Naya Pakistan Housing Loan | How to Apply for Housing Scheme | Meezan Bank Car Loan | Meezan Bank Loan | Mera Pakistan Mera Ghar

meezan bank car loan calculator

meezan bank car loan calculator

meezan bank personal loan apply

meezan bank loan calculator

meezan bank loan scheme

meezan bank loan for new business

meezan bank loan pakistan

meezan bank loan online apply

meezan bank loan application form

meezan bank loan for home

meezan bank loan application form

meezan bank loan for students

meezan bank loan for overseas pakistani

meezan bank loan against gold

meezan islamic bank loan

Meezan Bank Loan for Home

Eligibility Criteria

Pakistani national (Resident or Non Resident) as per policy

Age

Primary applicant: Minimum 25 years & maximum 65* years at financing maturity

Co-applicant: Minimum 21 years & Maximum 70* years at financing maturity

Income

Salaried

Minimum Gross Income of PKR 40,000 per month.

100% Co-applicant income may be clubbed in case of spouse only.

Self-Employed / Business Person

Minimum Gross Income of PKR 75,000 per month.

Employment Tenure

Salaried

Permanent job with a minimum 2 years continuous work history in the same industry / field.

Self-Employed / Business Person

Minimum 3 years in current business / industry.

Mera Pakistan Mera Ghar

Build Your Dream Home

Easy Home – Low Cost Housing Finance Scheme

Product Features & Benefits

Basic Eligibility Criteria

Processing Charges

Key Qualification Criteria

Meezan Bank Car Ijarah

The Meezan Bank car financing scheme works under a rental car agreement – the bank purchases the vehicle and rents it out to interested individuals for 1-7 years. Once the car ijarah period is completed, the car is either sold to the individual at a token amount or gifted.

Key Features of Meezan Bank Car Ijarah

Eligibility Criteria for Meezan Bank Car Ijarah

Meezan Bank Car Ijarah Variants

Documents Required for Meezan Bank Car Ijarah

Car Ijarah Application Form (available at all branches) filled out and signed by the interested individual

For salaried professionals: copy of most recent salary slip

For businessmen: proof of business such as NTN, Tax Return, Association Letter or Bank Certificate which confirms proprietorship

Copy of the latest 6 bank statements

Most recent photograph

Specimen signature in bank’s recommended format

You can also visit Mawazna car loan comparison service or meezan bank car ijarah calculator on this page to compare and apply for car finance products offered by Meezan Bank or any other banks.

Easy Home

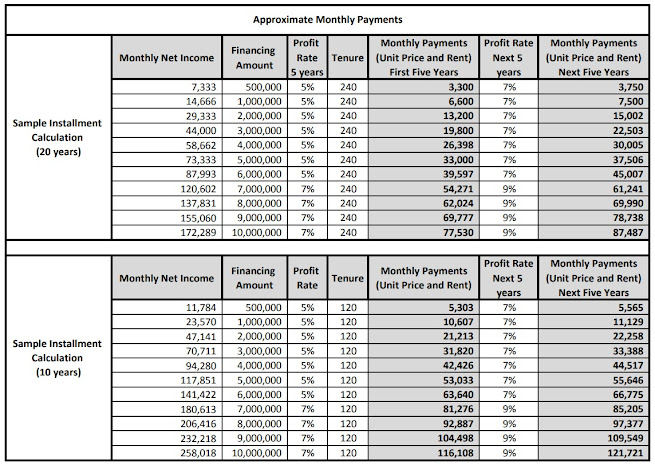

Very Low Cost House Finance Scheme in Pakistan offer convenient & affordable options to ful fill you need to construct & purchase built affordable house units in completely Shariah compliant way use Diminishing Musharakah mode of financing.

Also Check : PM Complaint Portal – Naya Pakistan Housing Scheme

Also Check : JS Bank Loan – Mera Pakistan Mera Ghar Loan

Also Check : All Bank Loan Scheme – Mera Pakistan Mera Ghar

Also Check : Khushhali Apna Makaan – Naya Pakistan Housing

Also Check : State Bank of Pakistan – Mera Pakistan Mera Ghar

Old 10 Pages Form

New Form Download

Mera Pakistan Mera Ghar Appliccation Forms

Formal Salaried Appicants (Green Form) Click Here

Informal Income Applicnts (Pink Form) Click Here

Formal Business Applicants (Blue Form) Click Here

Call

Centre

+92 (21) 111-331-331 & +92 (21)

111-331-332

کسٹمر کیئر یونٹ

آپ اپنی شکايات ہم تک مندرجہ ذيل ذرائع سے پہنچا سکتے ہيں:

·

24/7

کال سینٹر : 331-331-111

(21) 92+ & 332-331-111 (21) 92+

ہم آپ کی شکایت موصول ہونے پر اسے جلد از جلد حل کرکے آپ کو 7

کاروباری دنوں میں جواب دیں گے۔

Naya Pakistan Housing Loan | How to Apply for Housing Scheme | Meezan Bank Car Loan | Meezan Bank Loan | Mera Pakistan Mera Ghar

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com