Digital Loan in Pakistan – Finja Loan

Digital Loan in Pakistan – Finja Loan

You are 2 mintutes away!

From getting a Professional line of credit upto

Rs 10,000

Ek dafa form fill karain, aur hasil karain!

Please Read Carefully

Job Alerts: Join WhatsAppGroup

FINCA Microfinance Bank Ltd. helps you achieve your dreams with multiple loan products coupled with the best interest rates, easy repayment options, seamless loan processing and quick turnaround time for acquiring loans.

Niswan Karza

FINCA Light Commercial Car Loan

Karobari Karza

Kashtkar Karza

Convenience For Livestock Farmers

Sunheri Karza

House Loan

Motorcycle Loan

Smart Qarza Safe Easy Cash Loan App

Niswan Karza

A successful woman is the one who can build a firm foundation. Niswan Karza helps women build that foundation with a loan for their business needs.

FINCA Light Commercial Car Loan

FINCA Light Commercial Vehicle Loan / Lease facility caters to the needs of business individuals involved in the transportation business or requires commercial vehicles to support their business activities.

Karobari Karza

Take your business to new heights with Karobari Karza that gives you a chance to fulfil your working capital / capital expenditure requirements for your business.

Kashtkar Karza

Kashtkar Karza gives farmers the opportunity to expand their farming business. Repayment of this loan is synced with crop cycles to provide ease.

Convenience for Livestock Farmers

A loan facility that is designed to meet the ever growing financial needs of the livestock sector to increase productivity and fulfill capital requirements.

Sunheri Karza

Instead of selling your gold to finance or expand your business, you can now provide gold as a security collateral against the loan while still keeping ownership of your gold.

House Loan

House Loan is a medium to long term loan facility. The product is designed for renovation, improvement, extension, restoration and enhancement of customer’s existing housing unit.

Motorcycle Loan

Motorcycle Loan is funded secured short to medium-term loan facility classified as business / conveyance loan and is designed to finance motorcycle (s) of reputed brand (s). The loan is payable in equal monthly installments. This facility will be extended for Business transportation needs of businessperson/ self-employed professionals & carriage needs of Milkman (Livestock dairy customers).

Muaziz sarif, aap say guzarish ki jaati hai ke professional line of credit hasil krnay say pehele form bhartey waqt apnay mahana akhrajaat kee maalumat jitna ho sakay darust andaaz main darj karien. Information ghalat ya incomplete honay ki surat main humara system app k liye behtreen raqam kee nishaan deh nai kr paye ga. Jitna app apnay akhrajat ki information dalein gey, utna he hum appki madad kar sakein gey.

Also Check: Dubai Islamic Personal Finance Loan

Please note that a device-locking app named PayJoy will be installed on your device as a security measure and your device will be remotely locked if you miss your monthly payments. Once the missed installments are paid, the device will be unlocked and can be used again as normal.

This service is currently available for users in Lahore only. Terms and Conditions Apply

Terms & Conditions

For tenures up to 3 months FLS is offering Digital Loan in Pakistan Finja Credit Line (FCL) for salaried individuals with the following Terms & Conditions:

Salaried individuals with minimum salary of PKR 30,000 credited in a bank and having at least 6 months of employment tenure with their current employer.

Also Check: Barwaqt Emergency Loan in Pakistan

Resident of Lahore

Annual Processing Fee of PKR 1,160

Up front charges of 4%, 8%, 12% for up to 1, 2 & 3 months respectively, with 30% DBR (on approved/ requested amount)

4% LPC (Late Payment Charges) at outstanding after due date

Equal Easy Monthly installments

Supporting documents: Last Month Salary Slip, 3 Months Bank Statement, Valid CNIC, Copy of Utility Bill

The easiest way to access digital credit to meet your business goals

Unlock the true potential of your business by smoothing out your cash flows. Do not worry if you have a need today but the cash is coming in after few days or few weeks.

Stop waiting to make that payment or purchase, make it now with Digital Loan in Pakistan Finjas exclusive credit solution for SMEs. Finja believes in promoting capital towards business growth with minimal rates and flexible variables.

Whether you are expanding your business, investing in marketing or advertising or managing cash flow, it is hard to grow without the right kind of financing.

Who is this for Digital Loan in Pakistan Finja is offering an exclusive credit line catered to salaried individuals in Lahore as a medium to reduce financial stress and burden. We want you to have the freedom to spend money whenever and wherever you want without having to check your account’s balance!

Finja Invest is Digital Loan in Pakistan’s first P2P lending platform, licensed and regulated under the sandbox by the Securities and Exchange Commission of Pakistan (SECP). Finja Invest connects the investors to the SMEs (Karyana stores) in need of finances and in return offers short-term loans to the Karyana Stores and a promising return on investment to the lenders.

