Bank Al Falah Loan – Alfalah Karobar Finance

Bank Al Falah Loan – Alfalah Karobar Finance

Alfa Business

Loans

We have designed our loan products keeping your individual needs in mind. With affordable tailor-made financing options that offer you the flexibility to choose your repayment plans, we help you stay in control of your finances and make the most of life’s opportunities today.

Bank Alfalah Loan App Branch List

Job Alerts: Join WhatsAppGroup

Basic Eligibility Criteria For Bank Al Falah Loan – Alfalah Karobar Finance

All Pakistanis who have an ID card

People who do not have a private home and want to build their own home for the first time

For the first time participants in the Government of Pakistan’s subsidy scheme.

Also Check: Barwaqt Emergency Loan

Alfalah Mera Pakistan Mera Ghar Scheme

Eligibility Criteria For Salary Person.

The age of the candidate should be between 25 to 60 years

Monthly salary up to 25 thousand

I have been working continuously for two years

Basic Eligibility Criteria

All Pakistani citizens holding valid CNIC / NICOP / SNIC.

Eligibility Criteria For Businessmen and professionals

Age range between 25 and 70 years

Monthly income up to 50 thousand

The candidate has been in business for three years

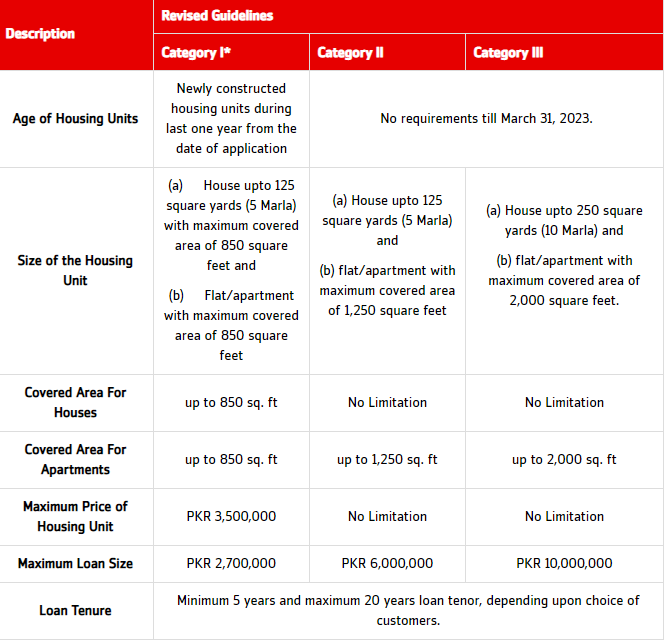

How much can I get a loan from Bank Al-Falah to build a house?

You can get a loan from Bank Al-Falah to build a house of 5 marlas or 10 marlas

Also Check: UBank Loan Pakistan

Description of five marla house

A five-marla house with sizes ranging from 125 square feet to 850 square feet

A loan of Rs 2.7 million to Rs 3.5 million can be obtained for a five-marla house

Details of ten marla house

10 marla house with sizes from 1250 square feet to 2,000 square feet

Required Documents Mera Pakistan Mera Ghar Scheme Loan

Application form

Copy of ID card

Income proof

Property Documents

Also Check: Fori Cash Loan

How To Apply For Mera Pakistan Mera Ghar Scheme Loan

Candidates should go to any branch of their nearest Bank Al-Falah and fill up the form and submit it along with the required documents.

Minimum Documents

Facility Application Form

CNIC copy of the applicant / co-applicant

Proof of income documents

Copies of property documents / details of property

Bank Al Falah Whatsapp

Bank Al Falah Loan – Alfalah Karobar Finance

Say Job City in Pakistan for today latest jobs opportunities in private and Govt departments. View all new Government careers collected from daily. sayjobcity.com