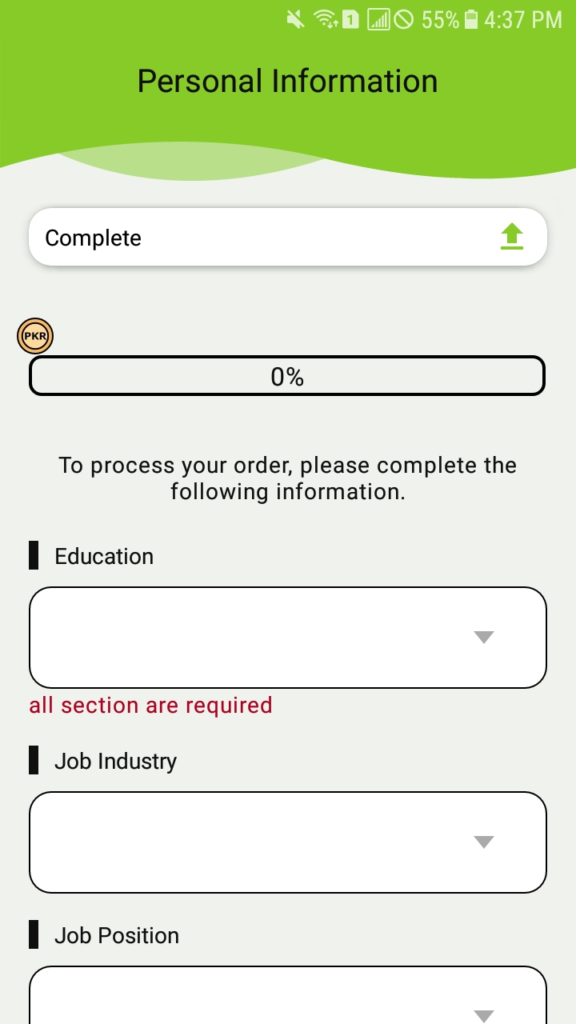

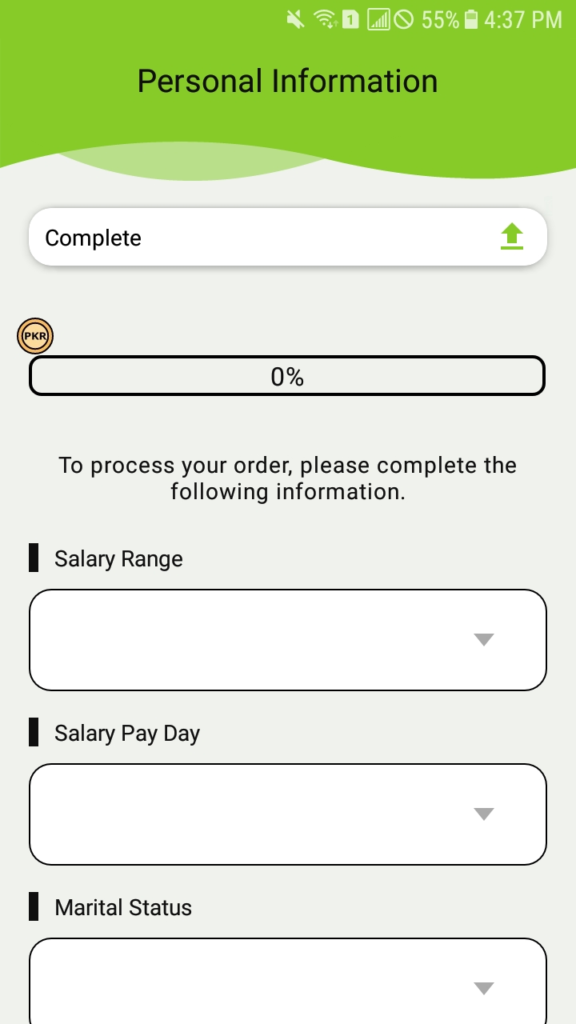

To apply for a loan, download the Golden Rupiye Loan App from the respective app store. Follow the on-screen instructions to register, submit required documents, and complete the application process.

What are the eligibility criteria for obtaining a loan?

Eligibility criteria may include factors such as age, income, credit history, and other financial parameters. Refer to the app terms and conditions for specific details.

How long does it take to get a loan approval?

The approval process duration may vary. Generally, it depends on factors like document verification, eligibility checks, and the app internal processes. Check the app for estimated approval times.

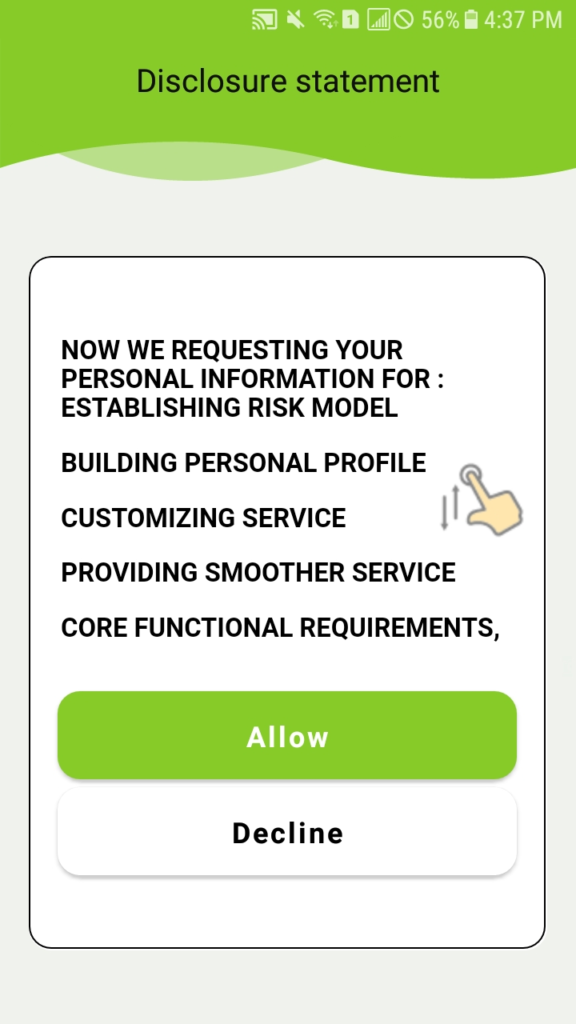

What documents are required for the loan application?

Commonly required documents include identification proof, address proof, income statements, and other relevant financial documents. Ensure you have these ready for a smoother application process.

What is the repayment process for loans taken through the Golden Rupiye Loan App?

The repayment process typically involves periodic payments. The app will provide details about the repayment schedule, modes of payment, and any associated fees.

Review the terms and conditions of the Golden Rupiye Loan App for a clear understanding of all charges and fees associated with the loan. Transparency is crucial for responsible borrowing.

Is my personal and financial information secure with the Golden Rupiye Loan App?

The app should have robust security measures in place to protect your data. Check the app privacy policy and security features to ensure the safety of your information.

What happens if I miss a loan repayment?

Missing repayments may result in additional fees or penalties. It is crucial to communicate with the app customer support if you anticipate any issues with repayments.

How can I contact customer support for assistance?

The Golden Rupiye Loan App should provide contact information for customer support. This could include a helpline, email, or an in-app chat feature for addressing queries and concerns.

Note: The information provided is based on general loan application processes, and details may vary. Always refer to the specific terms and conditions of the Golden Rupiye Loan App for accurate and up-to-date information.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com