Eligibility

Applicant must be a resident of Lahore

Applicants must have a salary above PKR 30,000 and should receive salary in a bank account.

Applicants must fill out the Finja credit line form by providing all required information truthfully.

No history of fraudulent activity (Should not be in Finja’s grey list)

Credit limit is generally at 30% DBR of an individual’s monthly salary.

Also Check: Apna Ghar Loan Scheme

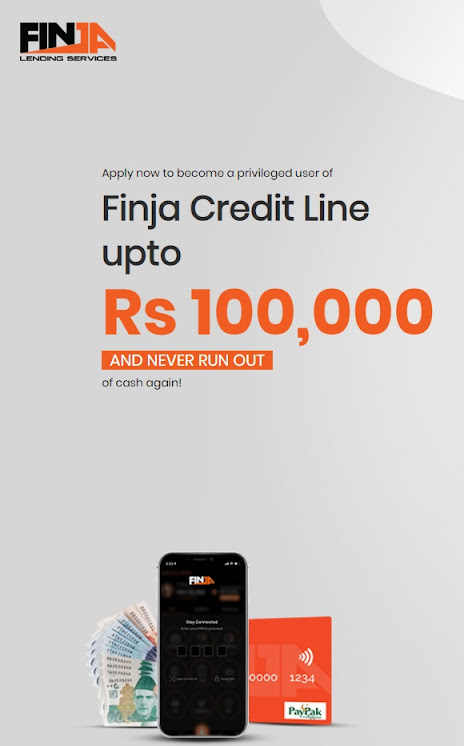

Digital Loan in Pakistan Finja credit line is offered with the minimum credit limit of PKR 10,000 to a maximum credit limit of PKR 100,000.

Finja charges an upfront service of 3.5% – 4% and PKR 1,000 processing fee.

What documents are required?

- CNIC

- Salary slips

- Bank statements

- Utility Bills

Call Us

042-38100050

Apply For Mobile App

Digital Loan in Pakistan

Apply for instant loans from Digital Loan in Pakistan Finja partner institutions

Make payments to friends and family anytime, anywhere

Add money to your wallet by simply submitting a request for Cash-In at doorstep

You can add money by visiting nearby agents or any Internet Banking facility

Pay your Utility bills and Recharge your network within few clicks

Save your recipients in Quick Pay for performing future transactions in less clicks

Make QR payments with the built in QR scanner

Shop online from hundreds of merchants

Remotely manage work chores like:

- An employee can apply for leaves

- An employee can extract salary slips

- An employee can view their attendance

- An HR/Line Manager can approve leaves

- An HR/Line Manager can view employee’s attendance

- An HR can approve expenses

- An HR can process salaries

- Set a secure Login PIN or simply add bio metric authentication

- Keep a record of your account’s activity in the Activity Feed

- Real-time notifications whenever you send or receive funds

Download now and sign up using your mobile phone number and CNIC!

Mobile App Click Here

Chat with us

Chat with us 24/7

FAQs: Digital Loan in Pakistan – Finja Loan

What is a digital loan?

A digital loan is a financial product that allows individuals to apply for and receive loans entirely online, without the need for physical paperwork.

How do I apply for a digital loan in Pakistan?

Typically, you can apply for a digital loan through the lender’s official website or mobile app. The application process usually involves filling out an online form and providing necessary documents.

What documents are required for a digital loan?

The required documents may vary, but common documents include proof of identity, proof of income, and bank statements. Digital lenders often use online verification methods.

How long does it take to get approved for a digital loan?

Approval times can vary, but digital loans are known for their quick processing. Some lenders provide instant approval, while others may take a day or two.

What is the interest rate for digital loans in Pakistan?

Interest rates can vary among lenders. It is essential to check the specific interest rates and any additional fees associated with the loan.

How do I repay the digital loan?

Repayment methods are usually outlined by the lender. It could involve automatic deductions from your bank account or other online payment methods.

What happens if I miss a repayment?

Consequences for missed payments can vary. It’s crucial to understand the lender’s policy on late payments, any associated fees, and the impact on your credit score.

Is collateral required for digital loans?

Many digital loans are unsecured, meaning they don’t require collateral. However, terms may vary, and some lenders might offer secured options.

What are the eligibility criteria for a digital loan?

Eligibility criteria often include factors such as age, income, credit history, and residency. Checking the lender’s website will provide specific details.

Are digital loans available for businesses in Pakistan?

Some digital lenders may offer loans specifically tailored for small businesses. It is essential to check the available options and eligibility criteria.

Remember that these are general questions, and you should refer to the specific FAQs provided by Finja Loan or any other digital loan provider in Pakistan for accurate and detailed information.

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com