NBP Loan | National Bank Loan | Bank Loan | Mera Pakistan Mera Ghar | Naya Pakistan Housing Scheme | Kamyab Jawan Program

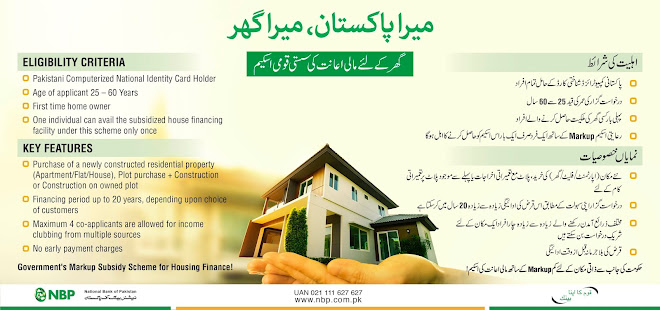

Eligibility Criteria

All men/women holding CNIC

First time home owner

One individual can have subsidized house loan facility under this scheme only once

Tiers of the Scheme:

Financing under Tier 0 is available through microfinance banks for financing of housing units under non-NAPHDA projects.

Financing under Tier 1 is available through banks for financing under NAPHDA projects

Financing under Tier 2 and Tier 3 is available through banks for financing of housing units under non-NAPHDA projects

Size of Housing Unit:

Size of the loan is segregated into four tiers, as under:

Tier 0 (T0) – (a) House upto 125 sq yds (5 Marla) and (b) flat/apartment with maximum covered area of 1,250 sq ft.

Tier 1 (T1) – (a) House upto 125 sq yds (5 Marla) with maximum covered area of 850 sq ft and (b) Flat/apartment with maximum covered area of 850 sq ft.

Tier 2 (T2) – (a) House upto 125 sq yds (5 Marla) and (b) flat/apartment with maximum covered area of 1,250 sq ft.

Tier 3 (T3) – (a) House upto 250 sq yds (10 Marla) and (b) flat/apartment with maximum covered area of 2,000 sq ft.

Age of housing units:

Newly constructed housing units during last one year from the date of application. However, this requirement will not be applicable till March 31, 2023 under Tier 0, Tier 2 and Tier 3

Maximum Price of Housing Units:

Maximum Price (Market Value) of a single housing unit at the time of approval of financing, as under:

Tier 1 (T1) – Rs 3.5 million

Tier 0 (T0), Tier 2 (T2) and Tier 3 (T3) – No cap

Maximum Loan size:

Maximum size of the loan of a single housing unit, as under:

Tier 0 (T0) – Rs 2.0 million

Tier 1 (T1) – Rs 2.7 million

Tier 2 (T2) – Rs 6.0 million

Tier 3 (T3) – Rs 10.0 million

Loan Tenor:

Minimum 5 years and maximum 20 years loan tenor, depending upon choice of customers.

Security Requirements:

As per banks’credit policy and prudential regulations for housing finance, the housing unit financed will be mortgaged in favor of financing bank.

Allocation in Budget:

Finance Division shall give authority to SBP to debit GOP account on quarterly basis for the subsidy payment to banks. Payment will be made to the banks on submission of quarterly-consolidated subsidy statement as per format prescribed by State Bank.

Loan Tiers

Tier 0

5% for first 5 years &

7% for next 5 years

Tier 1

3% for first 5 years &

5% for next 5 years

Tier 2

5% for first 5 years &

7% for next 5 years

Tier 3

7% for first 5 years &

9% for next 5 years

For loan tenors exceeding 10 years, market rate i.e. bank pricing will be applicable for the period exceeding 10 years.

Executing Agency:

All commercial banks including Islamic banks, microfinance banks and House Building Finance Company Limited (HBFCL)

Application Form:

A standardized Application Form both in English and Urdu will require minimum essential information with simple format. The processing time will not exceed 30 days after submission of all documents by the borrower and the same will be clearly stated in the application form.

Standardized Procedures:

Banks to have standardized loan documents and risk acceptance criteria

Monitoring:

SBP will publish consolidated information about the loans extended under this program for information of the public on quarterly basis on its website.

Geographical distribution:

Whole of Pakistan

Contents

Related posts:

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com